As mentioned in last week’s newsletter, we decided to do a deep-dive into Bata’s impact on inflation in Pakistan. We found that the lowest 20% consumers of the country spend more on Bata footwear than on other well-known commodities such as cigarettes, petrol, tomatoes and eggs. While Bata is just a proxy for footwear in Pakistan, it is still surprising to know how much of an inflationary impact, the increase in price of one brand can have. We also discussed the impact lockdowns had on Small and Medium Enterprises (SMEs) in the country. 82% of SMEs in the country reported lower sales in first half of 2020 as compared to the same period the year before. This is just a reminder of the devastating impact COVID-19 has had on several key players in the economy.

How has COVID-19 affected Afghan refugees in Pakistan?

By Victoria Kulesza

The ~2.8 million Afghan refugees in Pakistan were living in a precarious situation before COVID-19. The pandemic made it harder for them to earn a living, access essential local resources and maintain familial economic linkages. Since pandemic-related resources were closely tied to Proof of Registration, about half the population was excluded from any relief. Further still, UNHCR’s emergency cash program was focused on those living in Refugee Villages, which make up less than 30% of the registered population.

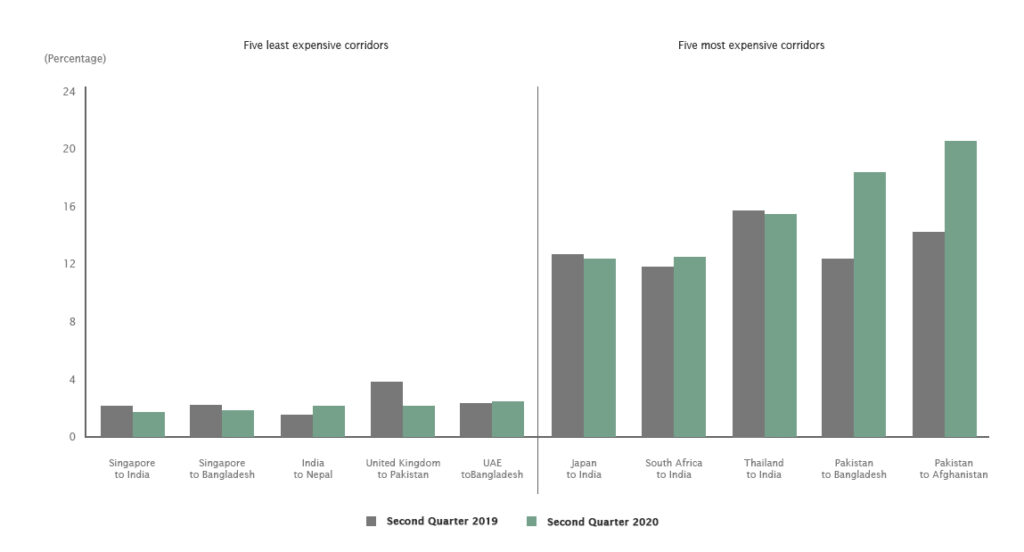

Refugee registration has been a particularly touch-and-go issue recently in Pakistan. New registrations were suspended for 6 months during lockdowns, from mid-March to mid-August, due to the outbreak of COVID-19. While many Afghan refugees were left out of accessing COVID-19 resources, remittance fees also sky rocketed. They jumped well over 20% in 2020, making the Pakistan to Afghanistan remittance corridor one of the most cost-prohibitive in the world according to the World Bank.

Read the full article to learn more about the demographic details of these Afghan refugees and the impact of COVID-19 on this group.

Costs of Sending Remittances to South Asia

Cost of sending remittances through the Pakistan-Afghanistan corridor was over 20% in Q2 2020

Source: World Bank Remittances Price Worldwide database.

Note: Cost of sending $200 or equivalent

Despite hitting a 16-year high volume this week of over a billion shares traded, indexes on the PSX were down this week. KSE-100 was down almost 2% due to lower international oil prices affecting the E&P sector. However, strong foreign inflows helped the PKR continue its appreciation trajectory. Roshan Digital Accounts have now attracted almost USD 500 million in new deposits since their opening in Sep 2020. The Dollar Index also fell slightly this week, amidst confusion around the impact of US stimulus package. Despite a weaker dollar, gold prices continued their downward trajectory, after showing signs of recovery. The annual change in Sensitive Price Index rose to 9.17% compared to 7.82% last week.

This means inflation is back above the 7-9% estimates of the Monetary Policy Committee, which had warned last month of temporary rise in prices of food & beverages along with electricity. The bottom 40% of the country experienced inflation of more than 10% mainly due to rise in electricity charges for the lowest quintile of 3.72%. In addition to that, prices of food commodities such as Chicken (+5.37%), Eggs (+4.86%), Sugar (+3.74%) and Wheat (+2.52%) also rose. While Tomatoes (-18.63%) and Potatoes (-3.77%) continued their downward trajectory, there is cause for concern. Most food commodity price movements have been sustained for the past few weeks, which could indicate they are not temporary, as advised by SBP earlier.

This means inflation is back above the 7-9% estimates of the Monetary Policy Committee, which had warned last month of temporary rise in prices of food & beverages along with electricity. The bottom 40% of the country experienced inflation of more than 10% mainly due to rise in electricity charges for the lowest quintile of 3.72%. In addition to that, prices of food commodities such as Chicken (+5.37%), Eggs (+4.86%), Sugar (+3.74%) and Wheat (+2.52%) also rose. While Tomatoes (-18.63%) and Potatoes (-3.77%) continued their downward trajectory, there is cause for concern. Most food commodity price movements have been sustained for the past few weeks, which could indicate they are not temporary, as advised by SBP earlier.

What Else We’re Reading (Local)

- Pakistan should welcome the fact that cotton acres of the past are being allocate to a diversified set of crops that offer better returns to growers (Business Recorder)

- Tax system should be seen in a holistic manner where linkages between tax policy, tax administration, and tax culture are appreciated (The Nation)

- Circular debt is increasing by PKR 45 billion per month due to continuous increase in payables and late payment charge (Profit)

What Else We’re Reading (International)