Regular readers of the news have probably heard a lot about the COVID-19 response in Pakistan. Everything from ‘smart’ lockdowns to the emergency relief program has been discussed at length. Macro Pakistani wants to explain things a bit differently. Now that we have a basic understanding of what Pakistan’s economy was about pre-COVID let’s explore how it has been performing since the pandemic hit. Since data for the current financial year of 2021 is limited, we will focus on what happened until end of June 2020.

The pre-COVID crisis

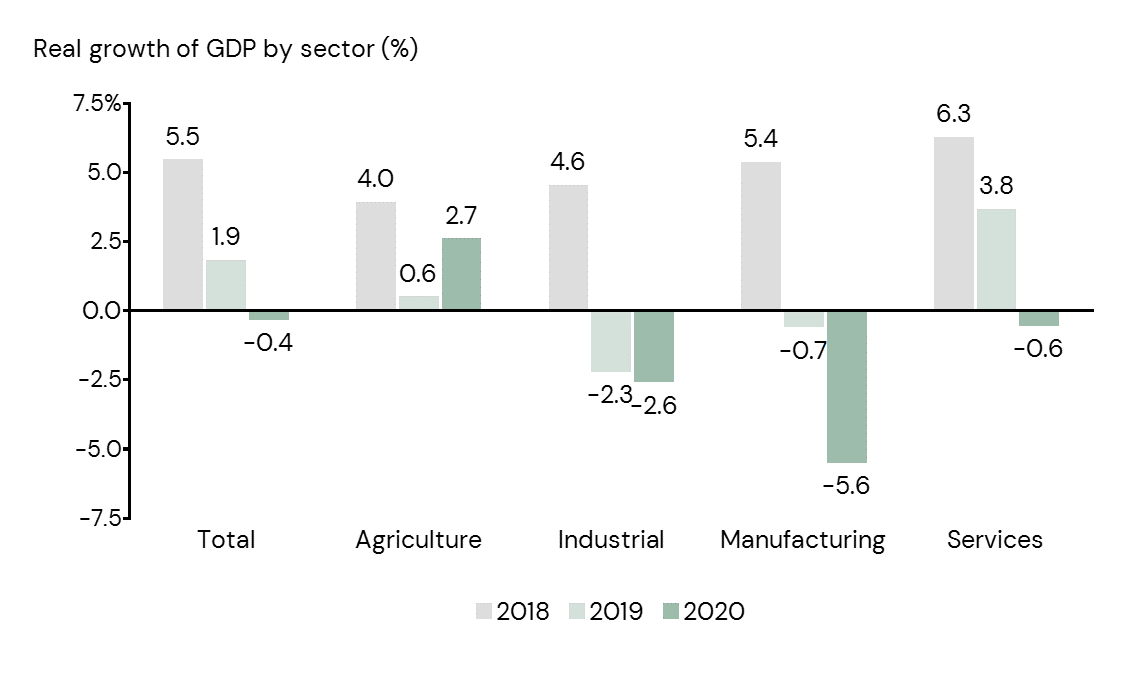

We have discussed how Pakistan’s economic struggles began even before COVID-19. Growth in all sectors fell from 2018 to 2019 with manufacturing being hit the hardest. While total GDP growth fell from 5.5% to 1.9%, manufacturing growth fell from 5.4% to -0.7%.

Real growth in Pakistan’s GDP by sector (2018-20)

Provisional data for 2020, including the impact of COVID-19, shows that the trend of the economy slowing down continued. Except agricultural, which was largely unaffected by the lockdowns, all other sectors contracted. Agriculture sector grew by 2.7% during 2019-20 with the crops sub-sector growing by 3%, while livestock (2.6%), forestry (2.3%) and fishing (0.6%) displayed slower growth. Industrial sector had the sharpest contraction at 2.6% with manufacturing sub-sector contracting by 5.6% and mining by 8.8% but utilities and construction displaying positive growth of 17.7% and 8.1% respectively. Interestingly, within manufacturing, small scale also showed positive growth of 1.5% while large scale contracted heavily by 7.8%. Services sector contracted slightly by 0.6% with transport suffering the most with a 7.1% contraction. Wholesale and retail trade also fell by 3.4% while all other services displayed positive growth.

