Most businesses you talk to, will cite the struggle with expensive and unreliable electricity in Pakistan as a major issue. They complain in general about how it is not easy to do business in this country. However, that goes against the public rhetoric because Pakistan was one of the most improved countries in World Bank’s Ease of Doing Business ranking in 2019. All positive news should be encouraged, but it is useful to know where the improvement is coming from.

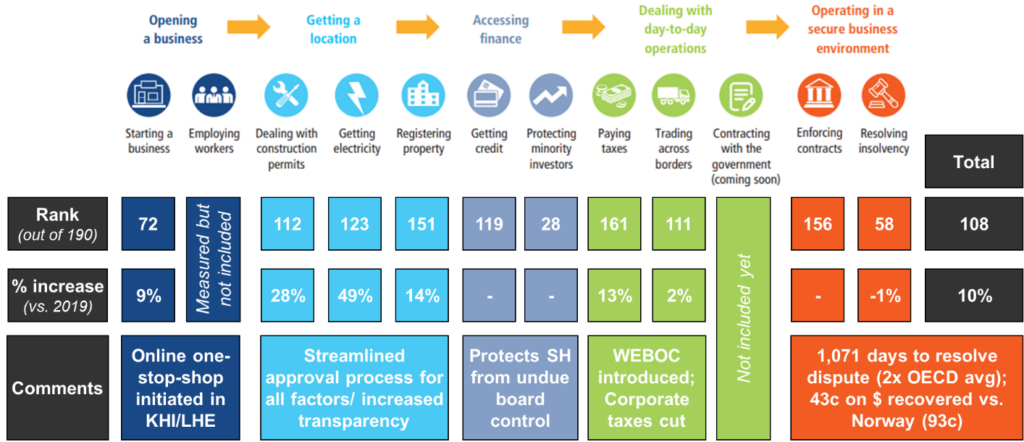

World Bank uses five key factors in determining Ease of Doing Business for 190 countries around the world. From opening a business, getting a location, accessing finance, dealing with day-to-day operations to operating in a secure environment. It assigns points to sub-categories within each of the five factors and then takes an average of those points. If you dig deep into this mechanical exercise, you will get a few key insights.

Getting electricity is easy

World Bank’s Ease of Doing Business ranking for Pakistan 2019

By far the biggest contributor to Pakistan’s increase in total points from 55 to 61 (10% increase) was ‘Getting electricity’. This was even more surprising, given what business owners complain about. Points under this sub-category increased by 49% in one year, allowing Pakistan to jump 28 places to 108 in the world. Within this sub-category are sub-sub-categories and Pakistan improved most in one of them: time required to obtain an electricity connection. By cutting down the time required to get a new connection from 162 days to 123 days, Pakistan made it easier to do business in the country.

In case the sarcasm is not clear yet, let’s look into pricing of electricity in Pakistan. Here’s a footnote from the report:

“Doing Business measures the price of electricity, but it is not included in the ease of doing business score nor in the ranking on the ease of getting electricity.”

Ease of Doing Business, World Bank

In our last post, we spoke about how low access to finance is limiting investment in the country. Notice ranking for ‘Getting credit’ of 119 is actually better than the improved ranking for ‘Getting electricity’ of 123. Hope all Macro Pakistani readers, go through the entire report next time it is published by the World Bank. Or we can just publish a bite-sized version of it.

