If Agriculture were the starting point of development, the next logical step to develop the economy would be to boost manufacturing in Pakistan. Successful modern economies set a strong foundation for agriculture and then shift toward more value-adding industries. The playbook has been tried and tested in other developing economies and should have been adapted for Pakistan much earlier.

In the last post, we discussed how if we are to somehow improve agricultural productivity, requiring less workers in that sector, we will need to absorb the migrating workforce through a wide scale industrialization program. In Pakistan, the Industrial sector includes Mining (15%), Manufacturing (65%), Utilities (10%) and Construction (10%). We will first focus on manufacturing in Pakistan and then explore the other sub-sectors.

How Asia Works

I was too harsh in the last post in saying agricultural productivity has been stagnant in Pakistan for the last 25 years. That technically means growth in agriculture value add has been zero but that is not true. Agriculture value add in Pakistan actually grew by 18% in 25 years which is almost insignificant compared to value add in China which grew by over 300%.

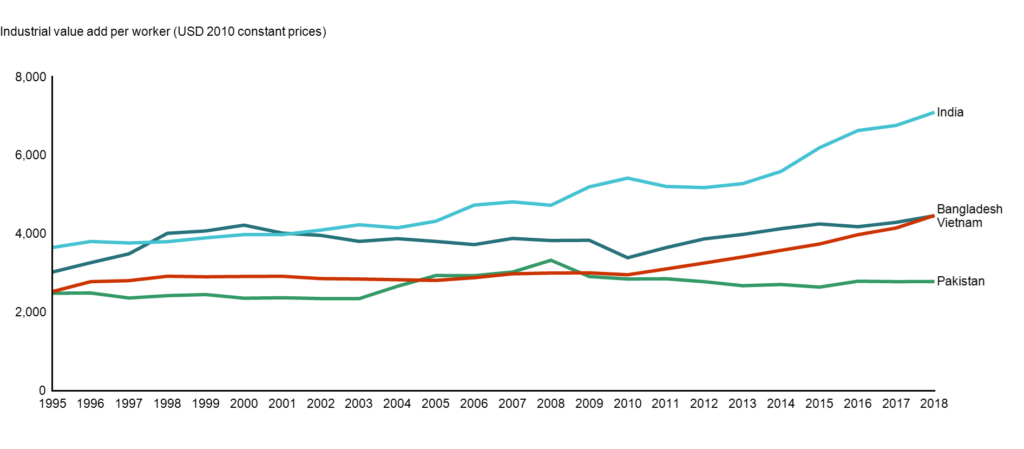

Industrial value add per worker in Pakistan vs. Global benchmarks

Hence, I will not be as harsh when comparing Industrial value add per worker in Pakistan with other developing countries in Asia. Over the last 25 years, Pakistan’s industrial productivity increased by 12% while it increased by 512% for China. That is an unfair comparison so it is not even included in the chart. Maybe India is a more realistic comparison. Like in agriculture, India has managed to double its productivity in the industrial sector. These countries improved value add by focusing on public investment in manufacturing, creating a business friendly environment for entrepreneurs by protecting domestic industry and then forcing businesses to export and encouraging competition. Pakistan on the other hand, has had limited public investment in manufacturing and inconsistent policies concerning both ease of doing business and trade protectionism.

Make in Pakistan

We have discussed before how a lack of investment, limits an economy’s ability to grow. Nowhere is this truer than in the case of manufacturing in Pakistan. Even the investment that has come into Pakistan from other countries has not been efficiency-seeking.

The global comparison shows how Industrial value add per worker has lagged other developing economies until 2018. The performance in 2019 and 2020 of manufacturing has been even worse.

