This week Macro Pakistani did a deep dive on the sectoral breakup of Pakistan’s GDP. Relative to the historical norm for countries at similar levels of per capita GDP, while Pakistan’s agricultural sector is of typical size, its manufacturing sector is small and services sector large. The country has been deindustrializing prematurely while the services sector has gained share. From 2011 to 2020, Industry went from making up 21.2% of GDP to 19%, with Manufacturing, and in particular, Large Scale Manufacturing being the most affected. During the same time, Services grew their share by almost 4% of GDP, with the highest growth coming from ‘Other Private Services’ which includes Tour Operators and Travel Agencies.

Resurgence of Pakistan’s Multi-Billion Dollar Tourism Industry

By Mahrukh Mohsin

The greater part of the last decade was spent recognizing the limitless potential of Pakistan’s tourism sector. In 2019, Tourism contributed 6% of GDP and almost 4 million jobs to the economy. Within the first quarter of 2020, tourism was poised to break all previous records. Then the world was struck by a pandemic and lockdowns ensued. However, as soon as the lockdowns were lifted in August, local tourism in Pakistan started to make a comeback within the same year.

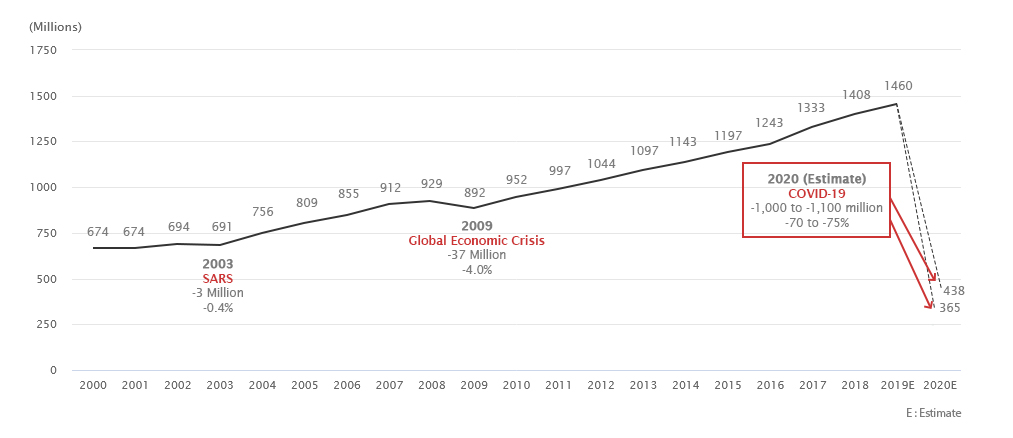

According to the United Nations World Tourism Organization, international tourism declined by 70-75% last year. The resultant loss could amount to up to USD 935 billion in tourism exports. During the financial crisis of 2008-09, 37 million less people traveled compared to the year before. Due to COVID-19, over a billion people who travelled in 2019 did not do so in 2020.

International tourist arrivals, 2020 (millions)

COVID-19 has forced international travel to decline by up to 75% in 2020

Source: United Nations World Tourism Organization

What people had written off as a doomed year for travel, start-ups like FindMyAdventure ended up taking as a year of lessons. They spent time to understand the growing needs of the Pakistani market and leveraged increased digital penetration in the country to go from having a marketplace for trips and tours to collating a fragmented market into an in-destination full stack tourism marketplace. Read the full article to learn more about the tourism industry in Pakistan and the story of FindMyAdventure.

