Have you ever wondered why your parents could buy a whole lunch for Rs. 5, and you can’t even afford candy for that price? Well, we have some answers for you that stretch far beyond the rudimentary explanations of how inflation works.

It all started with a plan to conquer foreign markets and reap the benefits through seigniorage. The East India Company also established a mint in Mumbai to issue coinage sanctioned by the Crown. In the past few centuries, little has changed. Dominant currencies control how domestic markets respond to their economic needs. For instance, the dollar and its reign over the globalized international market cause serious repercussions for developing countries such as Pakistan.

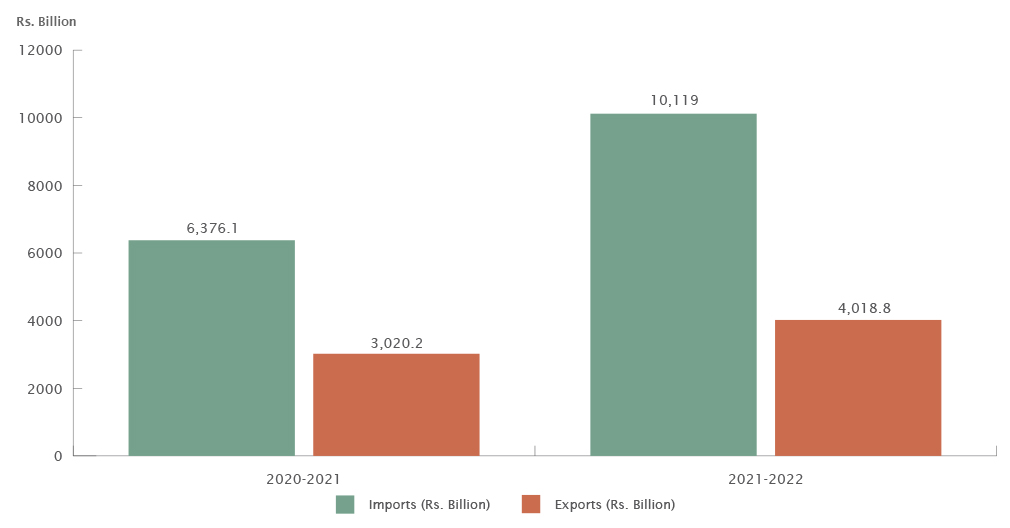

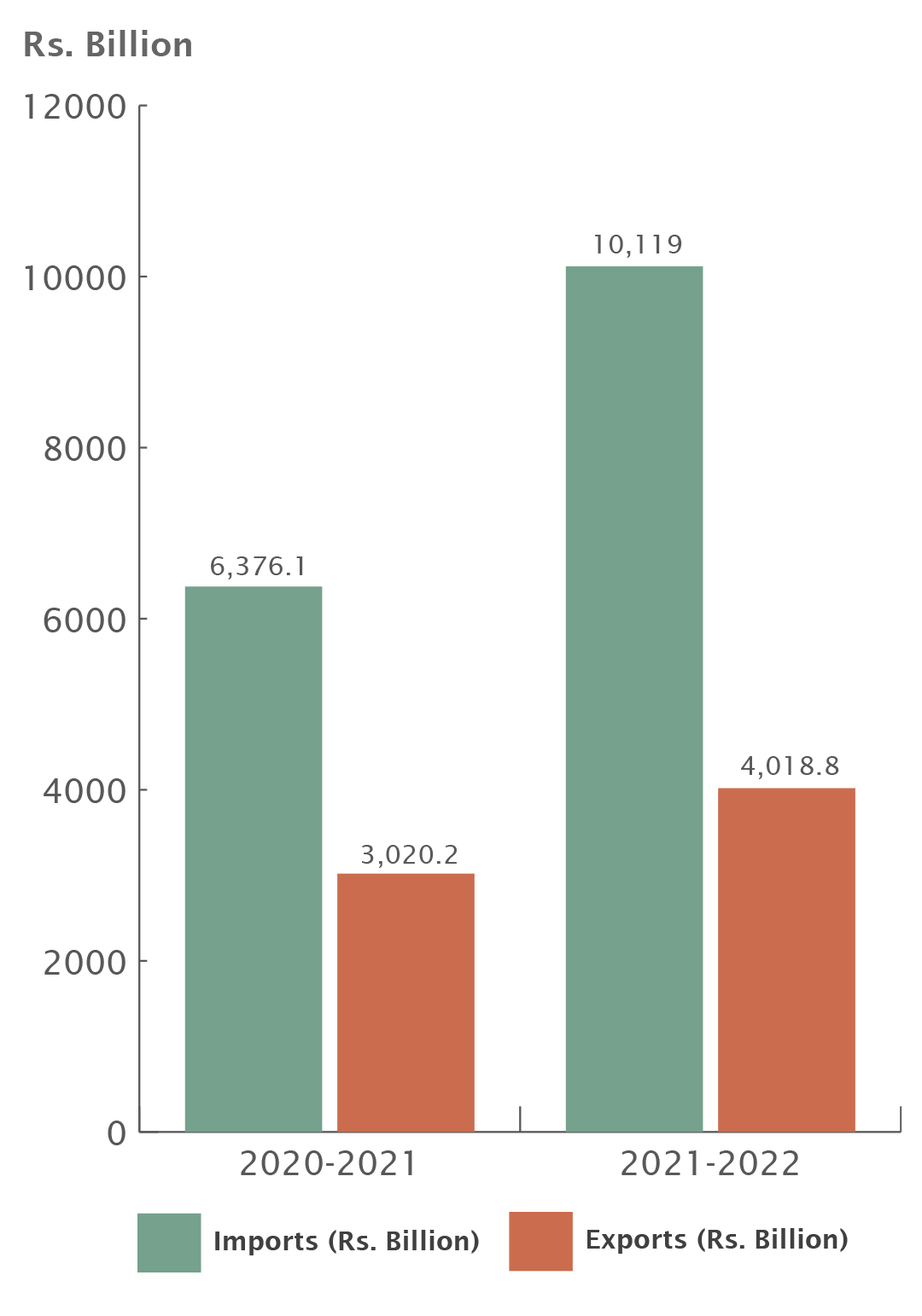

Particularly, in Pakistan, the transactions in the local market are in Rupee terms, whereas our import bill is in Dollar terms. This has widespread implications for prices, production, employment, and every other economic characteristic of Pakistan. Such effects of the global circumstance can be explained by the current account differential, or more specifically the trade balance. The role of monetary theory in Pakistan is important, due to the role played by exchange rates in international trade.