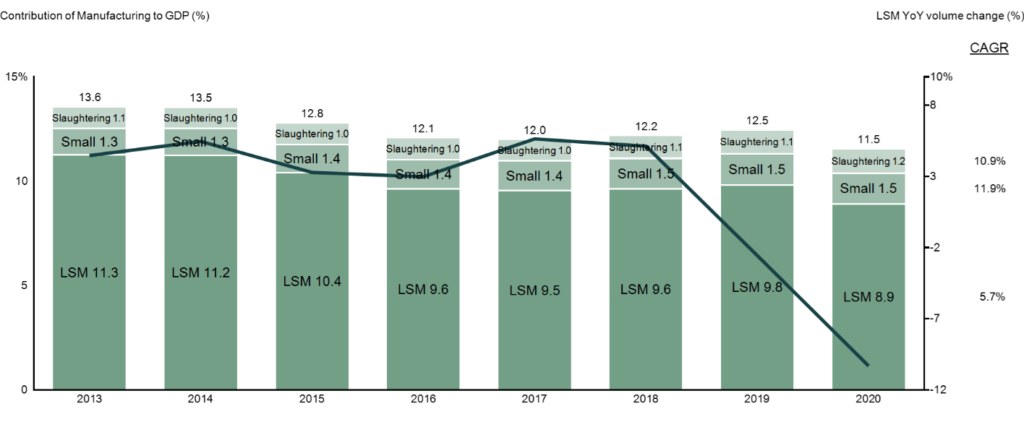

Manufacturing to GDP in Pakistan (2013-2020)

Manufacturing in Pakistan consists of Large Scale Manufacturing, which makes up the bulk, small scale manufacturing and interestingly enough, slaughtering. This is good place to remember that GDP calculation works on a value add basis. For example, cattle rearing will be included in Agriculture, while slaughtering would be included in Manufacturing. Small scale manufacturing and slaughtering have actually grown at almost double the pace of Large Scale Manufacturing (LSM) since 2013. All this while, share of LSM has fallen from 11.3% to 8.9% of GDP.

This is the true definition of deindustrialization when the share of industry in GDP falls. This contribution is in terms of nominal GDP but there is an index that tracks physical output of LSM (blue line), which shows you the real picture. Historically, the index was stagnant but took a sharp dive 2018 onwards. Most will blame 2020 on COVID-19, but notice the line was trending downward even before the pandemic.

Let’s get real again

The primary reasons for this nosedive in real output of LSM are the PKR devaluation, rising energy costs and higher taxes. The interlinkages between the different structural issues in Pakistan will all start to make more sense once we complete the ABCs of Pakistan series at Macro Pakistani. For now, consider this: lack of investment brought down productivity, the real effective value of the PKR kept decreasing and Pakistani goods became less competitive in international markets. Inefficiencies within the utilities sector did not allow energy costs for industry to fall, increasing their input costs and making them even less competitive. Additionally, the revenue starved government continued to increase taxes on the sector that already pays the most taxes.

As soon as the government started bringing the currency to its fair value, it set off a domino that revealed the fragilities of our economy. We will discuss real effective exchange rates and their impact on the current account deficit later but just know it made everyone unhappy.

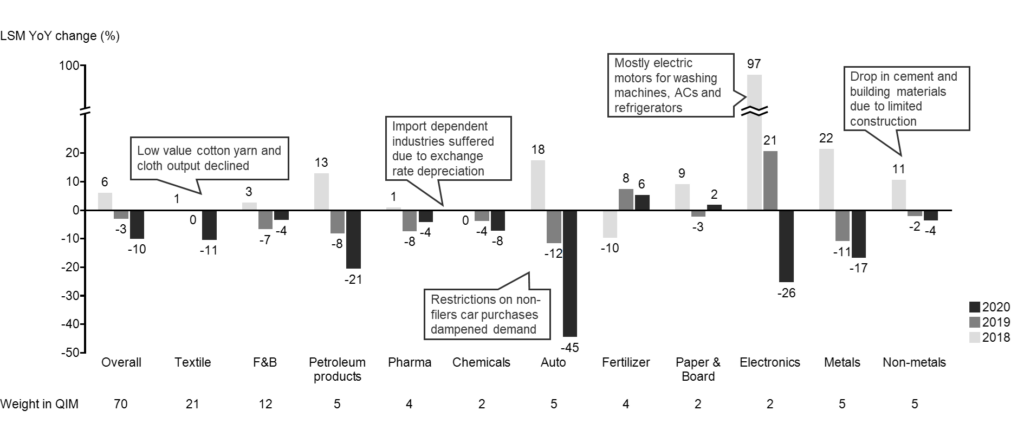

Change in Large Scale Manufacturing sub-sectors in Pakistan (2018-2020)

The Quantum Index of Large Scale Manufacturing (QIM) provides details for each sub-sector in the LSM. The numbers are the bottom show what each sector’s contribution is to the overall LSM and the bars show how much they changed in real terms every year between 2018 and 2020. Each sub-sector has its own issues but Petroleum, Auto and Electronics were the hardest hit recently. You should also note that even though Textile and Food & Beverages have had lower declines, they make up the largest portion of LSM and hence even their relatively small declines have a major impact.

