Having touched upon the basics of trade, let us now dive deeper into Pakistan’s trade policy and recent world trade developments. This article discusses Pakistan’s tariff policy, the effect of exchange rate on trade, the US-China trade war, and trade during the COVID19 pandemic.

Tariff Policy

The development strategy in the post-war world focused on protecting domestic industries from foreign competition. The aim was to shield domestic producers until they grow and can compete internationally. As a result, import tariffs were set high for goods produced by the protected industries and were set relatively low on inputs of such industries. Pakistan was no exception.

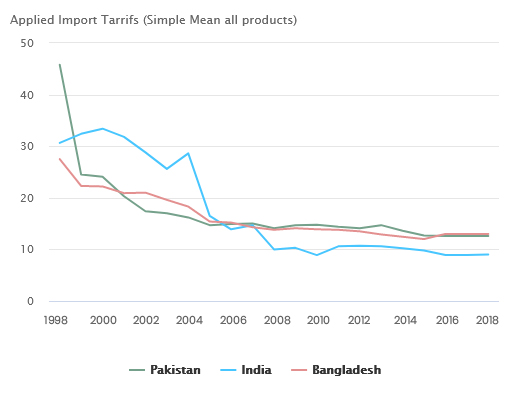

However, as mentioned in our previous piece, subsequent rounds of GATT/WTO negotiations succeeded in bringing down import tariffs all around the world. While the developed world made bigger tariff concessions, developing countries were given some flexibility in terms of slower transitions to lower tariffs. This meant that average applied tariffs rates remained in double digits for these countries.

Applied Import Tariffs % (simple mean, all products)

Import tariffs fell drastically after the formation of World Trade Organization

Source: World Bank

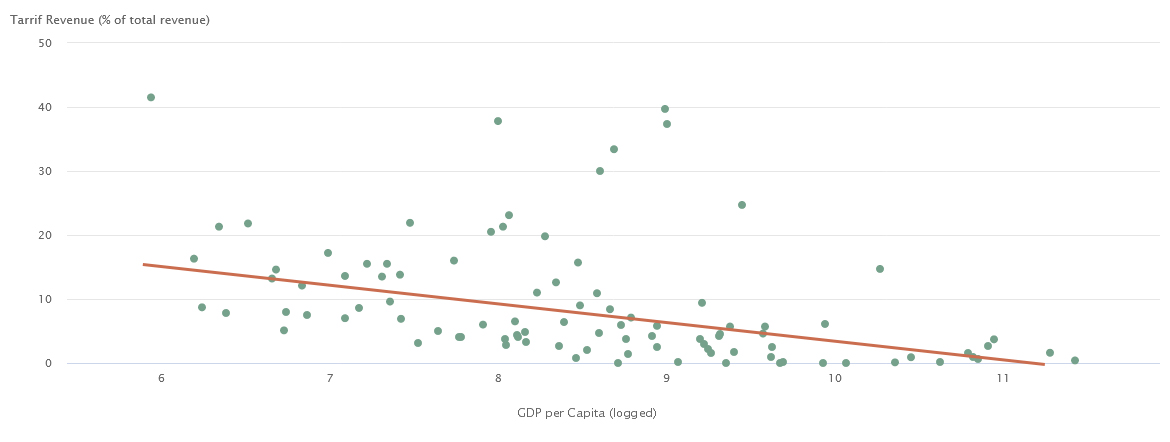

Among others, one reason for this leeway is revenue generation, which is an objective of tariff policy in developing countries. High degree of informal economic activity (around 35% for Pakistan) makes it hard to tax businesses and individuals. This narrow tax net forces governments to look for indirect methods of taxation. Since it is relatively easy to observe goods entering the country (due to limited entry points), imports generally bear the burden of meeting revenue targets. This revenue constraint, among other factors, has so far inhibited benefits of trade in terms of higher productivity and participation in GVCs from being realized.

Tariff revenue (% of total revenue)

Richer countries rely less on import tariffs as a source of revenue

Source: World Bank

Currency Peg and Its Effects

Any discussion on trade policy would be incomplete without mentioning exchange rate and its effects on trade. When a country’s exchange rate depreciates, one needs more of it to buy a unit of foreign currency e.g. Pakistan’s currency depreciating from Rs 60/USD in early 2000’s to Rs100 in early 2010s. A depreciation favors exporters, who receives more PKR for every USD exported, and hurts importers, who pays more PKR for a USD than they did before.

At a theoretical level, exchange rate is determined by the canonical forces of demand and supply of a currency relative to a benchmark currency (default being the USD). Central banks can however manage the exchange rate by altering the amount of home currency relative to USD in the market. A central bank can increase demand for its currency by buying it in exchange of USD from its reserves. This appreciates the value of domestic currency (fall in PKR/USD).

While other developing countries are often accused of keeping their currency undervalued (to boost exports), Pakistan has a reputation of keeping its currency overvalued. The arguments cited in favor of such policy include increased stability (as long as it lasts) that may have positive effects on trade and FDIs.

