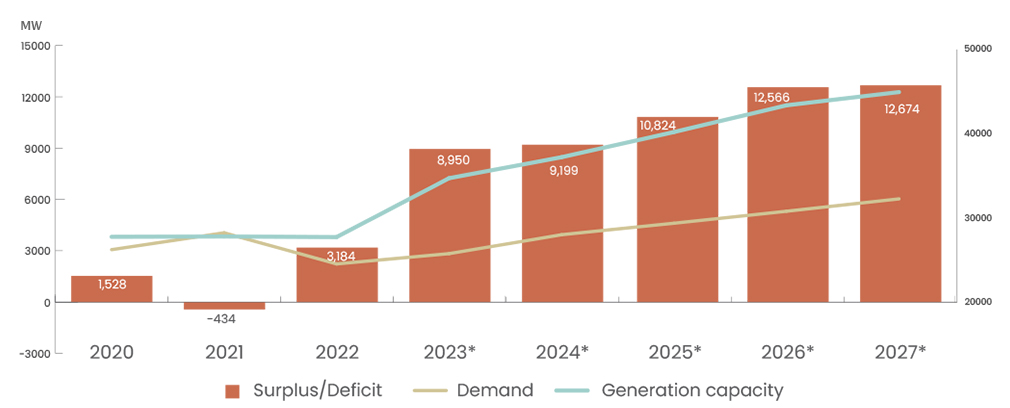

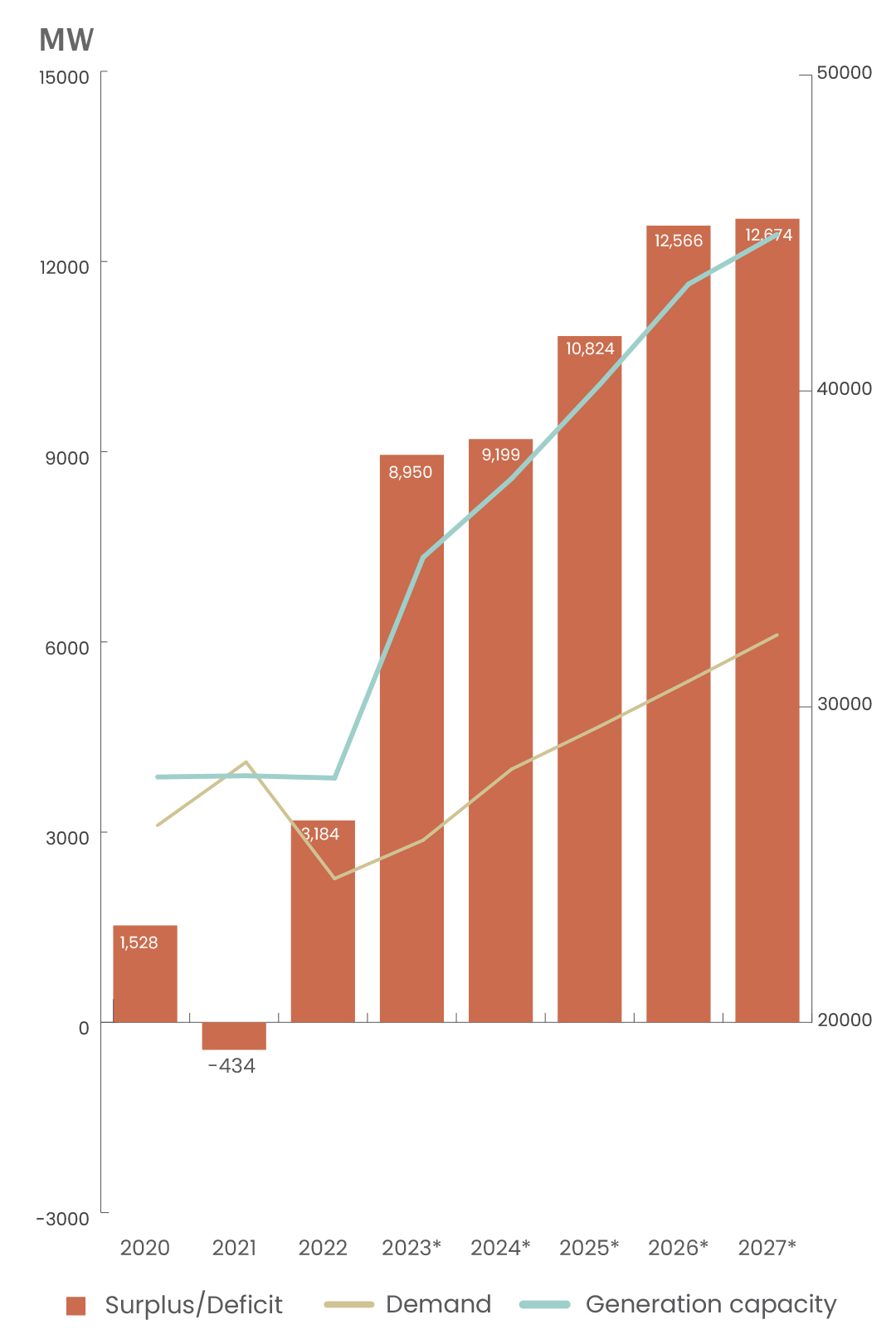

Pakistan’s electricity demand is projected to increase by 19% from 2025-2030. Can Pakistan manage this growth? Pakistan’s electricity generation will likely supersede its energy demand in the upcoming years. Yes, you read it correctly; Pakistan is producing more electricity than it needs. But this hasn’t always been the case. During the early 1990s, Pakistan experienced unprecedented electricity outages, unlike anything seen before in the nation’s history. An imbalance between supply and demand preceded this era, as demand was growing by 9-10% per year in the 1980s however supply was lagging. This was caused by a series of interlinked factors, all of which came down to administrative negligence. Particularly the investment in infrastructure didn’t receive much attention showing a lack of foresight. Moreover, the electricity pricing wasn’t determined properly. As a consequence, Pakistan’s domestic and industrial consumers found themselves dealing with an unprecedented crisis. A new power policy rose to the occasion in 1994.

Excess Electricity

A Short History Lesson

Let’s go back to 1994 when Pakistan’s existing offices were crippled under the weight of electricity shortages. International institutions had to step in to help Pakistan out with the problem at hand. As a result, Pakistan came up with the Private Power Policy. This decision was taken after the government realized its inability to independently handle Rs. 108 billion for development strengthening in the energy sector. Therefore, the government decided to attract foreign investment, or what we know today as independent power producers. During this time, the capacity charge was introduced, it encompassed debt servicing, fixed operation and maintenance costs, insurance expenses, and the return on equity. Energy price would be added on top of it based on energy sold. And the government would buy electricity by paying a power purchase price.

Around this time, a heavy emphasis on thermal energy emerged in Pakistan. Low oil prices in the early 2000s helped the policymakers maintain a myopic version. During the high GDP growth of 7 percent, a 9% increase in electricity supply would be necessary. However, during that period, the installed capacity saw a growth rate of merely 2 percent, leading to a disparity between supply and demand. The expansion in capacity lagged behind the expansion in demand. And just like that, Pakistan found itself back in the 90s, confronting even greater challenges than before. Overall since then, power shortages have resulted in an annual loss of about 4 percent of GDP.

