Glossary

GDP stands for Gross Domestic Product and is used to assess national output in a country. It is a measure of a country’s prosperity and is commonly used to compare countries.

Learn more

Definition: GDP stands for Gross Domestic Product and is used to assess national output in a country. It is a measure of a country’s prosperity and is commonly used to compare countries.

GDP measures national output, not money, in an economy. It is the market value of all final goods and services produced within a country over a given year. The market value allows for comparisons to be made across countries, while only counting final goods and services ensures that nothing is double counted.

Expenditure method is commonly used to calculate GDP. This method is useful in avoiding double counting in calculations.

Learn more

Definition: Expenditure method is commonly used to calculate GDP. This method is useful in avoiding double counting in calculations.

The Expenditure method of calculating GDP consists of the following formula:

GDP = C + I + G + X –M

- Consumption by households (C)

- Investment in productive assets (I)

- Government spending on goods and services (G)

- Exports from a country to others abroad (X)

- Imports into a country from others abroad (M)

The advantage of this method is that it avoids both double counting and over counting. It avoids double counting because a business’ investment that is eventually consumed by a household is only counted within Consumption, and not Investment. Meanwhile, Imports are excluded from the equation since they are included in the GDP of another country (as part of their exports).

Balance of trade is the difference between the value of a country’s exports and the value of its imports.

Learn more

Definition: Balance of trade is the difference between the value of a country’s exports and the value of its imports. When a country trades and imports more goods and services than it exports, it is said to have a trade deficit. Conversely, if it exports more than it imports, it is said to have a trade surplus.

Pakistan usually has a trade deficit. That doesn’t necessarily have to be a bad thing. Think of it like a bank loan. A bank loan could be very helpful if you took it to invest in a factory so that you can earn future income and pay back the loan with interest with ease. But if you are taking a loan so you can live beyond your means and increase your consumption to an unsustainable level, this is not productive. Unfortunately, in Pakistan’s case, it is the latter. Most of the imports historically have been to finance unsustainable consumption.

