Since the financial year for Pakistan runs from July to June, doing a Year in Review 2020 in December is slightly premature. FY 2020 ended back in June, when Macro Pakistani did not exist. We kicked off in July and joined others in making projections. Since the economic contraction Pakistan experienced was already forthcoming, we first discussed where the country stood pre-COVID-19. Then we talked about how the economy was immediately affected by COVID-19 and how the silver lining was that our current account will not be worse off. Finally, we detailed how Pakistan’s COVID response should be good enough to address the projected economic loss of 5-6% of GDP. In the months since, several emerging data points indicate a strong recovery, while some raise further concerns. Hence, Macro Pakistani will do a premature Year in Review 2020 and select three things that stood out.

Falling Consumer Confidence

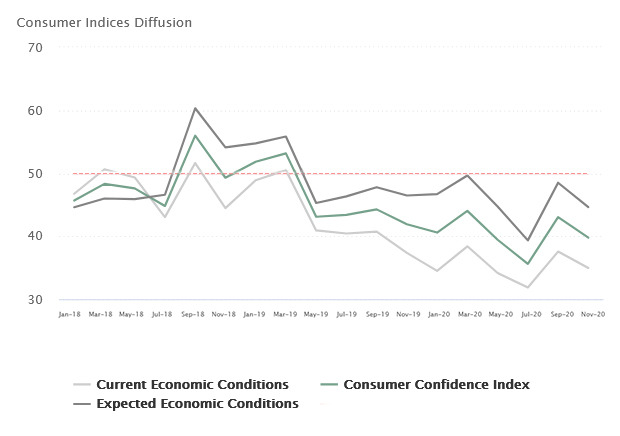

While we typically focus on lagging indicators that include output measures such as GDP, to provide advance warning of turning points in aggregate economic activity, it is also important to consider a few leading indicators. The State Bank of Pakistan, in collaboration with the Institute of Business Administration, conducts a Consumer Confidence Survey every two months. This survey uses households’ view of current and expected economic conditions to create a Customer Confidence Index. An indicator above 50 shows that people hold more positive than negative views about the current or future economic conditions of the country. If the same number is below 50, consumers hold more negative than positive views. In Pakistan, since July 2018, when the PTI government came to power, consumers have believed that Expected Economic Conditions (dark grey) are better than Current Economic Conditions (light grey). Pakistan is a hopeful nation.

Consumer Confidence Survey Results (2018 – 2020)

Consumers have believed that the future will be better than the present since July 2018, even during the lows of COVID -19

Source: Consumer Confidence Survey – SBP and IBA, MP Analysis

The average of the two gives us the Consumer Confidence Index (green), which has been on the decline since rising to 56 in September 2018. In January 2020, even before COVID-19, the index fell below 41 for the first time since November 2014. Pakistan was feeling the pain of high inflation and the stabilization measures demanded by the IMF program. Just when the economy started to show signs of recovery, the pandemic worsened consumer sentiment, which fell to historic lows until July 2020. As Pakistan seemingly defeated the pandemic and lifted restrictions, sentiments improved again in September 2020. However, the second wave of infections dampened consumer confidence, with the majority of households holding negative views about the current and future economic conditions in the country. All throughout 2020, the index has remained below 50. Nevertheless, Pakistanis continue to believe that the future will be better than the present.

