Since its inception in 1995, the Index of Economic Freedom has provided powerful evidence that economic freedom, makes an economy grow and prosper.

The Index of Economic Freedom measures 12 quantitative and qualitative factors, grouped into four broad categories of freedoms:

- Rule of Law (property rights, government integrity, judicial effectiveness)

- Government Size (government spending, tax burden, fiscal health)

- Regulatory Efficiency (business freedom, labor freedom, monetary freedom)

- Open Markets (trade freedom, investment freedom, financial freedom)

As the Index has documented, the most critical variable in sustaining the economic dynamism and wealth of nations is economic freedom. This is really about dispersing economic power and decision-making throughout an economy and—most important—empowering ordinary people with greater opportunity and more choices. At its heart, economic freedom is about individual autonomy, concerned chiefly with the freedom of choice enjoyed by individuals in acquiring and using economic goods and resources.

Pakistan’s ranking in Index of Economic Freedom

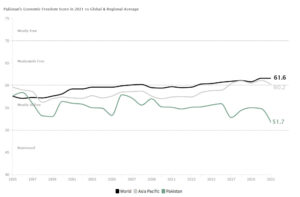

Pakistan’s Economic Freedom score is 51.7, making its economy the 152nd freest in the 2021 Index. Its overall score has decreased by 3.1 points, primarily because of a decline in fiscal health. Pakistan is ranked 34th among 40 countries in the Asia–Pacific region, and its overall score is below the regional and world averages. Pakistan’s economy, which has been rated ‘mostly unfree’ since the inception of the Index in 1995, lost more economic freedom this year and has nearly fallen into the lowest, ‘repressed’ category.

Pakistan’s Economic Freedom is borderline ‘repressed’, well below global and regional average

Source: Index of Economic Freedom (The Heritage Foundation)

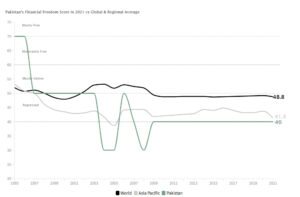

As per the Index, there is a clear relationship between improving economic freedom and achieving higher per capita economic growth. Over the past decades, those countries that have adopted some version of free-market capitalism with businesses supported by efficient regulations and open to the free flow of goods, services, and capital have broken the vicious cycle of poverty and dependence measured by the Index as financial freedom. Economically free countries have financial freedom scores of 80 or above.

Financial Freedom represents an accessible and efficiently functioning formal financial system, which ensures the availability of diversified savings, credit, payment, and investment services to individuals and businesses. In the Asia–Pacific region, on average, investment freedom and financial freedom fall far below world standards. Bearing no exception to its regional score, Pakistan also struggles on all the indicators of financial inclusion and economic freedom pertaining to banking and capital markets. The Financial Freedom score of Pakistan is 40.0 against world’s average of 48.7 remarking Pakistan’s financial freedom as ‘repressed’.

Pakistan’s low Financial Freedom score has remained unchanged for the past 13 years

Source: Index of Economic Freedom (The Heritage Foundation)

Potential to improve Pakistan’s Economic Freedom ranking

Honduras, a small country in Central America, has an Economic Freedom rating of 59.8 and is the 98th freest economy in the world. Honduras and Pakistan are relatively similar in all factors in the index’s ranking, with Pakistan being much better in terms of Government Spending and Business Freedom. However, a difference in financial freedom scores and as a direct consequence Pakistan’s fiscal health, pushes Pakistan 50 places below Honduras in the Index’s rankings!

Poor fiscal health and financial freedom means Pakistan is over 50 places below otherwise comparable Honduras

Index of Economic Freedom 2021

| Country | Honduras | Benin | Pakistan |

| World Rank | 98 | 100 | 152 |

| 2021 Score | 59.8 | 59.6 | 51.7 |

| Property Rights | 45.5 | 42.5 | 44.9 |

| Judicial Effectiveness | 36.0 | 37.0 | 40.7 |

| Government Integrity | 29.1 | 32.2 | 31.2 |

| Tax Burden | 82.2 | 68.4 | 73.8 |

| Gov’t Spending | 79.3 | 92.0 | 86.0 |

| Fiscal Health | 96.7 | 86.3 | 7.4 |

| Business Freedom | 48.7 | 54.6 | 60.5 |

| Labor Freedom | 32.0 | 58.5 | 41.2 |

| Monetary Freedom | 71.8 | 83.7 | 69.7 |

| Trade Freedom | 71.8 | 60.4 | 64.6 |

| Investment Freedom | 65 | 50 | 60 |

| Financial Freedom | 60 | 50 | 40 |

50% of adult Hondurans have access to an account with a formal banking institution compared to Pakistan’s less than 25%. To put Pakistan into perspective, only 26% of adults are financially literate in our country as per the S&P’s Global Financial Literacy Survey. As per the Global Findex 2017, in a country of over 210 million, only 21% of the adult population has a bank account; 35% of the adult population saved any money in the past 12 months and just 15% of the adult population saved for old age. This is also reflective in investing habits, as only 0.13% of the population invests in the local stock market. Such poor financial development clearly means that a country cannot be mobilizing a significant amount of savings, nor allocating capital which is precisely the dilemma Pakistan has been facing for years.

