This week, we celebrated Pakistan Day and Macro Pakistani highlighted a key statistic that is good to keep in mind as we discuss the current state of the country’s economy. At the time of partition, while Pakistan had 20% of the sub-continent’s population, it only received 4% of the industry. We received 75% of the largest cash crop (mostly in East Pakistan), Jute, but none of the Jute processing units. During the same week, Bangladesh celebrated its 50th Independence Day. In 1972, GDP per capita was almost 40% lower in Bangladesh than in Pakistan. Now it is over 40% higher. While we can continue to rue the unfair partitioning of the sub-continent in 1947, we should be cognizant of countries like Bangladesh that have managed to overcome handicaps. Macro Pakistani will continue to highlight areas of improvement within Pakistan’s economy, while keeping things real. One such area of improvement is the lack of savings in the country.

How can improved economic freedom nurture higher incomes in Pakistan?

By Zahra Ayub

Pakistan ranks 152nd in the Index of Economic Freedom, which is borderline repressive. The country’s performance across rule of law, governance, regulations and open markets, puts it below regional and global peers. There is a clear relationship between improving economic freedom and achieving higher per capita income growth. One way to improve economic freedom is to develop deeper capital markets, allowing Pakistanis to invest in productive assets to increase future income.

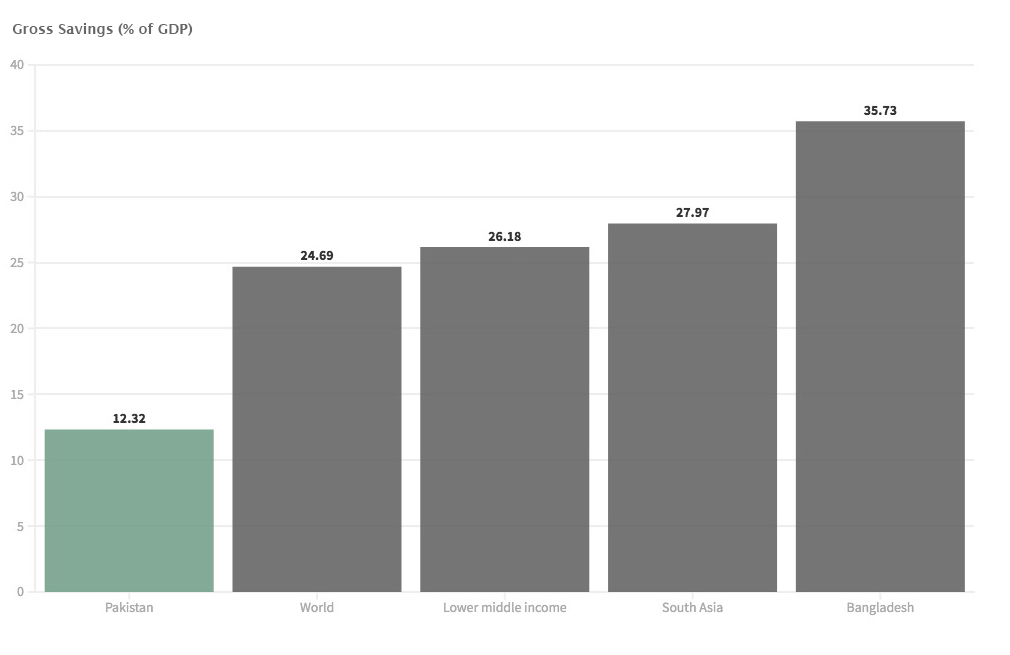

Increasing income is important because it is a requirement for increasing savings in a country. Saving is required for investment and investment is required to achieve economic growth. At present, Pakistan saves half as much as the global average and nearly three time less than Bangladesh. Whatever households save is mostly invested in unproductive assets such as real estate or gold.

Pakistan saves half as much as global average and nearly 3x less than Bangladesh

Source: World Bank

Source: World Bank

Zahra thinks that Pakistan’s young, urban & tech savvy population is our biggest asset, which if made financially equipped can generate enough financial resources for the country to be well on its way towards achieving economic freedom. This is why she has founded Nurture, which incentivizes savings over the non-essential consumption through a high return, low risk, no-set-aside, micro-investment system. Read the full article here.

KSE-100 is up 1.5% since last week due to improved macroeconomic outlook. It is up by almost 60% since last year and has stabilized over the 45,000 level. Given the worsening COVID-19 situation in the country and expectations of strict containment measures to be put in place, market growth appears to have slowed down. Exchange rate fell below the PKR 155/USD mark for the first time since March 2020, closing at PKR 154.59 USD this week. Sustained remittances, IMF Board approval for next tranche of USD 500 million loan and a current account surplus have ensured stable appreciation since early February. Gold prices remained stable at 106,400 per tola before jumping to PKR 107,200 per tola this week, off the back of the appreciating exchange rate. Rising COVID-19 cases tend to bring back international investors looking for safe havens such as gold.

The annual change in Sensitive Price Index is up to 15.35% as compared to 13.21% last week. SPI had declined for two consecutive weeks before the annual increase jumped by 2.14 percentage points this week. The whole country experienced higher inflation with the highest and the lowest 20% of the population facing an inflation of nearly 14% and 19% respectively. Weekly inflation is up due to hike in prices of essential food commodities. Prices of key food commodities such as Tomatoes (+20.04%), Chicken (+8.81%) and Vegetable Ghee (+0.97%) are up since last week. On an annual basis, the rise in prices of these commodities ranges between 14% and 96%. Prices of Onions (-2.27%) continue to fall which are now 50% less expensive than last year. Among other food commodities, prices of Garlic (-8.12%) and Potatoes (-1.98%) are down since last week. Food inflation may continue to increase ahead of Ramadan.

What Else We’re Reading (Local)

- There is nothing fundamentally wrong with the proposed amendments to the SBP Act since we need to prevent future exploitation by governments (Tribune)

- IMF Board approved USD 500 million for budgetary support, after domestic authorities took some tough steps to get the Fund’s nod (Business Recorder)

- World Bank and Pakistan have signed 7 project agreements worth USD 1.3 billion to support government’s initiatives in social development (Profit)

What Else We’re Reading (International)