Let’s keep it real

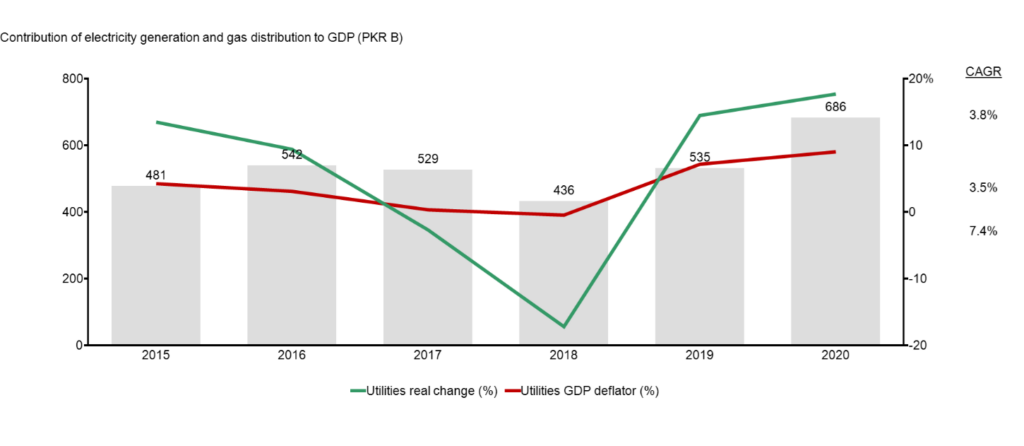

We have discussed real and nominal growth a few times in the past. Electricity is perhaps the most relatable sub-sector to understand this. The green line below shows the real change in utilities, which is part of the Industrial sector under electricity generation and electricity and gas distribution. The red line shows the GDP deflator or change in prices.

GDP contribution of utilities in Pakistan (2015-2020)

Interesting story here: there was a lot of talk in the press about how in 2018-19, Pakistan’s GDP growth rate of 1.9% was actually misreported as 3.3%? That’s usually how GDP projections go. First the Pakistan Bureau of Statistics publishes projected numbers. Then the year after they publish revised numbers. Then the year after they publish final numbers. The dip in the green line between 2016 and 2018 that you see above, was actually finally disclosed in 2019. In 2018, the State Bank of Pakistan reported that utilities grew in real terms by 5.82% in 2017 and 1.84% in 2018. Then in 2019 they reported that actually it grew by -2.69% in 2017 and -9.08% in 2018. Some vague explanations around a ‘substantial rise in input prices led to an increase in cost of production of this sub-sector’ were offered. Basically, fuel prices went up so suppliers of electricity in Pakistan could not provide the same amount of electricity at low prices.

But notice how when the prices started rising, the green line started rising again. Low investment leads to low productivity which means without higher prices, suppliers cannot provide the same quantity of goods. Prior to this, there were investments in power plants (you must have heard of IPPs), but limited investments down the value chain for transmission and distribution. We will talk about that in a bit so let’s return to high prices.

Paying for electricity is not easy

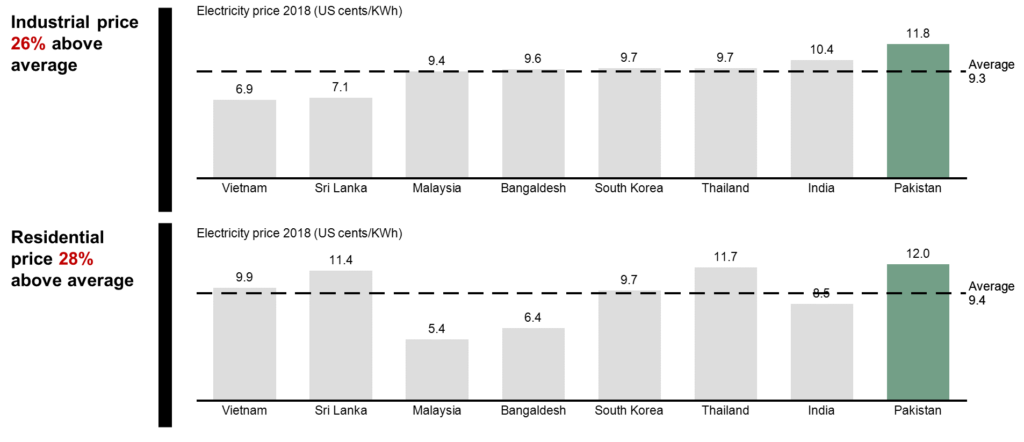

Electricity in Pakistan is more expensive than it is for comparable countries. For industrial consumers, it is 26% and for residential consumers, 28% more expensive than average.

Electricity prices in Pakistan vs. Global comparison (2018)

Note, here we are talking about average for simplicity and talking about the past. The government has actually agreed to lower tariff for export oriented sectors to US 7.5 cents/KWh but it is yet to be implemented fully. Let’s think like an exporter in the past.

