Everyone talks about taxes in Pakistan. Businesses talk about paying too much in taxes. Governments talk about not being able to collect any taxes. As we move on to talking about Government spending ‘G’ in CIGXM of the economy, it is important to first discuss where the money for that expenditure comes from. Eventually, Macro Pakistani also wants to break down budget documents and present them to you in a bite-sized manner. Hence, understanding the government’s revenue performance in past years will be useful going forward.

Governments need money

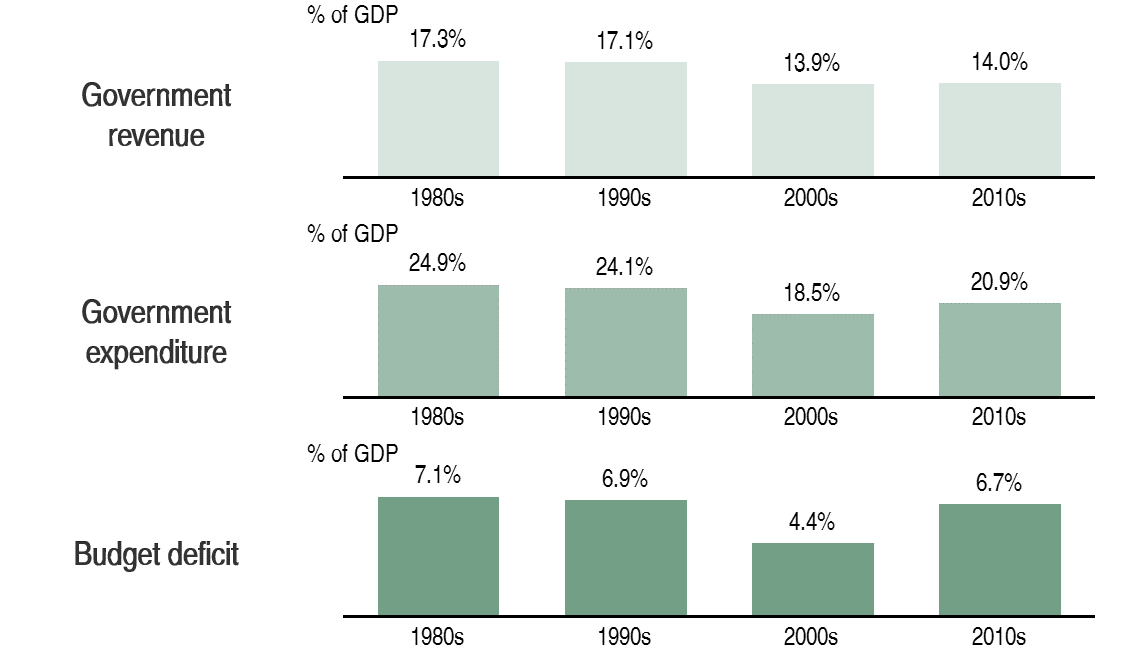

All governments need money to spend on public goods. Back in the 1980s and 1990s, the Pakistani government used to earn revenues of just over 17% of GDP. Instead of improving over the years, the state of our public resources has actually worsened. This has constrained government spending over the past 40 years and led to consistent budget deficits.

Historical performance of government revenues, expenditures and deficits in Pakistan

We will talk about government spending later but it is interesting to note a few things here. Budget deficits were around 7% of GDP back in 1980s and 1990s due to increased military spending (6.5% of GDP) in 1980s, followed by the interest charged on the loans that were taken to finance that deficit (6.8% of GDP) in the 1990s. Although that level of government spending has declined in recent years, the deficits remain. After falling to 4.4% of GDP, the deficits rose to 6.7% in the 2010s, peaking in 2019 at 9.1%. The 2020s have not gotten off to a great start either, with some estimates of 8.1% budget deficit under discussion. One major reason for the high deficits (pre-COVID) is the decline in revenues so let’s discuss that.

