Economies heavily rely on productivity, business cycles, the banking sector, and debt. Increasing productivity leads to economic growth, job creation, and higher living standards while managing debt levels is crucial for sustainable growth. The banking sector plays a vital role in providing financial services, such as loans and savings, to individuals and businesses. Understanding and managing these factors are essential for Pakistan’s long-term economic success, as the country aims to curtail its fiscal despairs and improve growth.

Over the last ten years, Pakistan’s aggregate productivity has hit a bit of a rough patch. Unfortunately, firms have become less productive over the past few years. Additionally, the COVID-19 pandemic dealt a massive blow to productivity in 2020, causing a staggering 23% drop. Interestingly, productivity is also a function of savings and investments among other things. Savings lead to productive investments which then build the productive capacity of firms, thereby forming a feedback loop.

The matter of financial services is pertinent to understanding savings, and consumption. Pakistan’s banking sector has undergone significant changes since its inception. In 1953, the focus of banking activity was mainly on commerce, which received 48% of the advancements. However, in the 1960s, there was a shift towards providing credit to the manufacturing sector, which was seen as a key driver of high economic growth at that time. Soon, the SBP realized the monopolies in the banking sector while reporting that only 88 accounts in Pakistan had access to 25% of total bank credit. Thereby, leading to the nationalization of commercial banks.