Robbing Ali to Pay Ahmed’s Prices

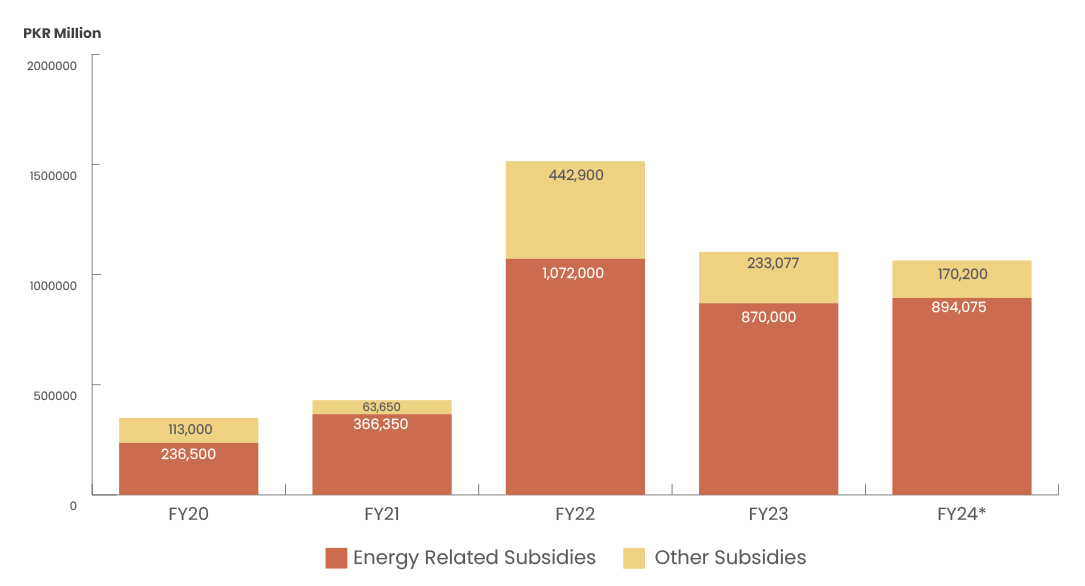

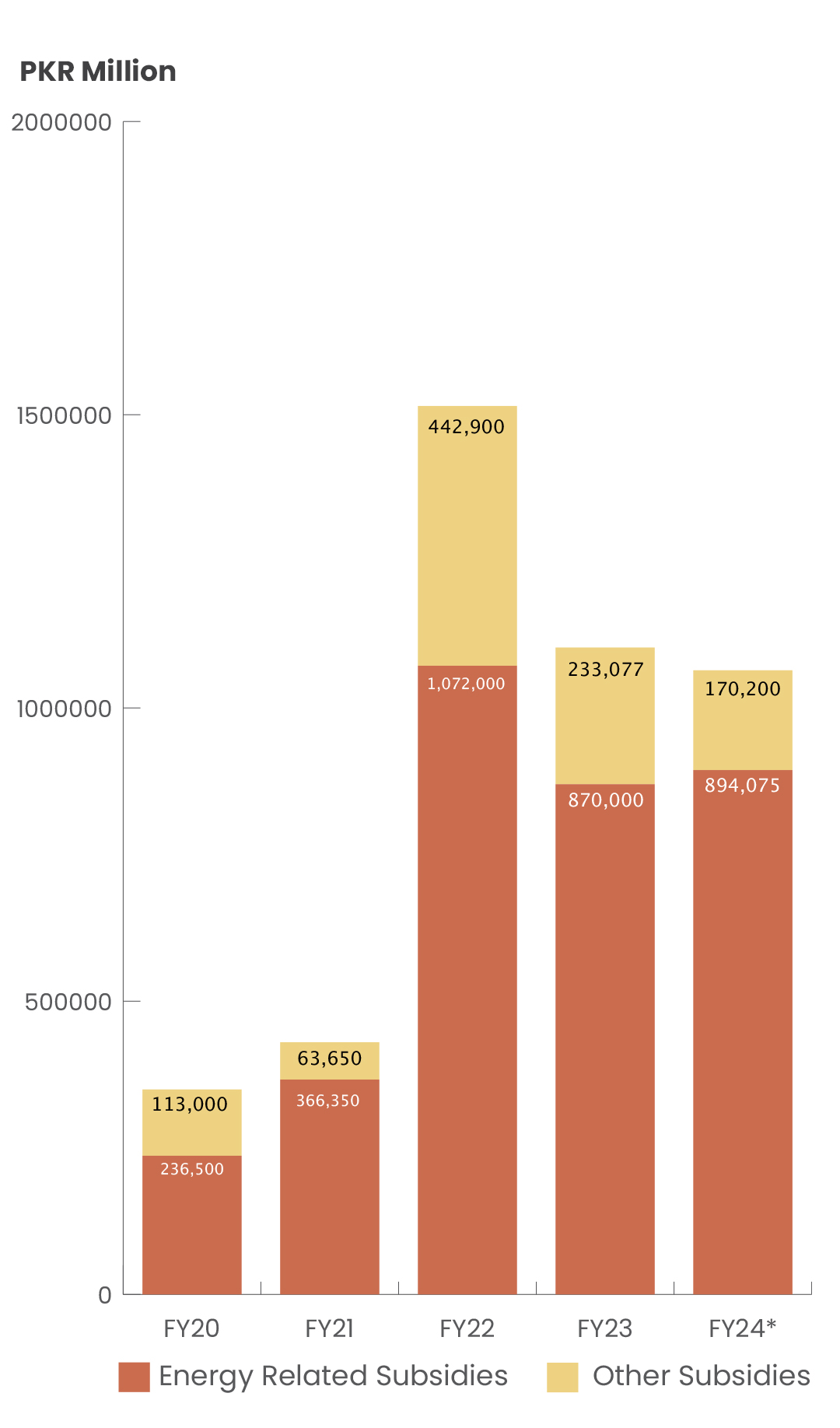

Furthermore, pricing was incorrectly determined, leading the government to subsidize electricity at an average rate of PKR 3 per unit. The nationally determined tariffs were way lower than whatever cost NEPRA, Pakistan’s Electric Power Regulatory Authority, determined through accounting fuel, maintenance costs, etc. Consequently, the Pakistani government continued to bear the burden of the high cost of electricity generation, largely denominated in dollars. Therefore, one can observe that the share of electricity subsidies in recent years has been quite high.