Trade recovers from COVID-19

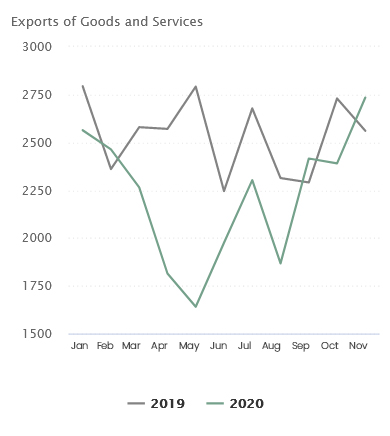

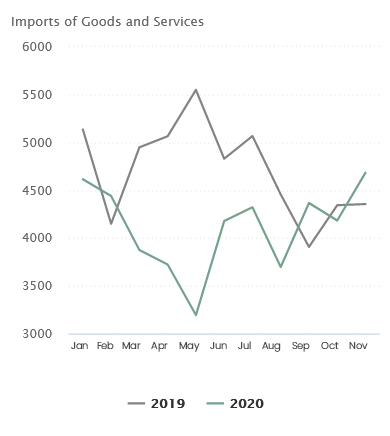

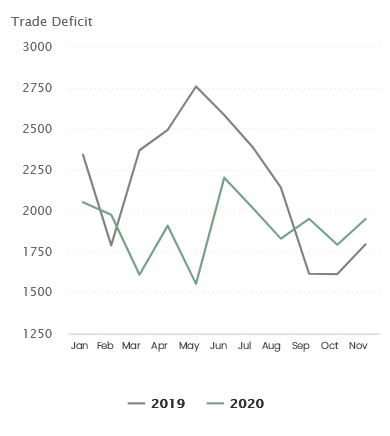

We have discussed before how Pakistan needs balance. Current account and trade deficits on their own do not mean much but we will discuss this further in the next few weeks. For now, we should highlight what changed in 2020. Comparing exports, imports and trade deficit for 2019 (grey) and 2020 (green), we see a double dip “W-shaped” recovery. From the beginning of 2020, Pakistan’s exports were on the decline, reaching their lowest point at USD 1.6 billion in May 2020, down over 40% from the year before. Even though exports increased post that dip, they remained below their low levels in 2019. Another dip came in July and August but fast forward to November; exports have recovered to above 2019 levels. Comparing the period July and November between the two years, exports are still down 7%. However, the pandemic and global geopolitics have helped bring about two major changes.

Balance of Trade Comparison 2019 vs. 2020 (USD M)

While exports recovered after lockdowns in 2020, rising imports caused trade deficit to increase in last few months

Source: Consumer Confidence Survey – SBP and IBA, MP Analysis

While overall textiles are down 6%, Knitwear and Bedwear have shown signs of growth. Pakistan has been able to capitalize on supply chains shifting from China and India and create higher value added products, as export of low value cotton yarn and cloth has fallen significantly. The other change has been IT services exports, which are up almost 40% since last year. COVID-19 has accelerated the trend toward digitization and Pakistan’s IT services providers are clearly benefiting. Imports followed a similar trend to exports, falling sharply in May before recovering above their 2019 levels by November 2020. Lower oil prices have reduced Petroleum imports, which are down 26%. Travel restrictions during the pandemic continue to reduce import of services such as Transport (-23%) and Travel (-52%). However, increase in imports of food commodities and raw cotton should raise some concern, given Pakistan’s trade deficit is back above 2019 levels.

Rising Food Prices

Food imports increased by 40% in Jul-Nov 2020 as compared to the same period last year. The largest contributor to this increase was the import of USD 229 million of wheat. In November alone, Pakistan imported USD 123 million of wheat. Last time the country imported wheat in excess of USD 100 million in a month was back in November 2008, when Pakistan faced another crisis. The reasons cited back then were similar to ones mentioned in the recent Wheat Inquiry Report. The decision allowing export of wheat in 2007/08 without knowing the actual size of the crop was not correct. Back then, the government established a special federal committee to review the wheat flour situation. Given the situation repeated itself in 2020, what should we make of the inquiry report now?

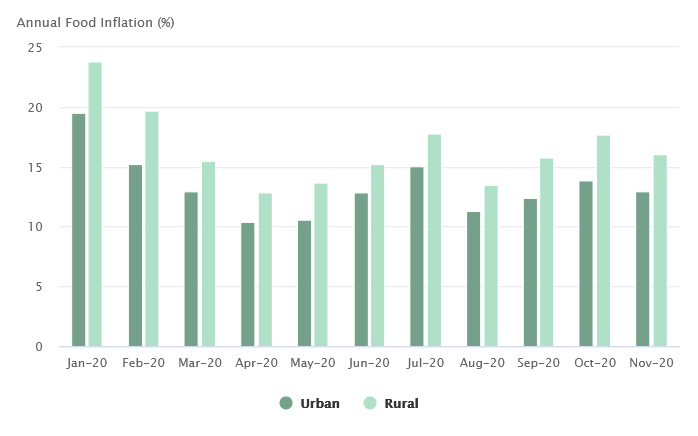

Similarly, Pakistan imported over USD 50 million of sugar in November 2020, matched last in January 2011, when there was a sugar crisis due to ‘hoarding and black marketing’. Direct state intervention in key sectors of the economy distort prices and prevent optimal allocation of resources. In 2020, prices of key food commodities were up almost 80% in some cases. Overall food inflation remained in double digits throughout the year, disproportionately affecting the poor in rural areas.

Year on Year Food inflation by region (%)

Food inflation has remained in double digits throughout 2020, disproportionately impacting the poor in rural areas

Source: Pakistan Bureau of Statistics

Food makes up almost half the consumption of the poorest 20% of Pakistan. Hence, administrative mismanagement hurts the lowest strata of society the most. While Pakistanis expect future conditions to be better than the past, they also have short-term memories. We let leaders of the country repeat the same mistakes and fail to hold them accountable. Now that food prices have started to fall, we will quickly forget the inquiry reports of 2020. Unless we increase civic engagement and force reforms that promote public interests, we will be ruing rent seeking and black markets again in 2030.