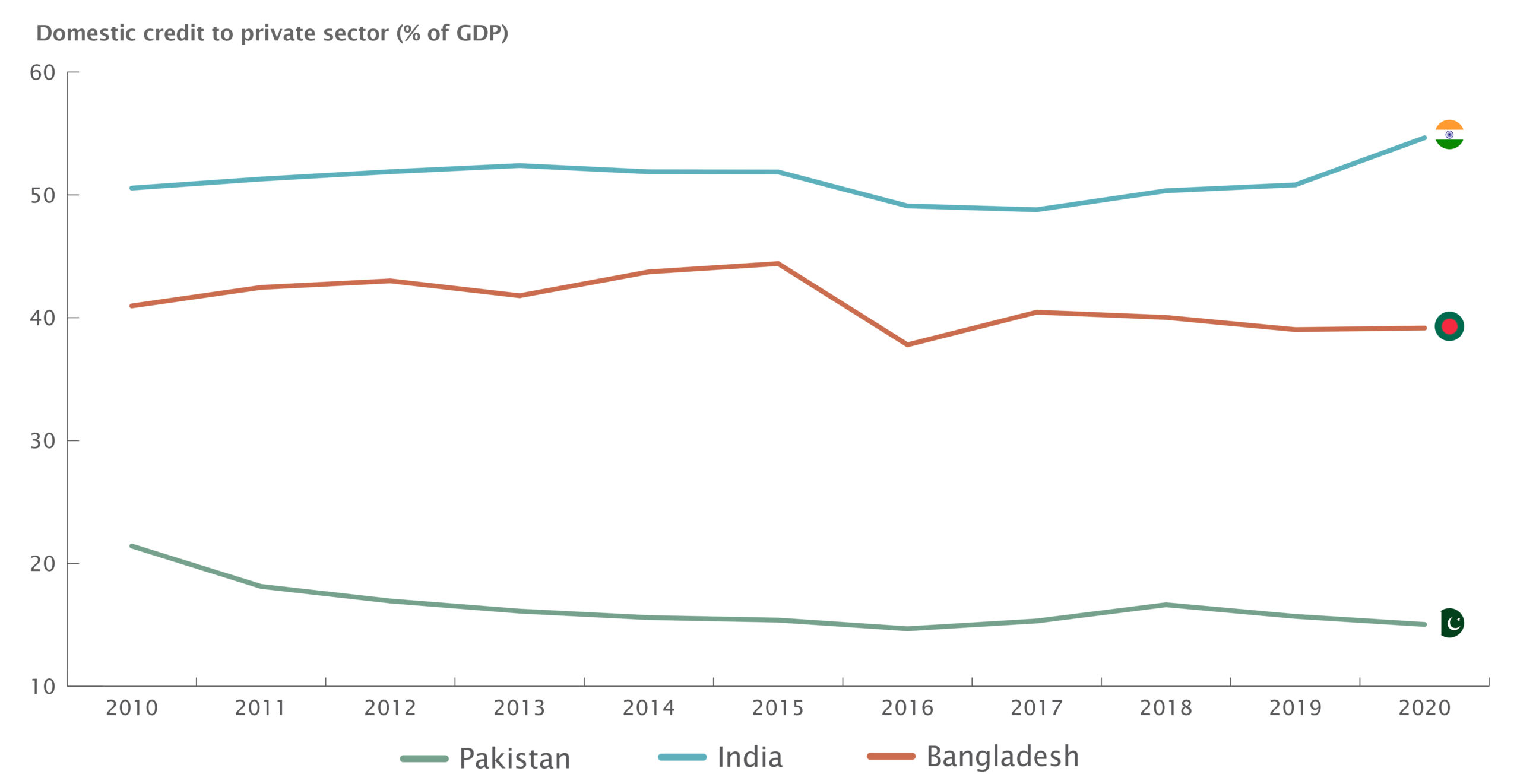

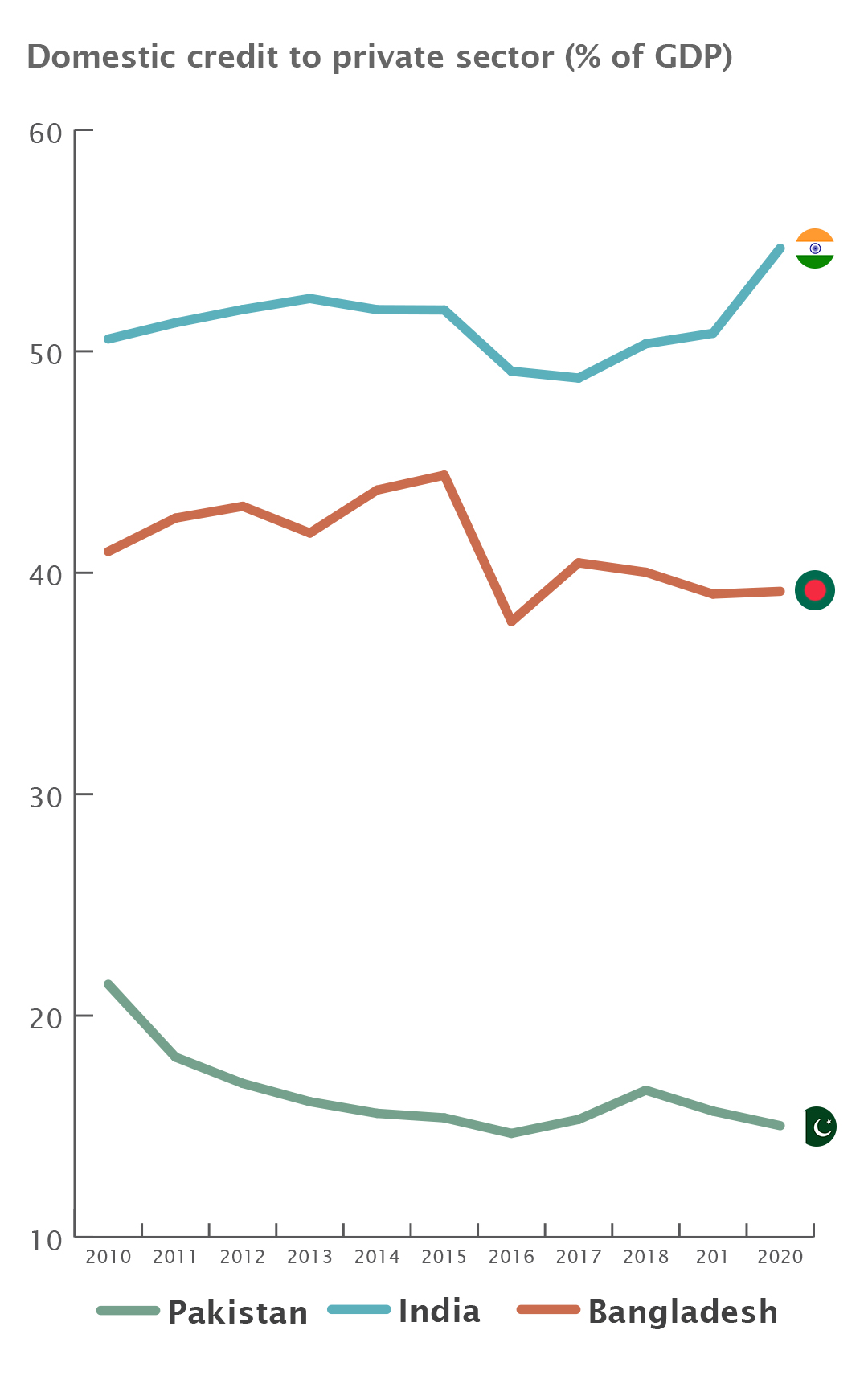

Source: World Bank

The direction of bank advancements has shifted from businesses to governments, depending on whoever had the dominant hand. But, what about the average consumer? Financial inclusion is like giving everyone a VIP pass to the world of finance. With financial inclusion, people can access credit, savings accounts, and insurance, which can help them build a better financial future and take advantage of opportunities they might otherwise miss out on. In Pakistan, formal credit is unheard of. But maybe there’s a silver lining there. At least you won’t have to worry about getting into debt, right?

