- Export-led growth: Exports have risen recently, but imported raw materials continue to be subjected to high tariffs, and overall productivity in the sector remains low. Most of Pakistan’s exports still comprise non-value added goods in the agriculture and textile sectors.

- Broadening the tax base: Growing Pakistan’s income tax base is essential for revenue growth. Instead, the government continues to rely on regressive, indirect taxes to marginally improve its tax collection figures.

- Better infrastructure: Special Economic Zones have spurred export-led growth in many countries in Asia. But SEZs can only be successful if they provide the incentives, transport and utilities that are conducive to business growth. Unfortunately, Pakistan has created many SEZs on paper, without properly executing them in reality.

- Well-planned urbanisation: According to the report, Pakistan’s cities suffer from “infrastructure deficits, overstretched public services, and environmental stress”. Was this report written by a Karachiite? Economic growth fundamentally stems from enhancing human capital. And for human capital to grow, settlements need public transit, waste management, clean water supply, and health and education facilities.

KSE-100 rose this week, as IMF’s loan program for the country was finally restarted. PKR appreciated marginally this week, as approval from the IMF meant that funding from the World Bank and ADB will also likely be revived in the near future. Local gold prices also rose slightly this week.

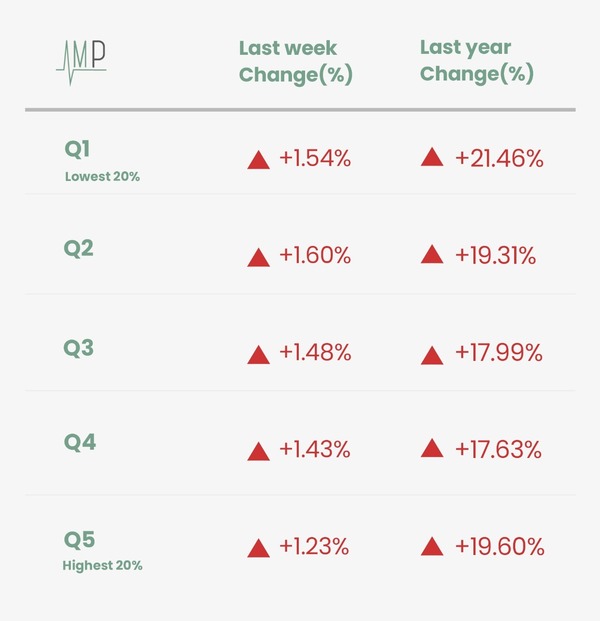

The annual change in Sensitive Price Index rose to 19.53% vs. 18.62% last week. The poorest of the country (Q1) were disproportionately affected with a change of 21.46% vs. 19.60% for Q5. On a weekly basis, prices rose for all quintiles by 1.35%.

Increase in prices of Tomatoes (+90.1%) and Chicken (+10.5%) contributed to weekly inflation. A fall in the price of Potatoes (-6.06%) and Eggs (-3.53%) helped moderate inflation this week.

What Else We’re Reading (Local)

- The online retail marketplace Daraz has rebranded itself. Is this merely a gimmick, or does rebranding actually make a difference? (Profit)

- The Honda Civic, a suburban staple in the rest of the world that has taken on the status of a luxury car in Pakistan, will retail its new model in excess of PKR 5 million. (Business Recorder)

What Else We’re Reading (International)

- Amazon’s value rose by USD 150 billion, while Facebook’s parent company saw its valuation fall by USD 230 billion, as numbers continue to lose meaning in the face of obscene wealth. (Bloomberg)

- One week after a successful coup in Burkina Faso, an attempted coup failed in the nearby West African country of Guinea-Bissau. (WSJ)