Why should Pakistan explore digital currencies?

By Faiz Ahmed

Challenges surrounding the country’s large informal economy, low digital penetration and high risk of money laundering and terror financing are well known. What has not helped is the State Bank of Pakistan’s cumbersome regulation and insufficient investment in digital infrastructure in the past. We think the launch of Central Bank Digital Currencies (not to be confused with cryptocurrencies like Bitcoin and Ripple) can be one way of reducing use of cash in the economy.

Given optimal design choices, a State Bank of Pakistan issued digital currency will provide an alternative close to cash to improve financial inclusion, document real-time picture of economic activity, implement risk-based approach required for Anti-Money Laundering/Terror Financing reforms, reduce share of cash in monetary aggregates and provide retail depositors with safer avenues for saving. Current improvements in the digital financial ecosystem still rely heavily on cash and need radical change.

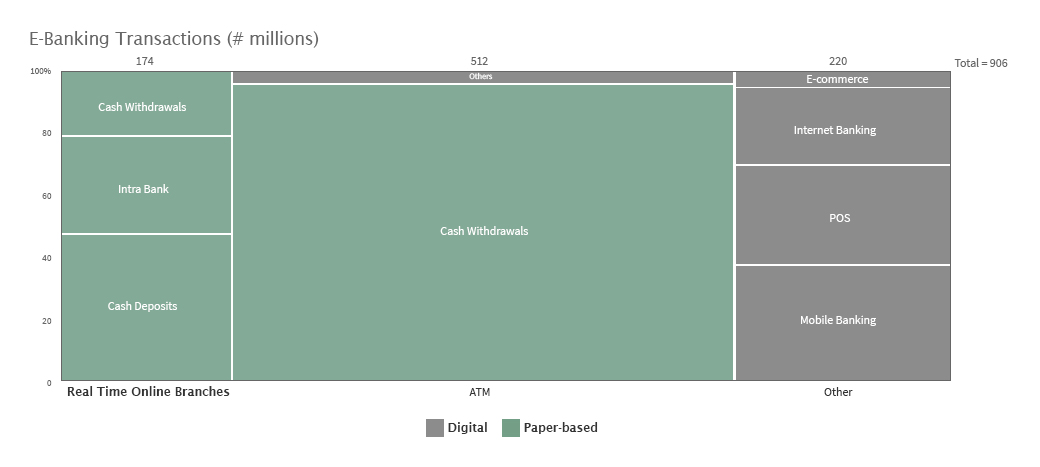

Over 70% of E-Banking transactions are also paper-based (cash/cheque dependent)

Source: State Bank of Pakistan

While it sounds digital, over 70% of E-Banking transactions in the country are paper-based. Take for example, cash withdrawals from ATMs. Even though the user is using an electronic channel, the cash withdrawn from the machine goes into the informal economy and becomes as untraceable as any other cash transaction. Read the full article to explore the current state of payments in Pakistan, how digital currencies can solve identified issues and the design options available to SBP.

KSE-100 is up 3% since last week due to improved investor confidence, off the back of expected political stability. It is up by 46% since last year and crossed the 45,000 level on Wednesday before closing at 44,853 on Friday. The unchanged policy rate announcement by SBP also kept the market up this week. Exchange rate fell below the PKR 156/USD mark for the first time since March 6 2020. Because of strong Forex inflows in the form of remittances, PKR has been gaining strength against the USD since early February. Gold prices rose to PKR 107,000/tola before declining to PKR 106,400 this week. The precious metal is up almost 7% compared to last week, after the US reported weaker than expected economic numbers. However, rising US Treasury yields have caused investors to move away from the safe haven of gold.

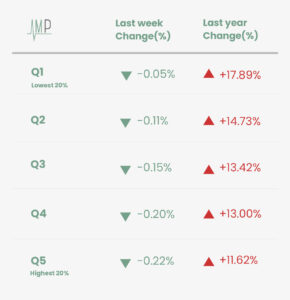

The annual change in Sensitive Price Index is down to 13.21% compared to 13.48% last week. The whole country experienced lower inflation for the second consecutive week with the lowest 20% facing inflation burden of less than 18%. Weekly inflation declined due to drop in the prices of some essential food commodities. Prices of key food commodities such as Tomatoes (+24.55%), Chilies powder (+1.81%), Eggs (+1.27%) Potatoes (+1.16%) are up since last week. On an annual basis, the rise in prices of these commodities ranges between 67% and 140%. Potatoes are, however, 10.97% less expensive than last year. Prices of Chicken are down by 6.63% since last week while prices of Onions (-3.67%) continue to fall among other food commodities.

What Else We’re Reading (Local)

-

SBP’s Monetary Policy Committee maintained the policy rate at 7%, upgraded its GDP growth forecast at 3% with headline inflation between 7-9% (Dawn)

-

Improved sentiments, upbeat momentum on remittances and government credit facility on oil movement have allowed currency appreciation (Business Recorder)

-

Housing project aimed at providing 1,500 homes to people with annual income of less than PKR 500,000 launched under Workers Welfare Fund (Profit)

-

Ending exemptions on taxation like those on dividend income by companies eligible for group relief will discourage corporatization (Business Recorder)

What Else We’re Reading (International)

- Gold declined as US Treasury yields reached their highest level in more than a year, continuing their climb as inflation worries mount (Bloomberg)

- Those hoping for significant de-escalation in US-China tensions, largely the business community, see that’s not going to be possible in the near term (Wall Street)