The progress of the Pakistani economy has often been isolated from its strong and consistently growing diaspora, despite the contributions it has and continues to make to the country. As a consumption-driven economy struggling to move beyond surface-level issues, examining the potential of the large, very well equipped expat community can allow us to find long-term solutions to issues that have seemed unsolvable for many years now: everything from economic growth to social development.

To explore the subject, it is first important to understand the make-up of our diaspora. We will then look at the impact of their economic activity, particularly, remittances, and how they influence Pakistan’s economy. To further this, we will then explore the multiplier effects that remittances and the growth they stimulate can have on Pakistan’s social construct. We will also briefly explore the factors that influence remittance inflow to Pakistan, highlighting how government initiatives capitalize on this national asset.

Where is the Pakistani diaspora?

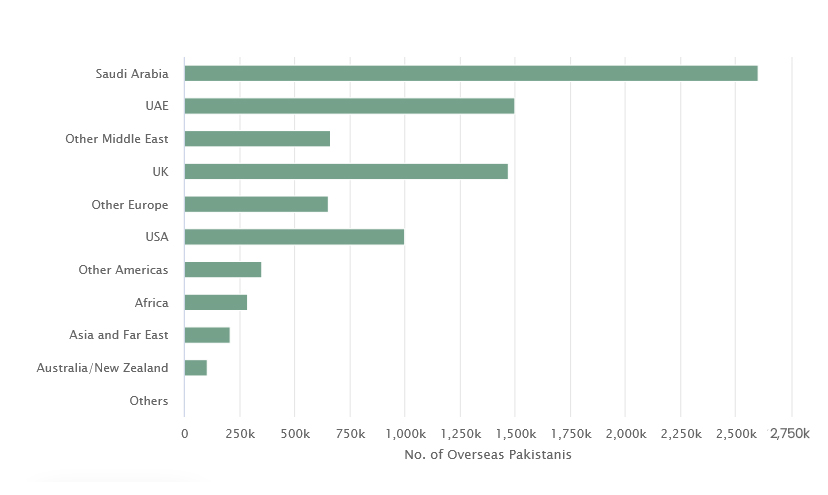

Number of Overseas Pakistanis living, working and studying abroad 2017-18

Over 50% of the ~9 million strong diaspora community lives in the Middle East

Source: Ministry of Overseas Pakistanis & Human Resource Development

According to the Ministry of Overseas Pakistanis & Human Resource Development, approximately 9 million Pakistanis were living, working or studying abroad as of 2017-18. The United Nations estimates that the Pakistani diaspora community is the 7th largest in the world. Almost 53% of these Pakistani citizens were based in the Middle East with Saudi Arabia alone hosting 2.6 million of them. Pakistan has maintained strong ties with the Middle East, particularly Saudi Arabia, throughout the 21st-century, and this can be attributed to the strong Pakistani presence in the region. A large proportion of the Pakistani community is also found in the United States, where approximately 1 million Pakistanis reside. Europe, Australia and New Zealand are also home to a large Pakistani diaspora community.

What are remittances?

Remittances are broadly defined as personal transactions between individuals or families within and outside a country, most commonly sent from developed countries to emerging economies. Each year, the Pakistani diaspora sends almost $20 billion worth of remittances to Pakistan, and this has a variety of impacts on the country’s economy.

As discussed in earlier articles, Remittances are the saving grace of Pakistan since the current account would be in significantly worse shape without them. Remittances to Pakistan have remained consistent and in fact, increased during times of crisis. They have provided more cash inflow than any other official assistance packages, and during the Coronavirus pandemic, reached an all-time quarterly high between July and September 2020. This allowed Pakistan to achieve a current account surplus, after a gap of 5 years and of the highest amount in value over the last 17-years.