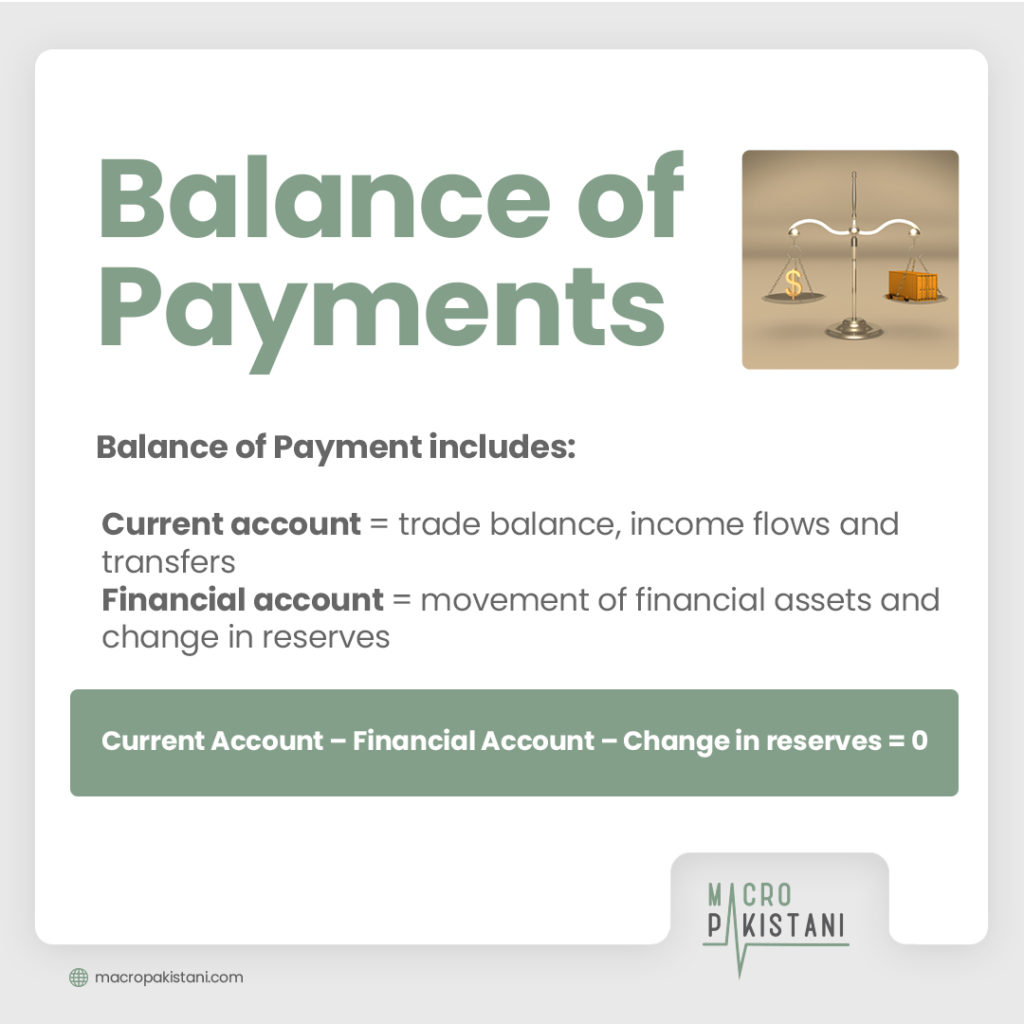

Balance of payments is the difference between all money flowing into the country, and outflows from the country, in a particular period of time.

Learn more

Definition: Balance of payments is the difference between all money flowing into the country, and outflows from the country, in a particular period of time. Balance of trade is one component of balance of payments.

The current account includes more than just exports and imports. While balance of trade is one component, it also includes other items such as primary and secondary income balance. The current account balance also has to be offset by the financial account and reserves, and this is called the balance of payments.

- Current account = trade balance, income flows and transfers

- Financial account = movement of financial assets and change in reserves

Current Account – Financial Account – Change in reserves = 0

Let’s consider 2018, which was one of the worst balance of payments crisis in Pakistan’s history.

- Trade balance was -12% of GDP (10% Exports and 22% Imports)

- Primary balance was -2% of GDP (includes interest, profits, dividends)

- Secondary balance was 8% of GDP (6% Remittances and 2% aid)

- Current Account Balance was -6% of GDP

If you are borrowing 6% of GDP from the rest of the world, this money has to come from somewhere.

- Foreign Direct Investment was 1% of GDP

- Portfolio investment (stocks and bonds) was <1% of GDP

- Loans by SBP and government were 3% of GDP

- Financial Account Balance was 4% of GDP

This is why, dollars had to be taken out of SBP’s reserve account (around 2% of GDP). This continued until 2019 when the IMF then bailed Pakistan out. In July 2019, Pakistan had USD 9 billion of reserves left which was not even enough to cover 2 months of imports.

Value of one nation’s currency in relation to other currencies.

Learn more

Definition: Value of one nation’s currency in relation to other currencies.

Related Terms: Nominal Exchange Rate, Real Exchange Rate, Real Effective Exchange Rate

In order to understand Pakistan’s history of trade deficits, it is important to keep in mind our exchange rate. In simple terms, there are two types of exchange rates: nominal and real. Nominal Exchange Rate (NER) is the rate at which an individual can trade the currency of one country for the currency of another country. Real Exchange Rate (RER) is the rate at which an individual can trade the goods and services of one country for those of another country.

Real Effective Exchange Rate:

In practice, a country trades with many others and it is difficult to calculate Real Exchange Rate with all trade partners. Hence, the Real Effective Exchange Rate (REER) is used, which is an index of bilateral exchange rates, weighted by amount of trade with the other country and adjusted for relative prices. Weights in the REER take into account trade between countries as well competition for trade in a third market.

Nominal Exchange Rate vs. REER:

Increase in value in nominal exchange rate is a depreciation (PKR 150/USD to PKR 160/USD is depreciation of PKR 10). This means more PKR are required to buy each US dollar. However, REER is defined in domestic currency as an index, which means an increase in REER is an appreciation. Before 2018, even though our REER was appreciating, due to inflation in the country, Nominal Exchange Rate was kept steady around PKR 100. This made Pakistani goods and services more expensive relative to competing countries and hence made our exports uncompetitive. This led to rising imports, stagnating exports and eventually a Balance of Payment crisis.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Learn more

Definition: Percentage change in prices during a specified period.