Taxes are important

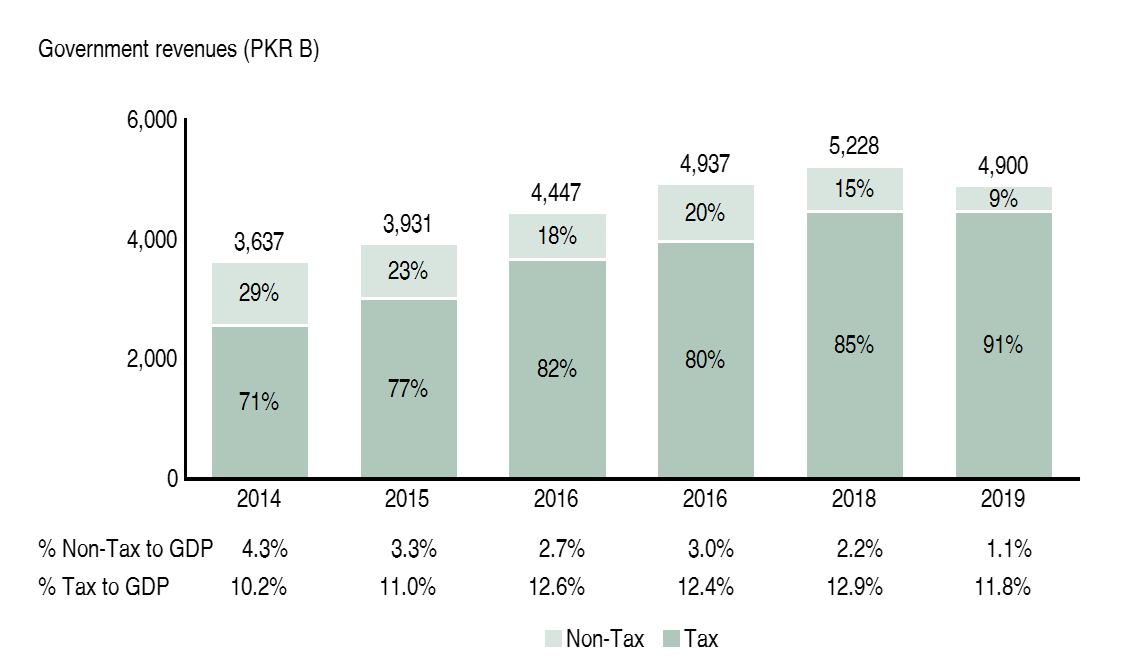

The government gets revenues from taxes, which individuals and businesses pay, and some non-tax sources. Non-tax resources include receipts from Civil Administrations such as the State Bank, income from other public sector enterprises and royalties. With the sub-par performance of public sector companies in recent years, non-tax to GDP ratio fell from 4.3% in 2014 to 1.1% in 2019. This has made collection of tax revenue even more important.

Total government revenues in Pakistan (2014-19)

With a push to document a larger part of the economy in recent years, tax to GDP ratio actually increased from 10.2% in 2014 to 12.9% in 2018 before falling to 11.8% in 2019. It is important to note that the tax to GDP ratio is not the same as the tax rate. A tax to GDP of 12% means that the government effectively taxed 12% of all incomes in the country but it attempted to do a lot more. According to the World Bank, Pakistan’s tax revenue potential is up to 26% of GDP. This is calculated by taking into account taxable portion of income, the applicable tax rates and assuming a 75% tax compliance. In summary, the authorities responsible for collection of taxes in Pakistan only capture 50% of the potential value.

The distinction between tax to GDP and tax rates is important because increasing tax rates is detrimental to the growth of the economy. According to the Pakistan Institute of Development Economics, international and national evidence points out that taxation and growth are negatively correlated. Focus should be on capturing the potential that is already available by documenting the economy and broadening the tax base.

