Should Pakistan Pursue Thar Coal?

Ever since Thar’s vast coal resources were discovered, the subject has been under significant scrutiny from various quarters with regards to its economic viability and sustainability at large. With Pakistan’s gas reserves nearly depleted—the Sindh Energy Minister recently stated that the province, which is the largest producer of natural gas in the country, will run out of reserves in a little over a decade—a grave question that faces all of us is the availability of alternative local fuel sources. In the absence of natural gas, what other relevant source of energy does Pakistan have which can provide indigenous, reliable and affordable fuel in the future? The answer lies perhaps in acknowledging the fact that Thar coal reserves can provide the country with the requisite energy security that is needed to sustain our growth and development.

Coal in the world of renewables

Various aspects of the Thar coal project have been questioned, but whether these statements are based on ground realities is a different matter altogether. Let us dissect these issues in detail. First, the loudly touted claim that the world is fast replacing coal with renewables is misleading. If you look at global data, yes, you see a general trend in coal power plants being shut down but the world is still producing approximately 84% of its energy from fossil fuels dominated by coal, oil and gas.

Moreover, it is not true that the rest of the world is not using coal to power their economy. For countries where baseload demand is high, such as China, India and the US, coal-fired power plants continue to provide energy to fuel their economic growth. In fact, according to another Bloomberg news report, India expects to invest USD 54.5 billion in clean coal projects over the next decade as it seeks to tap domestic energy sources and curb imports. It is important to note that coal still accounts for 65% of India’s energy mix. Therefore, it is not only Pakistan that is focused on developing its indigenous resources, but also other nations of the world.

Reaching economies of scale

Whilst we embarked upon exploiting our own coal resources much later than others, such as our neighbour India which started using its lignite resources during 1950s and 70s, it is also important to keep in mind that Thar coal resources in Pakistan were not discovered till 1992. Consequently, given that we are still in the early stages of development, the costs remain relatively high which will eventually taper down as we expand our mines and reach the optimum capacity. Mining coal and other relevant minerals, the world over, is a simple game of economies of scale. Pakistan has just commenced its coal journey and efforts are being made to ramp up production.

From Thar coal Block II alone, we have firm commitments for a power park of over 3,300 MWs, and at full capacity, Thar coal will produce the cheapest base load electricity for the nation. Comparing the current price of Thar coal with that of similar projects—but with different size, scope and age—is not a valid comparison.