These numbers should give you a decent idea of why Pakistan’s economy did not contract as much as expected. The country has been deindustrializing, with the industrial sector, severely affected by the lockdowns, contributing only 18% to GDP. Hence, its contraction had less of an effect on the overall economy. While depressed global demand should affect exports, Pakistan’s lack of participation in international trade actually benefitted it in during the pandemic. The ‘other services’ we mentioned that had positive growth, contribute almost 27% to GDP. Housing services remained strong, along with construction, which was one of the first few sectors to open post-lockdown.

It could be worse

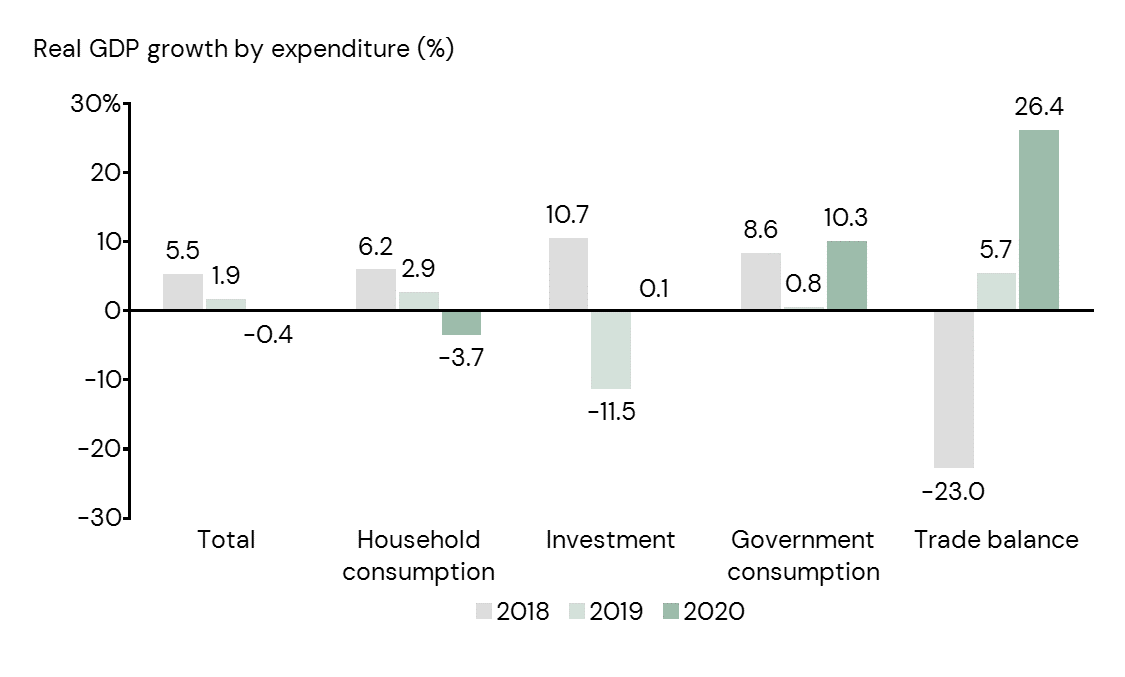

Note that these numbers are provisional and will be revised when we get data next year. However, some data points are concrete. We know exactly what our trade balance looks like, since it is reported on a monthly basis and have a fair idea of how much the government spent. If you consider the expenditure approach for GDP calculations, you will see that these two factors were significant in mitigating the adverse impact of COVID-19.

Real growth in Pakistan’s GDP by expenditure (2018-20)

As per the CIGXM of Pakistan’s economy, the biggest boost to our economy came from government consumption increasing by 10.3% and the trade balance of exports net of imports improving by 26.4%. Government expenditure increased partly due to the COVID-19 response in Pakistan and the trade balance improved because while exports increased only slightly, imports fell significantly. Consumption of imported goods fell by over 11% in real terms due to low oil prices and a switch to market-based exchange rate.

