The IMF released its outlook for Pakistan this week, forecasting 1.5% real GDP growth in 2021, rising to 5% by 2024. Investment is expected to rise to almost 17% of GDP in the next 5 years. Worryingly, this rise is not projected to be fueled by national savings. Current account deficits are expected to stay under 3% of GDP while fiscal deficits will be halved. Structural reforms required to complete the IMF program will be tough so expect these projections to move around significantly. Interestingly, inflation is expected to remain within 6-8% from 2022-2025. Given SBP’s proposed autonomy, this inflation target will come under significant scrutiny in the coming years.

How should SBP respond to changes in oil prices in Pakistan?

By Naafey Sardar

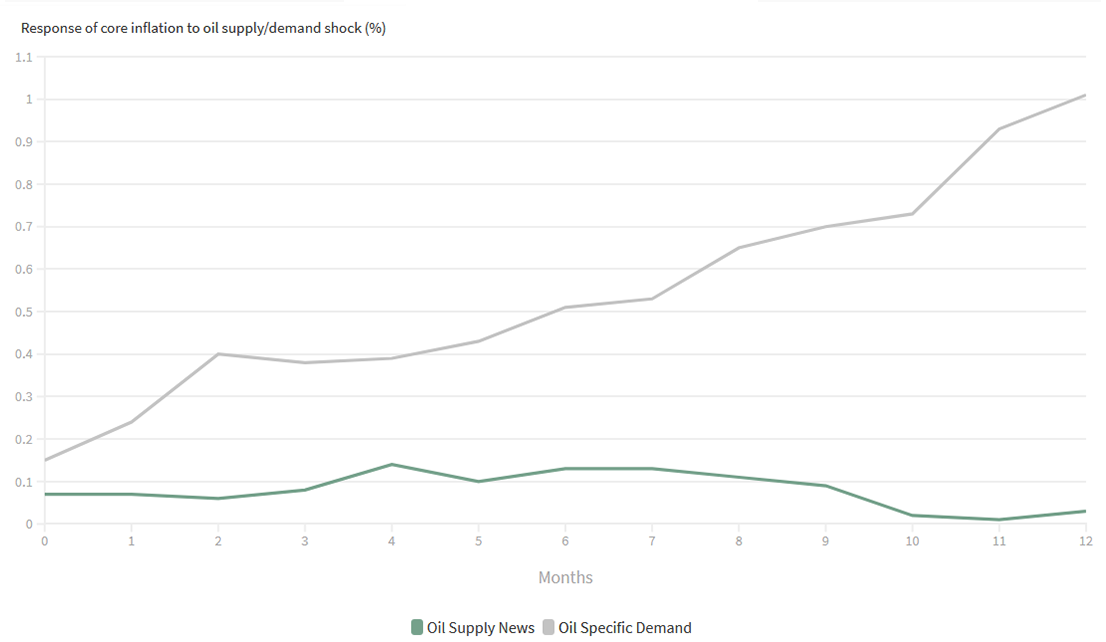

Oil prices in Pakistan are particularly relevant to consumer spending in the country. They make up 10% of consumer spending and their changes can have significant impact on inflation. Hence, it is important to understand what causes oil prices changes and how should SBP react to moderate their impact.Naafey identifies that oil price fluctuations are driven by oil specific demand or oil supply news shocks. Oil specific demand refers to a change in price from an increase in demand due to expectations of shortfall in future oil supplies. Oil supply news refers to announcements by OPEC on variation in production of crude oil. He finds that if SBP were to target Core (Non-Food and Non-Energy) inflation, in the case of OPEC announcements, it should not react at all. This is because oil supply news shocks have a very small impact on core inflation and only affect Food and Energy inflation directly.

Oil supply news shocks have a very small impact on Core (Non-Food and Non-Energy) inflation

Source: Karandaaz data portal and author’s calculations

If oil prices change by 1% due to a demand shock, headline inflation changes by almost 1% while core inflation changes by just over 1%. However, if the shock is related to oil supply news, headline inflation changes by 1.23% while core inflation is hardly affected. Read the full article to understand how oil prices affect inflation in Pakistan and the scenarios under which SBP should change interest rates to moderate inflation. Devising policy rates after understanding the causes of prices changes, specifically for a volatile commodity like oil, will enable SBP to meet its inflation targets.

KSE-100 is up 2.12% since last week and 58.20% up since last year. IMF’s improved forecasts on the country’s economic outlook have also boosted investor confidence. PKR continues to gain strength against the USD following a steady trend that began in early February. The exchange consistently fell this week before closing on its lowest level since June 12 2019. PKR is expected to appreciate further as macroeconomic forecasts are revised upwards. Gold prices opened the week at PKR 106,000/tola before stabilizing at PKR 104,000/tola. Gold prices have been fluctuating in the international market in response to higher US treasury yields and weaker dollar. Yields shot up in the middle of the week due to inflationary expectations resulting in lower gold prices. Changes in gold prices in Pakistan are in line with international market trends observed this week.

The annual change in Sensitive Price Index is up to 18.43% as compared to 17.21% last week. The whole country experienced higher inflation on annual basis, with the highest and the lowest 20% of the population facing an inflation of above 17% and nearly 22% respectively. Weekly inflation is up due to an increase in prices of some essential food commodities such as Chicken (+11.21%), Potatoes (+9.98%) and Tomatoes (+7.51%). On an annual basis, the rise in prices of these commodities ranges between 55% and 100%. Prices of Sugar (-3.07%), Eggs (-1.41%) and Wheat Flour (-0.69%) are down since last week. Electricity tariffs for lowest income quintile are also down (-1.28%). However, prices of these commodities are significantly up since last year. Eggs are almost 41% more expensive as compared to the same period last year.

What Else We’re Reading (Local)

- What is required for economic transformation is continuous reallocation of resources toward more productive activities (PRIME)

- Petroleum Levy may still fall short of its target by PKR 40-50 billion in FY21, yet IMF has budgeted highly unrealistic targets for next year (Business Recorder)

- Case for investing in healthcare is strong and its positive externalities impact not just health but also productivity, human development and economic growth (Dawn)

- Nobody seems to have a clue as to the market size of national cotton consumption with 1-2 million bales the difference between numbers reported (Business Recorder)

What Else We’re Reading (International)

- China will contribute more than one-fifth of the total increase in the world’s gross domestic product in the five years through 2026, according to IMF (Bloomberg)

- If the army comes to view Mr Khan as a liability, it is unlikely to have much compunction about dropping him, just as it did Mr Sharif (Economist)