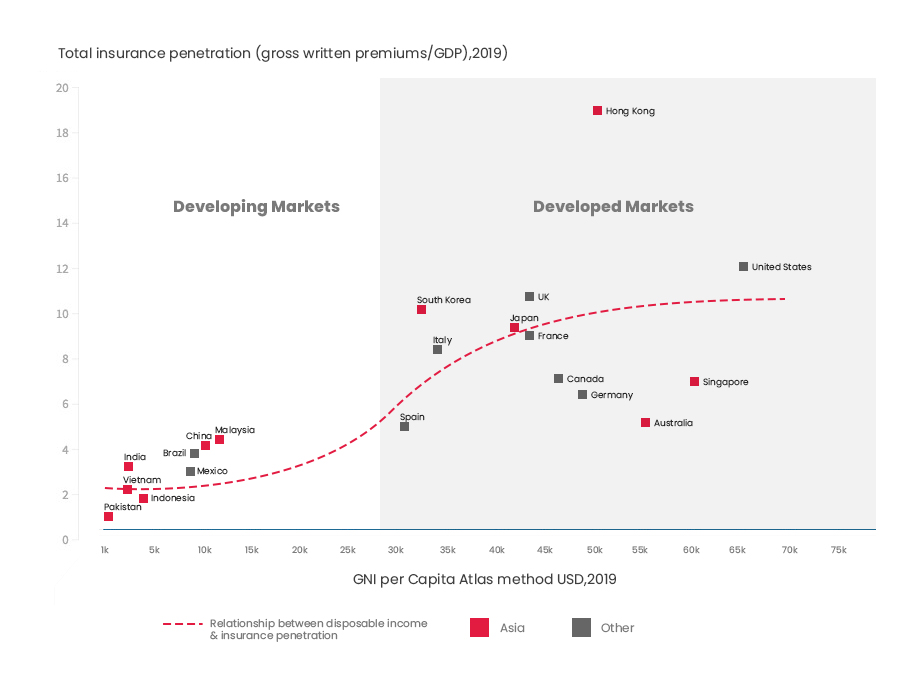

The industry of insurance in Pakistan has been a boring one, failing to excite its customers over the years. It is therefore not surprising that Pakistan suffers from grossly low insurance penetration levels. Gross premiums are at 0.92% of GDP for Pakistan according to a recent Insurance Association of Pakistan (IAP) report. The numbers are higher in comparable countries like India (3.76%) and Vietnam (2.24%),while globally it stands at 7.2% of GDP.

Total insurance penetration vs. per capita Gross National Income

Higher disposable income means increase in insurance penetration

Source: Swiss Re Institute, World Development Indicators

Issues of religion, mis-selling, opaqueness and products/processes that belong in the last century have plagued insurance in Pakistan. The religion question has recently been tackled with the onset of Takaful companies and products – Takaful being to Insurance like Islamic Banking is to Conventional Banking. Mis-selling has been a rampant issue primarily due to the chosen distribution channels. Ask anyone who has been sold a savings based life insurance policy through his or her banker with claims of payback within 3-4 years. It is probably a story of how they were guilt tripped into buying the product and of paybacks that never came in the promised time. When they tried to cash out, the cash value was less than what they invested. This “scam” is perhaps best depicted by the real life viral video of the famous “Ainak Wala Jin”:

Lastly, the blame for opaqueness and old processes/products lies squarely on the insurance companies who have established few channels of customer feedback and throw insurance jargon at a layman both when selling a policy and in after sales service.