US-China Trade Tensions

Being a part of hyper-globalized world necessitates keeping in touch with major trade events around the world. One such affair that has caused ripple effects across the world is the US-China trade war. It began in 2017 when the US started investigations into China’s allegedly unfair trading practices which led to high import tariffs being placed on China. As expected, China responded with its own tariffs on the imports coming from the US.

Whatever happens to trade between the US and china has large global consequences transmitted by the intricate trade networks. As China exported less to the US, it imported less from its inputs-providing countries that in turn reduced China’s suppliers’ sourcing from their respective suppliers causing a chain reaction to policy actions taken in Washington, DC.

According to estimates, the escalated trade war caused global GDP damage of up to 0.1% in 2019 alone. In comparison, the Great Recession of 2007-09, that brought global financial system to a brink of collapse, caused a contraction of world GDP by 1.7%. Such humongous impact from tweaking one policy instrument of import tariffs between two largest economies signifies the importance of GVC linkages.

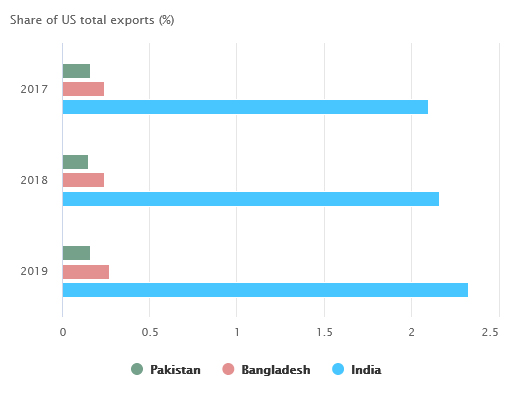

Alongside the negative impacts, there were also diversionary effects seen as US imports from other countries such as increased. According to UNCTAD estimates, around 63% of value lost by Chinese exporters to the US was gained by other economies. In this sense, the trade war provided an impetus for other countries to increase their production.

Share of US total exports (%)

As the US-China Trade War raged on, there were differential effects on regional trade partners

Source: World Bank

Trade and Trade Policy during COVID-19

Now let’s turn our attention to a bigger challenge to international trade. While wreaking havoc on almost every aspect of life, the COVID19 pandemic has also disrupted the pattern of global trade. While the virus spread across the world quickly, all the countries did not experience the high intensity periods simultaneously. This displayed another benefit of trade as trade allowed countries to go into lockdowns and take other preventive measures while the supply of goods and services was ensured from other trade partners.

A very relevant example is that of China. Although China was the first country to suffer from COVID19, it was also the first one to control its spread. This allowed China to produce and export the highly demanded Personal Protective Equipment and other medical devices (PPEs) in large quantities all across the world.

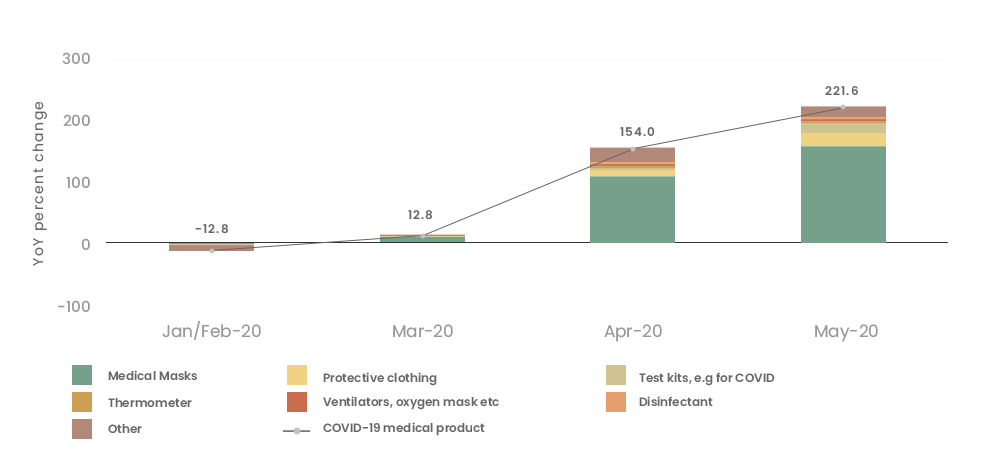

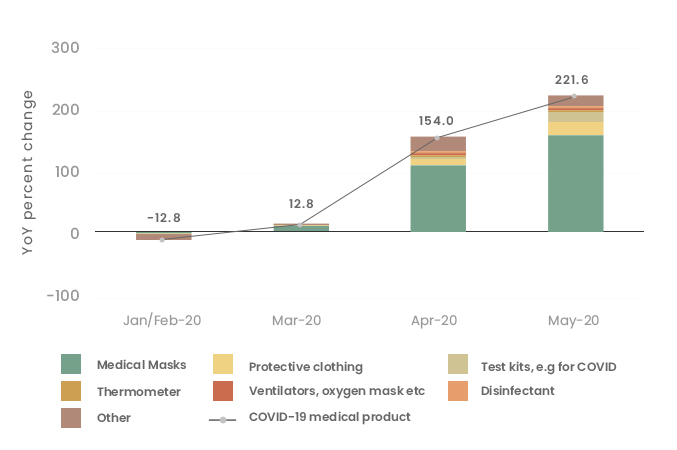

Growth in COVID-19 medical products exports from China (YoY % change)

