Pakistan’s economy is facing multiple challenges that are hindering its growth. The country’s tendency to spend rather than save creates an imbalance in money circulation and investment. This, combined with the social consequences of inequality and fewer opportunities, results in a sluggish economy with low investment and productivity.

Therefore, balancing the shortfall through investment is crucial for the stability of the economy. However, investing can be a complex decision with various options and the prevailing politico-socio-economic uncertainty. Finding the right investment strategy is crucial for the stability of Pakistan’s economy.

Savings & Consumption

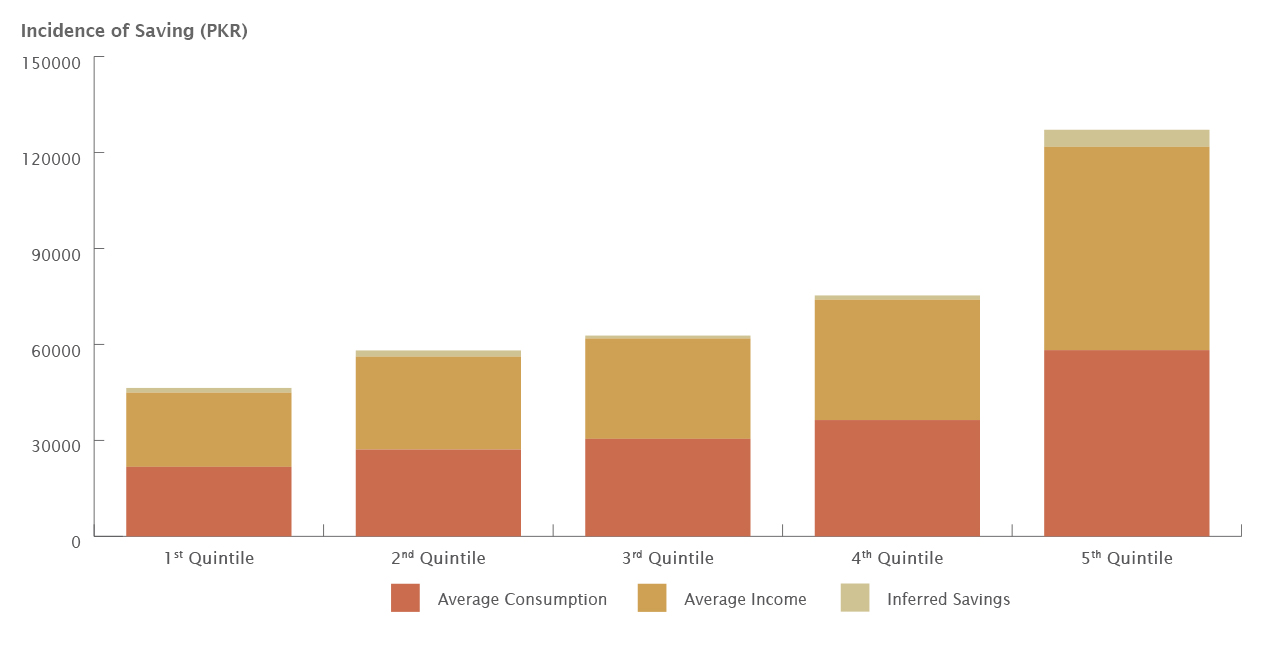

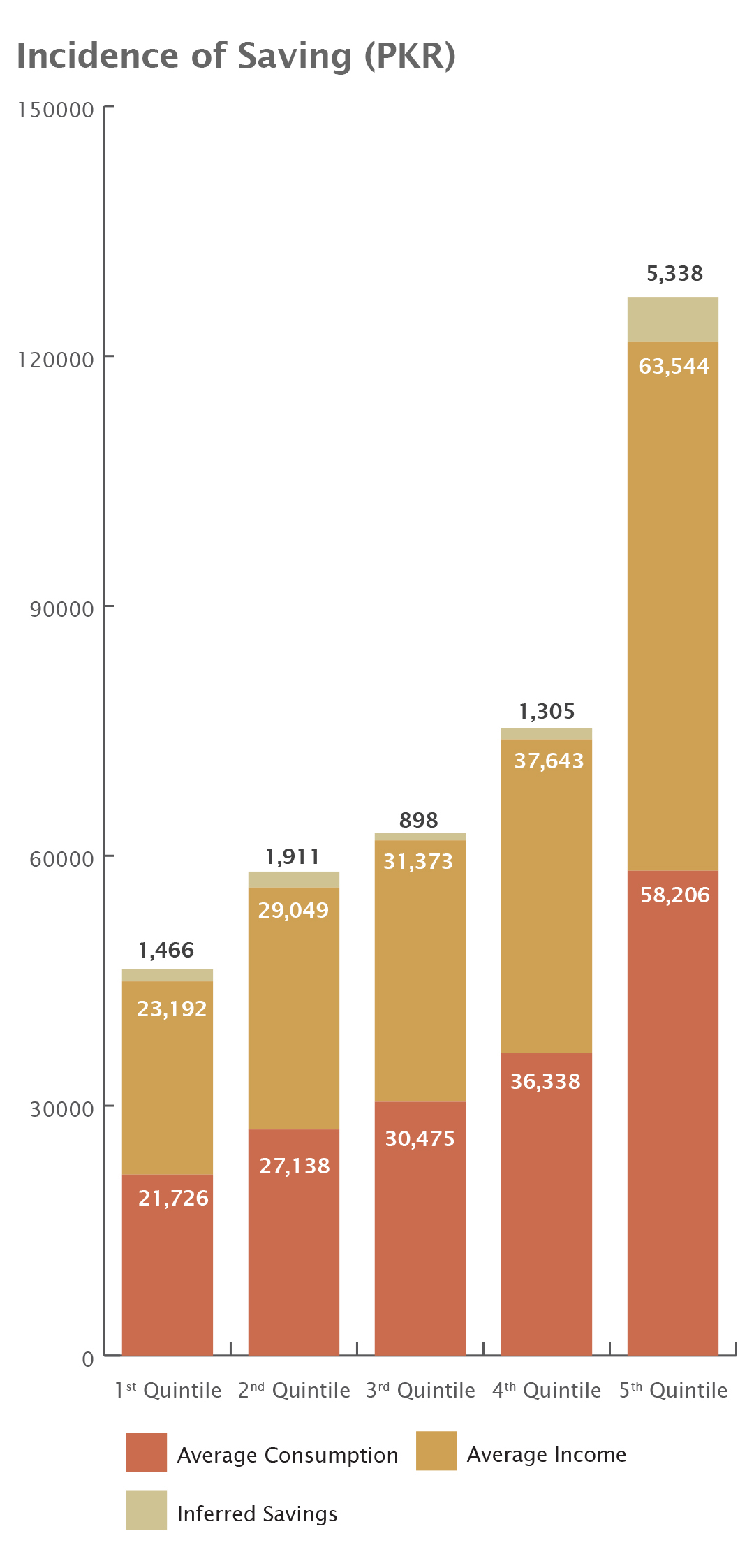

Income inequality and wealth inequality are closely related since savings from income accumulate over time to build assets. Lower income also correlates with lower savings, and lower wealth or asset holding. The disparities are apparent across the socioeconomic classes.