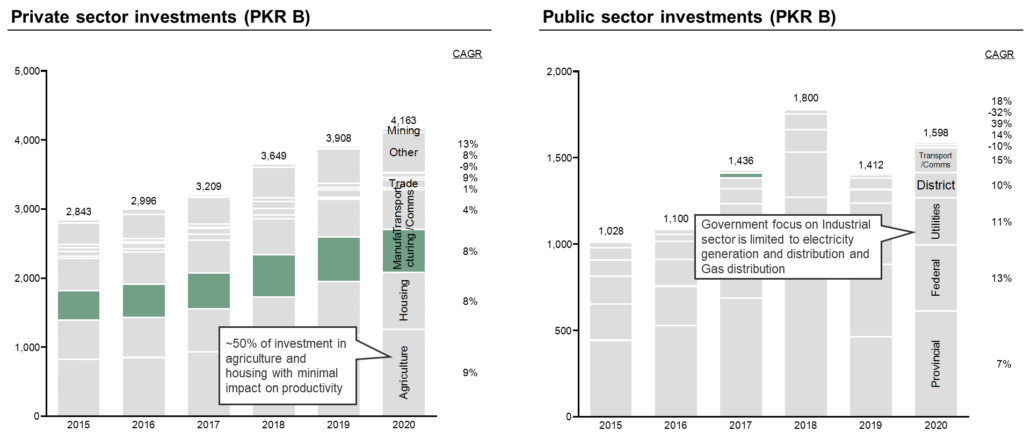

They don’t care for us

As part of the developing economy playbook, I mentioned how the first step is public investment in manufacturing. However, our public sector has assumed no responsibility for the same. Private investment in manufacturing in Pakistan has been sluggish, focusing their energies on low-tech agriculture and housing.

Investment in Manufacturing in Pakistan (2015-2020)

According to the World Bank, public investment in key infrastructure and human capital needs to increase in Pakistan. Public investment is important as a policy instrument to crowd in private investment and augment human capital to increase labor productivity. While it is good that we see some public investment in utilities, a lot more needs to be done to bolster competitiveness. This should be done through direct investments in industry rather than subsidy provisions to inefficient sectors.

Additionally, what is currently happening in Pakistan is that since the government borrows heavily from banks to meet its expenses, it crowds out private investment. If a bank has two options to finance, risk free government that will not default or a small business owner looking to expand through investments, it will usually choose the risk free option. We will discuss this in more detail next time.

Where does the money go?

Despite the public sector crowding out private investments, manufacturing makes up the bulk of private sector financing in Pakistan. Money makes money so financing is typically required to improve investment returns.

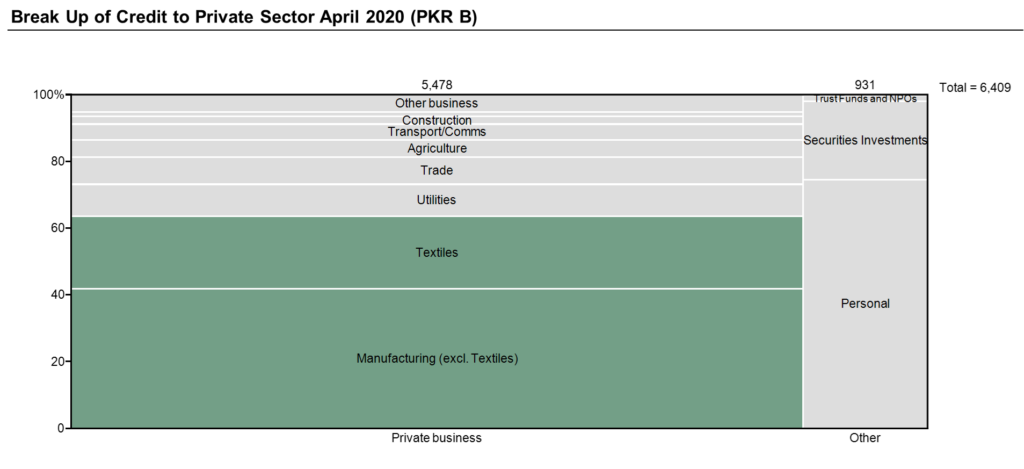

Financing to Private Sector by industry (2020)

Despite manufacturing making up 12% of our GDP, it takes over 60% of all loans to private businesses. As the biggest sub-sector, textile is responsible for 20% of these. Businesses typically take loans for three key reasons: short-term financing to meet day-to-day cash needs (e.g. buying inventory) called working capital or to meet cash flow needs as an exporter called trade finance or long-term financing for projects to invest in to improve the business.