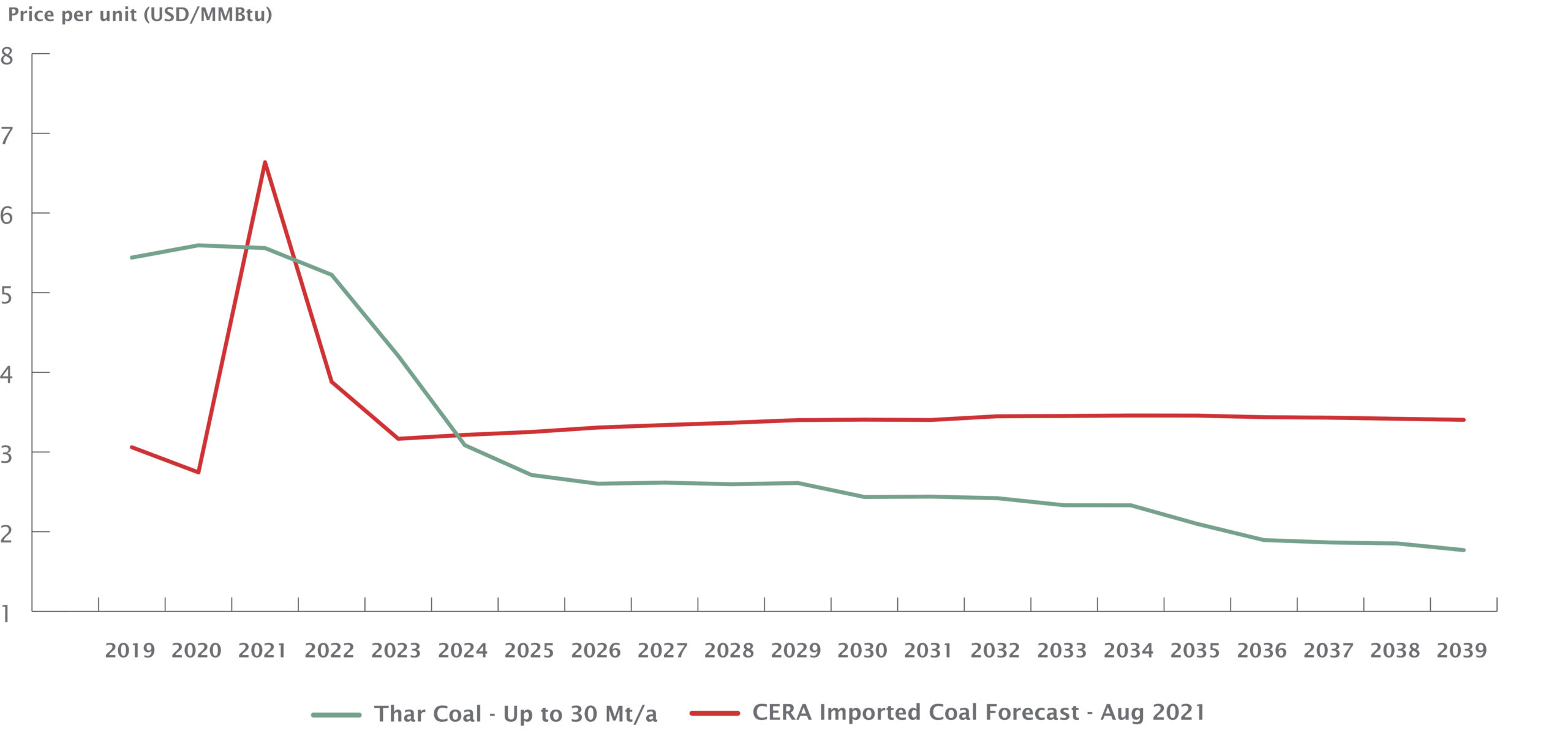

The cost of Thar coal is expected to drop significantly in the coming years, especially in comparison to imported coal

Source: SECMC/CERA, MP Analysis

Thar Block II has achieved financial close and construction has begun for expansion of the existing mine to 7.6 million tons per annum (MTPA) from the current 3.8 MTPA. This expansion alone will reduce the cost of Thar coal by around 30% or ~USD 20 per ton. Subsequent expansions and economies will result in additional savings and reductions in the associated costs of production. Moreover, post phase II expansion, Thar coal from Block II will be cheaper and more economical than imported coal and RLNG.

The price is right

Now let us shed some light on the issues critics often raise with regards to the management and policy of the Thar coal project. There is no denying that projects of such magnitude are generally implemented away from urban centres, yet the fact that Tharparkar has no basic infrastructure to support such an industrial venture required relatively high interest rates and return on equity components—which were driven by the increasing circular debt—in order to guarantee safe returns to the investors who were undertaking high risks on a previously-unexplored project in the country.

The argument of expensive lending rates for the project is not valid either, since the yields of Thar Block II project were comparable to Pakistan’s Eurobond auctions, which had a similar sovereign guarantee component as that of the Thar coal project. It is also pertinent to mention that, going forward, projects that are to come online in the next few years should have relatively lower CAPEX, RoE and interest rates since the proof of concept has been developed and major risks have been successfully mitigated.

False binary of renewables vs. coal

It is important to acknowledge that the idea of increasing the share of renewables in the energy mix is fast gaining momentum across the world—more so in the developed economies, who became developed riding on the back of coal and other fossil-based energy resources—yet it is crucial to understand that this shift will be a gradual transition, not an abrupt change-over.

While experts continue to argue that globally prices of energy production through renewables are decreasing, they fail to acknowledge the associated costs such as seasonality, storage, transmission and distribution which make them a relatively expensive choice for Pakistan. Moreover, the debate over here is not about Thar coal versus renewables. While it is important for Pakistan to develop its renewable resources, it is equally important to develop Thar coal resources, which currently account for less than 3% share in the energy mix.