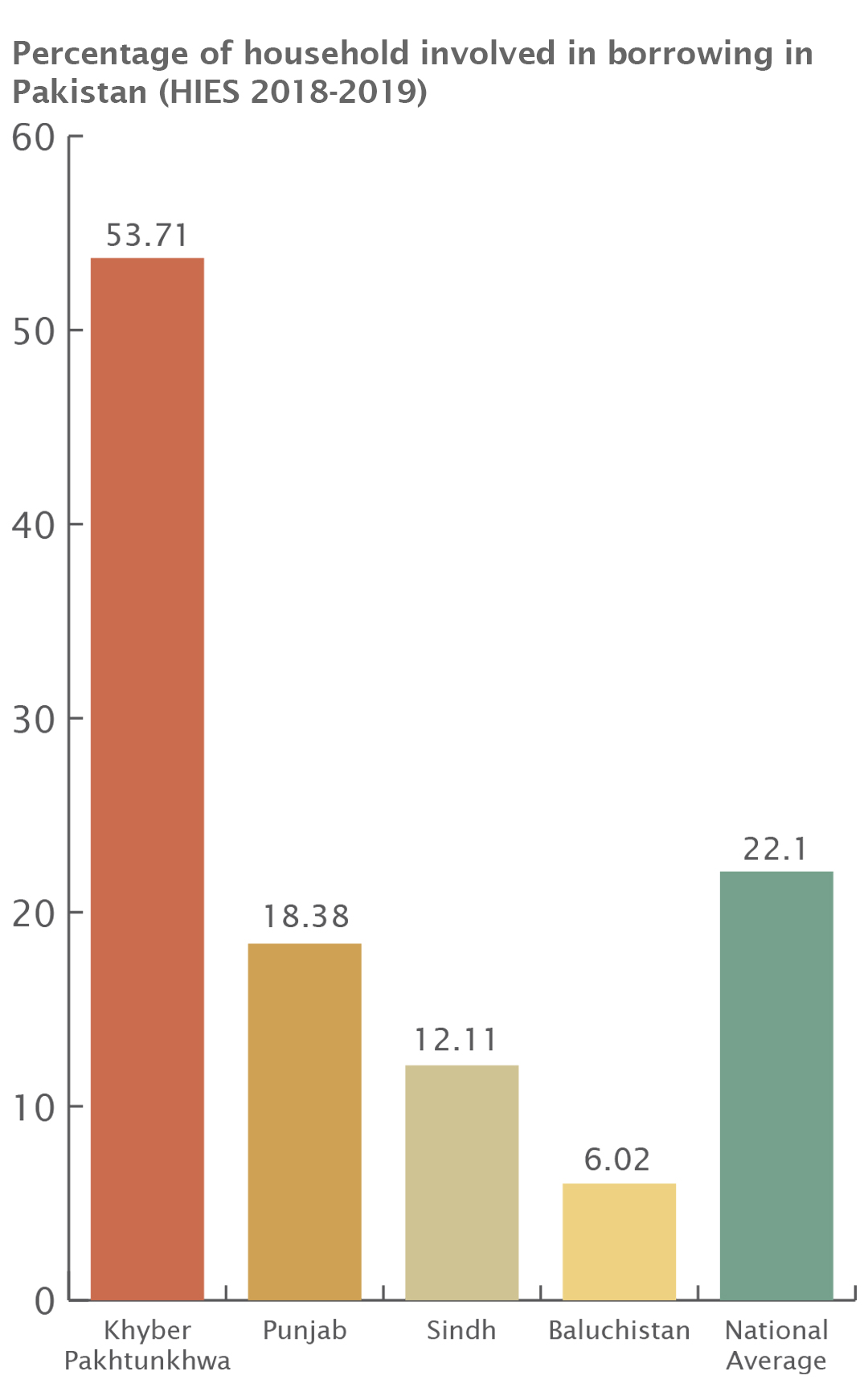

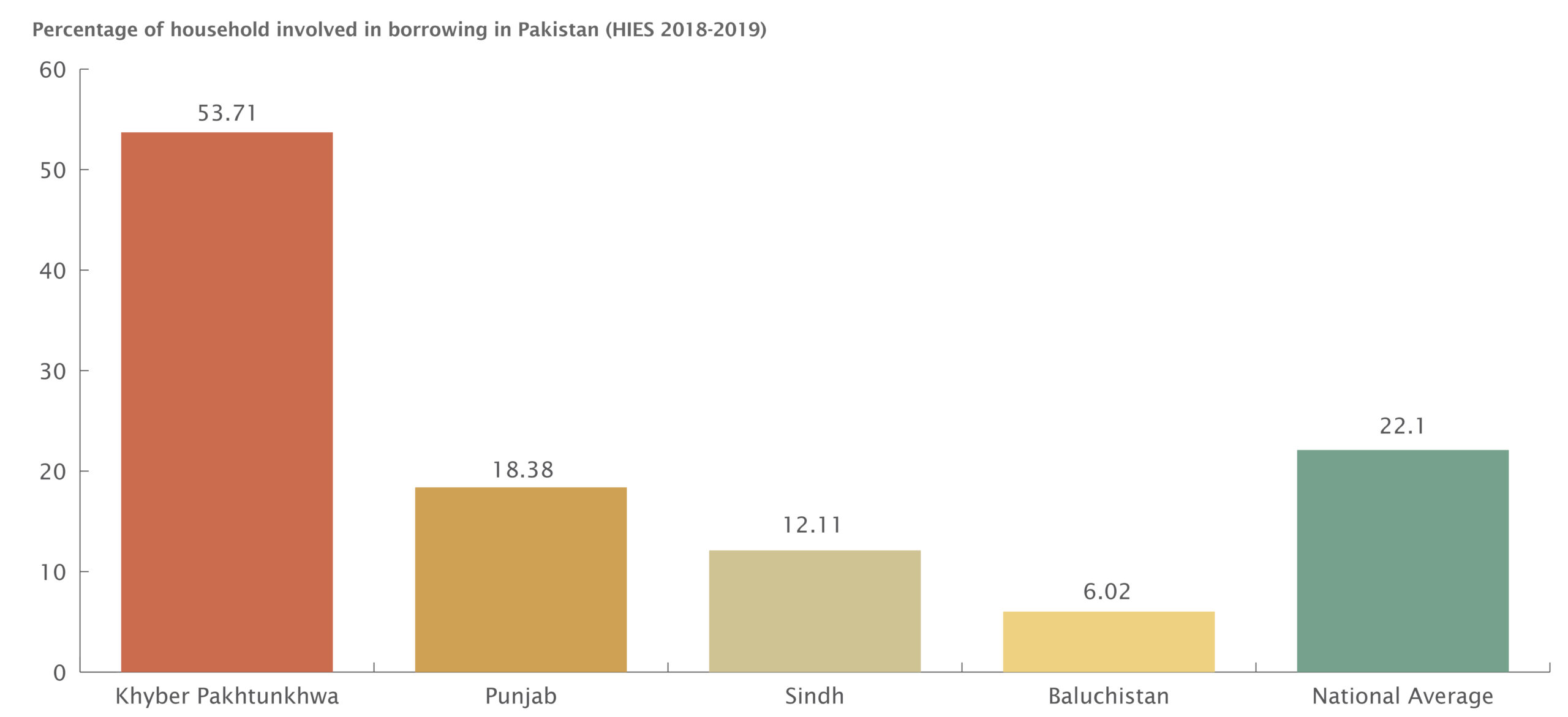

But in all seriousness, in Pakistan, the overall household debt in Pakistan amounts to Rs. 1169.78 billion, based on the average debt per household. However, most households (around 63%) borrow money to buy food opposed to the Western notion of buying houses or cars. Considering how Ray Dalio considers credit one of the cornerstones of his ‘economic machine’, where does Pakistan stand in this model?