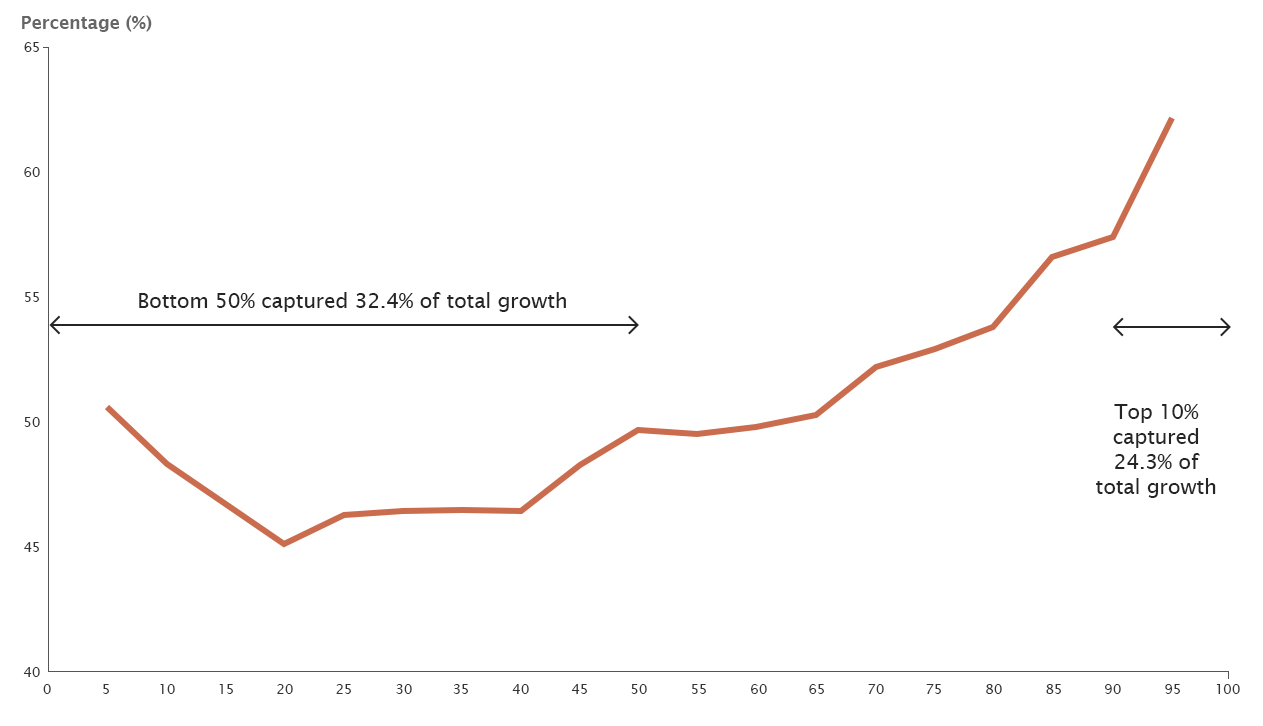

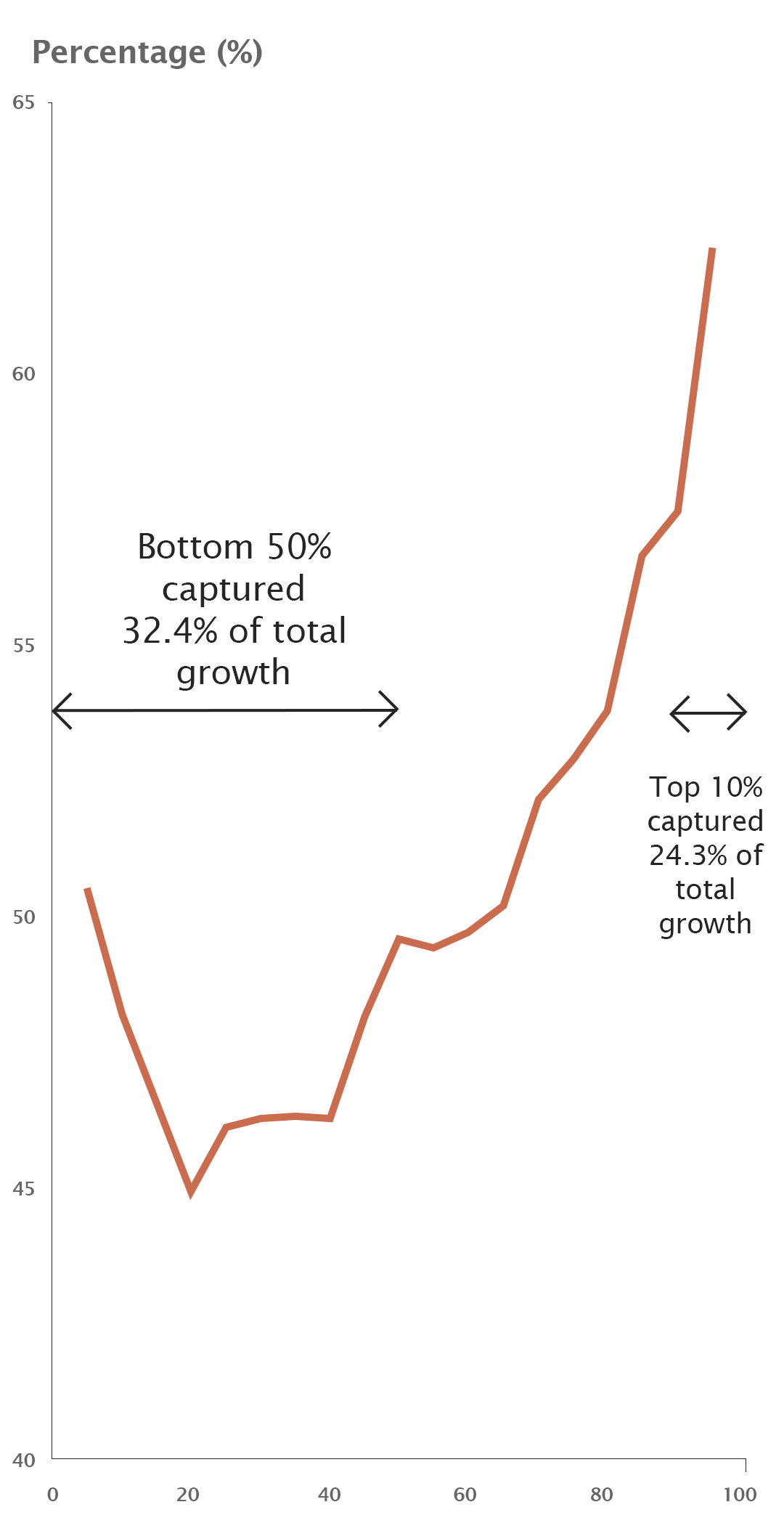

The inequality in our society results in unequal opportunities for employment and business ventures. This perpetuates a cycle where the rich get richer and the poor get poorer. In the case of Pakistan, economic growth has had a disproportionate effect on the wealthy and the poor, further limiting opportunities for savings and financial stability.