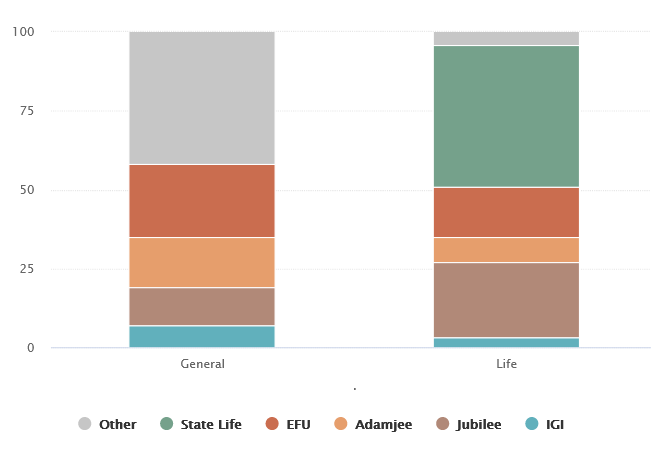

Players of the Insurance Industry

Insurance in Pakistan can be separated into two broad segments: Life and General. Life Insurance companies usually deal with life (savings based known as unit link and pure life) and health insurance products and are strongly regulated. General Insurance companies deal with Motor, Fire, Travel, Property, Marine insurance etc and have fewer regulations. According to Insurance Association of Pakistan reports, there are 8 life insurance players and 29 general insurance players in Pakistan as of 30-September-2020.

Insurance companies in Pakistan by share of premiums (%)

While State Life dominates Life insurance, 3 commercial players are dominant in General

Source: The Insurance Association of Pakistan

As can be observed, EFU, Adamjee and Jubilee make up ~50% of the market in both insurance markets while Life Insurance is dominated by State Life, which is a government owned entity formed as part of the nationalization process in 1972 which merged all life insurance companies into one. Insurance companies in Pakistan design products and get them approved from the regulator, which are then sold through various channels.

Current Sales Channels

The age-old method is the agent led model where-in a person sells insurance products through in person meetings in exchange for a commission on the sale. This model is slow, expensive, prone to mis-selling and doesn’t scale well. The other traditional channel is sales through banks, more popularly known as Bancassurance. Here savings based life insurance products are sold to customers who maintain healthy balances and other insurance products are sold as a bundle with loans that are given out by the bank (car insurance + car finance, home insurance + home finance etc). This model is much more targeted but again is prone to miss-selling and pushy selling (remember Ainak Wala Jin above?) and is also expensive (commission sharing with bank and its employees). With only ~23% of Pakistan’s population being banked, this model also has its limits when it comes to reach.

The third and more recently developed channel has been telecommunication companies, which has allowed insurance companies to reach bottom of the pyramid customers with micro insurance products. A customer is pitched an insurance product (usually health or term life) over a call and gives consent via USSD code and daily balance starts to deduct from their phone. While this model has had success in Pakistan, it has its limitations since it is a pushed product, not cashless and customers do not receive anything physically. Additionally, telecoms charge huge commissions of up to 30%, having reached revenue saturation with their main lines of business, increasing the price of the product for the end customer. According to industry insiders, more than 90% of insurance in Pakistan is generated through traditional agent led and banca models. Corporate sales forms 80% of general insurance sales and only 10% of life insurance sales.

Enter Smartchoice.pk

The most mature channel which the western world has already realized remains digital in the insurance industry, especially aggregators like ours at Smartchoice.pk. According to McKinsey, 50% of Europe’s online insurance business is generated through aggregators as of 2018. We at Smartchoice.pk believe that similar will be the case in Pakistan where people will resort to aggregators to search, compare and buy insurance plans. By making products and plans simple to understand for a customer, allowing them to compare and buy the policy straight from one platform through various payment methods and reducing the journey to a matter of minutes, we have managed to insure more than 10,000 lives all over Pakistan in 2020 alone. Surprisingly, 70% of our customers are first time insurance buyers and a significant portion of our customers are expats, who are buying insurance for their families back in Pakistan. We have also found very receptive partners in the insurance companies who have developed API’s to allow easy integration and instant issuance of policies, greatly simplifying the customer journey.

