The retail sector in Pakistan has been amongst the fastest growing markets, contributing almost 20% to the national GDP. It is the third largest sector of the country and the second highest employer, employing 15% of the labor force. Pakistan has around 2 million retailers, of which 0.8 million represent the FMCG modern trade and general trade channels, including kiryanas, general stores, medical stores, supermarkets, hypermarkets, etc. With the fifth highest population in the world at 220 Million, there is massive potential in the market due to ever-increasing consumerism. Sales in the retail sector in Pakistan have nearly doubled in the last 10 years. This consistent growth makes Pakistan an interesting prospect for international investors and brands, with Dutch giant Royal FrieslandCampina’s acquisition of Engro Foods in 2016 providing greater confidence for stakeholders in this market.

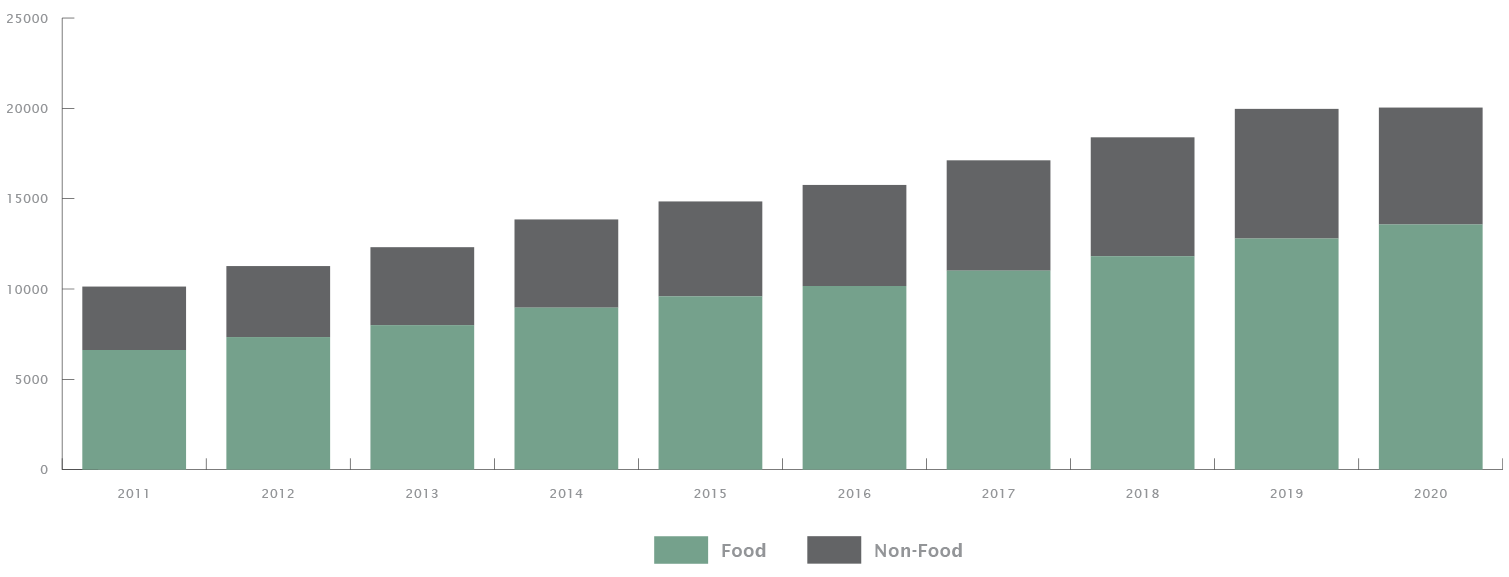

Sales in the retail sector in Pakistan have nearly doubled in the last 10 years

Retail sales by category (PKR B)

Source: Economist Intelligence Unit

Source: Economist Intelligence Unit

Young population presents a massive opportunity for growth

A major driver of growth in the retail sector in Pakistan is the country’s youth bulge. Pakistan has one of the youngest populations in the world with an estimated 35% under the age of 15. With the recent influx of technology and internet penetration, the economy is well positioned for growth. However, Pakistan has one of the lowest penetration levels in South Asia with internet users standing at 27.5% of the population, and total broadband subscribers at 46.4%. However, there is still great untapped potential within the existing base, and the increase in smartphone penetration has ensured the economy keeps moving in a positive growth trajectory. Figures suggest that mobile phones production during the first 2 months of 2021 stands at 1.2 million devices, compared to 2.1 million and 119,639 smartphone devices produced in 2020 and 2019 respectively.