Taxes are a problem

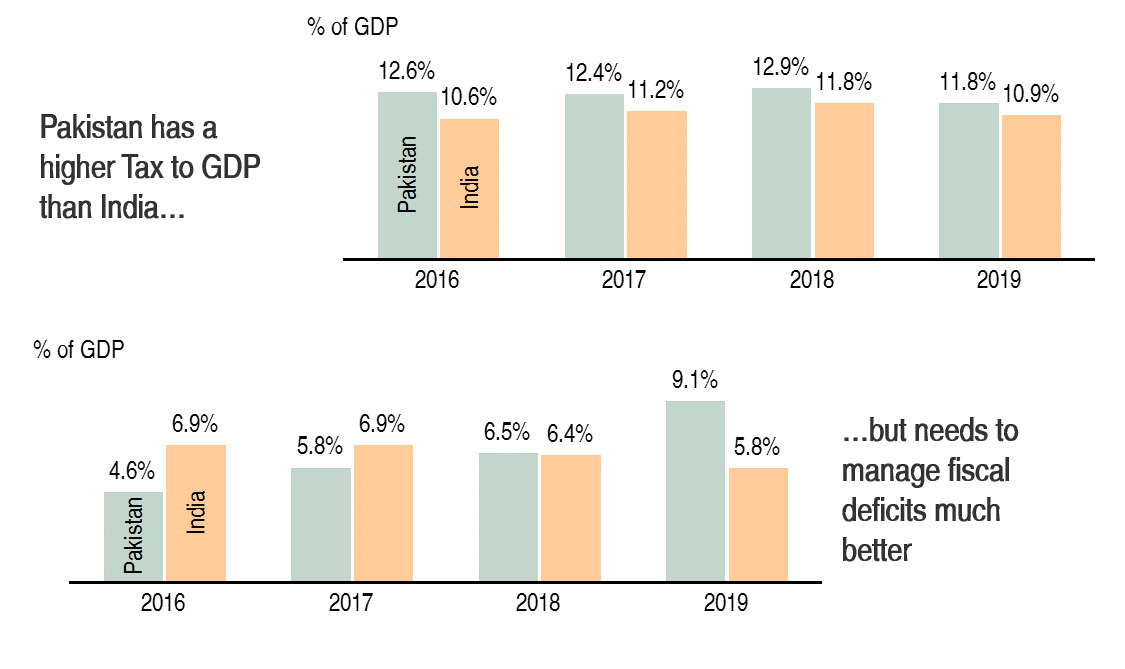

Usually Macro Pakistani points out international benchmarks to show how Pakistan is lagging behind other countries. However, in the case of tax to GDP, Pakistan has performed slightly better than India since 2016.

Tax to GDP and Budget deficits in Pakistan vs. India

India has many of the same problems that Pakistan has in terms of taxes. A large informal economy and weakness in compliance enforcement that enables large-scale tax evasion. Low and middle-income countries have an average tax to GDP of 13% and 18% respectively. As low middle-income countries, Pakistan and India should be somewhere in the middle of that range but are not. However, what India performs better at, is fiscal management. Even though it is not strictly followed, India passed the Fiscal Responsibility and Budget Management Act in 2003 and have since been pushing to reduce budget deficits to 3% of GDP. Recent projections are for the country to reach this target by 2020-21.

Pakistan on the other hand, also has a Medium Term Budget Strategy Paper, but falls short in compliance. We’ve discussed before how economic projections in Pakistan are not the best, with frequent changes to growth rates. Deficits are projected using projected revenues and expenditures. Revenues are calculated using GDP growth. The more people make in incomes, the more the government can tax them. In 2018-19, the outgoing government set a target for 6.3% real GDP growth and a budget deficit of 4.9% of GDP. At the end of the year, real growth was 3.3% (later revised to 1.9%) and the deficit rose to 9.1%, because of the shortfall in revenues. If Pakistan can document its economy better, it will not only be able to close the tax gap between potential and actual collection, it will be able to better project GDP and hence the subsequent budget requirements.

Everyone pays taxes

We have discussed how a low tax base leads to low tax revenue. The Federal Board of Revenue (FBR) has also claimed in the past that only 1% of Pakistanis pay taxes. These are the kinds of myths Macro Pakistani is out to bust. It is true that just over 2 million people file taxes in Pakistan but the truth is everyone pays taxes.