Another very important part of the analysis is the discrepancy between NEPRA-determined tariffs and government-approved tariffs. As we have mentioned earlier, Pakistan has been unable to price its electricity correctly. This has resulted in an accumulation of costs on the government side. For instance, at the end of June 2009, there was a need for an urgent 24 percent tariff hike to cover the generation cost. Nevertheless, the government opted to implement this increase in three gradual phases. All in all Pakistan’s previous missteps have prevented it from gaining stability, and the road keeps getting rockier.

Source: Budget Documents, Ministry of Finance

An Elaborate Electricity Mesh

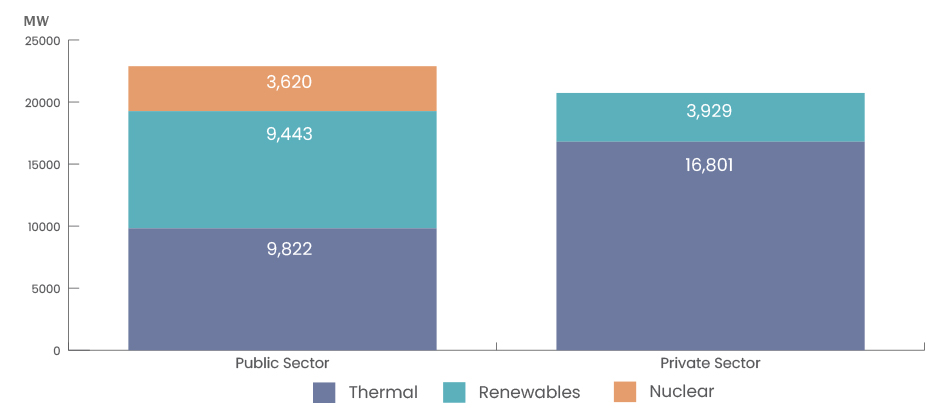

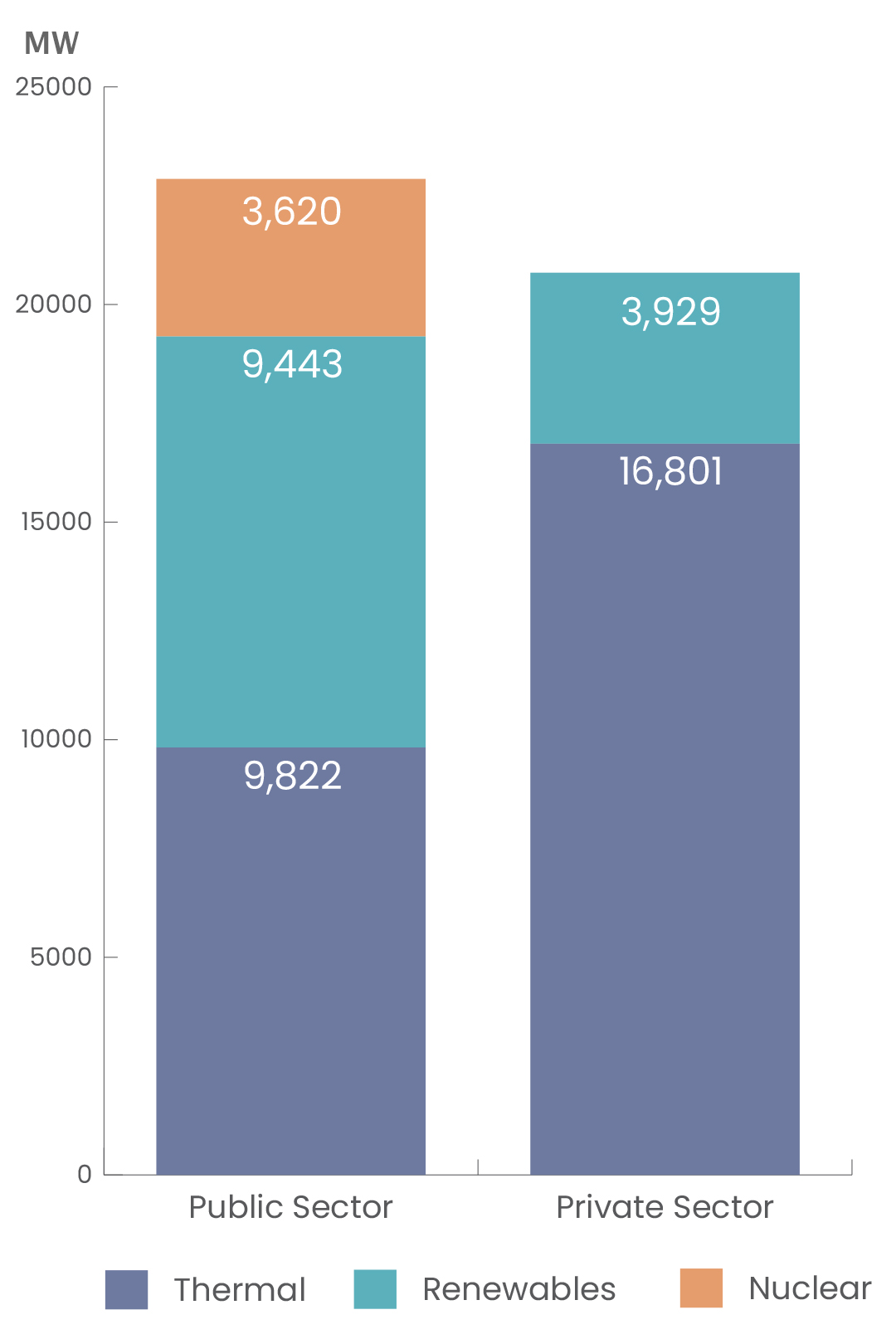

Another important piece of the power puzzle is the elaborate structure of Pakistan’s energy sector. For starters, we can divide it into energy suppliers, power generation companies (GENCOs), and distribution & transmission (PEPCOs). It all starts with oil refineries or gas companies that provide the fuel to power producers including independent power producers (private) and GENCOs (public). Alternatively, WAPDA uses water to produce its share of hydroelectricity and K-electric functions separately as well although it uses oil and gas. Once the electricity is produced, it moves on to the transmission phase which is managed by the National Transmission & Despatch Company. Particularly power distributors (PEPCOs) transmit this energy to the end consumers including households, industries, government, FATA, etc. You might be familiar with IESCO, LESCO, FESCO, and others depending on your region.

Electricity Price Pyramid

As we have talked before on the generation side, Pakistan’s policy shifted in 1994 with the formalized introduction of private power. Resultantly the generation relied on independent power producers helped form around 50% of Pakistan’s generation capacity. The financial side, as determined by the government at the time, included pricing electricity based on two features. But we’d like to elaborate on the capacity charge since it’s a significant contributor to Pakistan’s circular debt. For starters, the tariff offered to IPPs back then was already high and trimmed the element of competition that would be necessary to cut down costs and improve efficiency. Furthermore, attention was drawn to the ever-increasing component of the capacity purchase price, which includes fixed operations, maintenance, insurance, administrative costs, and return on equity. This offered IPPs, a guaranteed profit at the expense of the government and indirectly, the common man.