Here, the first quintile represents the lowest 1/5 of values. Pakistani households show a trend of low saving throughout different income groups

Source: PSLM-HIES 2018-19

Total income growth by percentile, FY2001/02 to FY2015/16

Source: https://mhrc.lums.edu.pk/why-do-income-and-wealth-inequalities-matter-for-pakistan/

Low Investment

The low saving rates in our economy also indicate the macroscopic issue of money circulation. In a consumer-driven economy, the flow of money and the money supply are always higher, indicating excess money that could be invested to create equal opportunities.

In Pakistan, several obstacles to investment exacerbate the issue of low saving rates and excessive money circulation. These barriers include high-interest rates, limited information about the investment process, and a lack of trust in available options.

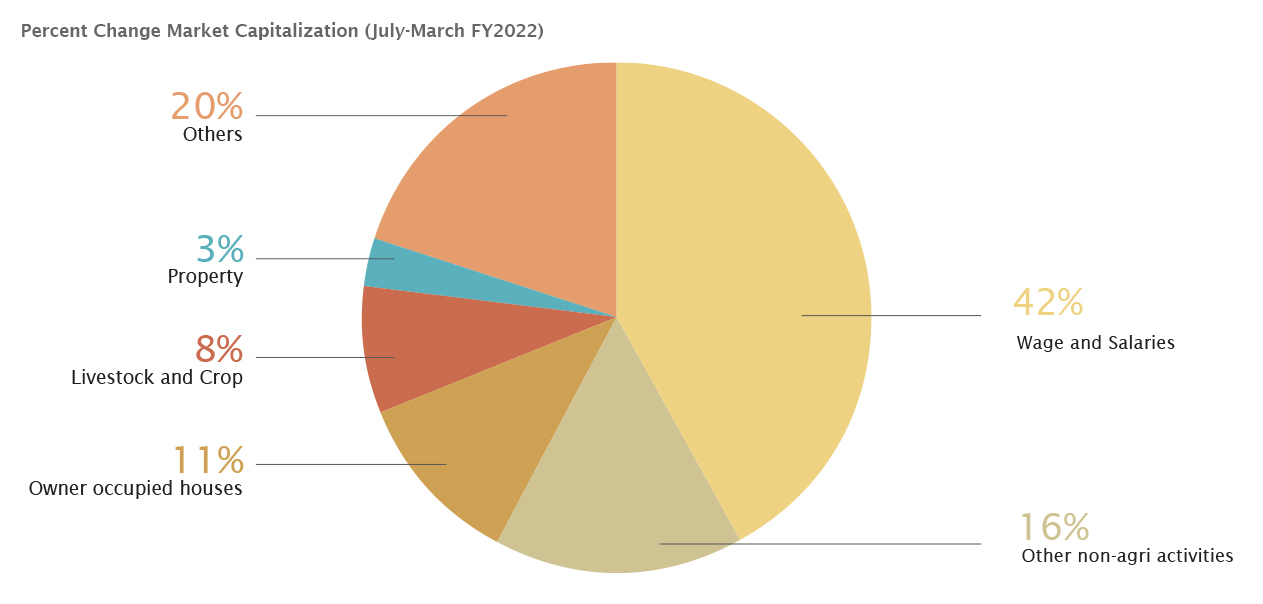

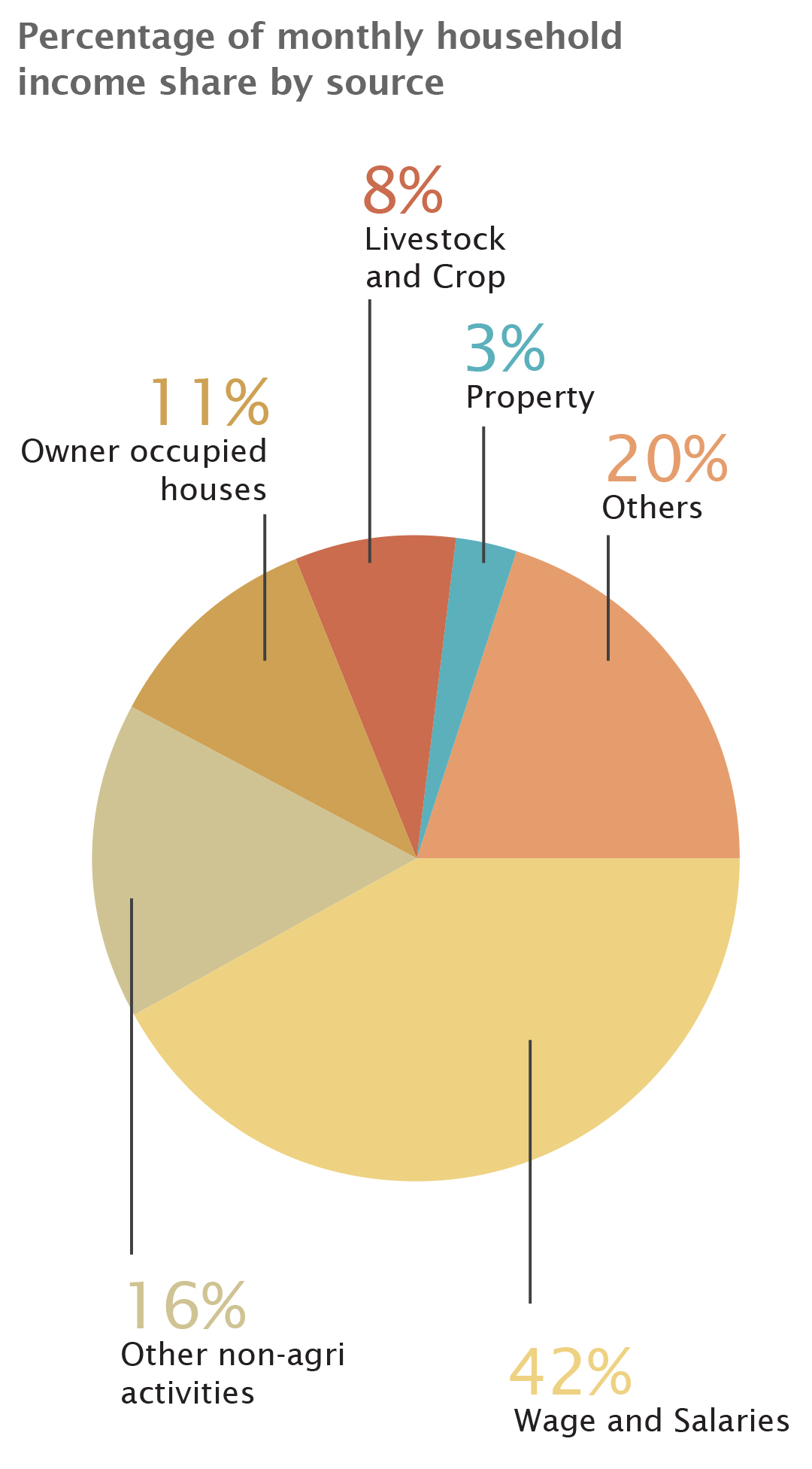

According to the World Bank, around 80% of the wealth held by Pakistanis is related to real estate. However, most of these assets are held by people above 60 years of age signaling accumulation over a long period of time. For the most part of their lives, Pakistanis rely on monthly wages and salary for sustenance, with nothing to provide an economic cushion in times of financial vulnerability.

A majority of the population relies on wages and monthly salaries to cover expenditures. However, this is not enough to protect households from financial vulnerability in times of inflation and economic uncertainty

Source: PSLM-HIES 2018-19

Viable Alternatives for Investors

If Pakistan’s saving problem is solved, there are various avenues for investment. The most common investment paths include; bullion, foreign currency, mutual funds, stocks, and real estate. The decision comes down to risk and rate of returns. Real estate is a steady industry that has seen various tax advantages in the past and continues to be a source of passive income. Since industries are attached to the investment, there are endless opportunities for wealth creation. The advent of real estate investment trusts also promises a boom in the sector and attached industries in the coming year. These industries extend from cement to steel and indirectly support the labor market.