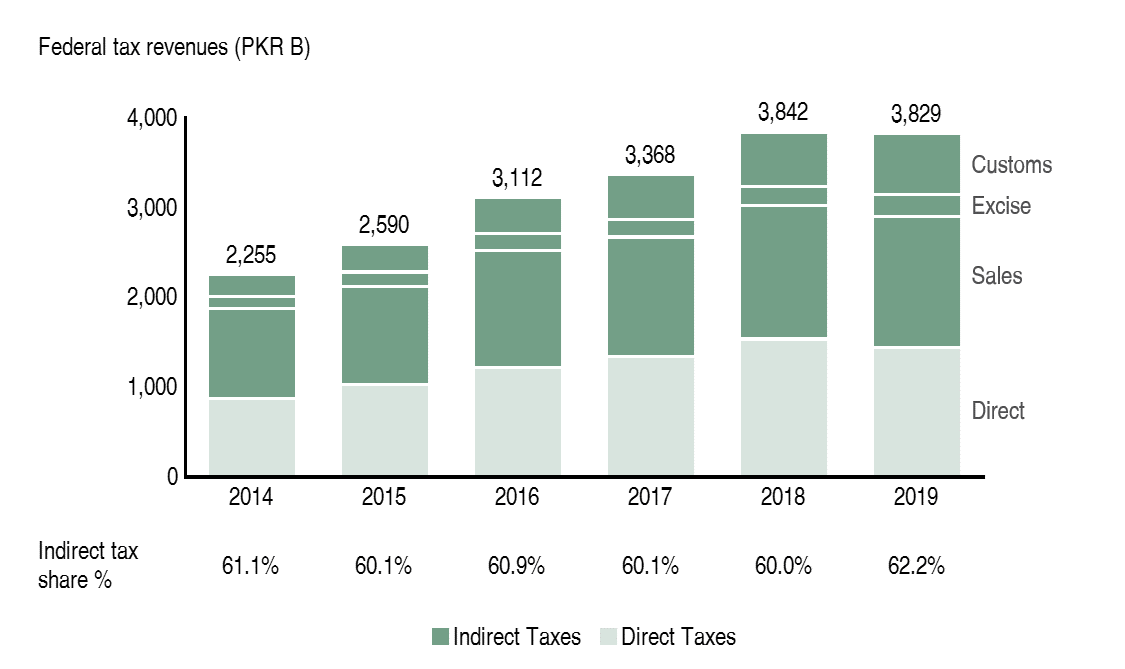

Total Federal Tax revenues by type (2014-19)

The government levies two kinds of taxes: direct and indirect. Direct taxes (light green) are paid by individuals and businesses based on their income and profits. Indirect taxes are levied on goods and services and do not differentiate based on income. These kinds of taxes are regressive because they tax everyone the same. Domestic help in people’s homes pay the same tax on petrol for their motorcycles as the homeowner pays. Over 60% of tax revenue in Pakistan is from these indirectly taxing the population. These indirect taxes include sales tax (both import and domestic), federal excise duty and custom duties for imported goods.

What’s even more worrisome is that even within direct taxes, roughly two-thirds is withholding tax. Anyone who has withdrawn money from the ATM must have paid the 0.6% withholding charge. Many might not know that they can claim some of that money back if they file taxes. This is the government’s way of making you file taxes but it is also regressive. The 0.6% charge is independent of your income level and if you don’t actually claim the amount, it becomes part of the direct taxes collected by the government. In short, everyone pays taxes in Pakistan.