You make shirts and bid for export orders. Bangladesh also makes shirts and bids for export orders. You might have invested in the past and are as productive as possible, but you cannot control the price of electricity you have to pay. Share of energy in your total cost is around 40% so this price, that’s out of your control, is quite significant. Bangladesh bids 2 cents lower than you and wins the order. Bangladesh exports grow while Pakistan’s stagnate.

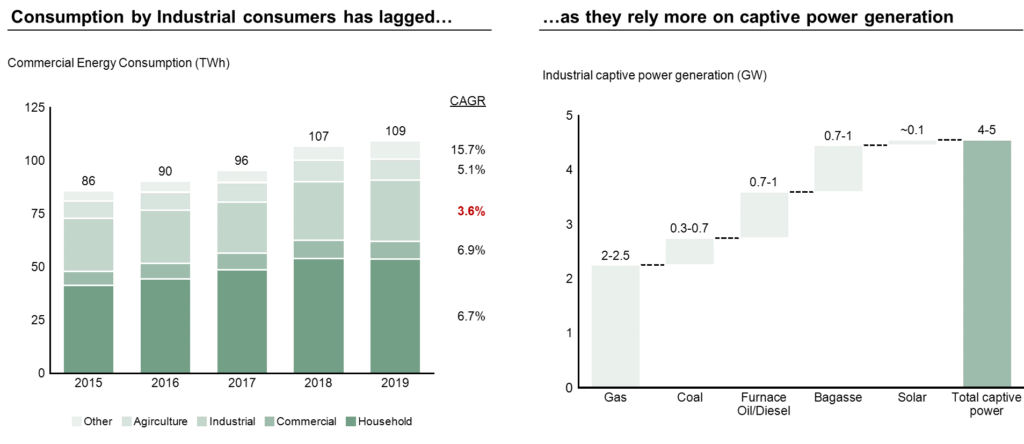

High electricity prices have hurt both industrial and residential consumers. Industrial consumers consume between 25-26% of electricity in the country. Not only is this lower than in Vietnam, where over 50% of power demand comes from industry, the share has been falling for the past few years. Industrial consumption of electricity grew by just 3.6% compared to the average in the country of over 6%.

Demand and consumption of electricity in Pakistan (2015-2019)

Instead of receiving electricity from the grid, industry has started to rely more on their own captive power plants. It is estimated that close to 50% of industrial demand for electricity is met by captive power generation. Industries find it cheaper to build their own personal power stations rather than buy expensive electricity from public utilities.

Roti, Kapra aur Makaan

For households, it is not exactly easy to set up personal power plants, though generators have become commonplace in the country. In an earlier post, we discussed how Pakistanis spend almost twice as much on housing and household fuels as their peers. This inflated spend on electricity in Pakistan leads to higher consumption, lower saving and lower investment. Load-shedding has been a recurrent issue in Pakistan and the government, to their credit, have spent a lot of money to try to solve it. They have focused on thermal generation (specifically coal) but that’s a topic for another day.

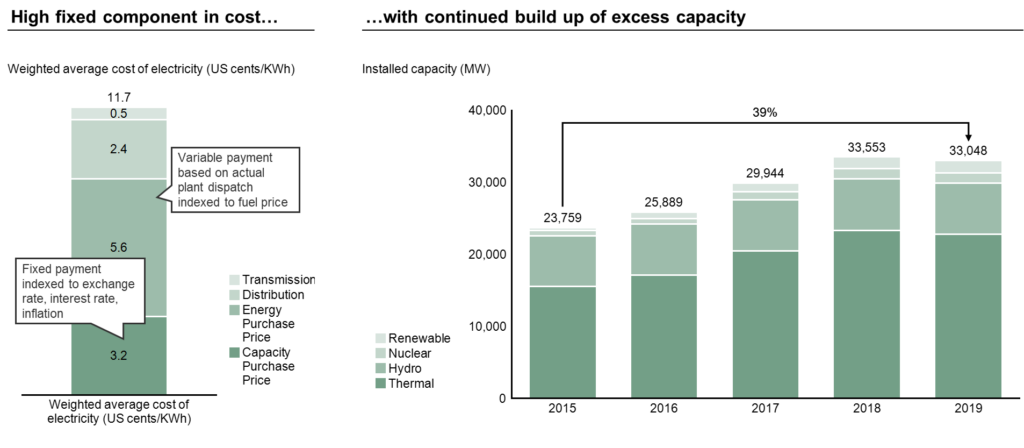

Cost and supply of electricity in Pakistan (2015-2019)