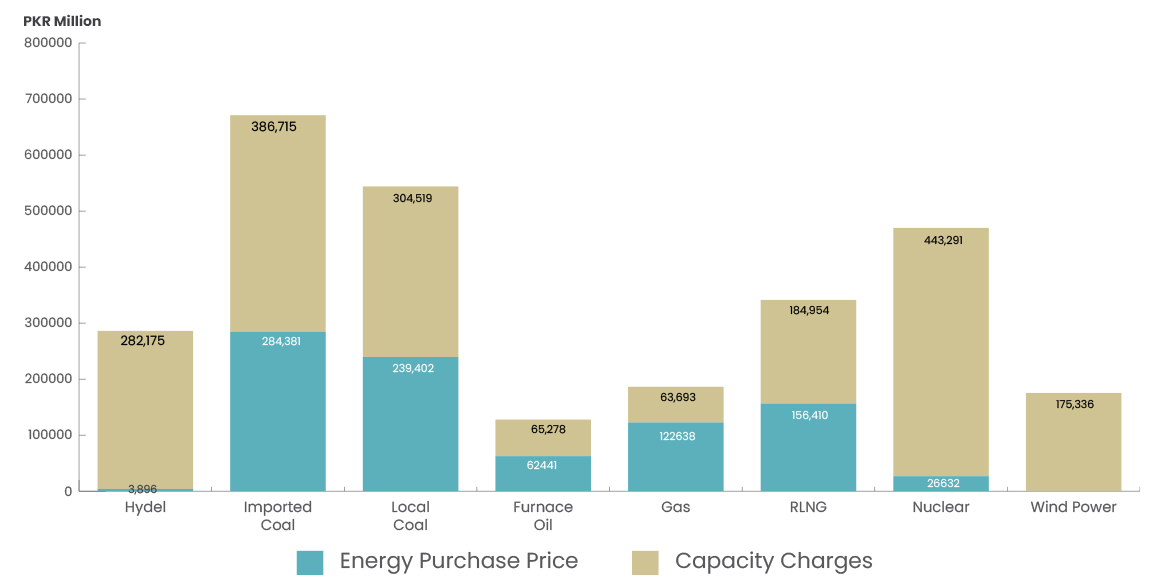

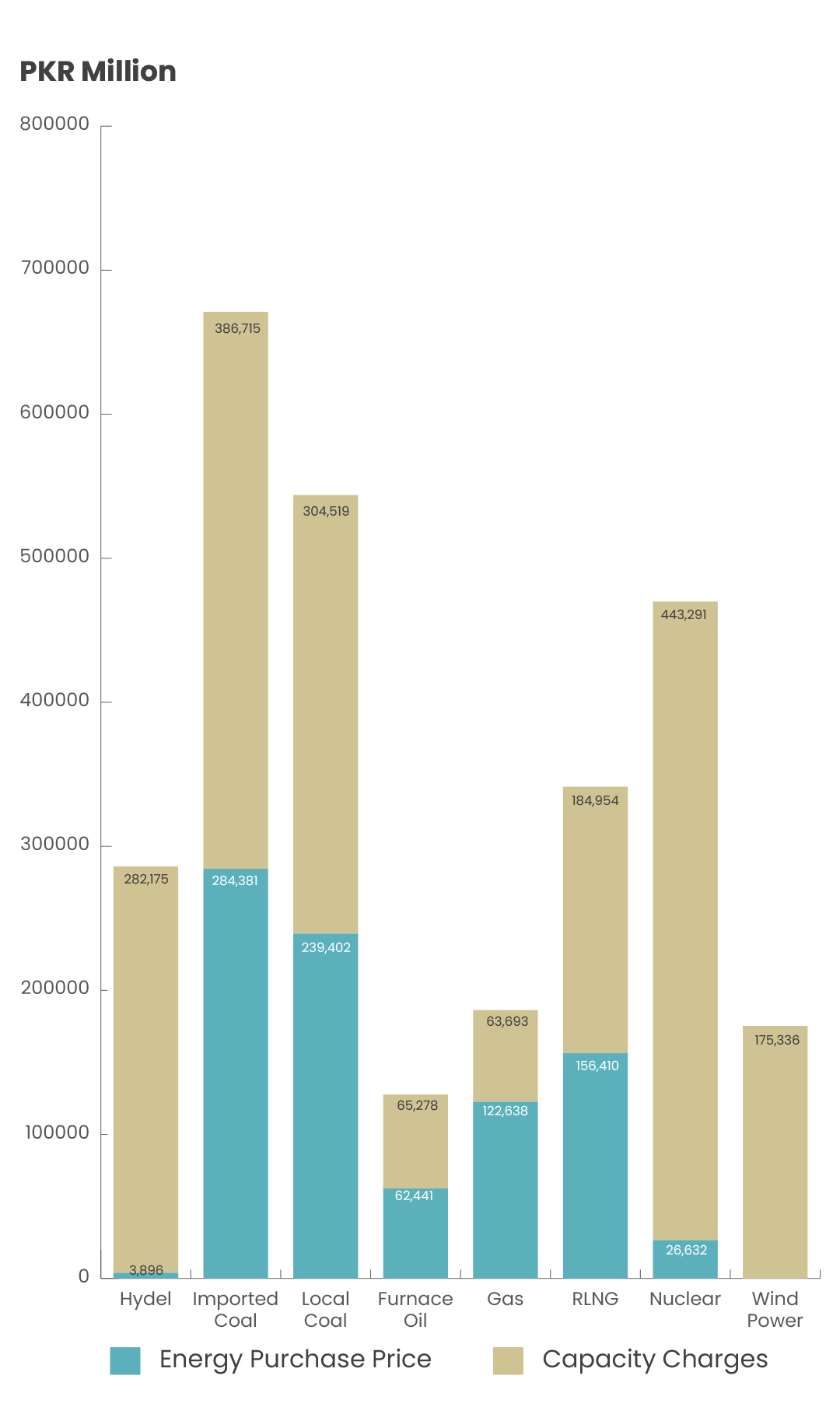

Currently, in Pakistan, capacity charges form the most significant portion of the energy payments made by the Central Power Purchasing Authority. This is because some power plants operate below their full capacity or follow the take-or-pay principle. As a result, the government ends up owing money to these power plants, even if they don’t function at their maximum capacity. The government has to cover these expenses directly due to past payment issues and financial constraints. If the government could sell the energy and use the revenue to compensate the generation companies, this problem would not arise.