Source: SDPI

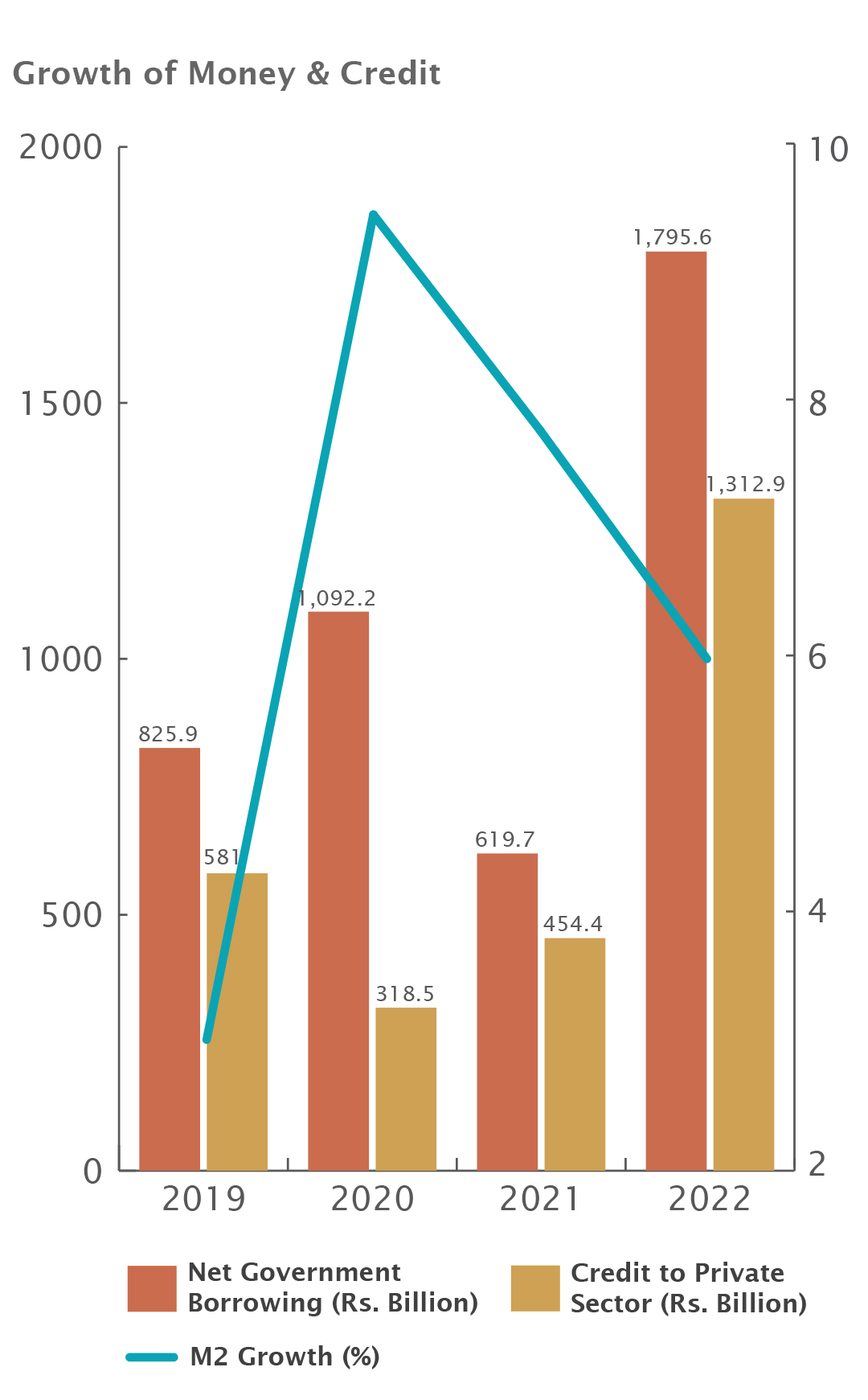

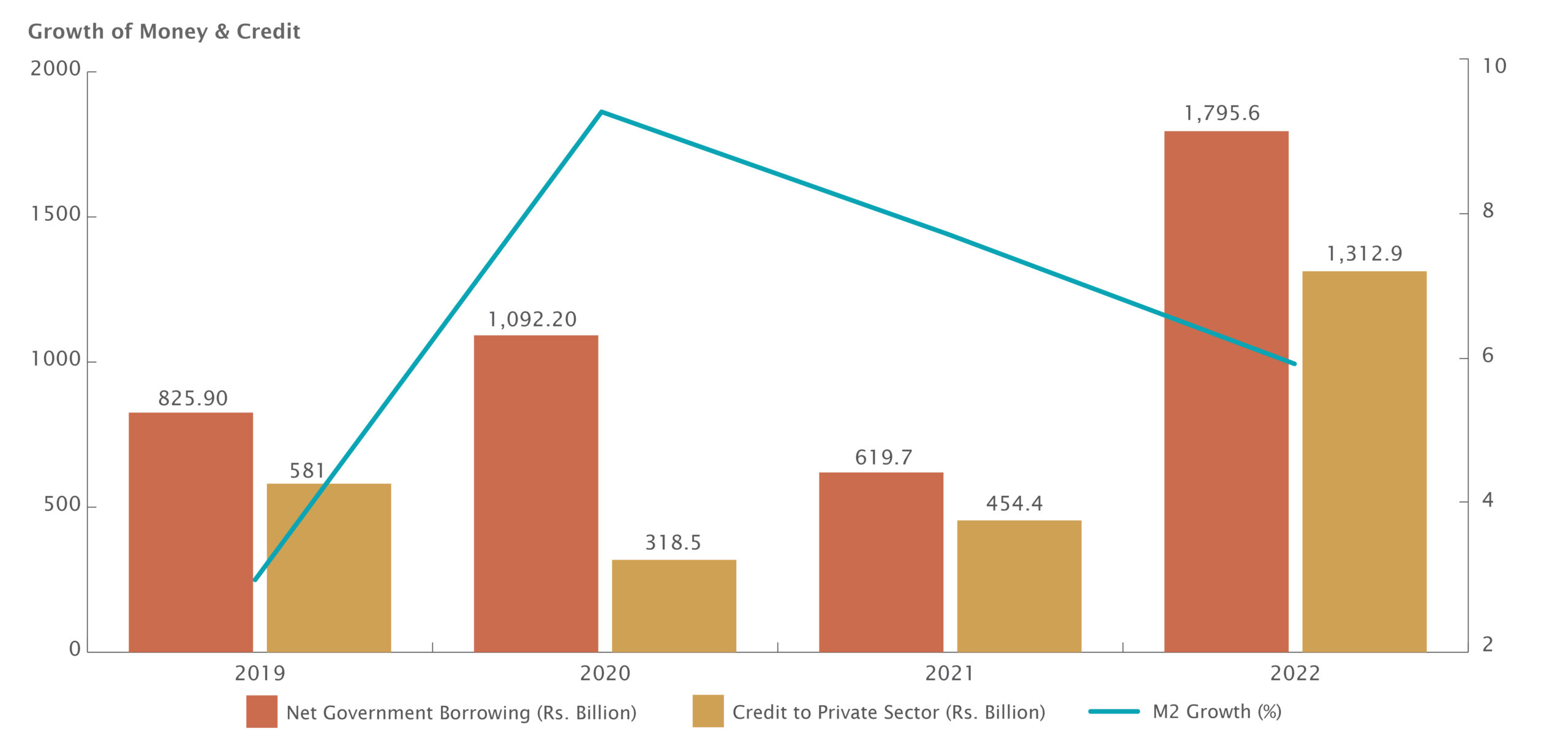

Credit primarily works in two ways; firstly, it improves consumption thereby enhancing aggregate output, and secondly, it facilitates investment that has similar impacts. The primary borrowers in Pakistan remain the private sector and the government, with little focus on consumers. This effect can be attributed to private sector bias in the banking sector, and easy gains for the banking sector in case of lending to the government. Resultantly, the case of Pakistan is unlike model economies and may respond differently to phenomena such as debt cycles.

The case of high net government borrowing has multifaceted consequences for our discussion. Depending on other factors involved, public spending can cause inflation, crowd out private investment, or even impact price levels directly. Therefore, Pakistan’s high debt-GDP ratio carries importance that isn’t reflected in fiscal policymaking. Recently, the government has announced its plan to borrow Rs. 7trn from banks in the upcoming months.

Source: Economic Survey, MoF (Various Issues)

Pakistan’s growth projections for FY23 appear rather bleak. According to Bloomberg, there exists a significant probability of 70% of an impending recession. In the past, the country had to deal with looming threats of recession as well, such as in the 90s, and later around 2018. The government responds in a mechanical way to recessions. The government utilizes a combination of fiscal and monetary policy to manage the threat. Recently, the government increased various taxes and hiked up the policy rate to prevent further deterioration in line with international economic practices.

In addition to recessions, Pakistan has also faced high levels of indebtedness at points. Leveraging up can ignite economic growth or lead to financial ruin. Productive investments generating high returns can pay for the debt, but credit used for consumption can spiral into debt. Unfortunately, Pakistan suffers from the latter where borrowing mostly fuels bridging the fiscal deficit. In June 2022, the Pakistan government’s debt stood at 73.5% of the GDP. This number is definitely higher than its neighbors such as Bangladesh owes around 39% of its GDP. It is possible for slow economic growth to be indicated by a high rate of debt growth combined with a low rate of income growth. It signals a worse economic pit and calls for deleveraging.