Since Pakistan has a consumption-driven economy, the additional shock to domestic consumption, which fell by 3.7%, reverberated across the entire economy. Our first instinct to finding out that domestic consumption fell sharply and made up 79% of GDP in 2020 as compared to 83% in 2019 was that it was probably because incomes fell.

Over 50% of Pakistanis have either taken a pay cut or lost their job due to the outbreak of COVID-19. Imagine our surprise then when we found out domestic savings in Pakistan had actually increased. From contributing 4.1% of GDP to investments in 2019, domestic savings rose to 6.8% of GDP. Simply speaking, of the 4% of GDP drop in private consumption, close to 75% was saved and invested.

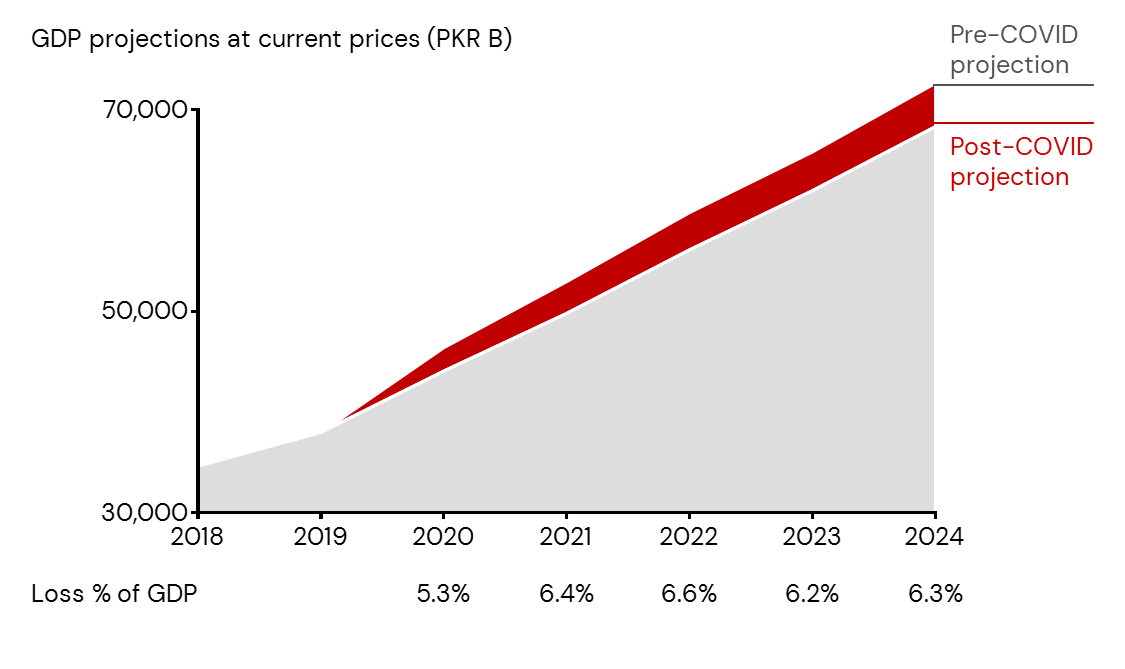

It will still be pretty bad

This shift from a consumption driven economy to one focused on investment is what Macro Pakistani has been looking forward to for years. If the economy manages to sustain this structural shift in the post-COVID world, the future will start to look less grim. However, for now, according to the IMF, Pakistan will lose economic value of over PKR 17 trillion until 2024, with over 5% of GDP lost in 2020 alone.

Difference in Pakistan’s GDP projections after COVID-19 (2018-24)

Source: IMF (April 2020); MP Analysis

Before the pandemic, Pakistan’s economy was expected to grow by 2.4% in 2020. Post-COVID, this growth rate dropped to -0.4% and future expected growth rates were also adjusted downward. Instead of a projected GDP of PKR 44.0 trillion in 2020, Pakistan ended up with PKR 41.7 trillion. That is an economic loss of PKR 2.3 trillion for just one year. The red portion in the above chart shows this loss is expected to compound for at least the next 4 years. Technically speaking, a V-shaped recovery is projected by international institutions, with growth returning to 2% in 2021. However, that growth rate is below the 3% real GDP growth in 2021 that was previously projected. Because the economic crisis in Pakistan began before the Great Lockdown, it will need to do a lot more to get back on the growth track envisioned in for 2025.