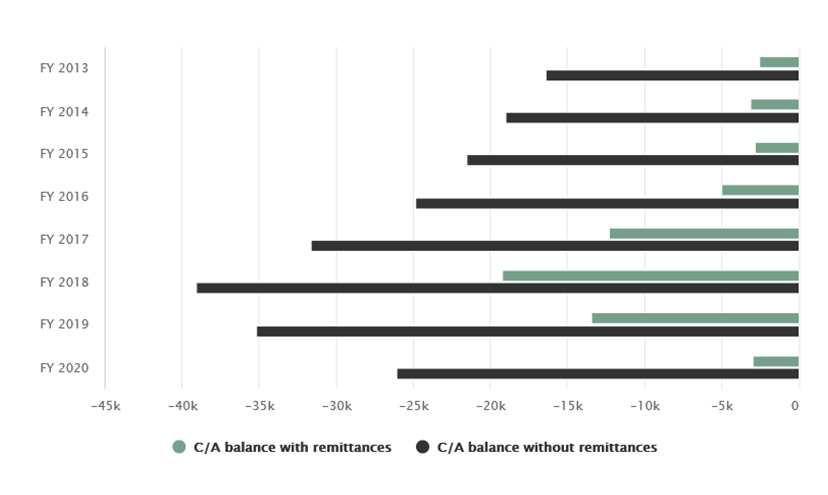

Remittances contribute directly to our secondary income balance and account for a large proportion of our otherwise massive deficit. By reducing this deficit, we are able to maintain the value of our currency in a market based exchange rate regime and avoid further devaluation. The below graph illustrates Pakistan’s current account deficit with and without remittances. As shown, if Pakistan did not receive remittances, our deficit in 2020 would be a staggering USD 26 billion. With remittances at USD 23 billion this year, we only have to account for a deficit of around USD 3 billion.

Current account balance with and without remittances (USD M)

Without remittances, Pakistan’s current account position would be significantly worse off

Source: State Bank of Pakistan, MP Analysis

To remit or not to remit

Remittances are also often termed ‘shock-absorbers’, meaning that during times of external shocks, they remain consistent, sometimes even rise to insure families against income shocks. The recent rise in our remittances was stimulated by, first of all, their ‘shock-absorber’ nature, where we saw remittances rise amid COVID-19, and the consequent impact of less travel, which has affected the informal channels of hundi/hawala.

Remittances also increase consumption and investment, as they provide disposable income to households in the country. These two core components of aggregate demand can then stimulate growth, as an increase in demand leads to a rise in production, employment, and eventually, productive capacity.

Remittance inflows are impacted by a variety of both microeconomic and macroeconomic factors, and this has been studied widely in the context of Pakistan. On a micro level, most commonly discussed factors include migrants’ income level, education and the number of dependents they are supporting in the recipient country. While on a macro scale, political stability, exchange rates and the ease of transfer tend to have the greatest influence. So, why have remittances increased?

