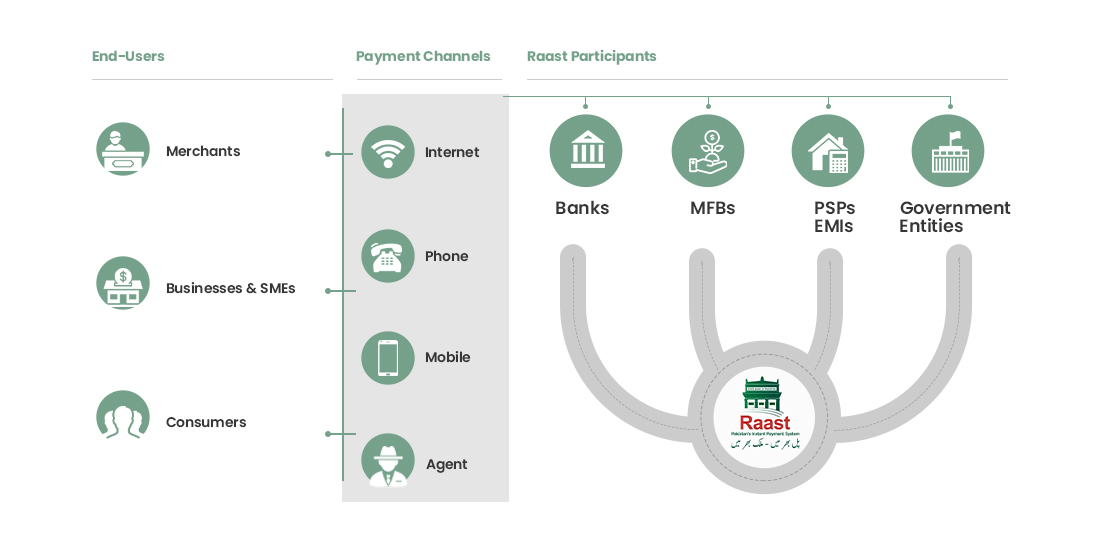

This will not be an explanation for how Raast, the State Bank of Pakistan’s instant payment system, works. Several publications have done a good job of explaining the mechanism by which Raast will enable end-to-end digital payments among individuals, businesses and government entities instantaneously. Macro Pakistani would recommend this and this. SBP’s own website also has a nice overview, which you can read here. We would like to focus on why such a system is required in the first place. Raast will be at the center of the Digital Financial Services ecosystem. However, why is there a need to connect end-users through payment channels in a seamless manner?

Overview of Raast

Raast will be at the center of the Digital Financial Services ecosystem in Pakistan.

Source: State Bank of Pakistan

Pakistan’s cash problem

Digital transactions make up only 0.2% of Pakistan’s ~100 billion transactions today. Pakistan’s currency in circulation as % of GDP is actually increasing as compared to other countries. Latest comparable data shows this number is up to almost 13% in Pakistan, while dropping in places like China, Singapore and India. However, as of June 2020, cash to GDP in Pakistan has increased to almost 15% with over PKR 6 trillion in circulation today. The State Bank of Pakistan’s printing cost has doubled since 2015, to over PKR 13 billion in 2020. In a country where only 17% of the labor force is in the formal sector, cash and informality is king. This informality leads to rampant tax evasion and gives rise to higher levels of corruption.

Currency in circulation vs. GDP (%)

Pakistan’s currency in circulation as % of GDP has been increasing as compared to other countries

Source: SBP; PBOC; MAS; RBI; EIU; ADB

Cash provides anonymity and prevents traceability. While there are those that would prefer their transactions remain outside the purview of regulators and governments, for a vast majority of Pakistanis, transparency could allow for more effective subsidy payouts. Financial inclusion and account ownership could also help reduce corruption, discourage tax evasion and cut down administrative costs unique to traditional cash disbursements. Think of when COVID-19 hit and the lack of a National Socio-economic Registry prevented the government from releasing funds to those who need it most, as fast as possible. Consider Macro Pakistani’s earlier complaints about limited availability of real time data to predict Pakistan’s economic performance. With a higher proportion of Pakistan’s population opting for digital financial services, we could close this information gap, take quick policy actions and, as a result, hold our leaders more accountable.

Pakistan’s digital problem

We have discussed the Digital Divide in the country before. We know that 25% of Pakistan and over 60% of Baluchistan has limited or no internet coverage. Even those that have internet coverage have not started to utilize it properly. World Bank’s Findex survey in 2017 found that while Pakistan was in line with most South Asian countries in use of financial institutions for payments, it lagged behind other similar lower middle-income countries. 41% of Pakistanis still used cash to send or receive domestic payments while 35% used financial institutions. 14% used mobile phones for money transfers, almost half the average of South Asian countries.

