This week, the findings from a new NBER Working Paper strengthened the economic case for Global Vaccinations. If poor countries are not provided with vaccines, rich countries will have to pay. A further USD 27 billion is required to provide pandemic resources to developing countries, as part of the Access to COVID-19 Tools (ACT) Accelerator launched by the WHO. This amount dwarfs the potential impact of further lockdowns and the spread of the virus, which could cost advanced economies up to USD 2.6 trillion. Even if advanced economies get vaccinated, with trading partners that produce most intermediate goods not getting vaccines, they will have to bear the economic loss. The cost of not pushing for global vaccinations is almost 100x the philanthropic commitments required to free the world of COVID-19. In the realm of international commerce and global supply chains, there is no hiding from the coronavirus.

Pakistani stocks regained momentum after dipping slightly last week, with the KSE-100 remaining above the 46,000 level all week. An assault on hedge fund equity positions in the US stock market caused the dollar to strengthen. When the value of the dollar increases, the price of gold tends to fall in international markets. Hence, gold prices were down by 0.36% this week. Nevertheless, the PKR also became stronger relative to USD to maintain its level around the PKR 160/USD mark. The annual change in Sensitive Price Index rose to 7.48% compared to 6.45% last week. This was the first time since 24th December 2020 that inflation rose above 7%, after falling in the past few weeks.

While on an annual basis, inflation experienced by the poorest of the country rose to 8.74% compared to 7.93% last week; this week again saw a lower increase of 0.43% in prices for them. The rest of the country felt a higher burden of inflation. Almost 4% of the consumption basket of the country is Chicken, which has risen to over PKR 200/kg in the last 2 weeks. Along with increases in prices of Ghee (+3.83%) and Cooking Oil, Chicken (+14.81%) is causing the most pain to the people of Pakistan. Since meat makes up a lower proportion of the consumption basket of the poor, inflation for them remained lower than the rest of the country. Additionally, the continued fall in prices of Tomatoes (-29.82%), Potatoes (-3.37%), Onions (-2.28%) and Sugar (-1.54%) helped moderate inflation.

While on an annual basis, inflation experienced by the poorest of the country rose to 8.74% compared to 7.93% last week; this week again saw a lower increase of 0.43% in prices for them. The rest of the country felt a higher burden of inflation. Almost 4% of the consumption basket of the country is Chicken, which has risen to over PKR 200/kg in the last 2 weeks. Along with increases in prices of Ghee (+3.83%) and Cooking Oil, Chicken (+14.81%) is causing the most pain to the people of Pakistan. Since meat makes up a lower proportion of the consumption basket of the poor, inflation for them remained lower than the rest of the country. Additionally, the continued fall in prices of Tomatoes (-29.82%), Potatoes (-3.37%), Onions (-2.28%) and Sugar (-1.54%) helped moderate inflation.

Pakistan’s Trade Policy and the Pandemic

By Shafaat Yar Khan

The same week that we mentioned the importance of global vaccinations due to the interdependence between advanced and emerging economies, Shafaat elaborates on the need to facilitate a trading environment based on mutual trust. Pakistan’s trade policy has been defined by high import tariffs and an overvalued currency while the globalized world has moved toward the opposite.

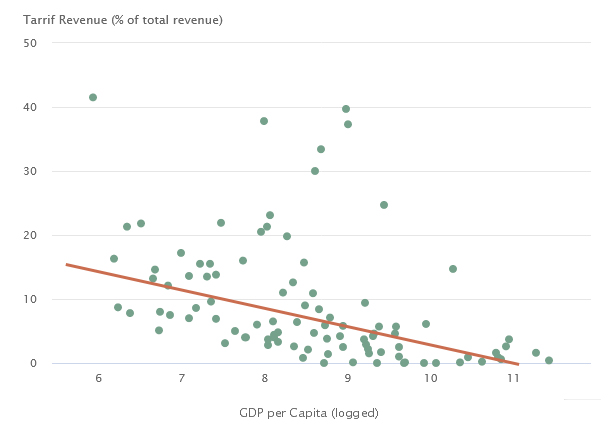

Pakistan’s case is quite similar to other developing countries with long-standing structural constraints that inhibit trade openness. Mercantilism that favors certain sectors over others restricts imports and diverts resources toward sectors without comparative advantage. On the other hand, informality in the economy leads to a narrow tax base, which eventually puts pressure on governments to rely on import tariffs as a source of revenue.

Tariff revenue (% of total revenue)

Richer countries rely less on import tariffs as a source of revenue

Since it is relatively easy to observe goods entering the country (due to limited entry points), imports generally bear the burden of meeting revenue targets. This revenue constraint, among other factors, has so far precluded such countries from benefitting from trade in terms of higher productivity and participation in Global Value Chains. With a high degree of informality in Pakistan (around 35%), it is hard for the authorities to tax businesses and individuals. Formalizing the economy could help open new trading avenues for the country as we have seen in cases of Asian tigers and more recently Vietnam.

What Else We’re Reading (Local)

- Excessive power generation capacity troubles once energy-starved Pakistan, which is set to have as much as 50% excess electricity by 2023 (Profit)

- A tussle is ongoing between the textile industry and the federal government on provisioning of gas to captive power plants for own generation (Business Recorder)

- The impact of Pakistan’s severe development challenges started becoming visible in the 1990s but now their impact is agglomerating (Dawn)

What Else We’re Reading (International)

- A failure to distribute the COVID-19 vaccine in poor nations will worsen economic damage, with half the costs borne by wealthy countries (NY Times)

- Johnson & Johnson’s vaccine shows 66% efficacy for moderate and severe COVID, although trial results indicate lower efficacy against certain variants (Financial Times)