Since Pakistan’s generation mix is composed of thermal energy, fuel price is an important component of the price. NEPRA determines Fuel Charge Adjustments (FCA) to accommodate fluctuations in fuel prices and generation mix. As fuel is mostly dollar-denominated the passing-on of fluctuations affects the consumers most. This shows Pakistan’s vulnerability to external shocks based on the structure of its generation mix.

Electricity Flow

So far we have understood the inefficiencies in power generation. But power distributors also have an equally crucial role to play in the matter as they are responsible for most of the cash flows (from users to government to GENCOs). They are responsible for electricity supply as well as tariff collection. They face the challenge of ensuring their inflows cover the costs incurred through procurement, fuel, etc. However, this proves to be an intricate process, as outflows for contractual payments are certain, while inflows are uncertain due to potential delays or inefficient bill recoveries. As a result, there exists a persistent imbalance in PEPCO’s cash flows, with inflows consistently lagging behind outflows.

Distribution companies are also vulnerable to high transmission and distribution losses. Picture yourself filling a bucket with apples to sell in the market, but along the way, you keep losing some apples due to a hole in your bucket. This unintentional loss directly impacts your already suffering revenue. On average, Pakistan loses 17% of its electricity according to NEPRA. This deepens the loss of revenue prevalent in the chain.

