Regular readers may recognise that housing has been a frequent topic of coverage at Macro Pakistani. The State Bank’s monthly Inflation Monitor, released this Monday for June 2021, shares some context on why exactly we keep coming back to this issue.

First though, an explanation of how these metrics even work. The measurement of inflation relies on the Consumer Price Index, which essentially measures the cost of various expenditures made by consumers like you and I. It also weighs the expenditures according to what proportion they make up of our total expenditure; the more spent on a particular category, the higher its weight. Nationally, out of a total weight of 100.0, food and beverages (34.58) and housing and utilities (23.63) are by far the two most important categories.

With that in mind, SBP’s national CPI numbers tell us that inflation in June 2021 overall was 9.7%, increasing by a point in comparison to the June 2020 figure of 8.6%. Dig a little further in the numbers however, and it reveals an interesting divergence. While overall inflation did rise year on year, inflation in food and beverages actually fell (from +14.6% in June 2020, to +10.5% in June 2021). Instead, a big factor in rising inflation was housing and utilities (rising from +5.4% in June 2020, to +9.1% in June 2021), further evidence of the growing housing crisis in the country.

By Uzair Akram

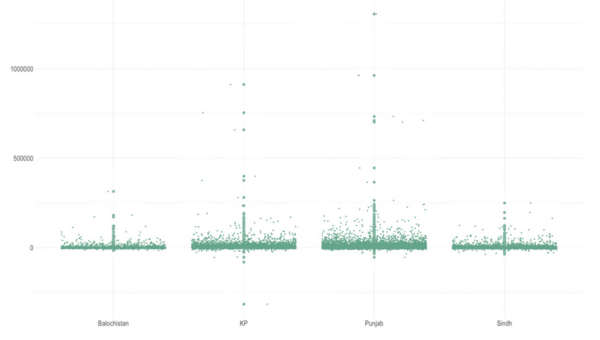

Provincial breakdown of monthly savings shows that most people save between PKR 10 to 50,000 per month.

BoxPlot of Monthly Savings by Province

Source: PSLM

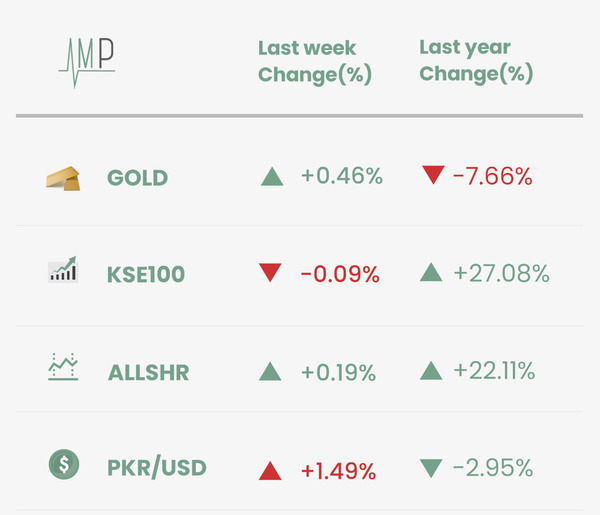

KSE-100 fell marginally this week, with Eid holidays leading to lackluster trading. PKR depreciated again this week, with news of rising imports and current account deficit. Local gold prices rose slightly this week, in the wake of growing Covid-19 infections

KSE-100 fell marginally this week, with Eid holidays leading to low volumes of trading in the market. PKR depreciated again this week, with news of the monthly current account deficit rising to USD 1.6 billion in June and ending the year at 0.6% of GDP. While exports hit their highest annual mark at USD 31.6 billion, imports for the month of June also crossed the USD 7 billion level for the first time ever.

.

What Else We’re Reading (Local)

- Can BNPL (Buy Now Pay Later) services thrive in Pakistan, despite not charging consumers any extra fee? With a few start-ups reportedly launching in the country this year, we may find out soon. (Profit)

- After partnering with Kia for car assembly in the country, the Lucky group is now partnering with Samsung to locally assemble smartphones. (Business Recorder)

What Else We’re Reading (International)

- Ice-cream maker Ben & Jerry’s decision to pull their products from Israeli-occupied West Bank and East Jerusalem has led to financial and diplomatic consequences for its parent company Unilever. (WSJ)

- Zomato, the Indian food delivery company, saw its share price jump by 80% on the first day of its IPO, increasing its value to USD 12 bn (FT).