Related Terms: Consumer Price Index, Headline Inflation Rate, Core Inflation Rate

The inflation rate is defined as the growth rate of prices in the economy. The price measure used to calculate the inflation rate is known as the Consumer Price Index (CPI), which represents the price paid by all consumers (urban and rural) for a basket of consumer goods and services.

Consumer Price Index Calculation:

The Pakistan Bureau of Statistics (PBS) is responsible for defining the collection (or basket) of goods and services a typical consumer in Pakistan buys. This basket is determined using survey data on consumers’ expenditure behavior collected across 000’s households in urban and rural areas. Based on this survey data, 34.6% of consumer spending in Pakistan is on food and non-alcoholic beverages, whereas 23.6% is on housing, electricity, gas, and fuels. The survey data, which tells us about the goods and services consumed, along with their prices is then used to find the cost of the basket each year. This is subsequently then used to calculate the CPI.

Headline Inflation Rate:

The most common indicator reported is the year-on-year (y-o-y) headline inflation rate, which tells us the rate at which the CPI has changed over the last 12 months. For example, y-o-y inflation for March 2021 was 9.05%. This means that if a household was spending PKR 50,000 on a basket of goods and services in March 2020, they would now have to spend PKR 54,525 to buy the same basket of goods and services (or 9% more than last year).

Core Inflation Rate:

Core inflation rate is the percentage change in the costs of goods and services but does not include those from the food and energy sectors. Food and energy prices are exempt from this calculation because their prices can be too volatile or fluctuate wildly. Consequently, some policy-makers might prefer to look at this measure of inflation instead of headline inflation.

Percentage change in prices during a specified period.

Learn more

Definition: Demand-pull and cost-push factors can cause an increase in Inflation.

Related Terms: Demand-Pull Inflation, Cost-Push Inflation

Broadly, inflation can be caused by two main factors: Demand-pull and cost-push. Demand-pull inflation occurs when an economy’s production capacity cannot keep up with rising consumer demand. Cost-push inflation occurs when an economy’s aggregate supply decreases because of an increase in production costs.

Demand-Pull Inflation:

As a consumption driven economy, our consumer demand has been on the rise. This is driven by both population growth rate, with more mouths to feed, and a tendency to spend more on higher value goods to improve quality of life. As demand for goods and services in the entire country, known as aggregate demand, rises, prices go up. Note that this will mostly be the case if there is no excess supply in the economy to provide those goods. If the country is productive and can cater to the needs of the people, demand-pull inflation will remain relatively low.

Cost-Push Inflation:

If the government increases the minimum support price on wheat to help farmers, the costs for the flour producer go up. This will lead to inflation. If the government increases electricity tariffs because of public misadministration, it will hurt consumers and lead to inflation. If the international price of oil goes up because there is a global supply shock and the government transfers this increase on to consumers, inflation will go up. Inflation caused by these supply-side factors is known as cost-push inflation.

State Bank of Pakistan’s role:

It is important to understand what kind of inflation SBP can control. SBP has limited control over cost-push factors but can change money supply and interest rates to affect demand-pull inflation.

Economic growth is driven by growth in labor, capital and Total Factor Productivity (TFP).

Learn more

Definition: Economic growth is driven by growth in labor, capital and Total Factor Productivity (TFP).

Related Terms: Labor, Capital, Total Factor Productivity

Economic growth is driven by growth in labor, capital and Total Factor Productivity (TFP). High growth comes from more physical and human capital and greater efficiency. Poor countries usually have less physical capital, human capital and lower efficiency. For most Asian economies in the past, economic progress was made through ‘perspiration’ (increasing labor and capital) rather than ‘inspiration’ (increasing TFP). In Pakistan, the story has been similar with 67% of growth coming from increased resources rather than using resources more efficiently since the 1970s.

Labor:

Factor inputs from labor or human capital include the effort made by people to manufacture goods and provide services. It includes both total hours worked and quality of labor, measured by average years of schooling. Although the employed labor force in Pakistan has increased, growth in human capital has been modest due to low levels of average years of schooling. The average Pakistani, above the age of 25 years, had only 5 years of schooling.