To clear any confusions – the growth rates we have discussed so far were in real terms. The economic loss of over 5% of GDP mentioned is in nominal terms. If the government wanted to stimulate the economy, it would have to spend as much as 5% to make up for the economic loss.

Let’s be real again

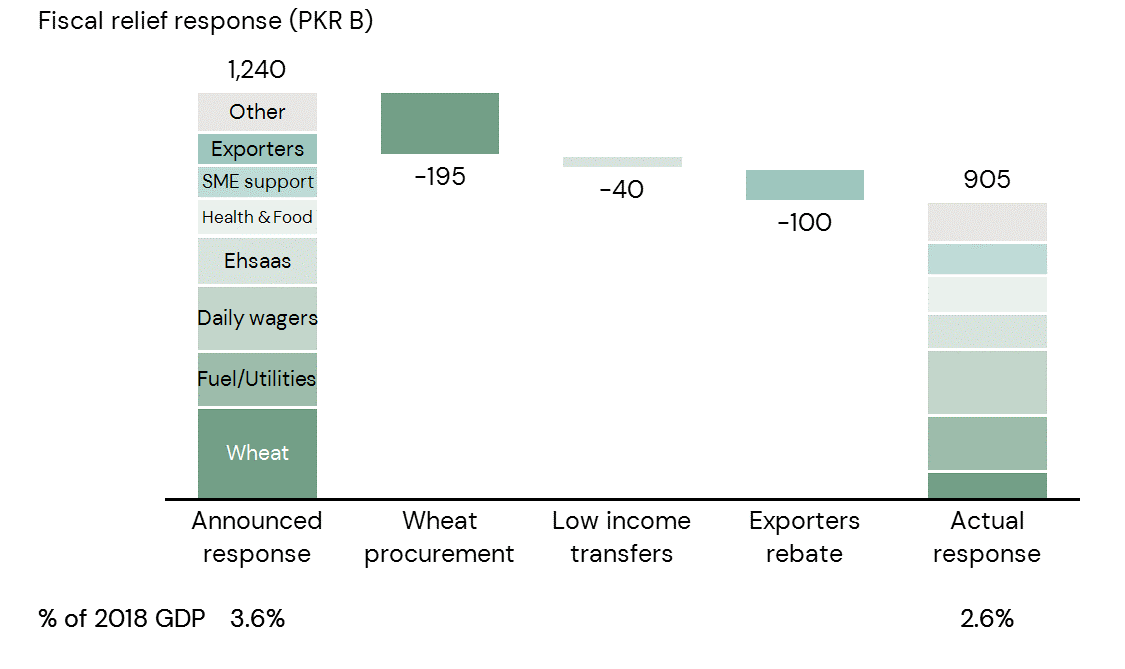

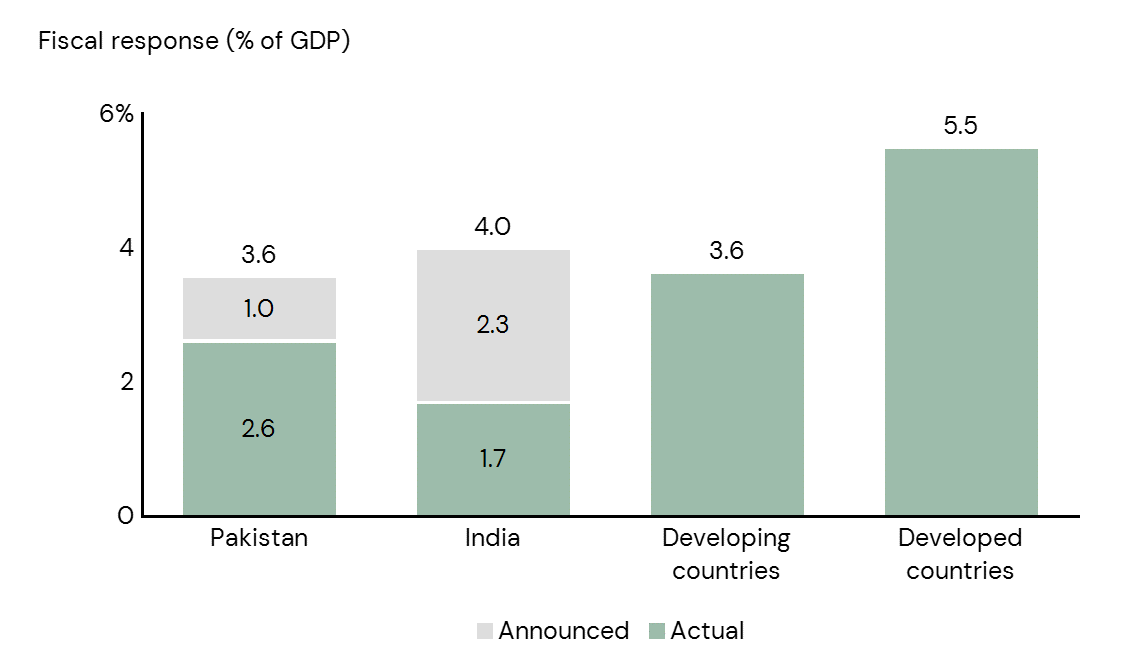

However, the announced fiscal response to COVID-19 in Pakistan, after accounting for already budgeted expenditures for 2020, was below 3% of GDP.

Break up of fiscal COVID-19 response in Pakistan

Source: Economic Survey of Pakistan 2019-20; MP Analysis

The PKR 1.2 trillion package attempted to provide relief to citizens and support to businesses and economy. Profit estimated at the time that the package was closer to PKR 750 billion, discounting certain initiatives altogether. Macro Pakistani wants to take a more optimistic view but still provide a fair haircut.

The biggest portion of the relief package was for wheat procurement. Through this initiative, the government was to buy 8 million tonnes of wheat from farmers at PKR 1400/40kg. This is an annual practice that the government undertakes, procuring on average 6 million tonnes of wheat at PKR 1,300/40 kg. Since a higher procurement target was set at a higher price, we consider only PKR 85 billion instead of the PKR 280 billion as part of the COVID relief package.

Next, the upscaling of Ehsaas program and creation of a National Socioeconomic Registry were already expected to be completed by May 2020. The increased outreach during COVID actually just helped complete an existing milestone. From the 12 million recipients, 5 million existing female beneficiaries were already budgeted to receive PKR 40 billion. Hence, we consider only PKR 110 billion from the PKR 150 billion package announced.