Products and Innovations

There is a long way to go in expanding innovative insurance in Pakistan and it is aggregators like Smartchoice, who are becoming the voice of the customer. To put it into perspective, until 2015 there was no company offering retail health insurance. Health insurance was a sought after perk only available if you worked at a big and shiny MNC. Fast forward to 2020 and there are now five companies offering retail health insurance products through digital mediums. Through direct feedback from customers, we have been able to push insurance companies to introduce products with higher hospitalization limits which suits the urban population. Another thing we are pushing for is monthly or quarterly payments of insurance premiums rather than yearly (as is global practice) to reduce ticket sizes and ease the burden on the customer’s pocket.

We have partially been able to solve this through partnering with banks and offering insurance through monthly installments on credit cards but are still looking for an insurance company to offer this as a full-fledged product. Down the road, we foresee products with flexible and personalized rates as is the norm in the West. Imagine if car insurance rates were calculated based on your driving history, age, the postal code you live in and the miles you drive in a year. Similarly, in health, with wearables being the norm and data being more accessible, we expect to see better rates for people maintaining healthy lifestyles and having better family histories. This is already happening in the west and we need to catch up fast if we are to make insurance exciting for the new generation.

With COVID-19, even SMEs are now offering basic health insurance to their employees whether it is for retention, reward or loyalty purposes. And why would they not as corporate health insurance is very affordable in Pakistan. It starts at Rs. 4k (USD 25) per employee per year while in the US the average is $6k/employee/year, which is about 200x. In Pakistan, health insurance is cheaper as compared to western countries because it does not cover OPD and does not have co-pay like in the West. It only covers in-hospital treatments, emergencies and day care procedures.

Claims and After Sales

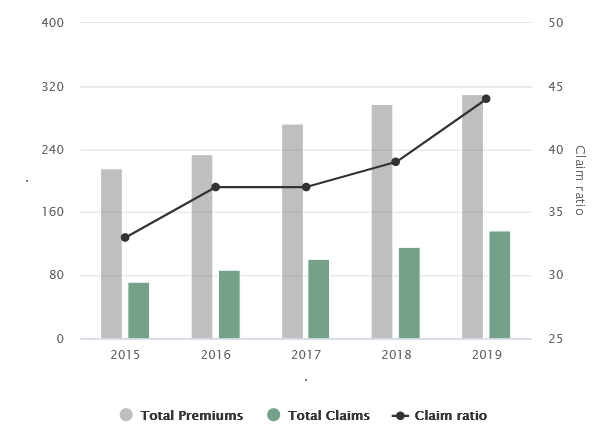

Claims remain the most opaque and distorted area of insurance in Pakistan, especially in retail. This is where all the broken processes come together to brew the perfect storm. Most insurance companies make you file claims physically (even though they sell digitally) with little to no expectation on timeline or traceability. When the claim is given, there is little to no explanation given as to why the claim is what it is. To top that, claims data is hard to find and companies do not release statistics on particular products, as is the norm in the region. With companies like Lemonade in the US paying out insurance claims in 3 minutes, we should as an industry target 30 minutes as a start to pay out claims to help build customer confidence. A myth amongst the diaspora is that insurance companies never pay out claims, so let’s explore the data.

Claims vs. Premiums for insurance in Pakistan (PKR B)

It is a myth that insurance companies do not pay out claims in Pakistan

Source: The Insurance Association of Pakistan

As can be seen from above graph it is a myth that insurance companies do not pay out claims. They do, but they just do not advertise it enough thereby shooting themselves in the foot. From the claims data we have gathered, more than PKR 15 million in claims have been paid out to our customers in last 12 months. In order to pacify customers, insurance companies need to present their payouts better, for both corporate and retail customers.