Everyone doesn’t file taxes

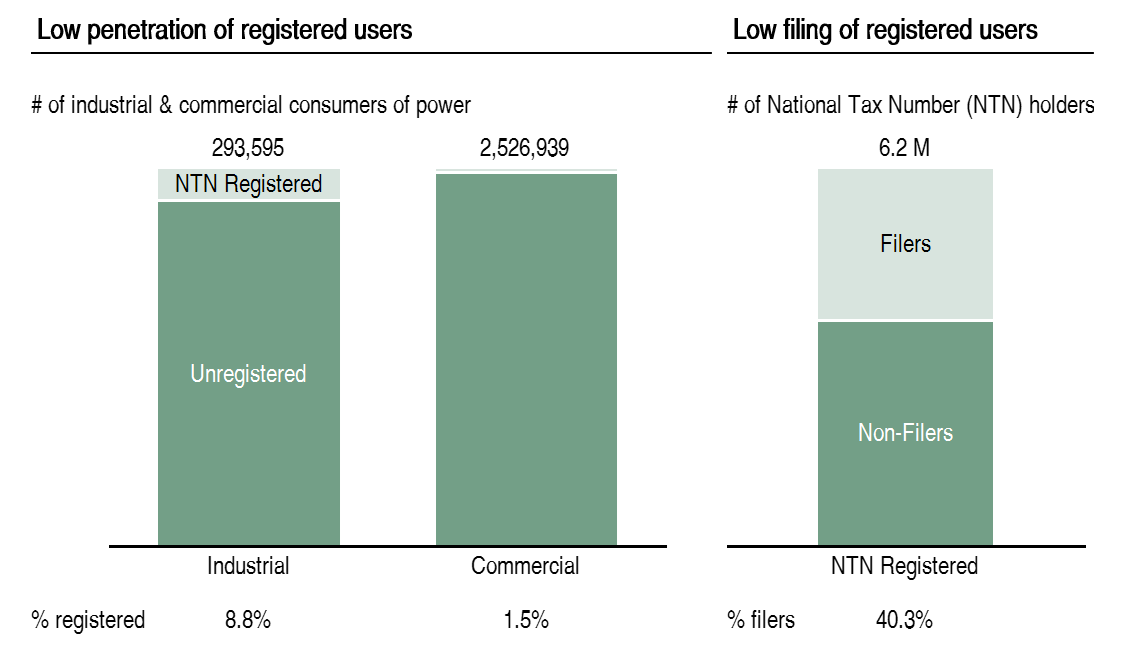

To broaden its tax base, Pakistan needs more filers. If the entire country pays their dues, we could collect twice as much as tax as we do currently and spend on public goods more effectively. Most salaried individuals will not even have to pay a lot of tax unless they make more than PKR 10 million in a year (at which point you are expected to pay 15%). However, businesses know that once they come into the tax net, their profitability will erode and hence they choose not to declare their incomes. The government knows these businesses exist, since in order to run a business, they at least need gas and electricity connections. However, less than 10% of industrial and 2% of commercial users with gas connections are formally registered. Furthermore, only ~40% of these registered users actually file taxes.

State of undocumented economy of Pakistan (2019)

Even though the government has tried to amend laws to allow for disconnecting electricity and gas supplies to non-compliant consumers, it is not an easy job. We have discussed before how the electricity distribution companies are inefficient at collecting their own dues from consumers. Imagine what their performance must be like in collecting tax dues as well. Most of them do not even have the National Identity cards of their consumers. This non-compliance is a major reason why Pakistan is not able to collect the full potential of taxes. The gap between actual taxes collected and full potential is significant across sectors. It varies from 46% for the manufacturing sector, to 67% for the services sector. For the agriculture sector, the gap is over 90% with an estimated tax gap of PKR 70 billion.