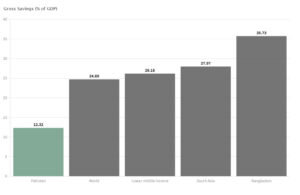

Savings are vital to economic health

Pakistan has one of the lowest savings rates in the world with a gross savings rate of 12.3% in 2019 against the world average of 24.6% and much below peer countries in the region. As discussed before on Macro Pakistani, if Pakistan, in the short and medium term, wants to sustain its growth and increase its investment without paying increasing shares of income in interest or dividends, it has to finance this investment through higher domestic savings.

Pakistan saves half as much as global average and nearly 3x less than Bangladesh

Source: World Bank

According to economic theory, saving is required for investment to take place, and investment is required to achieve economic growth. This means that, for a country to achieve economic growth and development, savings must be reasonably high and sustainable. For any nation, saving provides a vital engine for long-term economic prosperity and stability. If we look at the US, savings helped to create the world’s deepest and most liquid capital markets and a dynamic, entrepreneurial economy. Domestic saving can come from three places: government, corporates and households. Government savings are estimated from fiscal data, and have been limited in the past due to budget deficits. Within the private sector, corporate savings are assumed at 2% of GDP in Pakistan and the majority comes from households. An estimated 90% of national savings come from households and are a crucial source to increase savings if Pakistan wants to curtail its reliance on foreign resources.

Household savings are vital to Pakistan

To increase household savings, Pakistan needs to increase its household income. Empirical evidence suggests that the income growth channel is a strong determinant of saving in Pakistan as both domestic and private saving have responded positively to increases in output. To see a considerable boost in saving, income per capita needs to rise. Households around and below the poverty line save at rates close to zero as most of their income goes to subsistence. Household surveys around the world suggest that people tend to save more as they become richer. However, their ability to save increases sharply only after income exceeds subsistence consumption levels. Research has found a positive correlation between financial inclusion & poverty reduction for developing countries, thus emphasizing the need to increase financial inclusion in stimulating sustainable economic growth.

Investing in productive assets can be one potential way to increase income. Asian Development Bank has identified developing deeper capital markets as one of the five key drivers to achieve economic growth. Unfortunately, in Pakistan whatever is saved by the people is mostly parked in unproductive assets such as real estate or gold. As a result, 99.86% of Pakistan’s adult population does not invest in the capital markets despite the stock market’s incredible growth. After last year’s dip at the start of COVID-19, the KSE-100 index is up over 50%. Not only are our masses alien to this lucrative channel of income growth, their absence also makes capital extremely expensive and hinders entrepreneurship greatly in Pakistan.

Exclusive Capital Markets

Real world financial systems are far from inclusive, which explains why masses had been absent from capital markets. Traditionally, investing models were targeted toward individuals with expertise and/or assets exceeding their needs. However, the majority of people possess neither investment expertise, nor assets that exceed their needs. Secondly, available investing methods assume individuals will be able to defer consumption and reduce expenses, which for a country like Pakistan is nothing more than wishful thinking. Because of this reason, though existing models assume that money set aside ultimately increases in value over time, the set-aside requirement leaves many people unable to participate in investing.

Given that large sectors of the population do not invest, micro investing models have emerged to target people with less investible income. Micro investing models have attempted to increase financial literacy by lowering the barrier to entry for investment. However, they do not offer high returns and still operate on the set aside model hence, struggling to be the right product-market fit for the untapped population.

Road to Economic Freedom

Focus on innovating traditional financial systems may help drive financial inclusion and achieve economic freedom. In a nutshell, the government needs to take initiatives which not only increase awareness on the importance of saving and investing for households, but also develop innovative and need based formal financial services suited to financially excluded segments of the population. These initiatives should identify best ways to outreach different target groups and more generally overcome consumers/potential investors’ biases. The private sector can also support experiential learning amongst consumers. The development of low-cost, ‘no-frills’ savings or investment products, adapted to the needs of inexperienced savers may permit new consumers to make more confident and appropriate choice according to their savings needs .

There is light at the end of every tunnel. Pakistan’s young, urban & tech savvy population is our biggest asset, which if made financially equipped can generate enough financial resources for the country to be well on its way towards achieving economic freedom. As highlighted by OECD, ‘It is vital that the financial assets of households are used more appropriately in order to spur growth by providing capital for enterprises whilst also ensuring that households can cope with important long-term risks. Such investment, if undertaken wisely, could have a multiplier effect, providing the private sector and governments with the capital they need to improve infrastructure and increase employment and GDP, whilst also providing households with a nest-egg for future expenditure on education, healthcare and retirement, thus reducing the tax burden for future generations.’

In his recent National Assembly address on March 6, 2021, Prime Minister Imran Khan also stated ‘wealth creation’ as the only way to improve our economic situation. This cannot be achieved unless we create equitable & effective income growth opportunities for all segments of the society.