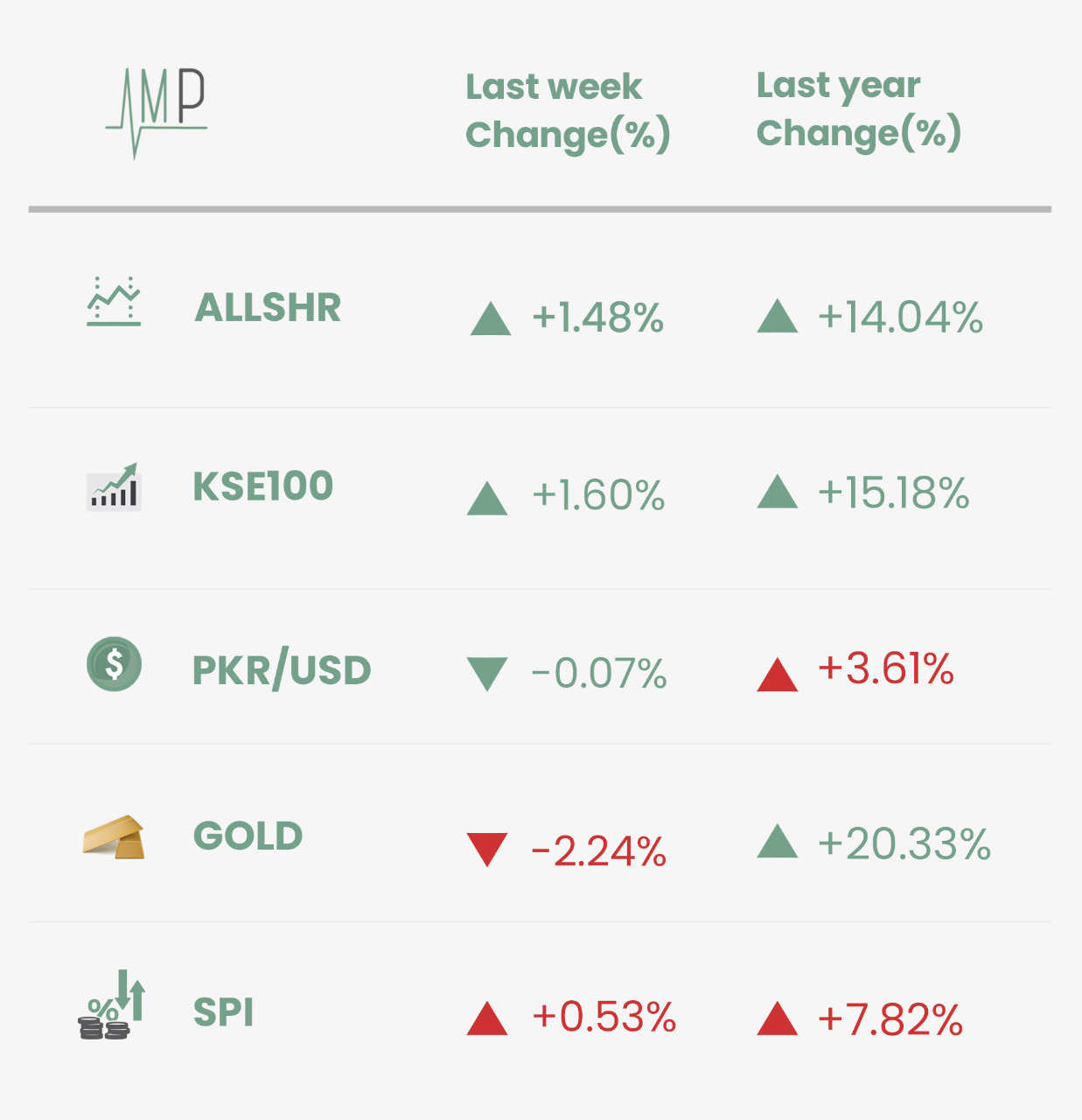

This week, the KSE-100 crossed the 47,000 mark for the first time in 3.5 years. Strong growth in sectors, especially cement, drove the markets higher. Strong economic numbers, such as the fourth consecutive month of +USD 2 billion exports, also helped the PKR appreciate, closing just under the PKR 160/USD level. In line with international prices, the domestic price of gold also fell. Expect this trend to continue as vaccine rollouts succeed in bringing the coronavirus under control and investors move away from the safe haven of gold. The annual change in Sensitive Price Index rose to 7.82% compared to 7.48% last week. Sensitive Price Index tracks the price of only 51 essential commodities and is a leading indicator to the more comprehensive Consumer Price Index, which fell last month.

Only the top 20% of income earners in the country experienced inflation lower than 8%. Surprisingly the main reason behind this was Bata increasing the price of their sandals by a third! The price of gents’ sandal that used to cost PKR 899/pair, increased to PKR 1,199 and it had implications on the country’s inflation trajectory! We will investigate this further and get back to you. Continuing the trend from past month, prices of Chilies powder (+7.45%), Chicken (+3.04%) and Petrol (+2.49%) rose while those of Tomatoes (-10.46%), Onions (-2.49%) and Eggs (-1.30%) fell.

What Else We’re Reading (Local)

- Digital news: A study in how not to do business – key distinguishing feature between Pakistani and foreign news website is a paywall (Dawn)

- Even though most feel the need to overhaul India’s agriculture, the way farm bill legislation has played out is a lesson in how not to transform it (Business Recorder)

- Exports cross USD 2 billion for fourth consecutive month, rising 8% in January 2021 compared to January 2020, with growth in value-added sectors (Profit)

What Else We’re Reading (International)

- Fallout from the military coup in Myanmar will be painful for the already struggling economy, with billions of dollars’ worth of foreign investments at risk (NPR)

- After a decade of rapidly falling costs, rechargeable lithium-ion battery is poised to disrupt industries and transform the way the world uses power (Wall Street)