Last, the payment of rebates to exporters of PKR 100 billion cannot be included as part of a fiscal relief package. Exporters are due to receive tax refunds with or without a pandemic. Hence, the return of PKR 100 billion owed to the private sector from before is also excluded from the package.

Response was good enough

Other initiatives of the package can also be contested. The daily wagers scheme of PKR 200 billion, which sets aside PKR 17,500 per month for 3 million laid off workers, has only managed to disburse PKR 14 billion to date. However, debating the exact amount of the package is not as fruitful as understanding how much is required and comparing across countries. The fiscal response to COVID-19 in Pakistan was actually in line with other developing countries.

Fiscal COVID-19 response in Pakistan vs. global benchmarks

The fiscal response also included an SME & Agriculture support package of PKR 100 billion, support for health and food supplies of PKR 65 billion, utility stores subsidy of PKR 50 billion, fuel price reductions worth PKR 70 billion and utility bills relief of PKR 100 billion. The reason Macro Pakistani is not going into details of the entire package is that these initiatives should be celebrated rather than criticized. While miscommunication should be corrected, we should keep in mind that Pakistan had to address the pandemic in the midst of an existing economic crisis. While the crisis is far from over, Pakistan’s COVID response to date can be considered good enough.

The announced fiscal packages across the developing world average 3.6% of GDP, which is the same as Pakistan. We can assume there is a difference between the headline numbers and the actual package in other developing countries too. In India, for example, the headline reports include a fiscal relief package of 4% of GDP while some estimates claim the outlay to be around 1.7% of GDP. The overall package provided by the Indian government is around 10% of GDP, including fiscal and monetary measures.