Tech dependency has become a business critical need

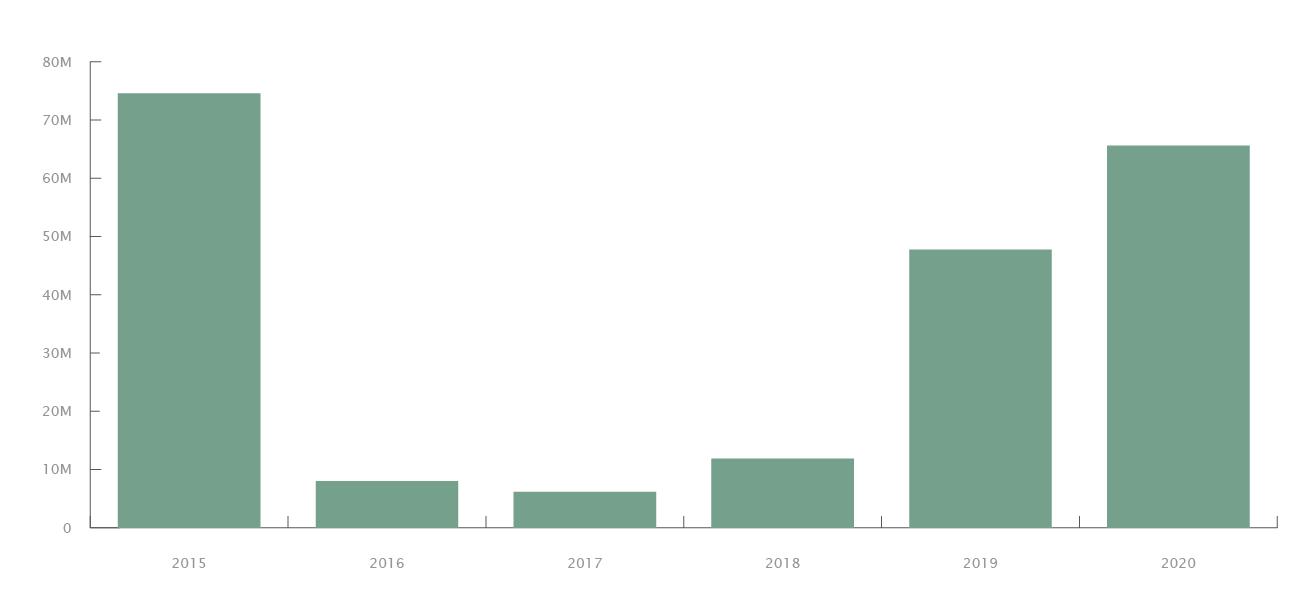

The ongoing pandemic has accelerated the impending tech boom, and the need for digitization and servitization of the economy has taken center stage, accelerating the paradigm shift towards a digital economy. This transition has also had a great impact on Pakistan’s economy, which has experienced a surge in tech startups, having raised over USD 65 M in funding during 2020, a sharp increase from USD 47.5 M raised in 2019. The run rate has been on an upward trajectory in 2021, with over USD 34 M raised to date. The country has seen some very promising start-ups launch in the B2B space, with Retailo Technologies leading the pack with one of the highest pre-seed and seed rounds raised in the MENAP region. Launched in peak pandemic lock-down times in early 2020, the company continues to disrupt the B2B supply chain industry, serving over 30,000 retailers in Karachi and Riyadh.

Despite the pandemic, startups in Pakistan have raised the most financing since 2015

Amount raised by Pakistani Startups (USD)

Source: i2i Deal Flow Roundup 2020

Source: i2i Deal Flow Roundup 2020

How is Retailo supplementing the tech revolution?

Retailo is an online B2B marketplace that aims to technologically supercharge retail supply chains in the region. Retailo’s platform allows manufacturers, wholesalers and distributors to get access to a wide range of retailers that are outside of their existing target markets. It aims to economically empower the 10 Million SMEs operating in the retail sector across the MENAP region with technology and real-time data to make complex supply chains ‘beautifully uncomplicated.’

Currently the B2B space in the country works through multiple channels. Retailers can access the manufacturers through either a distributor or a wholesaler. Each of these players charge a commission that leads to reduced margins for both the manufacturer and the retailer. We believe there is an opportunity to replace these layers with a technological solution.