Regulator and the Government

The regulator (SECP) and the government also has a significant role to play in creating an enabling environment to increase insurance penetration in Pakistan. For example, third party motor liability insurance is mandatory under the Motor Vehicles Act of 1939 for all cars on the road. However, no one knows about it and rarely will any police officer ask you for it. It is a small ticket item, which does not interest agents or insurance companies as distribution costs according to traditional models, are too high. Here digital aggregators like smartchoice.pk step in and automate the process making it simpler to buy third party motor insurance without any human involvement. Another big hurdle is that savings based Life insurance which forms 80% of total retail sales of insurance, cannot be sold online as the regulator does not allow it.

However, both the new government and the new regime at SECP has made good progress on promoting insurance in Pakistan. The introduction of the Sehat Sahulat program for the poorest population has increased awareness about insurance as a whole, while also reaching the bottom of the pyramid that needs it the most. On the SECP side, the regulator with its sandbox program is experimenting with the public on different insurance solutions. Three out of the six approved solutions in the first cohort of the sandbox are insurance related. According to the SECP, they are also working on a centralized database of all insurance customers, which will allow better tracking of customers when they shift providers and also allow customized quotations based on history.

How to increase insurance penetration?

Here are a few ideas, which can help increase insurance penetration and result in win-win for all stakeholders:

- Simplified, fast, transparent and trackable claims process

- Introducing monthly premiums rather yearly premiums in health and car insurance

- Reduced KYC requirements when buying insurance. (Example: There are a few insurance companies out there asking for source of income if you purchase car insurance from them. Why?)

- Insurance companies should release Claim Disbursement Ratio per vertical (Health, Car, Life) to build consumer confidence that claims are given and build differentiation on product performance rather than just pricing

- Centralized open database to allow tracking of insurance history of customers

- Enforcement of mandatory laws like Third Party Motor Liability

- Personalized insurance products rather than one size fits all

The above-mentioned improvements should help reduce friction and make insurance in Pakistan more likeable and affordable, which will help in its awareness and ultimately increased penetration.

Do you think for a market like Pakistan, life insurance products (savings based) can be effectively sold through digital platforms? If the SECP allows the digital selling in future, do you think a person would be willing to invest PKR 50,000-60,000 (average premium for savings based product) digitally? Especially with the belief that insurance companies are mostly fraud as can be seen in the Ainak wala jin video. As you pointed out only 23% of the population is banked, what proportion is digitally literate? I believe the government and the regulator has a big role to play here. The companies will keep on relying on the old methods as long as they reach a wider audience and the agents/banks led business is profitable for them.

Hi Saad,

Currently life insurance commissions stand at 40-60% of first yr premium for the offline agent making the sale. These high commissions cause two issues – miss-selling because of greediness and secondly lower returns for the customer as a significant portion of first two three years investment goes into commissions for the agent. So if you were to invest 100k each yr in life insurance at the end of the first three years the actual invested amount would be ~180k and the other 120k went into commissions. Thus the insurance company gives out much less amount if you were to abandon your policy within the first 5-7 years. After the 7th-8th year, your investment starts growing by a significant portion. And thus if want to withdraw early, you end up in the Ainak Wala Jin situation.The argument for high commissions is that offline sales are expensive (multiple meetings, agents running after clients etc) so their has to be enough incentive for the agent to do the running around.

Online sales for savings based life insurance would cut this cost down drastically at selling and renewal time both as you would reach the potential customers digitally and do all follow-ups on the phone over a recorded line preventing mis-selling. This would allow insurance companies to reduce the commissions and invest more of the money towards the fund, increasing over-all returns for the customer and making the product more attractive and decrease the time it takes for the investment to break even. A one click renewal would make renewal collection so much easier and cheaper also.

“Insurance companies are mostly fraud” – I wouldn’t agree with that statement. It’s just the beast they have created around them which they cannot control due to legacy systems.

There is a rumor in the market that SECP is looking at capping life insurance commissions to 25-30% and putting a rule that in a bank, a life insurance personnel will make the sale and your bank RM. This should help reduce the mis-selling. Digital selling for first year is still not on the cards I blv, not sure why.