While Macro Pakistani is primarily a platform for economic information on Pakistan, we also always want to take a stand for what is right. As humans, we stand with Palestine and for this reason, apart from sharing as much information as possible from authentic sources we also dug into the Palestinian Central Bureau of Statistics and highlighted a few key points. Losses for Palestinians since 1948 exceed USD 300 billion (current GDP is USD 16 billion). Before occupation in June 1967, the Occupied Palestinian Territory generated GDP per capita of about USD 1,349 in 2004 prices. By 1994, this number had increased to USD 1,438 – an increase of only 7% in 27 years. What’s more surprising is that, after rebasing to 2015 numbers, GDP per capita today has fallen by almost 40% in Gaza. Unemployment was on the rise and exceeded 45% even before the pandemic and recent Israeli occupation. Macro Pakistani appreciates the recent ceasefire agreement and will continue to condemn Israeli aggression against innocent Palestinians. Our team is happy to engage with you if you have any questions or comments.

What are the problems faced by the retail sector in Pakistan?

By Haseeb Ahmed Khawaja

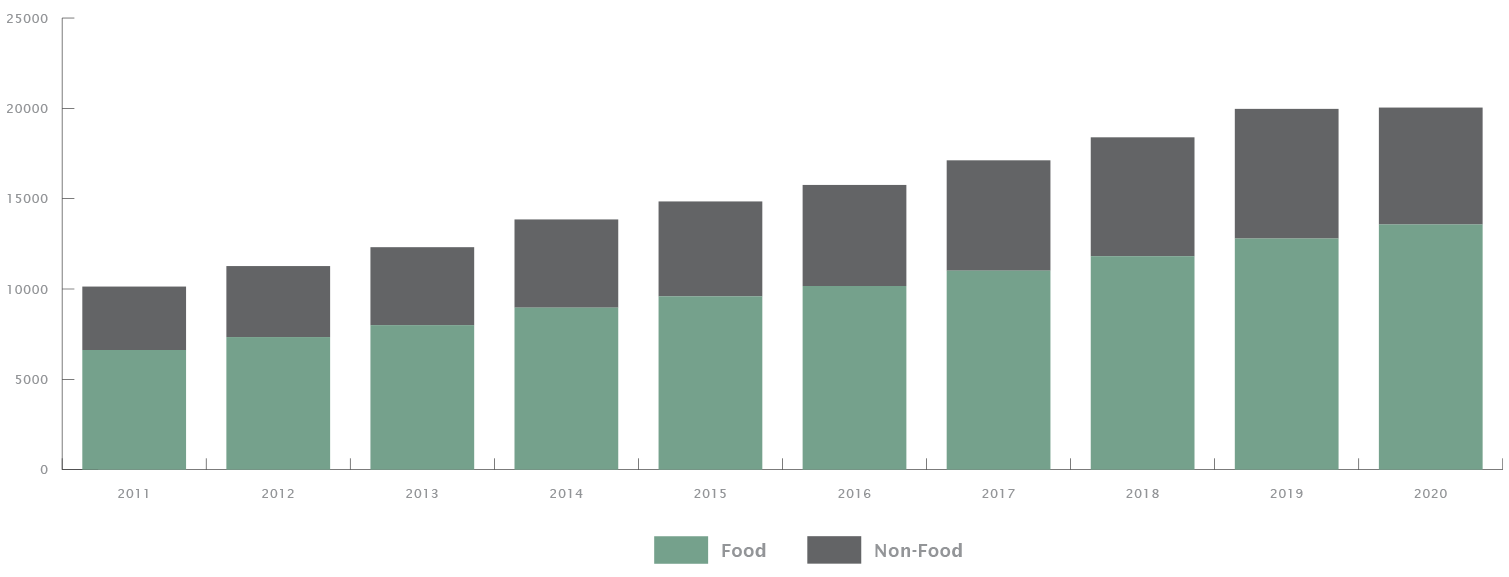

The retail sector in Pakistan has been amongst the fastest growing markets, contributing almost 20% to the national GDP. It is the third largest sector of the country and the second highest employer, employing 15% of the labor force. Pakistan has around 2 million retailers, of which 0.8 million represent the FMCG modern trade and general trade channels, including kiryanas, general stores, medical stores, supermarkets, hypermarkets, etc. With the fifth highest population in the world at 220 Million, there is massive potential in the market due to ever-increasing consumerism. Sales in the retail sector in Pakistan have nearly doubled in the last 10 years.

Sales in the retail sector in Pakistan have nearly doubled in the last 10 years

Source: Economist Intelligence Unit

However, despite the growth of the sector, several problems plague the value chain at present. Retailers, particularly those in general trade, face challenges of pricing, predictability and procurement. Wholesalers and distributors have a limited customer and product base. Manufacturers find the cost to serving individual retailers high and building supply chains difficult. These are the problems that Retailo aims to tackle by digitizing and supercharging the retail sector across the MENAP region. Read the full article to learn more their vision and value proposition.

KSE-100 continued its rise since recovering from lows of early May, up by over 1.5% since before Eid holidays. It is up over 35% since last year, as economic recovery looks set to return 3.94% GDP growth in FY21, amidst lower than expected COVID-19 cases. However, the PKR/USD exchange rate depreciated despite the dollar falling to its lowest level in 4 months. As US trade and account deficits weigh in, the dollar is expected to continue its slide, which should mean the PKR should appreciate. Since investors expect no action from the US Fed any time soon, bond yields remain low. This has allowed gold prices to recover as investors search for higher yielding assets amidst inflation concerns.

The annual change in Sensitive Price Index is up to 17.23% vs. 17.05% last week. The whole country experienced slightly higher inflation on an annual basis than last week. The lowest 20% of the population still faced inflation of almost 20%. Weekly inflation is up slightly due to increase in prices of a few food commodities. Increase in prices of Chicken (+12.74%) continued to be the single largest contributing factor toward high inflation. Sugar (+3.35%), Wheat (+3.01%) and Eggs (5.36%) prices continued to rise even after Ramadan. Even though Electricity charges fell by 3.24%, food inflation continued to hurt consumers across Pakistan. Drop in prices of Tomatoes (-17.96%) was also not enough to control inflation.

What Else We’re Reading (Local)

- Inclusion of micro finance banks and specialized housing finance companies can help in building the five million homes envisaged for low-income group (Dawn)

- Deregulation in the market for sugar would encourage competition and incentivize producers to enhance productive, technical and allocative efficiencies (Daily Times)

- Fiscal deficit is down to 3.6% of GDP in last 9 months compared to same period last year (3.8% of GDP) with development spending curtailed (Business Recorder)

What Else We’re Reading (International)

- As Israel’s bombardment hits pause, according to the Palestinian FM, ceasefire is good but it does not address the core issue in the region (TRT World)

- Nations with sufficient supply of COVID vaccines could donate 1 billion doses to vaccinate 60% of world population at a cost of USD 50 billion (Financial Times)