Over 20% of all internet users in Pakistan looking for news get it from YouTube. While the website and social media channels for Macro Pakistani are useful for spreading bite-sized information on Pakistan’s economy, in order to expand awareness, we had to add video to our content. Macro Pakistani is thankful to Investor Lounge for giving us the platform to discuss our findings in detail. With them, we have launched BaKhabar, a series of smart, data-driven conversations about Pakistan’s Economy and its future. Plan is to present to you on a weekly basis, the untold stories about economic and governance related challenges in Pakistan. You can watch the first video podcast here and give us feedback on how to improve!

How have high levels of private consumption affected Pakistan?

By Faiz Ahmed

We have mentioned several times that Pakistan is a consumption driven economy. Pakistanis spend over 80% of their income on private consumption, which leaves little for saving and investment. The last time we promoted this article, Macro Pakistani had 73 followers. Now that we have over 200 times that number, it makes sense to repost it.

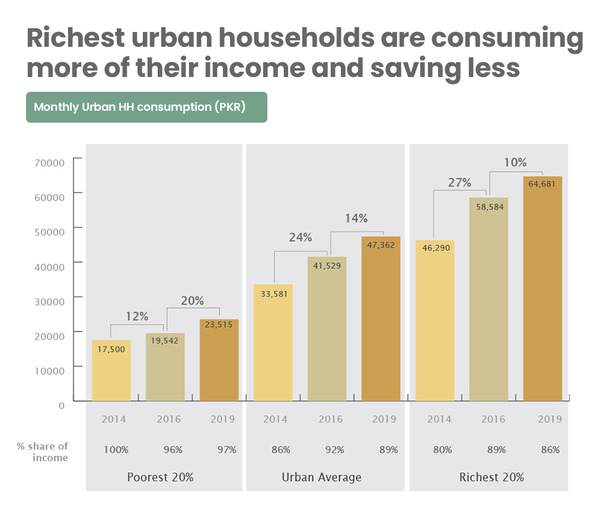

We discussed recently that ability to save for consumers increases only after their income exceeds subsistence consumption levels. Hence, people tend to save more as their incomes increase. However, over the last few years, Pakistani household surveys show a slightly different trend.

Source: Household Integrated Economic Survey 2018-19

Comparing the richest urban and the poorest rural households gives us an interesting insight. Urban households in the highest quintiles are consuming more of their income while rural households in the lowest quintiles are saving more. While the rich are expected to save more as their incomes increase, inflationary pressures are forcing them to consume faster than their incomes rise. In 2014, highest income earners in urban areas used to consume 80% of their income and save the rest. By 2019, that number had increased to 86%, meaning less money left over for saving and investment. Read the full article to understand more about why Pakistanis are unable to save and subscribe to our YouTube page to know when the next podcast on this topic is out.

The stock exchange indices remained stable this week, with the KSE-100 hovering above the 45,000 level. Despite the dollar index losing value this week, after US treasury yields dipped, the PKR/USD exchange rate did not appreciate further. It has remained stable under the PKR 153/USD level. Despite falling yields and the international price of gold rising slightly, the domestic price of gold continued its decline. It closed at PKR 102,000/tola, down 2% from last week, despite international prices rising almost 2%.

The annual change in Sensitive Price Index is up to 18.89% as compared to 18.43% last week. The whole country experienced higher inflation on annual basis, with the highest and the lowest 20% of the population facing an inflation of above 17% and 22% respectively. Weekly inflation is up due to an increase in prices of some essential food commodities ahead of Ramadan. Prices of key food commodities such as Potatoes (+7.42%) and Tomatoes (+15.02%) continued to rise from last week. Wheat (+2.71%) prices are also up since last week along with prices of Bananas and Telephone call charges, which are up over 15%. Prices of Daal Masoor (-1.72%), Eggs (-0.76%) and Sugar (-0.74%) are down since last week but not enough to control inflation.

What Else We’re Reading (Local)

- Vegetable farming by smallholders of land can be a way of boosting productivity and incomes, along with improving the health well-being of consumers (The Nation)

- Hammad Azhar has been assigned energy ministry while Shaukat Tarin, a former minister under the PPP, has been appointed finance minister (Profit)

- PM Khan has announced a PKR 446 billion development package to uplift 14 districts of Sindh, with implementation planned to take place within a month (Dawn)

What Else We’re Reading (International)

- Pakistan to rein in USD 14 billion government owed to energy firms, starting with paying PKR 400 billion in late fees to several electricity producers (Bloomberg)

- To win EV wars, Europe’s Auto CEOs want more taxes on gas guzzlers to ensure electric vehicles remain attractive to consumers after subsidies expire (Wall Street)