The government, in the past, has utilized taxation, austerity, debt restructuring, and increasing money supply to deleverage the economy. However, Pakistan’s favorite solution has historically remained the IMF. As mentioned above, the way to long-term stable growth is an increase in productivity which brings us back to the savings-investment framework.

Investment during a recession plays a critical role in stimulating economic growth and creating jobs. While recessions seem daunting for businesses and investors, it is important to recognize that opportunities for long-term growth and profitability often arise during such times. However, it is also crucial to allocate investments efficiently, as it maximizes returns and minimizes risks. As investments also result in improved productivity or efficiency in the economy.

Now, Pakistan’s investments are concentrated in the real estate sector, more specifically in land and plots. However, the development niche within real estate promises development throughout all sectors of the economy. Real estate development is an essential component of economic growth, as it generates jobs, drives demand for goods and services, and contributes to the growth of related industries, such as construction and architecture. For instance, the construction sector includes around 7.61% of the labor force, a considerable portion of the 72 million people in the labor force.

Enter DAO PropTech, a platform aiming to revolutionize the way we interact with real estate. By selecting only the top developmental projects and onboarding them onto their platform, they are working to ensure that developmental real estate can be accessible to everyone. With their innovative approach, they hope to further increase the impact of these projects on the economy, propelling Pakistan towards a more prosperous future. This new approach will bring about increased participation in developmental real estate projects, leading to even greater job creation and wealth generation. By enabling easy access to real estate, DAO PropTech is contributing to the growth of the economy, opening up new opportunities for people to participate in and benefit from this sector.

Very well thought and well written article! Keep writing more!