Capital:

Capital or more specifically, physical capital refers to the goods used in the production of other goods. These include all kinds of production technology including machinery as well as software. According to PIDE, over 40% of Pakistan’s growth in the last 50 years has come from capital accumulation. However, less than 2% of this growth has come from IT capital.

Total Factor Productivity:

It is not enough to have resources; we also need to know how to use them smartly. Total Factor Productivity measures the increase in total output relative to the increase of total inputs. It is a measure of the economy’s efficiency in combining the factors of production, labor and capital, to produce goods and services. Therefore, it is the main determinant of long-term economic growth. In the last 50 years, highest economic growth in Pakistan came about due to high investment levels and TFP growth. Since 1980s, investment has been on the decline and growth has stagnated as a result.

Unemployment rate is the unemployed population expressed as a percentage of the labor force.

Learn more

Definition: Unemployment rate is the unemployed population expressed as a percentage of the labor force.

Related Terms: Labor Force, Employed, Unemployed, Labor Force Participation

Unemployment rate is the unemployed population expressed as a percentage of the labor force. Official unemployment rate has varied between 5-6% in last two decades, higher for females (9%) and lower for males (5%). Youth in Pakistan is defined as those between the ages of 15 and 29 years. According to the ILO, youth unemployment in Pakistan was at 8.9% before the pandemic. In 2017-18, over 30% of youth was not in employment, education or training. Again, this rate is worse for females than males.

Labor Force: Currently active population including all persons 15 years and above who are employed or unemployed and looking for work

Employed: Part of labor force who are either paid-employed or self-employed

Unemployed: Part of labor force not in paid-employment or self-employment but available for work and seeking employment

Labor Force Participation:

As per the latest Labor Force Survey from 2017-18, Pakistan’s official population was 208 million out of which 148 million are part of the labor force or currently active population. Currently active population or labor force comprises of all persons 15 years+ who can be categorized as employed or unemployed. Population not in the labor force can be in school, engaged in household duties, retired, too young, handicapped or unable to work, agricultural landlords or property owners, or those who rely on royalties or dividends. Labor force participation is particularly low in Pakistan for females. While 68% of working age males are in the labor force, only 20% of females are. Even after accounting for housekeeping, activity rate is 52% overall and 35% for females.

Income received that is not spent on consumption.

Learn more

Definition: Income received that is not spent on consumption.

Related Terms: Domestic Savings, National Savings, Foreign Savings

Like labor, capital is another factor of production. In order to increase capital investments in a country, and improve the Investment to GDP ratio and productivity, savings are required. Savings are income received that is not spent on consumption and are a source of financial capital for investments.

Domestic Savings: Portion of income not spent on private or public consumption.

National Savings: Domestic savings after adding remittances and net investment income.

Foreign Savings: Financing of current account deficit with loans or Foreign Direct Investments.

Savings-Investment Gap:

In the GDP calculation section, you can see the formula for calculating GDP: GDP = C + I + G + X – M

If we move things around in the above equation, we can get:

(GDP – T – C) + (T – G) + (M – X) = I

Private Saving + Public Saving + Foreign Saving = Investment

Savings in an economy can come from private sector, which is the GDP after taxes and after all that is spent on private consumption. They can also come from the government, if they have any leftovers after deducting public expenditures from tax revenue collected. Hence, domestic savings are portion of income not spent on private or public consumption. If we add net factor income from abroad, including remittances and investment income from abroad, domestic savings increase to national savings. If these national savings are not enough, then foreigners have to provide the capital for investments in a country – the difference between imports and exports. These foreign savings are used to finance the current account deficit and are a source of financial capital for investments.

Savings Data for Pakistan:

In Pakistan, the Investments in 2020 were 15.4% of GDP out of which 13.9% of GDP came from National Savings and 1.5% came from foreign savings. Less than half (6.8% of GDP) of National Savings came from Domestic Savings. Since public savings are usually non-existent in Pakistan due to fiscal deficits, private savings are the largest contributor to domestic savings. From private savings, 2% of GDP is assumed to be from corporates and rest from households. It is important to note that these numbers could include large measurement errors. Investments could be underestimated due to a large informal economy and preference to invest in precious metals or foreign currency. Interestingly, only around 25% of national savings goes into financial savings. Any illegal outflow of capital is also incorrectly assumed to be part of national savings, but this is not available for domestic investment.