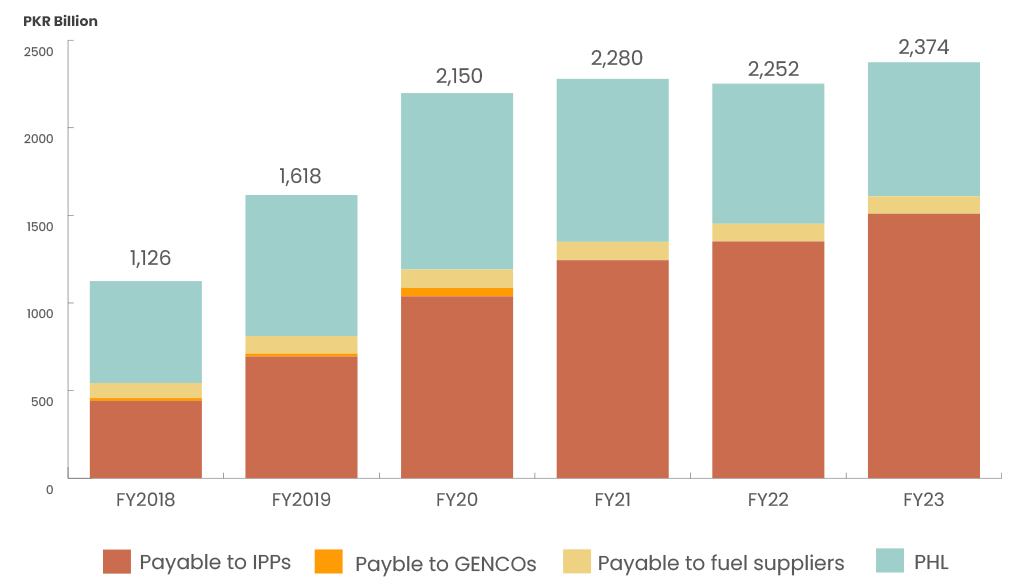

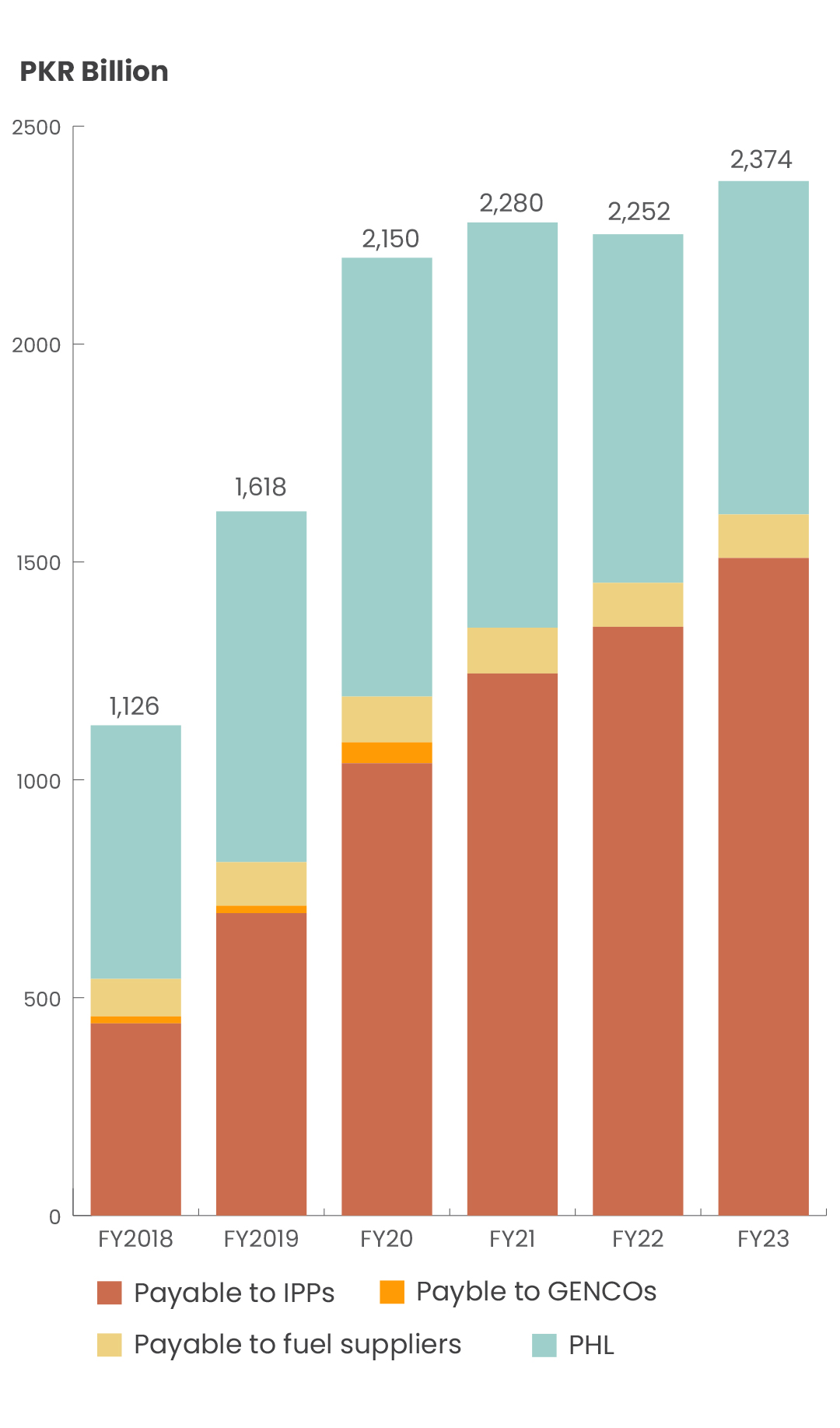

Circular Debt

In short, all of these payment problems culminate in the form of debt. Circular debt in Pakistan refers to the recurring problem of unpaid bills and delayed payments among the government, power generation companies, and distribution companies. It creates a cycle of financial instability, leading to energy shortages and disruptions in electricity supply. The main components include outstanding payments, delayed tariff adjustments, and rising fuel costs. The circular debt is a point of concern for the IMF as well, therefore, Pakistan is currently trying to curtail it as much as possible with the help of increasing tariffs. However, upon further examination of the sector, we come to realize that this is not the sustainable solution we require.

Source: NEPRA & Profit

Future Hurdles

For one Pakistan needs to diversify its generation mix, but so far all we’ve got is the transition from imported coal to local coal. This will be equally harmful to the environment. Pakistan also needs to restructure its energy sector and revitalize the system. Whether it be bill collections or investing in infrastructure to curtail T&D losses, we need a focused effort to solve the problem. However, the easiest route for now is to pass on the debt to consumers. The dilemma we face is quite pertinent if we account for intergenerational equity. The previous generation has enjoyed lower pricing and a seemingly endless supply of energy, whereas the current generation needs to equalize the imbalance.

In conclusion, Pakistan’s future depends on strategic energy investments in infrastructure & new energy and sustainable growth. While the alternative energy policy is promising, it leaves a lot to be desired.

good one…. However, in contrast to the past articles, this piece does not convey its message clearly. It would have been nice to have a series of articles in which we first discuss how the Pakistani energy market works, how the pricing works including the capacity charge, and finally the circular debt and potential solutions to this problem.