Let’s first understand how cost of electricity is calculated and understand the value chain. First, you create a power plant and with it capacity, for which you are paid Capacity Purchase Price (CPP). This is a fixed payment that you receive as long as you have the capacity to provide electricity. This payment varies according to the exchange rate, interest rate and inflation. Listen to this fantastic podcast if you want to understand more. Next, you get paid to generate and provide electricity, Energy Purchase Price (EPP), which varies with the amount of electricity you provide and the price of fuel you use. Last, transmission and distribution companies get paid for getting that electricity to the required location.

In 2018, cost of electricity in Pakistan was US ~11.7 cents/KWh out of which fixed amount of CPP was ~US 3.2 cents/KWh or 28% of total. The variable amounts were split between EPP (48%), distribution (20%) and transmission (4%).

More is good but more is bad

In order to do the CPP calculation, you would take the fixed capacity payments you made, for example USD 3.2, and divide it by the units of electricity that were provided, for example 100 KWh. If the the units provided were lower, the per unit cost would be higher. So if you expected to provide 100 KWh but instead were required to provide only 80 KWh, your capacity payments would remain the same but consumers would be charged US 4 cents now. Theoretically, if consumers demand less electricity than is available now, they will be charged more.

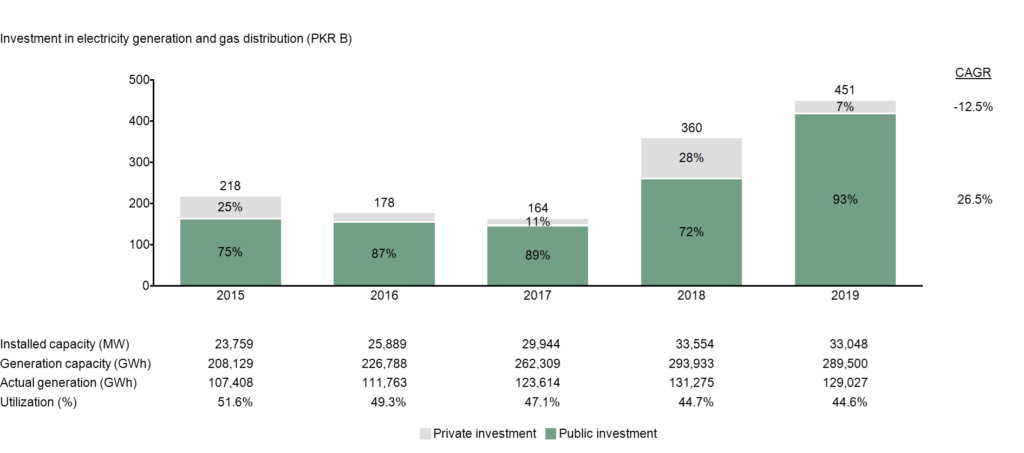

To address the issue of load shedding, the government boosted generation capacity. They had to do this to make sure when demand is at its peak, mostly in the summer months, they can provide reliable electricity. Issue is, for about 5 months of the year, demand is 30-40% lower than peak. Think winter months without fans as compared to summer months with air conditioning. Hence, the total generation capacity is not fully utilized.

Peak demand of electricity in Pakistan hovers around 23,000 MW but since our generation capability is on average ~77% of installed capacity and we lose a further 18% in transmission and distribution inefficiencies, the 23,759 MW capacity we had in 2015, was not enough to cover our needs.

Investment in utilities in Pakistan (2015-2019)

This investment in generation capacity was necessary to tackle load shedding but beyond a certain point, investment in distribution becomes more important. As generation capacity built up to over 33,000 MW, our utilization fell from 52% to 45% in 2019. Building more power stations without making distribution more efficient and having a plan to boost demand for electricity, will lead to lower utilization and higher prices for the consumers.