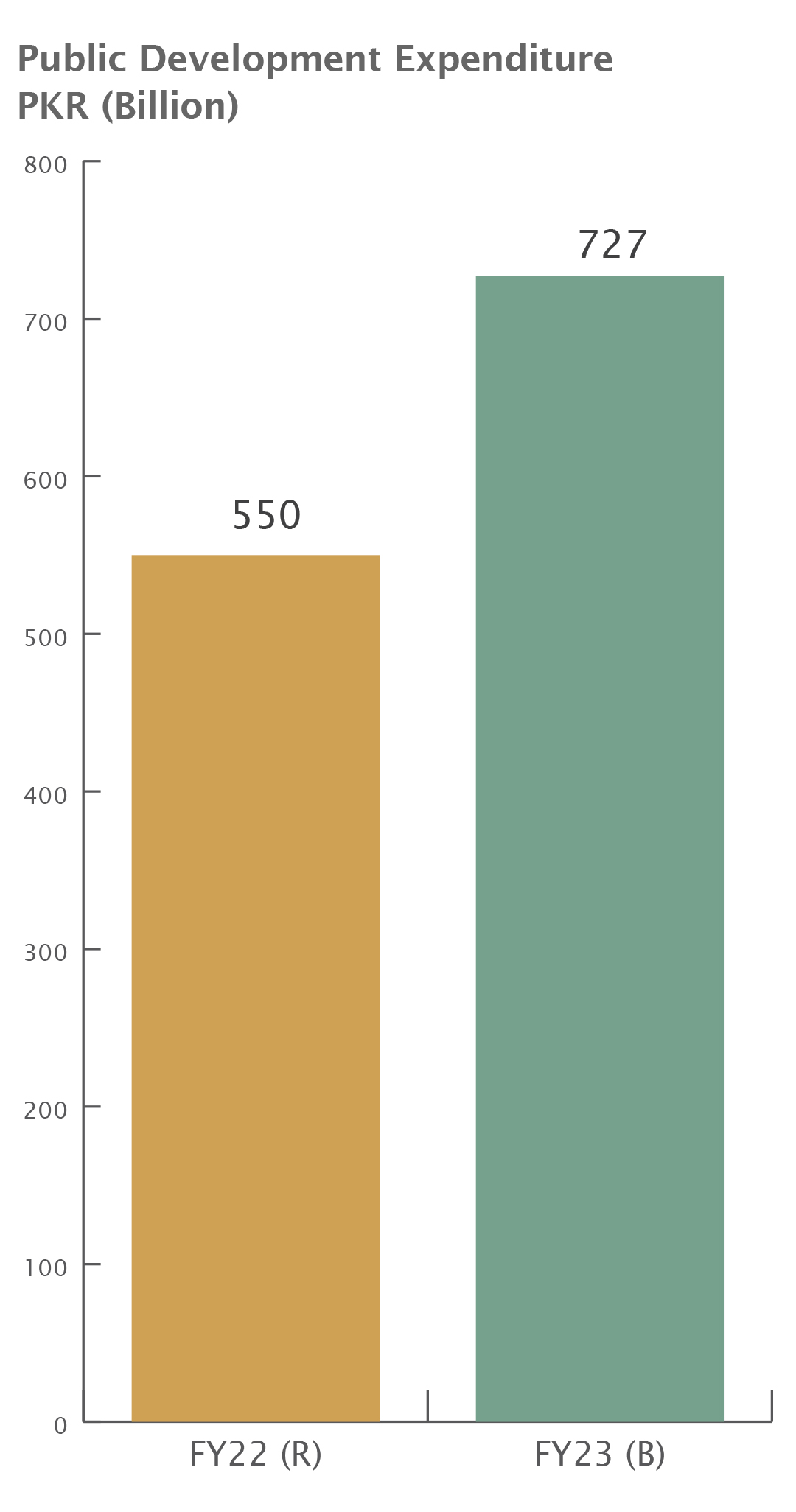

An increase in public spending on projects leads to an increase in cyclical demand for construction materials such as cement and steel

Source: Ministry of Finance. Annual Budget Statement FY23

Other than that, public development expenditure also provides an impetus to the industries by creating cyclical demand for labor, raw materials, and capital. The Government’s budget allocation for Planning, Development & Special Initiatives, is quite monumental for FY 2023. It is also estimated that the volume of investment in real estate is around USD 88 billion, with pending projects amounting to around PKR 1.1 trillion. All in all, the sector is on a stable growth trajectory.