Domestic Payments (as of 2017; among adults age 15+)

Payments through financial institutions in Pakistan lag behind other similar countries

Source: Findex; World Bank

Note that the data is from 2017 and shows India almost in line with Pakistan in terms of digital financial inclusion. Cash dependency in both countries was quite similar as 43% of transactions in India took place in hard currency. India introduced its equivalent of Raast, the United Payment Interface (UPI), in 2016 and their digital financial services ecosystem completely changed. Not only did UPI take the lion’s share of transactions, it also increased the size of pie. Retail financial transactions increased from 7.1 billion in 2016-17 to 26.5 billion in 2019-20. More recently, since October 2020, there have been over 2 billion transactions facilitated by the system per month and its share in total transactions has risen to over 60%. Notice the transactions that UPI has replaced. The two major ones have been Automated Clearing and Cheques and both involve paper money transactions.

Share of UPI transactions in India (% of total financial transactions)

There are over 2 billion transactions on United Payment Interface, making up 63% of total now

Note: Excludes ATM cash withdrawals

Source: NPCI

Pakistan’s digital opportunity

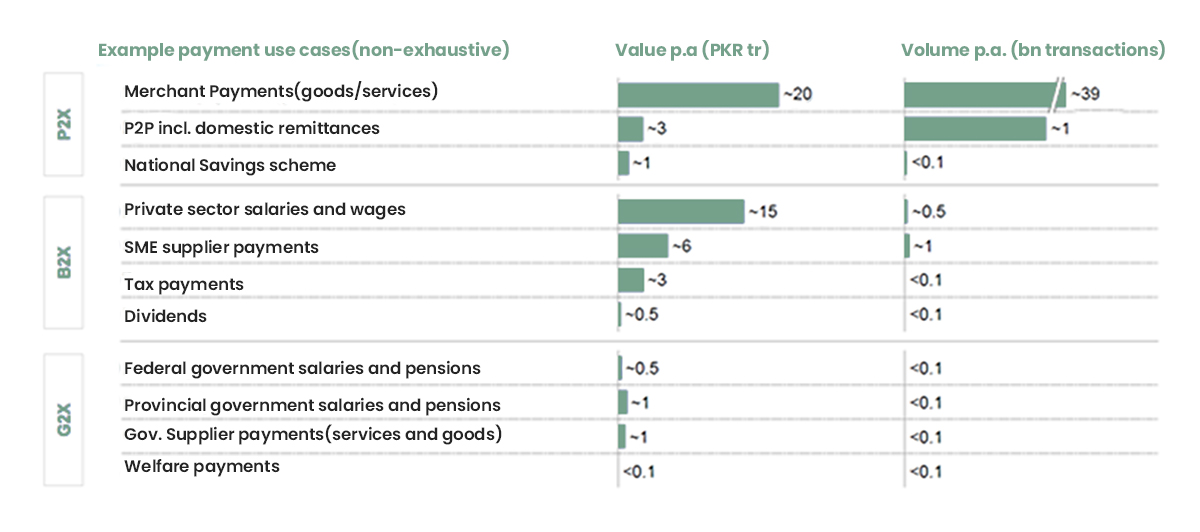

Raast will provide the Pakistani masses an opportunity to integrate digital financial services into their daily lives. It will cover everyday use cases such as merchant payments and domestic remittances, which are high volume but low value transactions. Both combined make up close to 40 billion annual transactions in the country, compared to the 300 million digital transactions occurring today. Even though the initial launch includes only Government payments (G2x) and Dividends, which have limited volumes, the system is expected to transition to retail payments (P2X) by the end of 2021. This will build the necessary rails required to ensure a move toward a cashless economy.

Raast will also have immense economic benefits. Apart from the issues with cash mentioned earlier, it will allow new innovation to take place, with financial technology firms able to challenge incumbent banks. At present, digital financial services tools are few are far between in Pakistan. The instant payment system will allow startups to get on an equal footing with the banks, in terms of infrastructure, and compete for the same customer base. According to Standard Chartered, frequent users of digital tools save up to 8% more than others. In Pakistan, 50% of the emerging affluent saves by storing cash at home as compared to 15% in India and 8% in China. One of the ley reasons is lack of use of digital tools available to support saving in Pakistan. Only 10% frequently use digital tools and services, as compared to India’s 43% and China’s 47%.

Example payment use cases for Raast

The instant payment system will focus on high volume, low value payments

Source: State Bank of Pakistan

Source: State Bank of Pakistan

Frequent users of digital tools and services (as of 2017; % of sample survey)

Pakistanis are not digital savvy when it comes to financial management

Source: SCB Emerging Affluent Survey

We have discussed earlier how Pakistan increasingly relies on foreign savings for investments as domestic savings have declined, causing consistent external imbalances. Providing the necessary digital tools for saving could help plug in the Savings-Investment gap. However, we must remember that for Raast to be successful, the private sector will now have to leverage this public infrastructure to cater to the requirements of the masses. According to the World Bank, public investment is important as a policy instrument to crowd in private investment and augment human capital to increase labor productivity. With Raast, the necessary public investment has begun and it is time for all private financial institutions in the country to augment SBP’s efforts. It is only then that Pakistan will be able to address its cash problem and improve financial inclusion in a meaningful way.