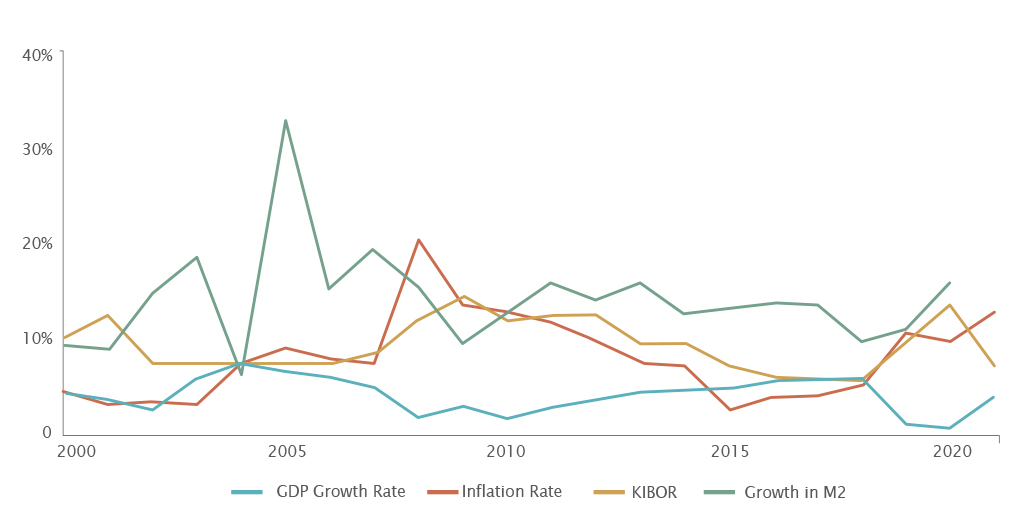

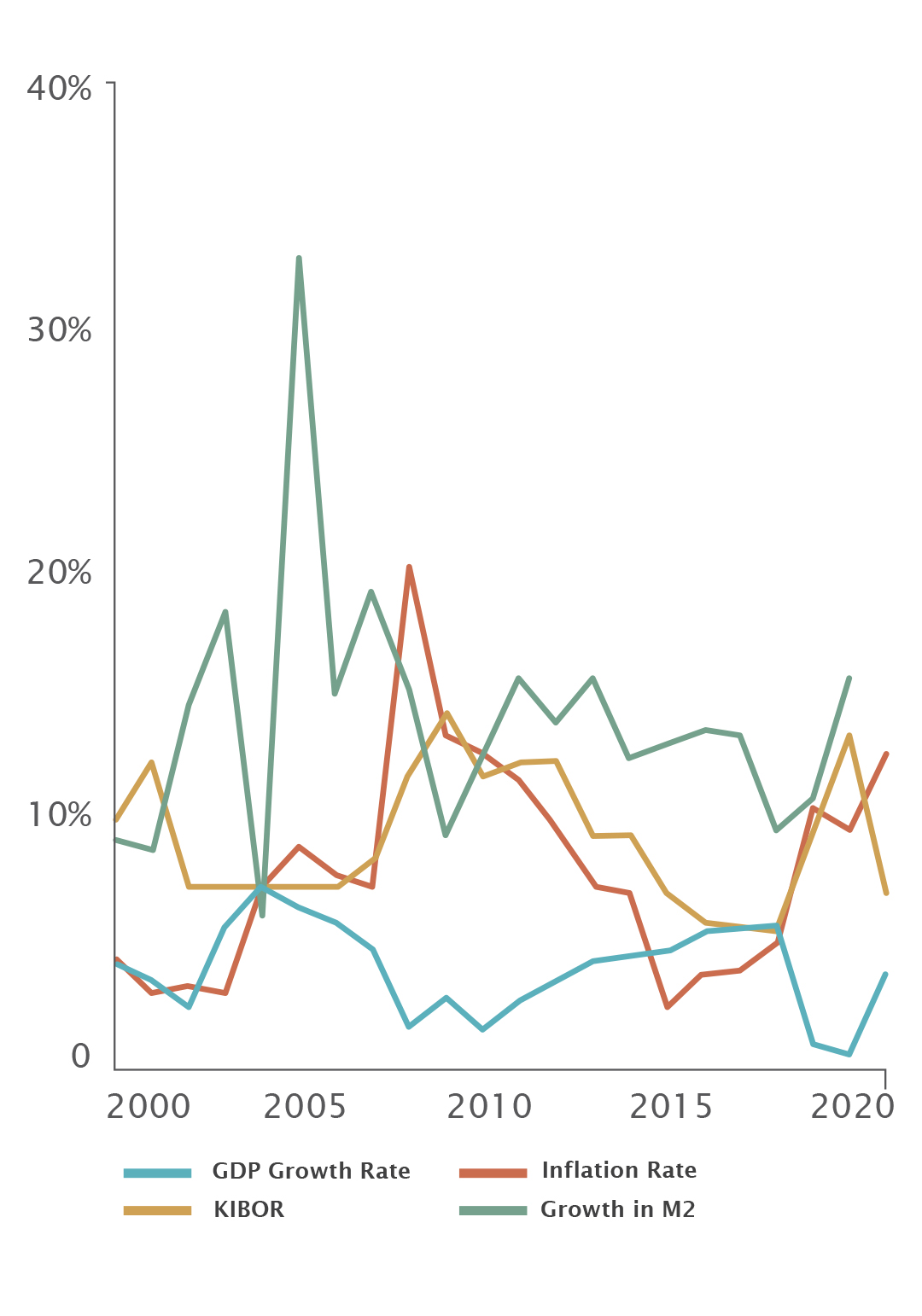

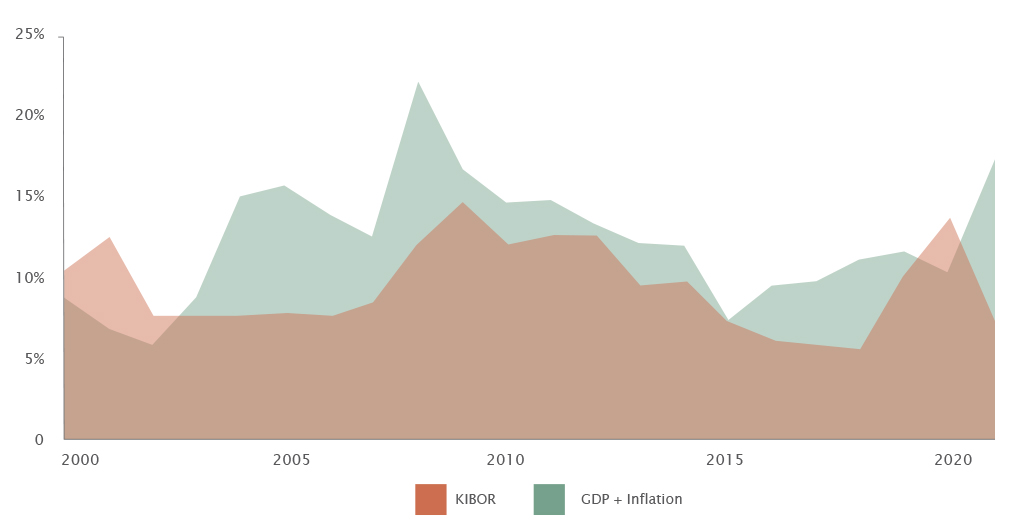

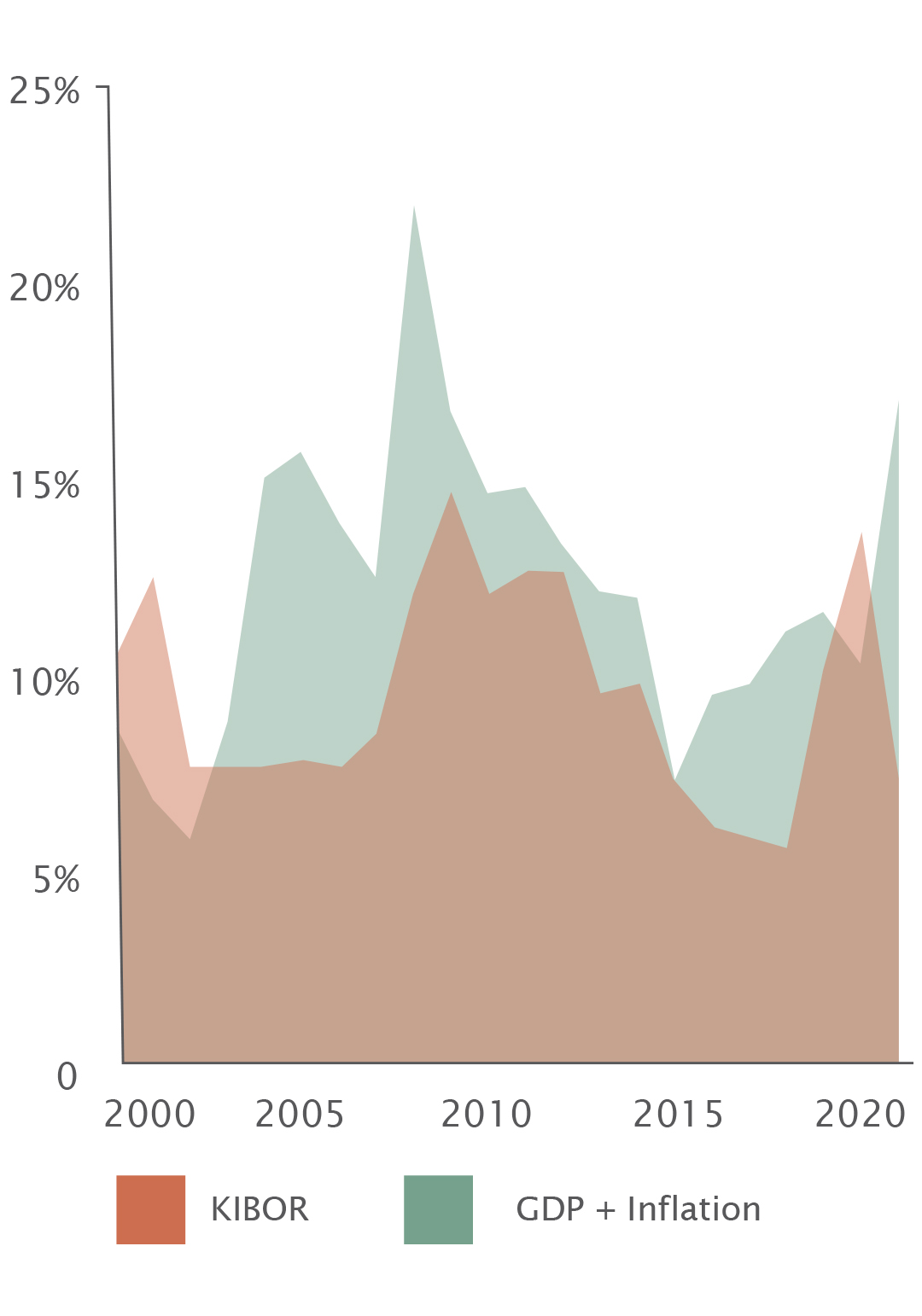

The central bank in Pakistan, The State Bank, uses cash flow or money supply to manage inflation, and exchange rates, and influence the business cycles. At its most basic level, the money supply constitutes of currency in circulation, and deposits with banks. The SBP manages this flow through open market operations or printing new money. More money can spur economic activity in the economy through less interest rates, and increased incidence of investment.

But at the same time, there is a direct relation between the increase in money supply and the increase in price levels. Through the market’s mechanisms, price levels increase and the currency devalues. This devaluation isn’t only harmful to domestic purchases, but also to imported items. The import bill increases considerably, and so do interest payments on external debt. For an economy dependent on imported raw materials and ridden with debt, this can have serious consequences.

One of the multitudinous aspects of this mechanism is the devaluation of the currency. As mentioned in the beginning, why did Rs. 5 buy more in the past and less now? In a consumption-based economy like Pakistan’s, this can mean extraordinary pressure on the most important economic actors, the households.

Source: PBS

Global Economic Circumstances

In ordinary circumstances, the relationship between money supply and inflation has ripple effects throughout the country for many years. When added to politico-economic global circumstances, this can add further pressure on consumers.

For instance, the 2007 financial crisis impacted global economies and currencies devalued all over the world. A similar shift was observed in 2020 after the COVID pandemic; the repercussions of which were plenty on their own, but the Russia-Ukraine War has caused a greater decline. All in all the Rupee has devalued by 21% over the past year.

Additionally, the global market for raw materials has observed fluctuations over the past couple of years. As Pakistan’s major industries; automobile, and manufacturing capital, rely on imported raw materials, this results in harsh results for ‘local industries as well.

