A spectre is haunting HBL customers in Pakistan—the spectre of failed online transactions. Borrowing from Karl Marx’s Communist Manifesto to explain HBL’s digital travails may seem like a bit of a stretch, but bear with me. Similar to how the alliance of Europe’s powers could not exorcise the spectre of communism, nothing can stop the HBL app from crashing on the first of each month. Not the State Bank, nor the thousands of complaints to the Banking Ombudsman, not even the righteous fury of venting Twitter users. No matter the criticism, HBL’s response always remains the same:

The image that sends chills down every HBL customers’ spine

The rise of a digital Pakistan

What makes the HBL app’s frequent downtime particularly frustrating is that it comes in the context of Pakistan’s rapidly growing digital economy. According to the State Bank of Pakistan, FY 2020-21 witnessed 287 million mobile and internet transactions, with a value of PKR 10.5 trillion. Compared to the previous year, this was an increase of 106% and 124% in volume and value of transactions respectively. In this same time-period, the volume of e-commerce transactions also doubled. Put simply, digital payments in Pakistan are booming.

With the launch of the State Bank’s Raast payment system, this trend is likely to be accelerated. While Raast is radically overhauling a lot of things in the back-end, for consumers, it will deliver a few key benefits. For one, inter-bank fund transfers will be immediate. Previously, their processing through the 1-Link Network meant that around 3% of all transactions would get delayed for several days, causing unnecessary anxiety for the sender and beneficiary. Second, and most importantly, Raast allows one to set up aliases to receive money. What that means is that much like in EasyPaisa and JazzCash, all that’s needed to send and receive money is a cell phone number, eliminating the need to remember and enter bank account numbers in the correct format.

The ease of access and reliability built into Raast will be key in encouraging more people to adopt digital payments. However, even Raast requires your bank’s mobile app to function, which is where the problem comes in.