Money makes money

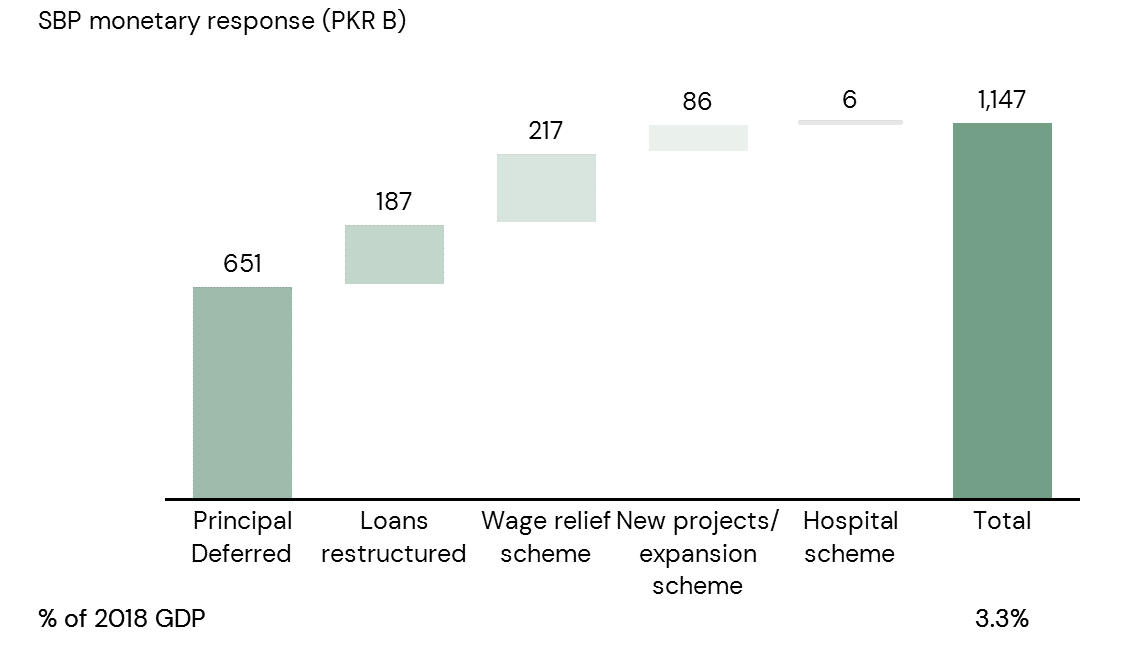

Coupled with the fiscal response of 2.6% of GDP, Pakistan’s monetary response of over 3% of GDP should be enough to address the projected economic loss of 5-6% of GDP.

Break up of monetary COVID-19 response in Pakistan

Prior to the pandemic, Pakistan’s overheating economy required slowing down, which required interest rate hikes. By June 2020, however, the State Bank of Pakistan cut the policy rate by 625 bps to 7% to lift depressed demand in the economy.

SBP also helped inject liquidity into the economy through a few relief measures. The most significant initiative was that of allowing businesses to defer repayment of principal loan amounts. Without this, borrowers would have had to pay over PKR 650 billion back to banks, which would have further strained cash flows. Over 95% of borrowers that availed this facility were small in nature.

Nevertheless, even if principal amounts were deferred, interest on these loans would still have to be paid. Hence, SBP relaxed a few requirements for banks who in turn restructured PKR 187 billion worth of loans. Additional measures to prevent layoff of workers helped avoid unemployment for over 1.5 million workers with loans of up to PKR 217 billion.

We have discussed before how access to finance is critical for improving the investment landscape in the country. For this reason, SBP encouraged cheap credit availability for hospitals to purchase medical equipment and other businesses to invest in new projects or expansions. Collectively, these initiatives have yielded over PKR 90 billion in new loan disbursements. Macro Pakistani hopes these initiatives continue beyond the current one-year timeline and are directed toward investment in productivity enhancing initiatives. Next time, we will round up the ABCs of Pakistan series and discuss next steps for Macro Pakistani.