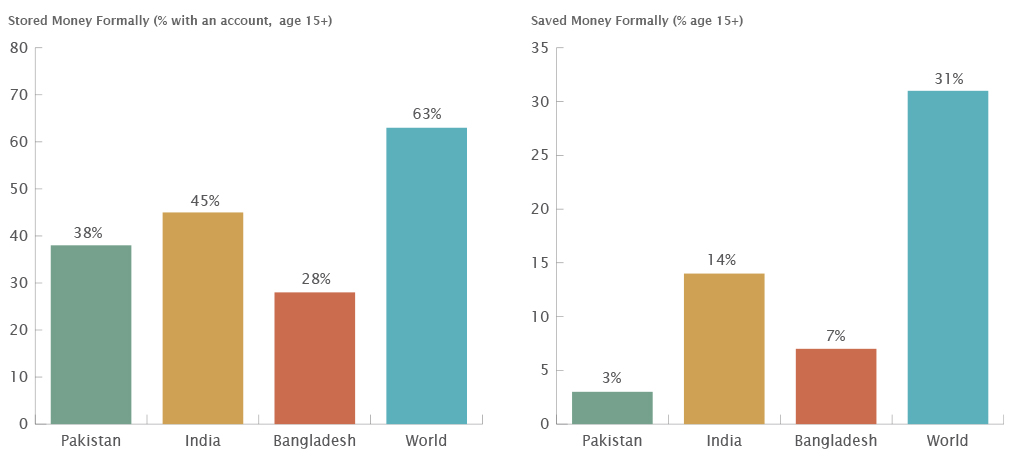

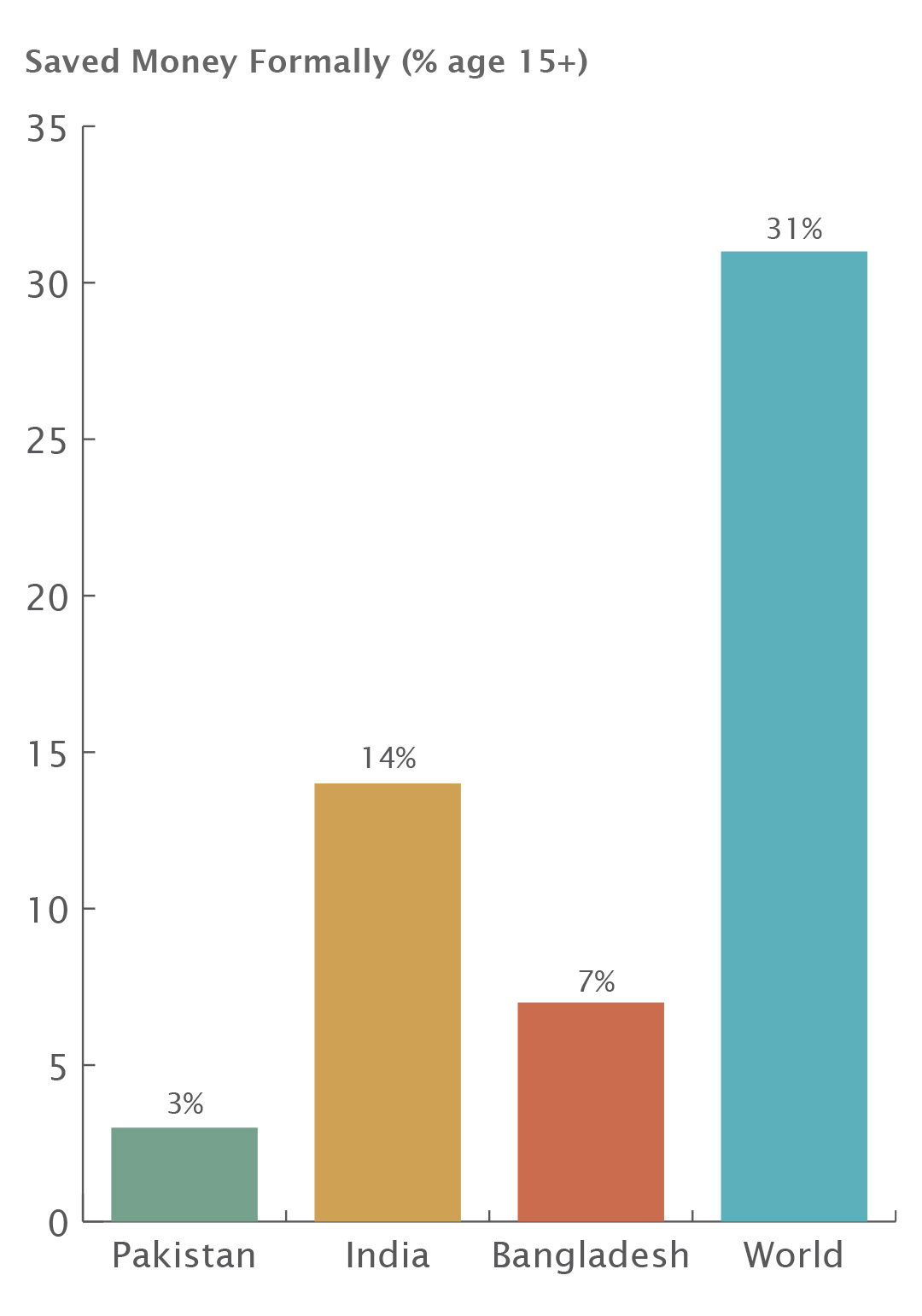

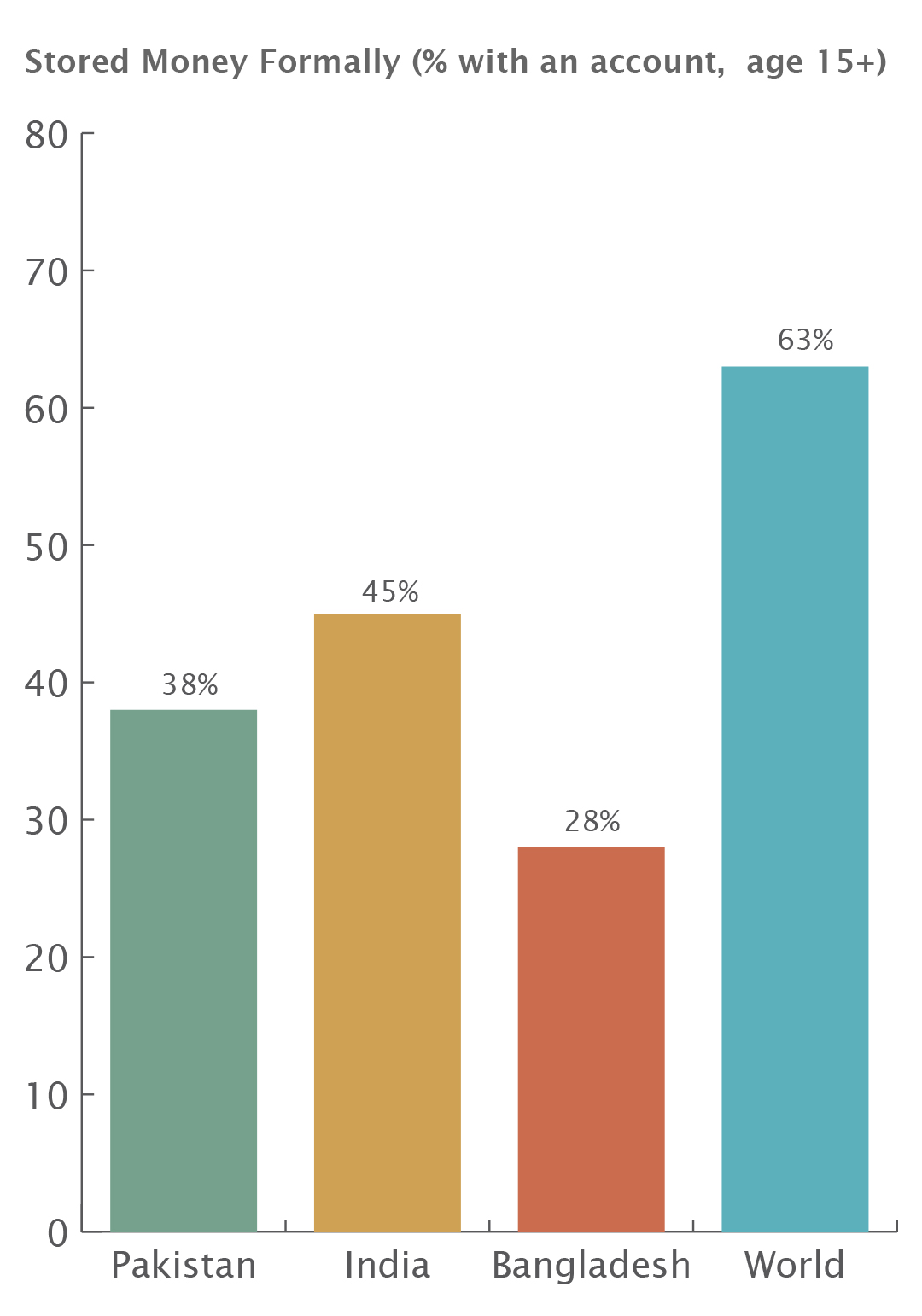

Source: FINDEX 2021

Pakistan’s Infrastructural Problems

In progressive developing countries, savings have played a monumental role. For instance, Bangladesh’s microfinance movement in the 1980s by Grameen Bank. The model relies on commercial sustainability, with savings playing an important role. Furthermore, the model concentrates on capital accumulation for the poor. Resultantly, more than 30 million people have access to building capital and ensuring a sustained stream of income.

On the contrary, Pakistanis rely heavily on cash payments, which is pretty characteristic of underdeveloped and stunted economies like Pakistan with limited digital penetration. Furthermore, people also hold cash due to speculative inflation in the country. This is termed as speculative demand for money, there is a high demand for cash that can be used in transactions in the assumption of future inflation. With