The online banking conundrum

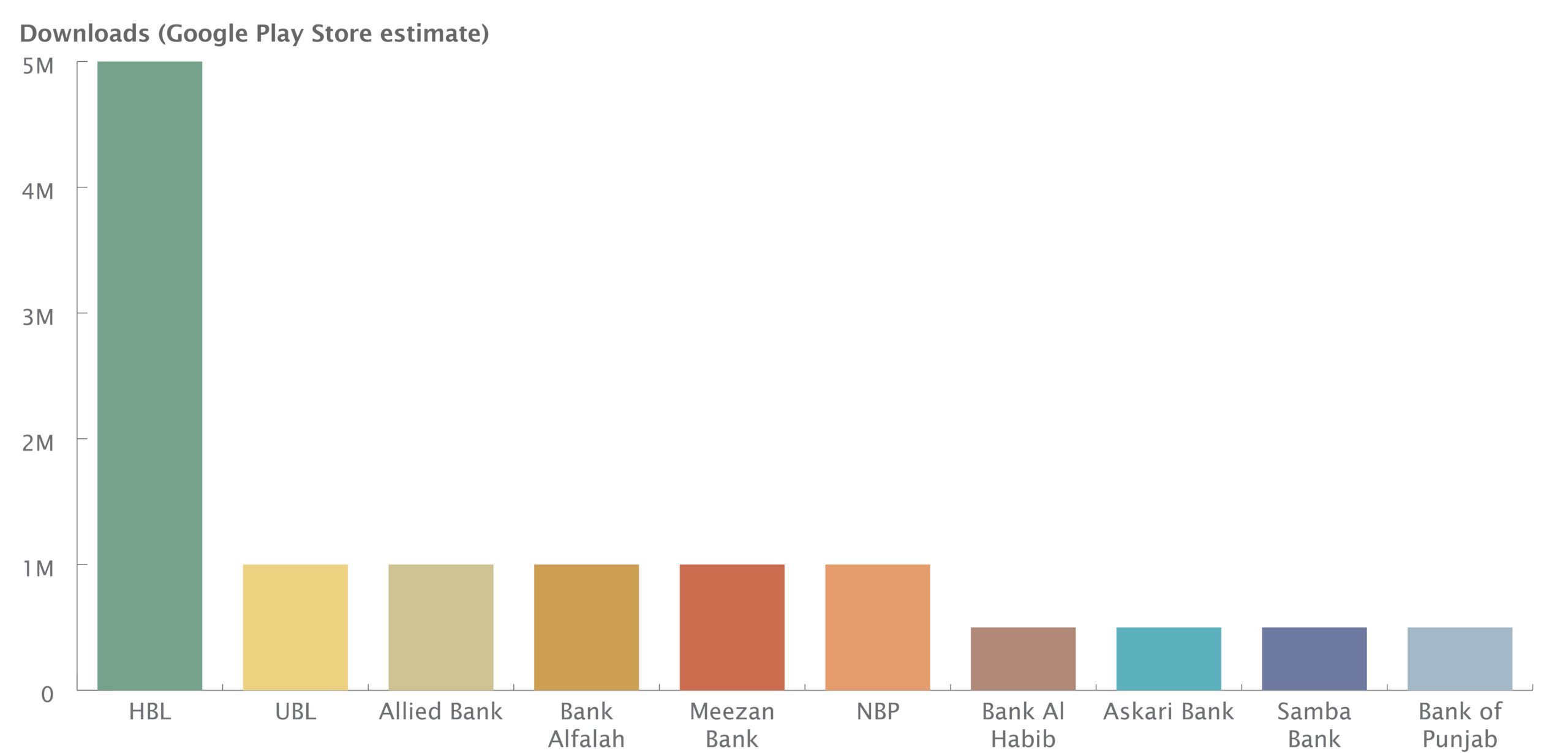

Banking apps are undoubtedly popular in Pakistan, as illustrated in the graph below. Unfortunately, that does not mean they are necessarily reliable. According to data from the federal banking ombudsman, as digital payments have skyrocketed, so have complaints. The first quarter of FY 2021 saw 135% more complaints than the corresponding quarter the year before.

Meanwhile on social media, rarely a week goes by without customers complaining about their inability to log in or transfer funds from their banking app. While this problem isn’t restricted to HBL, this article looks specifically at their app due to its status as the most popular mobile banking app in the country.

10 banks in Pakistan have more than 500,000 downloads on their mobile app, with HBL the most popular by some distance

Source: Google Play Store, MP Analysis

What’s wrong with the HBL app?

Judging by online complaints, the HBL app malfunctions around every other week. January 12, 2022 saw a minor outage, as did December 31, 2021. Those paled in comparison however to the events of January 3, 2022, when HBL’s entire banking system went down for several days. On the first working day of the year, customers couldn’t make online fund transfers, withdraw cash via checks at branches, or even check their balance digitally. The outage lasted at least three days, with many reporting difficulties with the app as late as January 9.

At this point, HBL’s app crashing on the first day of the month is a familiar story. One Twitter user, in fact, has collated a thread of him testing this theory each month. Starting February 1, 2021 (when the app crashed), he noted that the app was not working on March 1 (for more than 30 hours), April 1, May 3, July 30, September 1, and October 1. If a Twitter user can pick up on this trend, then what is HBL’s tech team doing?

Another big crash occurred in October 2021. First, the HBL app was non-functional for many users up till 36 hours starting October 1. Then, subsequent issues meant that HBL’s entire network was intermittently down till the middle of the month, similar to the crash that would again occur in January 2022.

The cost of unreliability

There is a cost to these frequent downtimes, and it is paid by the customers. Trouble with online payments in January led to Foodpanda temporarily declining credit and debit cards as a payment option for orders. Others faced even graver issues, in terms of not being able to pay their children’s school fees which are due by a strict deadline.

Utility bills also have deadlines for payments, and the unreliability of banking apps can leave people scrambling for alternate payment methods. Utility bill payments are usually due by the 10th or 11th of each month, whereas people usually receive their salaries around the 7th or 8th of each month. That leaves just a couple of days for one to make numerous attempts at bill payment, in the hope that at least one transaction won’t fail, or else they could face late fees that can run into thousands of rupees.

Besides the stress and anxiety caused by these app outages, there is also a financial impact. Though it is difficult to quantify, one can make a rough estimate considering the total volume and value of transactions, and that banking apps are temporarily down around twice a month. That means in one year, reliability issues affect around 24 million transactions with a volume of PKR 869 billion. This does not even take into account the times when the entire banking network crashes, which happens at least once every six months, and likely has an even higher financial impact.

Most crucially, the unexpected and extended downtimes have likely deterred millions more customers from making the switch over to online banking in the first place. The key selling point of mobile banking apps is supposed to be the ease with which transactions can be conducted. But frequent outages, such as the one encountered by HBL customers last week, directly go against this narrative, and are likely to dissuade customers that are on the fence.