Inequality in Pakistan, measured by the difference in income between the richest 20% and the poorest 20% of the population, rose the most during the authoritarian government of early 2000s. Interestingly, the same measure actually falls during times of democracy. Four hypothesis offer possible explanations to these changes in inequality:

- Higher GDP growth leads to higher inequality

- Rise in industrialization, employing more skilled and educated workers, leaving behind low-skilled labor and increasing inequality

- Lower direct taxes to redistribute income leads to a regressive society

- Given limited participation in stock market, higher equity returns for a few lead to higher inequality

Given the nature of historical economic growth in Pakistan, policy makers need to think carefully about how to make high growth inclusive in the country and ensure that the rising tide indeed lifts all boats.

What is the relationship between the IMF and Pakistan?

By Faiz Ahmed

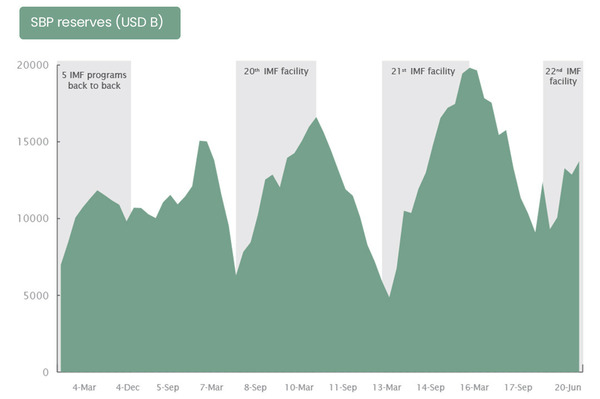

In early 2014, policy makers in Pakistan published a Vision 2025, which laid out the long-term growth plan for Pakistan. It envisioned real growth of 8% per year, making the country one of the top 25 global economies. However, Pakistan is seldom able to follow these plans because of its consumption-led growth model. Each time the country is on a growth path, it falls into a balance of payment crisis and has to resort to IMF support.

Balance of Payment crises force Pakistan back to the IMF for external funding

Source: State Bank of Pakistan; IMF

An earlier article that we wrote on Macro Pakistani is relevant here to understand the reasons behind why Pakistan’s growth is cyclical and why it keeps going back to the IMF. This will also be the topic of discussion for the latest episode of BaKhabar. We hope you have subscribed and will continue to send us feedback to improve.

KSE-100 continued its fall from last week due to surging COVID-19 cases in the country and increased political tensions amid by-elections in Karachi. The exchange rate rose above PKR 154/USD for the first time in April, before falling slightly this week. Gold prices remained stable at PKR 104,400 after rising due to investor unease last week. Increase in price is muted since vaccine distribution in developed countries is ensuring international investors are not looking for safe haven investments as rigorously as they were during previous surges.

The annual change in Sensitive Price Index is down to 16.90% as compared to 17.68% last week. The whole country experienced inflation on annual basis at a lower rate than last week, but the lowest 20% of the population still faced inflation of over 20%. Weekly inflation is up slightly due to increase in prices of a few food commodities such as Wheat (+2.29%) and Potatoes (+2.11%). Even though Potato prices rose on a weekly basis, they are down by 12.61% since last year. A significant drop in prices of Tomatoes (-17.15%), Onions (-4.19%), Eggs (-3.98%) and Chicken (-0.70%) managed to curb inflation growth. Prices of these commodities are up between 20-67% since last year, leading to higher annual inflation.

What Else We’re Reading (Local)

- As part of containing circular debt, government-owned inefficient power plants would be closed by Sep ’22 and 11 private IPPs will be purchased (Business Recorder)

- SBP revises current account deficit for FY 20 by 50% from under USD 3 billion to USD 4.4 billion, due to earlier underreporting of imports and loans for PSEs (Tribune)

- Housing and construction loan portfolio of banks has grown by PKR 54 billion to PKR 202 billion from July to March compared to stagnant position last year (Dawn)

- Achieving its Sustainable Development Goals by 2030 would require 9% of GDP in additional financing according to the IMF (Business Recorder)

What Else We’re Reading (International)

- Nearly 130 m girls were out of school before the pandemic and an additional 20 m who were in secondary school may never return once it subsides (Financial Times)

- PIA will lay off half of its 14,000 employees, replace some of its fleet and permanently close loss-making routes in a bid to be profitable (Bloomberg)