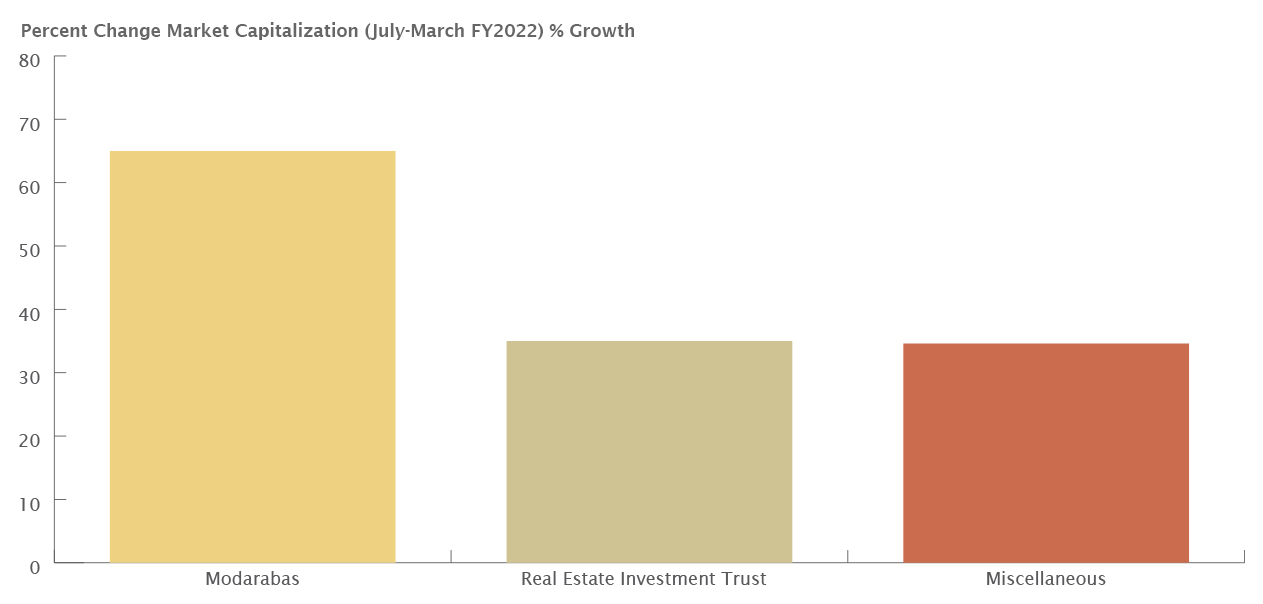

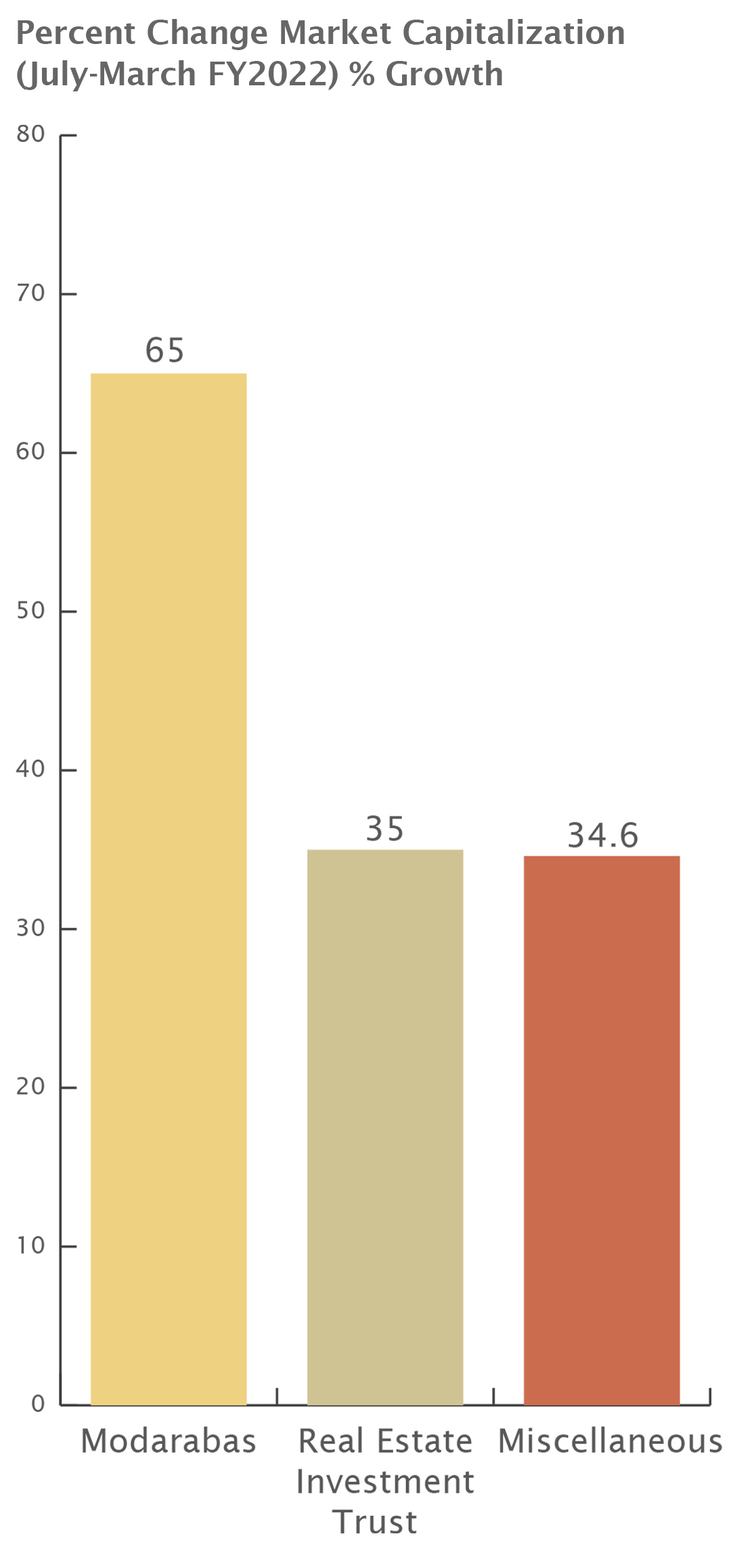

Real-estate investment trust has grown considerably, making it easier to finance real estate development

Source: Pakistan Stock Exchange (PSX)

The barrier to entry in real estate, however, limits even those who are willing to invest their savings. For instance, the initial investment for plots and buildings is relatively high, thereby turning away willing investors. Unlike the usual commodities markets where demand curves usually point downwards, on asset markets they often point upwards, and therefore give rise to this kind of instability. Especially, due to the lack of a perfectly competitive market, a few key players manage the landscape of real estate in Pakistan. This often leads to losses in economic welfare for consumers, since the producer has more leeway to enhance profits.

Furthermore, there’s a tradition of floating ‘files’ in the market in exchange for a downpayment for a plot. This also creates a loophole leading to surplus profits for developers. Such projects rely on the sale and purchase of files instead of actual value-based property, thereby, becoming an opportunity for scammers.

In construction-related investments, it is quite tedious to keep track of progress. Since it adds to the cost of the project, most ventures deem it unnecessary to include a tracking or updating system. However, this brings about a different layer of information asymmetry that facilitate the exploitation of investors.

Moreover, considering land as an investment isn’t the most efficient financial decision. Instead, value addition and construction are better avenues within real estate.

The Better Option

In comparison to Pakistan’s relatively primitive industries including agriculture, manufacturing, etc., real estate investment is still a far safer and more productive investment. It can also function as a stable passive stream of income.

The pitfalls in real estate investment like information asymmetry are quite pertinent. As most of the pricing is dependent on speculation and information is held by a few, therefore, setting expectations for returns can be problematic. As mentioned above, these issues continue to hinder investment. Possible technological interventions in the industry can streamline inherent risks in the investment.