Amount of goods purchased or accumulated that are not consumed in a given year.

Learn more

Definition: Amount of goods purchased or accumulated that are not consumed in a given year.

Related Terms: Gross Fixed Capital Formation, Change in Inventories

Investment is the amount of goods purchased or accumulated that are not consumed in a given year. It is a critical component of GDP as it provides an indicator of the future productive capacity of the economy. In Pakistan, the ratio of Investment to GDP is around 15% while it is 28% in India and 32% in Bangladesh. For sustainable growth, it is not only essential to replenish capital stock, we also need to add new plants and machinery and upgrade infrastructure. If we do not, then GDP growth will be consumption-led and typically imported since the domestic economy will not be able to build productive capacity to deliver the goods and services demanded.

Gross Fixed Capital Formation: Measures net increase in fixed capital in an economy including spending on plant, machinery, land improvements and construction

Change in Inventories: Reflects the stock of finished products, intermediate goods and raw materials that are kept for use in future production

Components of Investment:

Gross Fixed Capital Formation (GFCF) measures net increase in fixed capital in an economy including spending on plant, machinery, land improvements and construction of commercial and residential property. Buying plots is not considered under fixed capital formation. Within the factors of production, new investment helps add not just capital (K) but also improves Total Factor Productivity (A). If an old factory gets new machinery, its workers will not only be able to produce goods more efficiently, quality of those products might also improve. GFCF makes up roughly 90% of Investment in Pakistan while the other component is that of Inventories. Change in inventories reflects the stock of finished products, intermediate goods and raw materials that are kept for use in future production. It is estimated at 1.6% of GDP in Pakistan.

Public vs. Private sector:

Given budget constraints at the government level, it is no surprise that the private sector dominates investment in Pakistan. Typically, public sector investment is required to crowd in private investment. In the 1990s, public sector investment used to make up 50% of investment in Pakistan when Investment to GDP was closer to 20%. Now, 68% of investment is private while only 32% is public, with 6% going toward autonomous and semi-autonomous bodies like PTCL, Railways and Pakistan Post and the rest going to General Government. With low tax to GDP and limited external financing, the government hardly has any resources to spend on development programs.

Long-term investment from a party in one country into a business or corporation in another country with the intention of establishing a lasting interest.

Learn more

Definition: Long-term investment from a party in one country into a business or corporation in another country with the intention of establishing a lasting interest.

Long-term investment from a party in one country into a business or corporation in another country with the intention of establishing a lasting interest is Foreign Direct Investment. Short-term investment from another country into stocks or bonds is Foreign Portfolio Investment.

At present, Pakistan receives less than 1% of GDP in Foreign Direct Investments, amounting to roughly USD 2.5 billion. In comparison, lower middle-income countries on average receive twice as much FDI, 2% of GDP, while Vietnam receives over 6% of GDP. Historically, Pakistan’s ratio of FDI to GDP was higher (3.7% in 2007) but as investment environment in the country worsened, the ratio dropped. Additionally, there is no clear policy for attracting FDI in Pakistan. Sector contributions vary significantly year to year, with Power and Oil & Gas exploration related FDI becoming relevant in recent years. In the last decade, over 2/3rd of FDI attracted by Pakistan has been in these sectors along with Food & Beverage and Financial Businesses.

Types of FDI:

Market-seeking: Motivated by interest in serving domestic or regional markets

Resource-seeking: Motivated by interest in accessing and exploiting natural resources

Strategic asset-seeking: Motivated by interest in acquiring strategic assets to compete in given market

Efficiency-seeking: Motivated by potential benefit from factors that enable a country to compete in international markets

Over 94% of Pakistan’s FDI has been market-seeking, motivated by interest in serving domestic or regional markets. Less than 1% has been efficiency-seeking, motivated by potential benefit from factors that enable a country to compete in international markets. Efficiency-seeking FDI is particularly important for countries looking to integrate into the global economy and move up the value chain. Pakistan’s share of this type of FDI is the lowest in all comparable countries. We need the kind of investment Samsung has made in Vietnam, where it has outsourced 40% of its mobile phones production to the country. This kind of FDI, not only helps with trade, it also boosts human capital and productivity.