China’s exports grew during the pandemic on the back of high PPE demand

Source: World Bank COVID-19 Trade Watch #4 July 31, 2020

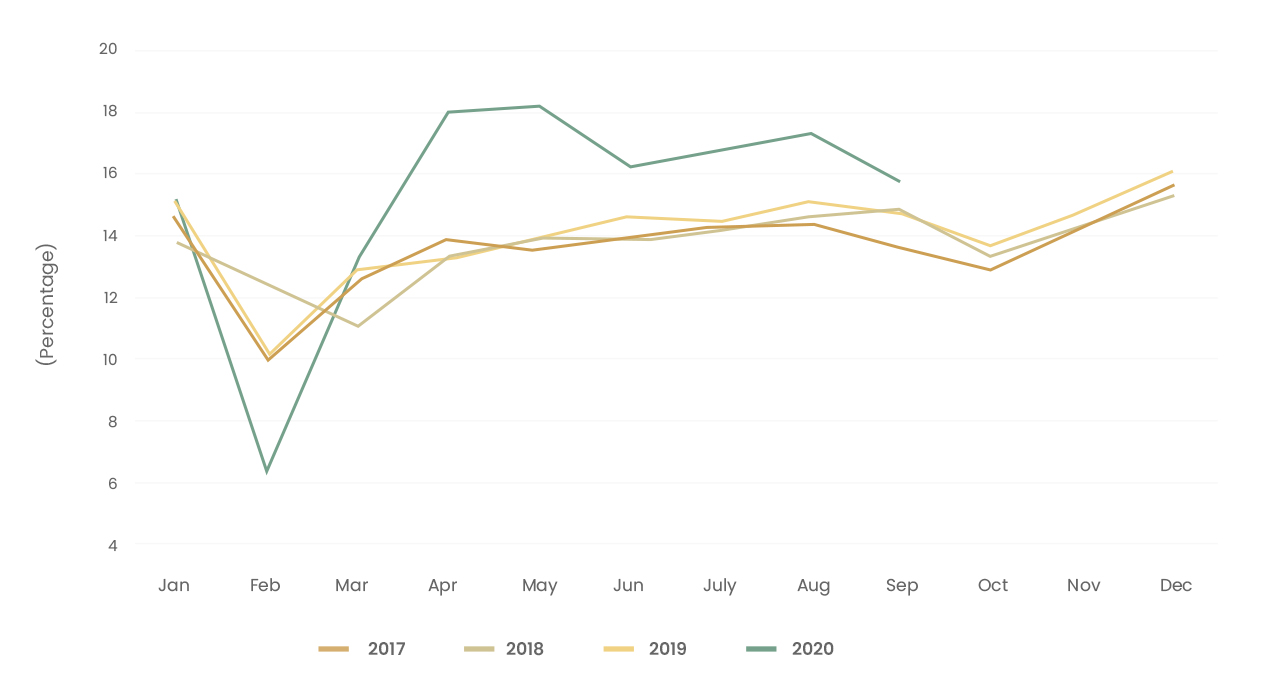

Growth in China’s exports (YoY % change)

China’s export performance improved considerably after initial setback

Source: World Bank COVID-19 Trade Watch #8 November 30, 2020

Domestically produced PPEs by imposing export restrictions (taxes, bans, quotas and price controls). Even countries in the highly integrated European Union began imposing export restrictions on their fellow EU members. Such actions initially caused bottlenecks and price hikes for these goods. However, since none of the countries produce all the PPEs and even for the ones they produce, supply chains are mostly transnational, such restrictive policies were less likely to be sustainable.

What could be done?

The WTO has been a bastion of free trade and has facilitated a trading environment based on mutual trust. As a result, the world saw decades of growth in international trade networks (global supply chains) that facilitated rapid and massive mobilization of resources during the COVID19 crisis. However, as discussed in this piece, the challenges to the world trading system have never been more severe.

The US-China trade war amid a general pushback on multilateralism has threatened to undo the decades long progress. Building confidence in multilateral trade institutions (as opposed to pursuing bilateralism) must be a priority to ensure an environment conducive to trade growth and exchange of ideas. Restoring and supporting the rules-based multilateral trading system would be a desirable way forward.

Apart from this, a long-standing issue is structural constraints on some developing countries that inhibit trade openness. Policies that promote formalization of economic activity are likely to relax pressure on import tariffs to fill the gap in government budgets. This would open new avenues for struggling economies as we have seen in cases of Asian tigers and more recently Vietnam.

The article is written in the author’s personal capacity and the findings and opinions expressed here do not necessarily reflect the views of the World Bank.

The spread of disease within and into Pakistan cannot be separated from the global context. The world’s urban population at 4.2 billion has now exceeded the global rural population, and almost 40% of Pakistanis live in cities. Meanwhile in the country, close to seven million use air transport .