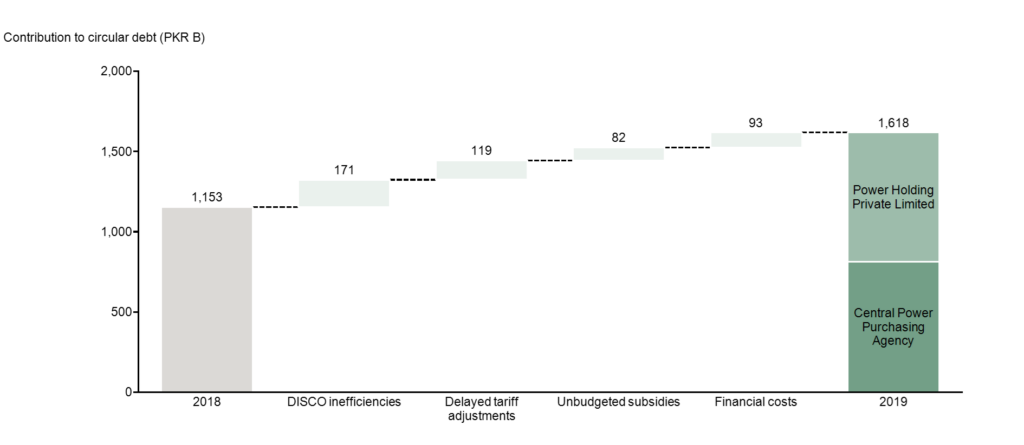

They do care for us

To be fair, the burden of higher prices is primarily borne by the government and not consumers immediately. The government is expected to subsidize electricity providers to continue providing consumers with lower priced electricity. These subsidies are typically not budgeted for and even though they are committed, they are not paid fast enough. To cater to this issue, a private company, Power Holding Private Limited (PHPL), guaranteed by the government was created to offer cash flow relief to the power sector. This leads to what is called circular debt.

Contribution to circular debt in Pakistan (as of 2019)

We won’t go into a lot of detail about circular debt but in short, the Central Power Purchasing Agency (CPPA) is the central buyer of electricity in Pakistan from all generation companies. Once purchased, electricity moves from generation companies to distribution companies (DISCOs). DISCOs are inefficient at tranmission and distribution but also at collection. QESCO, which serves the area in and around Quetta, collected just 25% of bills from consumers which was one of the reasons the CEO was sacked in 2018. This is because it is really difficult to cover an area as vast as 335,000 sq. km and also consumers just don’t pay. Watch this video of issues K-Electric has to face to prevent theft and recover bills for electricity it provides.

When CPPA buys electricity from generation companies, it needs to pay them. In order to pay them, it needs DISCOs to collect money from consumers. Prices for electricity change since fuel prices change, but this is not passed on to the consumers right away. Since some consumers don’t pay, other consumers are overburdened with charges. The government tries to reduce this burden through subsidies but is not able to fully cover. So PHPL takes loans to give cash to power sector. Roughly half the circular debt today is in PHPL which is basically loans taken to pay back loans. The recent price increase of electricity in Pakistan is the governments attempt to pass on the burden of circular debt to consumers. This will further increase consumer spend on housing, which we will cover next time.

Could you please elaborate on the difference between debt owed by PHPL and CPPA?

I understand from the text that in principle the flow of money is: consumers -> DISCOs -> CPPA -> producers. If consumers don’t pay then the PHPL enters and pays to power producers so in effect isn’t all circular debt owed by the CPPA?

In effect all circular debt is owed by the government. CPPA is the procurement arm for electricity and PHPL is the financing arm for the government. But it is kept off the books of the government since it has a public guarantee and is not strictly public debt. That is changing now because the amount is ballooning out of proportion and you cannot hide it with accounting anymore. PHPL liabilities are expected to move to public debt within the next 3-4 years.

Understood. Thanks!

How is generation capacity calculated?

If a region has peak demand of let’s say 100 MW in any given hour, the power station needs to have installed capacity to provide at least 100 MW. To get generation capacity in GWh, you will multiply 100 MW by 24 hours and 365 days (to get annual capacity in MW) and divide by 1,000 (to convert Mega into Giga). If you want to learn more, please send us a message and we will be in touch!