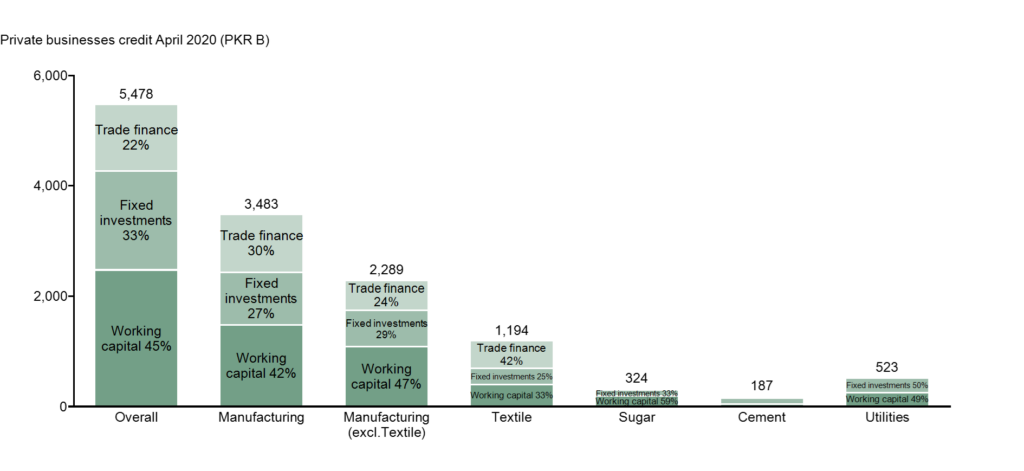

Financing to Private Sector by type (2020)

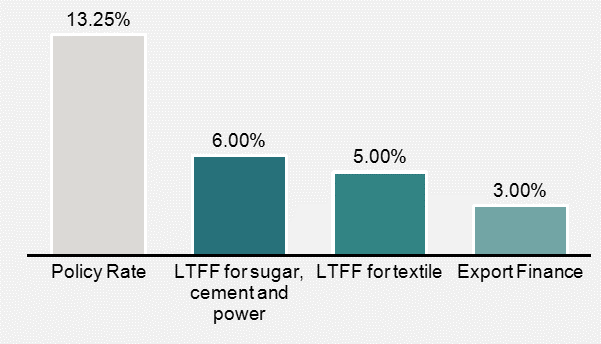

Investment in Pakistan is lagging behind because businesses are already cash strapped to pay for their short-term needs and have limited room for long-term fixed investments. This is despite the fact that long-term financing for export-oriented industries was available at subsidized rates for the last few years. Back when the policy rate was at 13.25%, the Long Term Financing Facility (LTFF) was available at 5% for textile and 6% for sugar, cement and power sectors.

Concessionary financing rates in Pakistan (as of January 2020)

Everything makes everyone unhappy

If you are a textile exporter, you might want to invest in new machinery to become more competitive. You might want to expand and make everyone happy. You might want to use local cotton for production but agriculture was underinvested in. Hence, you are not happy with the local content. You decide to import cotton for which you will need to pay in US dollars. You used to pay PKR 100 per dollar and it all made sense to you. But because so many like you wanted dollars, the value of PKR kept falling.

The government didn’t want to disrupt your business so they kept the dollar at PKR 100 and used up its own reserves to compensate. You wanted cheaper electricity because that was a significant cost but utilities were also underinvested in so you remained uncompetitive. You decided that even at a concessionary rate, it was not feasible for you to invest in becoming more competitive. So you kept increasing prices to meet a higher demand. In domestic markets, you could increase prices but in international markets, you were left uncompetitive. You did not become more productive, you did not export more and you kept importing.

When the government could not hold the dollar at PKR 100 anymore, you became unhappy. Your lack of investment in productivity came to surface and the problem perpetuated across industries. The government had also promised you rebates as an exporter, which it hoped to recoup through taxes. But because your revenue did not go up by as much, the government could not collect more taxes and could not pay you your rebates. Your cash worries continued. We will discuss next time how these cash worries are exacerbated for smaller businesses and how financing can play a role in fixing some structural issues.

A very thorough analysis of the situation!

This micro-management of the economy ends up looking like the government playing whack-a-mole. Govt crowds out pvt investment by bidding up interest rates (risk-adjusted), this necessitates concessionary financing rates which is basically directed investment. Most of the govt actions distort incentives to invest in what would be high return sectors absent these interventions.

Completely agreed. A more productive use of those ‘directed investments’ would be to support guarantee programs to make loan pricing favorable for small firms at least.