Pakistan has completed reforms required for release of USD 500 M as part of the reinstated IMF program. The USD 6 billion Extended Fund Facility initiated in July 2019 was temporarily suspended due to COVID-19. Instead, USD 1.4 billion were disbursed under the Rapid Financing Instrument to combat the economic shock of the pandemic. The original facility, of which USD 4.5 billion are yet to be disbursed, will now restart subject to IMF Board approval. The Pakistan Business Council has warned that the green shoots in the economy are still fragile and that the managers of the country should be careful as they reenter the program. Furthermore, a Gallup survey highlighted that over 40% of Pakistanis are not likely to get vaccinated once the vaccine is available. Pakistan will need to carefully manage this transitionary period as IMF’s austerity measures return while the pandemic is far from over.

What can credit ratings teach us about investing in Pakistan?

By Zain Faheem

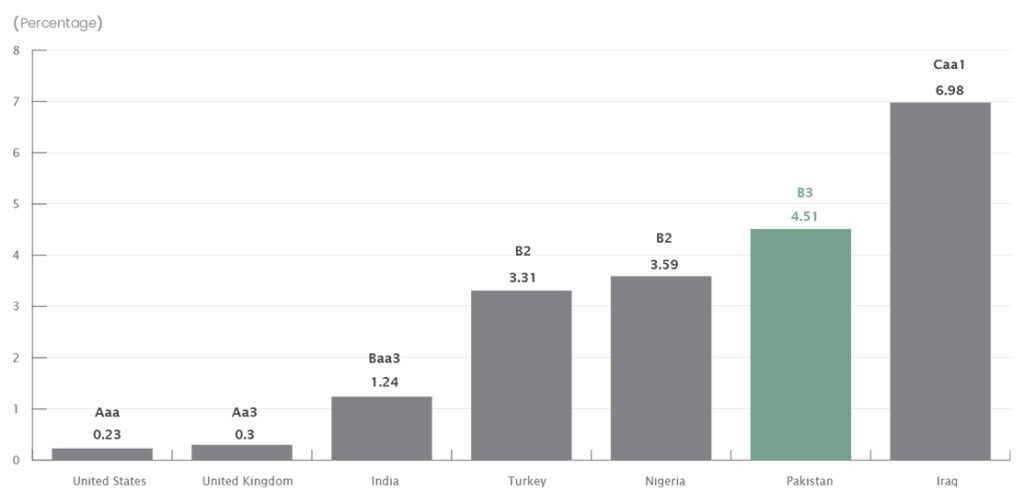

The recently launched Naya Pakistan Certificates are said to be offering ‘tremendously attractive’ returns for overseas Pakistanis. A closer look at Pakistan’s credit risk profile shows how the returns are merely ‘justified’. The 7% USD pre-tax return is justified given the credit rating of Pakistan as compared to its emerging market peers.

Zain walks us through a simplified version of what credit ratings represent, how they are assessed and what impact they have on Pakistan. He explains how Pakistan’s B3 rating makes investors demand a higher premium, when compared to other emerging markets like India, Turkey and Nigeria. Just as life insurance is expensive for non-so-healthy people, Credit Default Swap Spreads are higher for countries that are not as financially stable as others.

Credit Default Swap (CDS) Spreads (%) vs. Credit Ratings

A higher premium is required when investing in countries with lower credit ratings

Note: As at 1st Jan 2021

Source: Aswath Damodaran

Read the full article to learn more about how these ratings have varied for Pakistan during the last two decades and why Moody’s maintained their latest rating, despite a slowing economy.

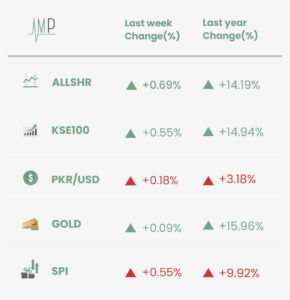

The KSE-100 is up by 0.55% since last week but remained below the 47,000 level it touched 2 weeks ago. However, the markets are up almost 15% since last year. Exchange rate also remained under the PKR 160/USD level due to strong foreign inflows reported in past weeks. Gold prices stabilized after falling consistently since early January. The uncertainty around future gold prices continues as vaccine rollouts are weighed against expected inflation in international markets. The annual change in Sensitive Price Index rose to 9.92% compared to 9.17% last week.

Only the highest 20% of consumers in Pakistan experienced inflation under 10%, while the rest of the country bore a higher burden. Inflation continues to exceed the target set by State Bank of Pakistan of 7-9%, mainly due to increase in food commodity prices. Prices of Chicken (+8.89%), Chilies Powder (+1.81%), Eggs (+1.53%) and Ghee (+0.72%) are up since last week. On an annual basis, the rise in prices of these commodities is even larger, varying between 50-140%. Inflation could be higher if not for drop in prices of Tomatoes (-4.00%), Potatoes (-2.11%) and Wheat (-1.99%). Prices of select clothing items have also started to creep up, which could cause further inflationary pressures.

What Else We’re Reading (Local)

- The success of this government’s economic recovery would be judged if this turns out to be the last IMF program (Business Recorder)

- Public transport constitutes only 5% of vehicle load but carries 42% of travelling public with 45 passengers competing for a single bus seat in Karachi (Dawn)

- Government is planning to issue a USD 500 M green bond in the next few months to help boost the development of hydroelectric power in Pakistan (Profit)

What Else We’re Reading (International)

- “Decolonizing development” has become a catchphrase in the aid sector as philanthropists are encouraged to provide more money directly (New York Times)

- Citi Pharma, a raw material supplier to GSK and Abbott Laboratories, is planning Pakistan’s largest public offering by a drugmaker, raising USD 18 million (Bloomberg)