We must also note that utilization of Thar coal should not just be restricted to power generation. Rather, efforts must be made to use this indigenous resource in other sectors such as cement, steel and, most importantly, for coal beneficiation to liquid, gas and fertilizer—all of which are technically viable with proper use of technology and capital investment. These alternatives can save billions of dollars by reducing the import of coal, RLNG and other petrochemical products.

Positive externalities for Thar

On the social front, the Thar coal power and mining projects have initiated industrial activity in an area which has historically ranked low on socio-economic indicators. The projects currently commissioned, and those that will come online in the years ahead, are providing much needed economic prosperity in the form of direct and indirect employment, as well as other business opportunities to the Thari people.

When industrial activity commences in any region, it spurs socio-economic growth, and Thar is proving to be a classic example of this development. In the past year alone, the project has saved foreign exchange through import substitution up to the tune of PKR 130 million. And in just two years, it has enhanced direct local employment, since 70% of the employees in the project are locals, who also earn royalty which will be injected back into the development of the region.

Looking to the future

While some critics talk about the new world order and our dependent and unsustainable economy, they fail to establish the fact that Thar coal in essence is primarily about providing strategic energy security to the country. As mentioned earlier, Thar Coal can replace demand from local gas in power generation, which is depleting, and substitute 100% of imported fuels from the energy mix. Additionally, on greenhouse emissions, we must acknowledge that Pakistan’s contribution to global carbon dioxide emissions only accounts to 0.5%, compared to over 50% by the four top emitters—namely China, United States, European Union and India.

In fact, even after developing Thar coal at full scale, Pakistan’s carbon emissions will be twenty times lower than the fast-growing and developed economies on an absolute basis, and five times lower than global average on per capita basis. With systemic issues such as hunger, poverty and high energy prices, it therefore makes absolute sense for Pakistan to develop its indigenous resources. This can sustain development by displacing imported fuels from the energy mix and saving approximately USD 3 billion in foreign exchange annually by 2030. In the previous fiscal year alone, our forex outlay was USD 5.5 billion which, in absence of abundant indigenous resources, will keep increasing in the years to come. Therefore, judiciously utilizing Thar coal is essential for our future prosperity.

Note: The author is the Chief Executive Officer of Sindh Engro Coal Mining Company (SECMC)

I firmly believe Pakistan should ban all imported LNG and furnace oil imports for powerplants and switch them to coal or coal gas. Switch all urea and cement makers to coal. Ban all local industry from producing electricity from coal. Allow imports of solar, wind, geothermal and tidal energy equipment tax free

sorry I mean ‘t to say BAN industry from making electric power from gas as it is imported and we are running out of reserves.

1. How “clean” is this clean coal? Specially since we are an agri country who will eventually see the effect of climate change. Plus thar coal is surrounded both in the north and south by fertile agri land. What will be the effect on agri from this “clean” coal?

2. Whats the $/MW investment capex comparison for coal vs wind vs solar vs FO vs LNG? Similarly whats the comparsion $/MWh of running these 4 type of plants?

3. Who is going to bear the cost of setting up Transmission lines from Thar to the main grid and what kind of line losses do you expect due to distance from population centers?

Pakistan is one of the top adversely impacted countries in the world wrt climate change and producing more power from coal (imported or local) will only exacerbate the problem. Words such as ‘indigenous resources’, ‘displacing imported fuels’ and ‘saving foreign exchange’ are only cliches compared to the cost which Pakistan will have to pay in terms of environmental disaster in the Thar eco system and to other connected regions. Engro is not doing this out of charity or a sense of patriotism but doing this to get the guaranteed profits.

Why is PTI govt planting 10 billion trees when the impact of coal powered power projects will nullify the positives of the plantation. Instead of importing a used coal power plant (from China) why not import solar panels to meet the energy requirements? Why not focus more on wind, solar and hydel power projects instead of developing coal power projects. We should not be looking to replace imported fossil fuel with local fossil fuel but be looking to replace fossil powered plants with clean energy power sources.

very easy to say remove coal but hard to do due to economics. European coal powerplants are back online because of high gas prices. For base load you can’t just depend on wind and solar. Wind is not blowing so UK is also increasing the price. do you even have batteries to store solar energy?

Nuclear and solar will help but it will take many years