At Macro Pakistani, we steer away from political commentary and stick to objective truths. While it is unclear if the strength of our family values can replace a well-targeted social safety net program, some aspects of family life in Pakistan can be objectively commented on. 12% of women in Pakistan, compared to 5% of men, think separation or divorce is an important risk to their household budget management. Husbands are considered the key to financial freedom, with only 20% of women aged 10 years and above economically active. Spousal violence reported is higher among women who are divorced, separated or widowed (45%) than among married women (33%).

Objectively, key issues with Pakistan’s current social fabric can be identified, which need to be addressed on a priority basis.

There have been improvements in addressing select issues with the Ehsaas program for poverty alleviation and Sehat Sahulat program for universal health coverage. However, further socio-economic value can be captured from tackling other identified issues. For example, educated women experience less spousal violence and have better health outcomes than those without any education. Macro Pakistani will dive into these topics in the coming few weeks and keep its readers up to date.

Despite early indications of trade deficit worsening in November 2020, news of remittances staying above USD 2 billion a month, kept the exchange rate relatively stable. As the world weighs rising COVID-19 cases against upbeat vaccine trial results, gold prices and stock prices inched upwards again. Pakistan is expected to start COVID-19 vaccinations in April 2021 and has signed up for UN’s COVAX facility, which is aimed at providing equitable access to safe and effective vaccines worldwide. Inflation also continued its downward trajectory with food prices coming under control.

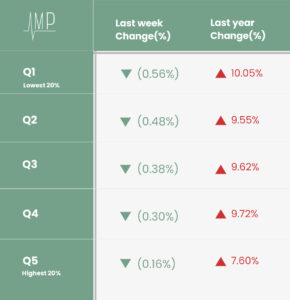

Similar to last week, prices fell by 0.26% this week across all income quintiles, with the poorest 20% of income earners benefiting the most. However, the annual burden of inflation remained highest on the poorest of the country, who experienced 10.05% inflation compared to the rest of the country’s 8.44%. Expect this trend to continue as food commodities make up a larger proportion of the consumption bucket of the poor. Price decreases in Potatoes (7.31%), Sugar (6.97%) and Onions (6.78%) helped the weekly price index drop. However, on an annual basis, increase in prices of Chicken (68.29%) and Potatoes (48.63%) kept the annual index up. You can browse these price changes on our dedicated page for more details!

Is Sehat Sahulat the answer to Pakistan’s health issues?

By Wajeeha Raza

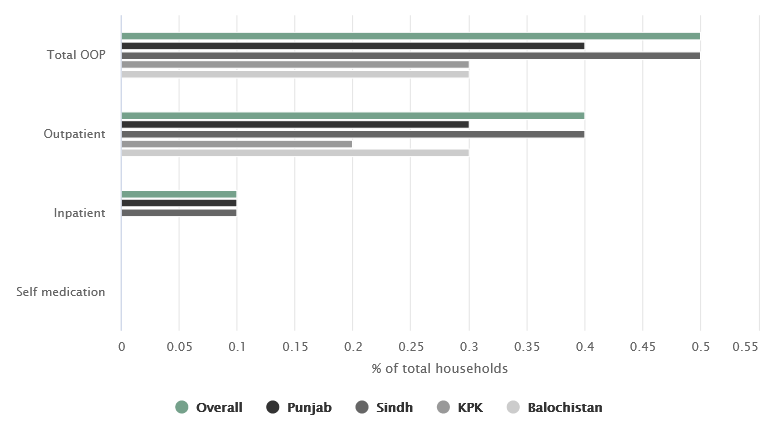

In earlier articles, we discussed how Pakistan has the highest neonatal mortality in the world, along with highest maternal mortality and the lowest life expectancy in the region. Wajeeha expands on those issues by discussing how the country is trying to expand its public healthcare spending and reduce private Out-of-Pocket (OOP) expenses. High OOP payments can lead to financial hardship in the form of catastrophic health expenditures or impoverishment due to health expenditures. Catastrophic expenditures occur when health spending takes up 10% or more of a household’s total consumption expenditure.

Read more

READ FEATURED ARTICLE

Households facing catastrophic health expenses by province and sector of care (% of total)

9% of all households in Pakistan face catastrophic health expenditures, mostly due to outpatient expenditures

Source: PSLM 2018-19

Source: PSLM 2018-19

VIEW GRAPH IN ORIGINAL ARTICLE

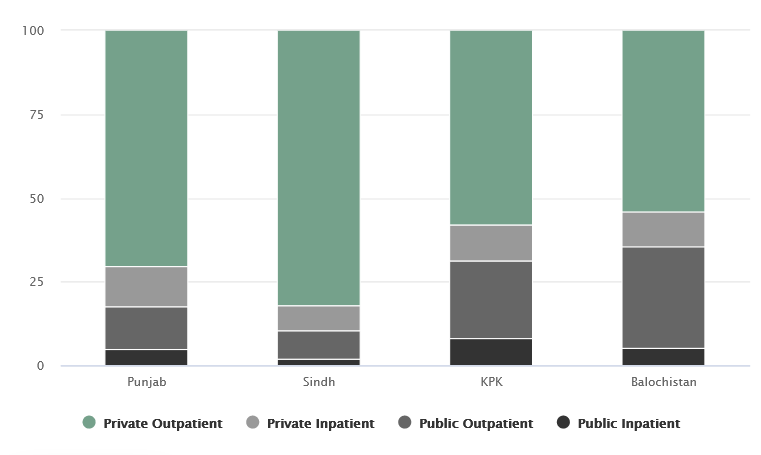

Sehat Sahulat, Pakistan’s novel social protection scheme can assist families in accessing care without incurring financial risk. However, it does not cover outpatient expenditures, which make up the bulk of catastrophic health spending in the country. Read the full article to understand how the country can improve the current offering by prioritizing across the different types of care and diseases covered. Nonetheless, the program currently does a great job at prioritizing the most vulnerable of the country and appropriately leveraging private sector infrastructure.

Usage of providers by public/private and type of care (%)

Private sector utilization of healthcare providers is as high as 80% in Punjab and Sindh

Source: Out-of-Pocket survey, Household Integrated Economic Survey 2013-14

Source: Out-of-Pocket survey, Household Integrated Economic Survey 2013-14

VIEW GRAPH IN ORIGINAL ARTICLE

Read the full article to get an overview of the provincial and federal Sehat Sahulat universal health coverage programs with identification of key design issues and suggestions for improvement.

What Else We’re Reading (Local)

Pakistan’s Ehsaas Program has shifted from politics of patronage to politics of performance by improving delivery and transparency (Delivery Associates)

Society needs to decide if they want to educate every child or not and who is going to pay for it given majority of parents in Pakistan cannot afford to pay (Dawn)

The government’s subsidies cell is expected to save PKR 500 billion through targeted subsidies, which make up PKR 2 trillion or 4.5% of GDP annually (Profit)

The wonky economic of retail smuggling explores how Pakistan’s informal networks are largely a function of barriers to trade in the country, creating inefficiencies in the market (Business Recorder)

What Else We’re Reading (International)

Europe hopes to spur an economic recovery from the pandemic by boosting government spending, a shift in strategy from the 2008 financial crisis (Wall Street)

Questions remain over profitability and broader social impact of gig economy firms, after Door Dash and Airbnb joined the public markets (Financial Times)

Collectively, the multilateral development banks will have provided USD 230 billion to reduce the impact of the pandemic by mid-2021 (Islamic Development Bank)