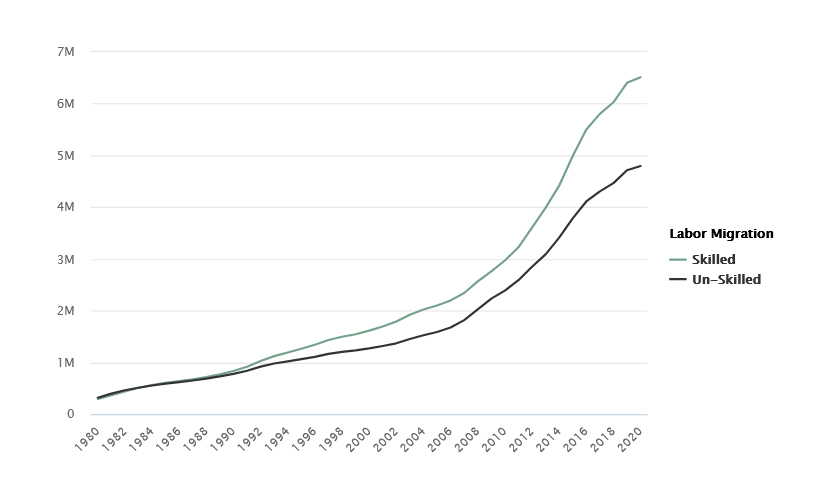

According to the IMF, the rise in remittances can be attributed to the rise in share of skilled worker migration from Pakistan. Skilled workers have much more stable sources of income, and are therefore able to consistently remit money back to their home countries. Another significant factor discussed is the geopolitical situation within the recipient country, as well as its relations with countries where migrants are based. A particularly interesting find was that following 9/11, many Pakistanis in the United States sent sums of money to Pakistan to avoid facing issues with an increasingly hostile US government. Remittances rose from $1 billion in 2001, to more than $3 billion in 2002.

Rising share of skilled labor migrating abroad can explain rise in remittances

Source: Bureau of Emigration & Overseas Employment

Multiplier effects of remittances

Economic prosperity stimulated from remittance flows can create multiplier effects that can support progress in other capacities to great extents. Studies conducted by the United Nations have shown that remittance-receiving households in developing countries are much more likely to invest in education and entrepreneurship. In a country like Pakistan, with low literacy rates and a general sense of political, social and economic apathy, this poses great potential.

In Sri Lanka, children from households receiving remittances had much lower dropout rates. Remittances also provided capital to small business owners that allowed for the stimulation of innovation and invention, and in turn economic progress. In Bangladesh, remittances were said to reduce the poverty headcount by 6%, while the number was even higher at 11% in Uganda.

The impact on remittances on education is reiterated by a study conducted by WorldRemit, which highlighted that children in Nigeria, Uganda, Tanzania and Pakistan are 40% less likely to be out of school if they are from remittance-receiving households. Much is said about the Pakistan diaspora and its brain drain issue, but it could be argued that this effect is offset by a ‘brain gain’, which is the idea that the networks, knowledge and skills individuals acquire from abroad can eventually be of benefit to developing economies. There is also the idea that the prospects of moving abroad incentivizes education.

Pakistan can not only improve its social construct but create a generation of empowered, educated individuals who can contribute to great economic growth. We have immense potential, but few resources, and remittances can help us close that gap, but only if we facilitate these. The Government of Pakistan has initiated a variety of programs in recent years that have significantly supported the integration of diaspora into the country’s growth, and these have already begun to show results.

Roshan Digital Accounts

The importance of the Pakistani diaspora and remittances is one of the few places most governments seem to have consensus. The talk-of-the-town is currently the Roshan Digital Account, an initiative of the State Bank of Pakistan to stimulate Pakistani diaspora involvement in the country. The central purpose of this is to streamline the process of transferring money from outside the country, into Pakistan. With digital remittances up to 2.1 percentage points cheaper than offline remittances, more funds are expected to be available to households to spend on needs such as education. With the Roshan Digital Account, overseas Pakistanis are able to digitally set up accounts with eight commercial banks in the country, from their base countries. By streamlining the process, it encourages not only remittances, but also long-term investment.

RDA will also enable investments into the Naya Pakistan Certificates issues by the Government of Pakistan. Diaspora bonds have been an extremely significant source of funding for other countries. In neighboring India, diaspora bonds were able to bring in a staggering $35 billion to fund development projects, and this injection into the circular flow of income could help fund similar infrastructure projects in Pakistan, creating jobs, increasing consumption, stimulating demand and generating long-term economic growth.

Where do we go from here?

The Pakistani diaspora is an asset. It is imperative that to maintain economic stability and also foster social progress, we work to integrate the expat community into our society to every extent possible. As we move forward, however, we must be cautious of dependence on one factor of inflow. If there is anything COVID-19 has taught us, it is that very few things last forever, and it is therefore important that we develop Pakistan’s economy in as many capacities as possible to create a stable, prosperous system

This is such an informative and fantastically written article, with some fantastic case study examples. Throughly enjoyed reading this one. Keep it up as I look forward to reading a lot more!

Glad you enjoyed it, Shoaib!