2 min read

Remember Reko Diq? The mines in south-west Balochistan, said to contain the world’s fifth largest copper and gold deposits, made headlines in 2019. An international investment tribunal, ICSID, ruled that Pakistan was liable for USD 6 billion in damages for prematurely scrapping the Tethyan Copper Company’s (TCC) lease of the mines. Recent developments, however, indicate that there might be some good news on that front soon.

The ruling had put Pakistan in a sticky legal situation. To state the obvious, Pakistan was in no situation to pay a fine that is the size of its entire loan from the IMF. Hence, TCC started moving aggressively to seize properties belonging to the government abroad, such as PIA’s Roosevelt Hotel and the Scribe Hotel in Paris. Had the situation kept going like this, it held the potential to bring substantial financial losses, as well as loss of face, for the government of Pakistan.

Fortunately, new reports indicate that TCC and the GoP have managed to reach an agreement whereby the shares of the Reko Diq venture will be split 50/50 between the two parties. The same reports also claim that the government will not pursue the venture, and instead hand over its share to a consortium of local companies.

This news will allow the government to save face, but it is not going to be smooth sailing from hereon. Many in Balochistan still despise the leasing out of the Reko Diq mines, which they regard as exploitation of their indigenous resources from which they will gain little benefit. So, if the agreement is confirmed, expect vociferous protests ahead.

KSE-100 rose marginally this week, as the State Bank’s auction of T-Bills led to lower yields than expected, boosting investor confidence. PKR depreciated slightly this week, as international crude oil prices continue to rise. Local gold prices also fell slightly this week.

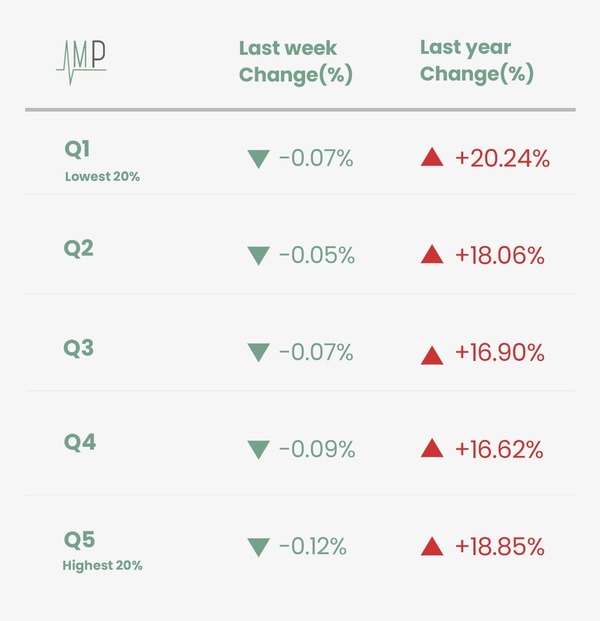

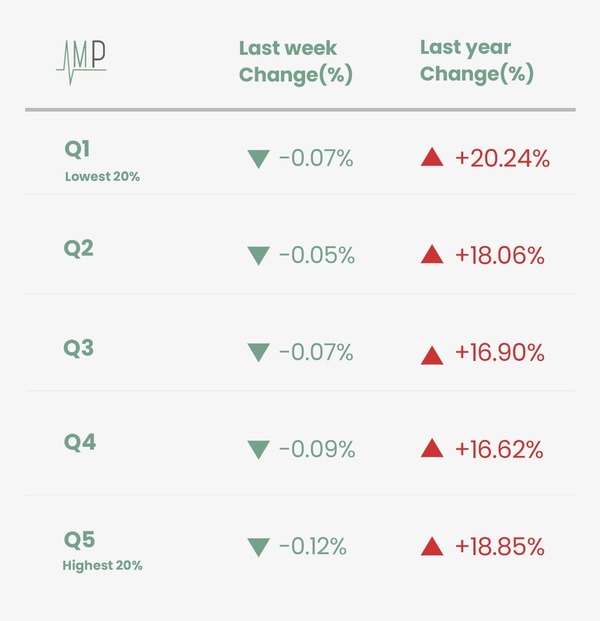

The annual change in Sensitive Price Index fell to 18.62% vs. 19.36% last week. The poorest of the country (Q1) were disproportionately affected with a change of 20.24% vs. 18.85% for Q5. On a weekly basis, prices fell for all quintiles by 0.11%.

Increase in prices of Tomatoes (+30.8%) and Garlic (+4.51) contributed to weekly inflation. A fall in the price of Chili Powder (-9.05%) and Chicken (-1.71%) helped moderate inflation this week.

What Else We’re Reading (Local)

What Else We’re Reading (International)