To counter these problems, transparency and accountability in conjunction with technology can be applied. This can greatly improve the investment experience for beginners. Especially, in the first few steps relevant to gathering information about the investment. Just like stock exchanges have free access to most of the information from equity to trends, similar transparency is crucial for real estate in the form of public ledgers. Clarity about the rate of returns and premiums is also an essential aspect of the investment procedure, which can be achieved through a digital solution for tracking the valuation of the property. This clarity in transactions between buyers and sellers, and consequently lower costs are further proof of the benefit of PropTech.

As proven in the world, Web 3.0 and Blockchain technology has immense potential for transparency. If combined with value-based assets such as real estate, the combination can use the best of both worlds to dissolve barriers for new investors. Furthermore, Pakistan’s real estate infrastructure relies on manual or physical means for recordkeeping. Digitization and geo-mapping can ensure impunity from fraud, and make records easily accessible.

After tirelessly looking for a solution, we stumbled upon a startup aiming to solve all these challenges. DAO PropTech’s tools make it possible to invest in real estate, safely through an elaborate dashboard. With its data-backed approach, leveraging technology, transparency, and accessibility are at the core of the product, thereby making an investment in real estate as hassle-free as possible. Learn more about DAO PropTech here.

References

- Housing and Construction | Board Of Investment

- Capital Markets and Corporate Sector

- Determinants of the prices of residential properties in Pakistan | Emerald Insight

- Budget FY23 Initial Impressions | Arif Habib Ltd.

- Why Do Income and Wealth Inequalities Matter for Pakistan? – MHRC

- Managing supply and demand: The key to getting ‘housing’ right in Pakistan

- SDGs INDICATORS COVERED BY PSLM

- Best investment options in Pakistan to hedge against high inflation

- Real Estate sector investment volume is $88b in Pakistan: President EAA

- Addressing challenges of income inequality, real estate

- Life Cycle Savings in a High-Informality Setting—Evidence from Pakistan (English)

Finally. Another article. Keep up with this amazing content.