Problems in the retail sector in Pakistan

Retailers:

- Retailers struggle with a lack of supply predictability, and slow (weekly) replenishment cycles resulting in regular stockouts

- Unlike modern trade players, the general trade players face challenges in accessing competitive prices, with product search also a major problem

- On average, a retailer spends 25 hours/week in procurement alone. 5 visits to the wholesale market, spending 2-4 hours per visit and around 60 distributor interactions/week with approximately 10 minutes/interaction. This conventional structure results in higher effort and greater time spent in procurement.

- Working capital restrictions are a result of the above 3 factors. To mitigate stockouts, the retailers invest more working capital into their stores. This also results in a skewed category mix, since working capital limitations prevent the retailers from increasing product range.

Wholesalers/Distributors:

- They have a limited customer base, restricted by geographical and logistical limitations

- The channels are characterized by information asymmetry, owing to lack of visibility of trade offers, and challenged product discovery

- Their over-reliance on human capital results in an overall higher effort required to generate orders

Manufacturers

- High sales management and engagement costs since retailer acquisition and order booking require extensive investment in human capital

- Logistics cost to serve individual retailers are high, and unoptimized routing and inefficient vehicle utilization increase the logistics overheads

- Building supply chains across a spread geography requires a difficult skill set and talent

How does Retailo tackle these challenges?

Retailers:

- Improved Order Cycle: 24/7 on demand ordering channel leading to lower inventory costs, higher working capital availability, and more predictability

- Competitive Prices: Aggregation of demand for products enabling small retailers to get competitive prices even without scale

- Order Convenience: Mobile based solution leading to reduced time and effort in interacting with distributors or travel to wholesalers. One stop shop for all retailers.

- Wider Product Range: Ability to order higher assortment/volume of products due to better working capital availability

Wholesalers/distributors:

- Wider Customer Base: The mobile application enables marketing the products to a larger base of customers, which is not restricted by geographic limitations

- Sales Convenience: Significantly lower engagement cost, and reduced efforts to build retailer base and sell the product

- Improved Communication: Easy dissemination of information, greater transparency in sharing trade offers with the market, and convenient product discovery for the user base

Manufacturers:

- Distribution as a Service Model: Leading to lower sales management and logistics costs. Dynamic routing places great emphasis on route optimization, which results in minimizing logistics costs.

- Tech Enabled Penetration: Enabling a wider geographical spread, and uncomplicating access into deeper pockets at much reduced costs

Why is Retailo a Superior Route to Market?

Retailo’s value proposition for retailers is superior to both distributors and wholesalers.

| Retailo | Wholesaler | Distributor | |

| Prices | Competitive | Competitive | Competitive |

| Order Window | 24 x 7 – On demand On average 52% of orders are outside normal working hours (Post 5 PM / Before 10 AM) |

8 x 6 (During working hours 10 AM – 6 PM for 6 working days) |

6 x 6 (During working hours (10 AM – 4 PM for 6 working days) |

| Delivery Cycle |

Daily (in-store) |

2-3 times per week (out of store) | 1-2 times per week (in-store) |

| Procurement Effort | Low (One stop shop for price and product discovery) | High (Category specific wholesalers and limited delivery to store options) | Medium (high number of interactions but delivered in-store) |

| SKU Range (Availability) | High (Cross cutting inventory and range across the FMCG spectrum) | Medium (Restricted to wholesaler type – typically one type of product e.g., oil etc) | Low (Restricted to distributor products – typically one company) |

Source: Retailo Technologies

Retailo’s vision is to create a go-to-market channel that is faster, cost-effective, and more engaging

On-demand ordering channel – Allows retailers to place orders 24/7 from anywhere at any time using the mobile app without any human intervention.

Cost effective distribution channel – Low demand generation costs, because of a tech-enabled ordering channel with minimum human intervention. Retailo’s distribution costs are lower because of higher value deliveries to customers owing to portfolio aggregation.

Faster distribution channel – Retailo does next-day deliveries to customers for orders placed before 12 AM. The weighted average turnaround time for orders placed on the platform is currently less than 24 hours for 80% of the deliveries.

Engaging channel for new products/offerings – Easier for brands to deploy trades offers and deals directly to customers because of transparency created through end-to-end digital ordering.

Becoming one of the highest funded startups in just 9 months, Retailo’s journey has however only just started. There is great room for innovation, and many verticals and regions to explore. With other tech players also investing heavily in developing the channel, the future looks very bright for Pakistan’s B2B space.