most of the country employed in the informal sector, there is less focus on digitizing the process. This aspect of the undocumented economy also results in hurdles for streamlining investment and saving methods.

But what is the alternative to cash holding in a country not oriented towards savings? Depositing your cash in banks is a viable solution, however, the interest/discount rates offered by banks merely benefit the sector. Since banks can transfer their increase in deposit costs to the consumer, there is little impact on their profits.

Furthermore, as an Islamic country, most Pakistanis deposit their money in an Islamic savings account that does not conform to the minimum savings rate condition applied by the state bank. Most banks exploit this discrepancy to offer lower savings rates to depositors. This has led to widespread mistrust as can be seen by the rise in currency circulation during the past 2 years.

Self-Serving Economic Agent

One of the foundational basis of Economics is the assumption that all economic agents maximize their own self-interest. Whether you study consumption or production, you will observe one common thread running through all these phenomena, maximization of self-interest. As consumers, with plenty of cash reserves, maximizing future consumption is also important. The economic agent needs to distribute consumption over his life and optimize his income accordingly.

Financial independence is one of the buzzwords of the 21st century. But considering global pressures, and local uncertainties how does one approach the issue?

Different assets and industries respond differently to global pressures. For instance, the automotive industry has experienced mounting strains due to import taxes. Even though automobiles are seen as a fixed asset in Pakistan, the impacts of economic circumstances have affected the demand for automobiles. Whereas, the real estate industry has observed a steady growth in demand and worth.

Enlightening…. Thank you for the amazing content every time.

Thanks a lot for encouraging us!