Existing tax filers are unhappy

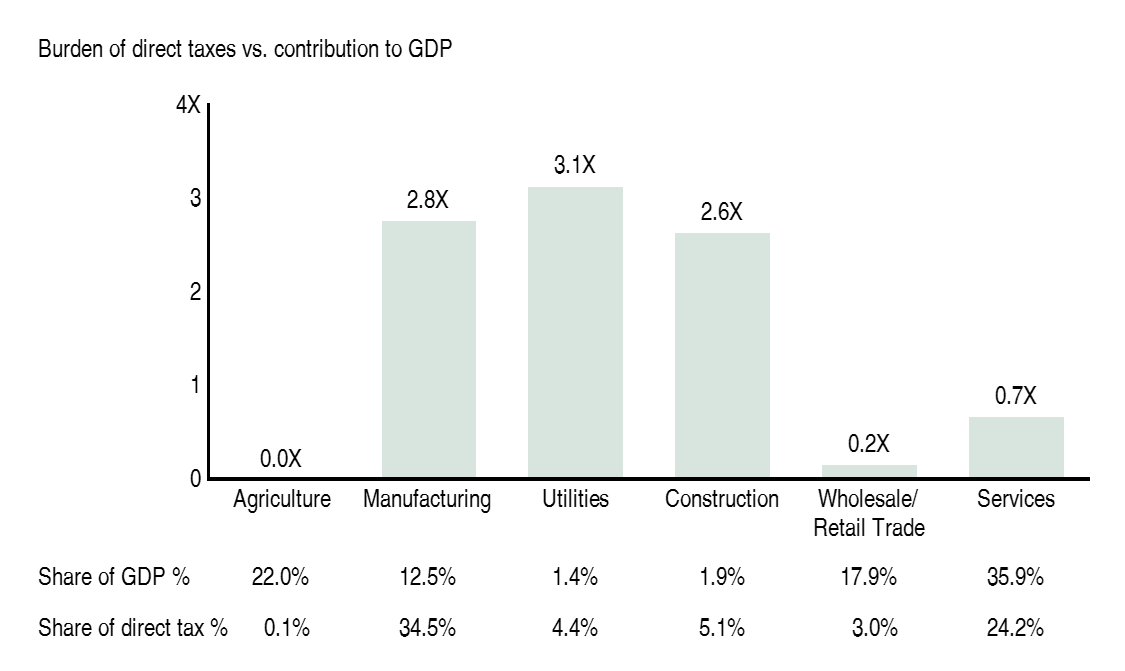

While agriculture sector pays hardly any taxes, manufacturing and utilities contribute up to 3x more than their GDP share in direct taxes. Because not everyone files their taxes, the formal sectors that do, are overburdened.

Sectoral analysis of share of direct taxes vs. share of GDP in Pakistan (2019)

While manufacturing sector makes up 12.5% of GDP, it pays 34.5% of all direct taxes in the country. If we account for indirect taxes too, the number rises to over 50%. The petroleum industry alone pays 17% of all taxes in Pakistan. Along with utilities and construction, manufacturing is the hardest hit in terms of taxes, contributing almost three times as much to tax collection as to the economy itself.

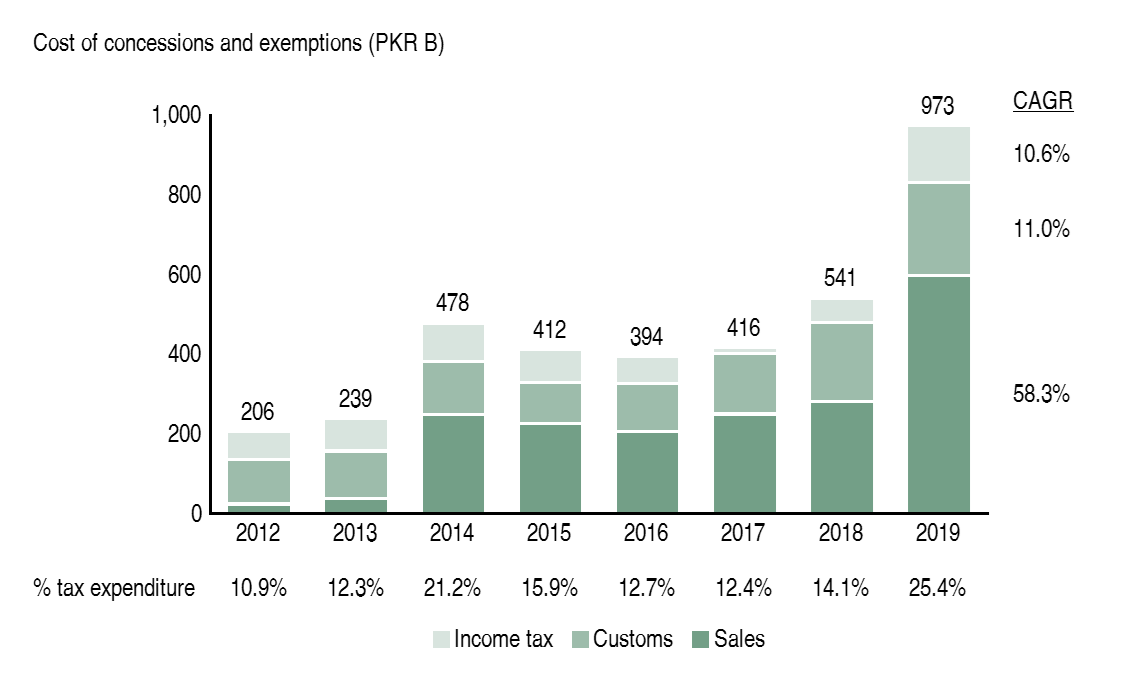

Some filers are very happy

Some of you might be wondering why there is a 46% tax gap in manufacturing if they pay so much in taxes. One of the reasons is the concessions and exemptions they receive. In 2019, over 25% of total taxes received was spent on collecting them by offering concessions, especially to export oriented sectors