Venture capital is a type of investment vehicle for individuals and institutions.

Learn more

Definition: Venture capital is a type of investment vehicle for individuals and institutions. It refers to financing that an investor provides for startups and small businesses, typically in exchange for shares.

Related Terms: Angel investors, venture capital firms

These investments are high-risk and long-term, but the potential upside is very high.

This form of investment is usually executed by high-net-worth individuals, known as angel investors, or by venture capital firms. Angels will typically be titans of industry who invest in their areas of expertise. See Mohammad Yusuf Jan, who built his career in public transit and technology. He’s now an active angel investor with FindMyAdventure, Eat Mubarak, Dawaai, Airlift, and Dastgyr in his portfolio.

VC firms will raise a fund from corporations, pensions funds, and/or a pool of individual investors and then invest that in startups.

How it works:

Startup founders will pitch to angels and/or VC firms, if they wish to raise external capital to either launch or expand. Investors will also hunt for opportunities to maintain their deal flow.

The pitch process may take anywhere from 4 to 12 weeks or more, during which investors complete reference checks, due diligence, and negotiations with founders. The investor will evaluate startup leadership, product-market fit, growth potential, etc. If it goes well, founders receive a term sheet, which delineates terms: equity percentage, board seats, voting rights, ancillary support, etc.

Invested funds may be released to the startup all at once or in tranches – fancy way of saying “installments tied to certain benchmarks & KPIs”.

There are also several types of VC financing that correspond to the stage of a company’s lifecycle. Hence, companies raise several rounds of funding. Including Angel, Pre-Seed, Seed, Series A, etc. These are all examples of early-stage capital.

A VC will ‘cash out’ on their investment after a liquidity event, which refers to an acquisition, IPO, or approved equity sale. The investor sells the equity they received at a higher valuation. Also known as an exit, startups that do see liquidity events will typically take 4 to 8 years to reach that point.

A great example of a venture-backed company that achieved an exit is Careem. Its backers, including Kingdom Holdings, Saudi Telecom Company, and Wamda Capital, earned up to 100x returns on their investments when Careem was acquired by Uber for $3.1 billion.

The Pakistan Context:

The startup ecosystem in Pakistan is currently going through a watershed moment with huge growth in VC funding. Local startups have raked in $120 million VC funds in H1 2021, almost double the total funding raised in 2020 at $66 million.

Startups like Airlift, Tajir, and Dastgyr have brought in major international VCs to Pakistan for the first time, including First Round Capital, Kleiner Perkins, and Seedstars.

Large Pakistani conglomerates are now also getting involved in the VC game, such as Lakson Investments Venture Capital and TPL e-Ventures.

Conclusion:

The average retail investor can get involved in venture capital today by either approaching a VC firm and committing an amount into their fund, or you may try your hand at angel investing, provided that you have the experience in specific areas of interest that startups are operating in to execute the necessary due diligence on your own.

Interest Rate: The interest rate is the amount a lender charges for the use of funds expressed as a percentage of the principal.

Learn more

Types of Interest Rates:

- Policy Rate: Most essential rate through which SBP conducts monetary policy

- Overnight Repo Rate: Rate at which banks borrow funds from each other

- Savings Rate: Rate that commercial banks offer when you deposit funds with them

Introduction: The interest rate is the amount a lender charges for the use of funds expressed as a percentage of the principal. This can also be thought of as the cost of borrowing funds.

Types of Interest Rates: There are various types of interest rates in Pakistan’s banking and financial sector. The policy rate is the interest rate that is used to conduct monetary policy and is controlled by the State Bank of Pakistan. Examples of other interest rates are the overnight repo rate that is charged by banks for lending funds to other banks, and the savings rate that is offered by commercial banks to savings account customers. The policy rate is the most consequential interest rate because all other interest rates in the economy are correlated with it.

Relation b/w Inflation and Interest Rates: There is a general tendency for interest rates and the rate of inflation to have an inverse relationship. In general, as interest rates are reduced, more people are able to borrow more money. The result is that consumers have more money to spend. This causes the economy to grow and inflation to increase. The opposite holds true for rising interest rates. As interest rates increase, consumers tend to borrow less which results in lower spending. As a result, inflation decreases.