Tax expenditure by type in Pakistan (2012-19)

If you are a textile manufacturer that exports shirts, until 2019, you could get a refund of sales tax. Granted there was a time delay of around three months before you received the refund, this was a way of encouraging exports in certain sectors in the economy. After this ‘zero-rated sales tax’ as it was called, was introduced in 2012, the concessions (dark green) grew by over 50% each year. The consequent impact was supposed to be an increase in exports, but as we will discuss later, that did not come about. Hence, in 2020, the facility was abolished. Even though businesses complained about cash flow issues since their sales tax (17% in most cases) was stuck with the authorities, the facility was misused too. Some very famous exporters used the facility for the local market, instead of exports, but we will not get in to that for now.

We talked about taxes in Pakistan after our sectoral overview so that you can understand how it all fits together. The government needs to do more to help businesses grow, but they need money to do so. Businesses and individuals are scared of exploitation by tax authorities so they do what whatever they can to evade taxes. As a result, the government does not end up getting the money it needs and the businesses keep complaining. We will discuss where the government spends the limited revenue it does end up receiving next time.

Data on India’s tax to GDP ratio doesn’t ring true. Looks to me you have referenced a source that only accounted for tax collected by the central government. Indian states levy and collect taxes that is cumulatively well over 60 percent of the central government’s receipt. IOW, the total tax to GDP figure would be somewhere around 17 percent of the GDP.

Hello thanks for pointing that out. Just doubled checked with the World Bank figures (https://data.worldbank.org/indicator/GC.TAX.TOTL.GD.ZS) and the numbers check out. Taxation on a provincial level would be reported as part of the provincial surplus/deficit that the federation receives from all states contributing to a fiscal surplus/deficit. Main point again is that revenues in both countries are limited but India does a better job at fiscal management.

Yeah, that link to WB site is opaque about how it arrived at that figure. In fact, looking at the GDP and tax collection data for the Union government that year, the percentage seems about right. Any tax/GDP ratio metric that ignores the state level (provincial) levy and collection would give an incomplete snapshot of the economy.

For example, the total central government revenue from raised in the FY 2019-20 was INR 21.63 trillion (USD 300 billion approx) with the GDP figure for that year assessed at about USD 2700 billion. This gives us a tax to GDP ratio of roughly 11.1 percent, not far from what you have mentioned in your analysis above.

But this wasn’t the total tax raised within the country that year, the people were also taxed by all the state government separately. For instance, even the poorest state of Bihar with little in terms of industry and being a largely agrarian economy (agriculture being untaxed) raised its own tax revenue of approx USD 4.5 billion.

Like I mentioned in my earlier post, this state tax revenue is NOT shared with the central government and cumulatively amounts to USD 180 billion. Adding this sum to the central government taxes helps us arrive at the true tax/GDP ratio.

Point taken but will stick to World Bank numbers for the sake of comparison. Even if opaque, I’m sure they have a way of calibrating across countries and can be relied on for this purpose.

Here are two links that should clear it up for you.

1. https://www.businesstoday.in/union-budget-2020/budget-for-the-salaried/budget-2020-is-india-an-under-taxed-country/story/394754.html

2. https://www.livemint.com/Industry/7UAyR2aM3Yh8rBeTD28WHL/Is-India-an-outlier-when-it-comes-to-taxGDP-ratio.html

The chart showing ‘Sectoral analysis of share of direct taxes vs. share of GDP in Pakistan (2019)’ is very striking. While the economic leadership claims to be forwarding a export-led industrial manufacturing growth policy, they have also distorted the balance sharply against this very sector.

Everything else constant, one would be tempted to invest in agriculture rather than manufacturing given the tax benefit. This in turn would further decrease the productivity of the sector by sucking more resources.

Precisely! If you have read any of the material by the Pakistan Business Council (https://www.pbc.org.pk/research/), they claim the same thing.

While it makes sense to provide small farmers with tax incentives, 2% of farming households own 45% of the land which goes to show that it is the large land owners that benefit the most from this policy.

Dear Sir,

Thanks for sharing such informative session. It is requested to guide me regarding tax and its laws on pakistani companies especially banking like super tax etc.