State Bank’s use of Interest Rates: The State Bank of Pakistan manipulates the policy rate to affect the inflation rate. For example, the policy rate in Jan 2018 was 5.75%. Over the course of the next two years, the policy rate increased to 13% by March 2020. This persistent rate hike was done to counter increasing inflation which was moving into double digits (greater than 10%).

The Financial Action Task Force (on Money Laundering) (FATF) is an intergovernmental organization founded in 1989 on the initiative of the G7 to develop policies to combat money laundering and terrorism financing.

Learn more

The Financial Action Task Force (on Money Laundering) (FATF) is anintergovernmental organization founded in 1989 on the initiative ofthe G7 to develop policies to combat money laundering and terrorismfinancing.

FATF Recommendations FATF provides Forty Recommendations on Money Laundering and NineSpecial Recommendations on Terrorism Financing that set theinternational standard for anti-money laundering measures andcombating the financing of terrorism and terrorist acts. Examples ofthese recommendations are:

- Cooperate internationally in investigating and prosecuting money laundering.

- Implement customer due diligence (e.g., identity verification),record keeping, and suspicious transaction reporting requirements for financial institutions and designated non-financial businesses and professions.

FATF Compliance and Black/Grey Listing Countries are placed on black/grey list based on their performance andcompliance with the recommendations set forth by FATF. Countries aregiven a grade of compliant (C), largely compliant (LC), partiallycompliant (PC), and non-compliant (NC) for each of the 40recommendations.Countries placed on the FATF blacklist typically demonstrate a lack ofcooperation manifested itself as an unwillingness or legal inabilityto provide foreign law enforcement officials with information relatingto bank account and brokerage records, and customer identification andbeneficial owner information relating to such bank and brokerageaccounts, shell company, and other financial vehicles commonly used inmoney laundering. Examples of countries on the blacklist include Iranand North Korea. Countries placed on the FATF greylist lists are judged to be partiallycooperative in the global fight against money laundering and terroristfinancing, with significant room for improvement. Pakistan currentlyfinds itself on this list. As of July 2021, Pakistan was found to befully compliant on 7, largely compliant on 24 LC, partially complianton 7, and non-compliant on 2 of the FATF’s recommendations onanti-money laundering.

It is an index used to measure income inequality. In an economy, the distribution of household income keeps changing over a period of time. Gini coefficient measures the gap between higher and lower income households.

Learn more

So, what exactly do we mean by GINI coefficient? It is an index used to measure income inequality in a region. First, we need to understand that in any economy, household income is unevenly distributed and keeps on changing. Over the period of time, the distribution of household income also keeps on changing. Owing to such change, the gap between the higher income and lower income households also tends to change (usually it increases). GINI coefficient measures this gap!

In case of Pakistan, the GINI Coefficient is 0.35, which is higher than the peer countries. The higher the number is, the more unequal the society is! Pakistan’s rank has been consistent for the past 5 years. As a matter of fact, Pakistan is more unequal than Egypt. Bangladesh and Iraq (World Bank)

Lorenz Curve

The question then arises as to how exactly do we measure GINI coefficient? The answer lies in Lorenz Curve. It measures the distribution of household income or in other words, GINI coefficient. First, household incomes are arranged in an ascending order and then are arranged in a cumulative proportion in terms of percentage on the x-axis against cumulative proportion of income is plotted on the y-axis. The resultant curve is called Lorenz Curve.

The straight diagonal 45 Degree line with a slope of 1 demonstrates perfect equality in income distribution. On this line, incomes of all households are equally distributed. Any deviation from the line of perfect equality represents income inequality. The farther away the curve is from the baseline, represented by the straight diagonal line, the higher the level of inequality. Through Lorenz Curve, how do we measure GINI coefficient?

Methodology of Calculating GINI

GINI coefficient lies between the values of 0 and 1 and, it is calculated through the area between the straight line and the curved line, expressed as a ratio of the area under the straight line.

Let’s call the area between the line of perfect equality and the Lorenz curve AREA A and the area beneath the Lorenz curve AREA B. GINI coefficient is then calculated by dividing AREA A by the sum of AREA A and AREA B. If the value of GINI coefficient comes out to be 0 then it means that there is perfect equality in the society. If it is 1, then it means the society has perfect inequality.