Independence Day weekend is a good time to be writing about taxes. If you’re looking to help fix one structural issue of Pakistan, file your taxes! Tax filing season will start soon in September. Play your part in documenting the economy by registering with the Federal Bureau of Revenue (FBR) here. Engage with us on Instagram and tell us if you’re a filer!

What is the issue with low collection of taxes in Pakistan?

The government gets revenue from a few different sources:

- Tax revenue which includes both direct and indirect taxes

- Direct taxes are paid by individuals and businesses based on their income and profits

- Indirect taxes are levied on goods and services and do not differentiate based on income

- Non-Tax revenue which includes receipts from Civil Administrations such as the State Bank, income from other public sector enterprises and royalties

The taxes we are asking you to file are the direct taxes. You pay the rest any way. Read the full article to learn more.

Governments need money

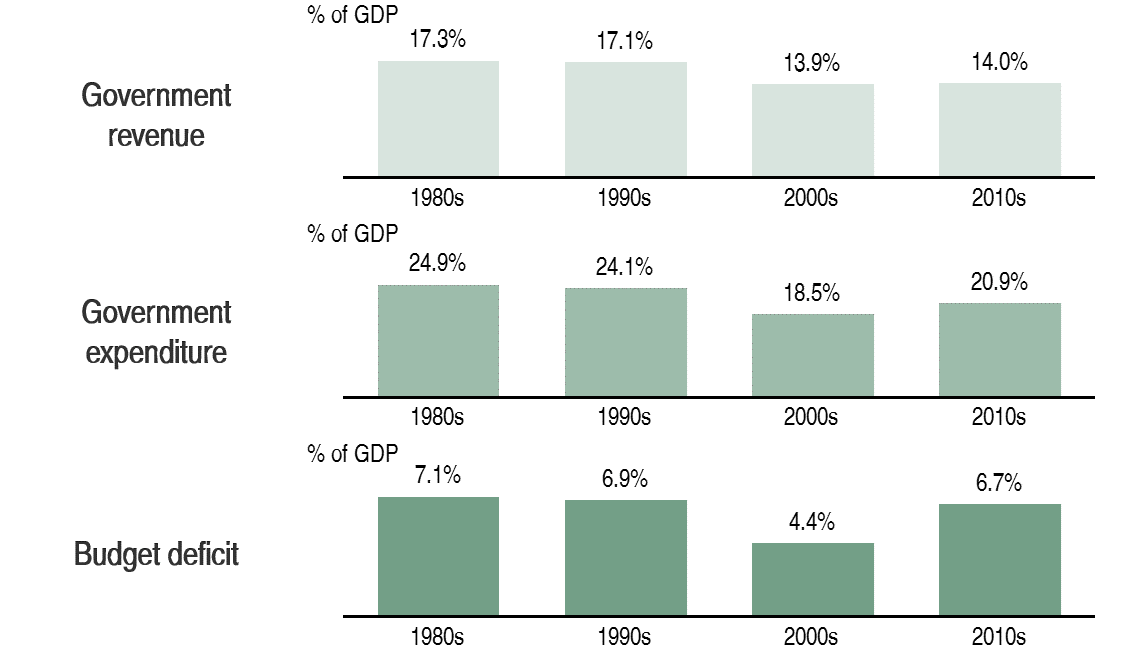

All governments need money to spend on public goods. This is the ‘G’ in the CIGXM of the economy we discussed before. Back in the 1980s and 1990s, the Pakistani government used to earn revenues of just over 17% of GDP. Instead of improving over the years, the state of our public resources has actually worsened. This has constrained government spending over the past 40 years and led to consistent budget deficits.

Source: Economic Survey of Pakistan 2019-20

Budget deficits were around 7% of GDP back in 1980s and 1990s due to increased military spending (6.5% of GDP) in 1980s and then interest on loans taken to finance that deficit (6.8% of GDP) in the 1990s. Although that level of government spending has declined in recent years, the deficits remain. After falling to 4.4% of GDP, the deficits rose to 6.7% in the 2010s, peaking in 2019 at 9.1%.

Taxes are important.

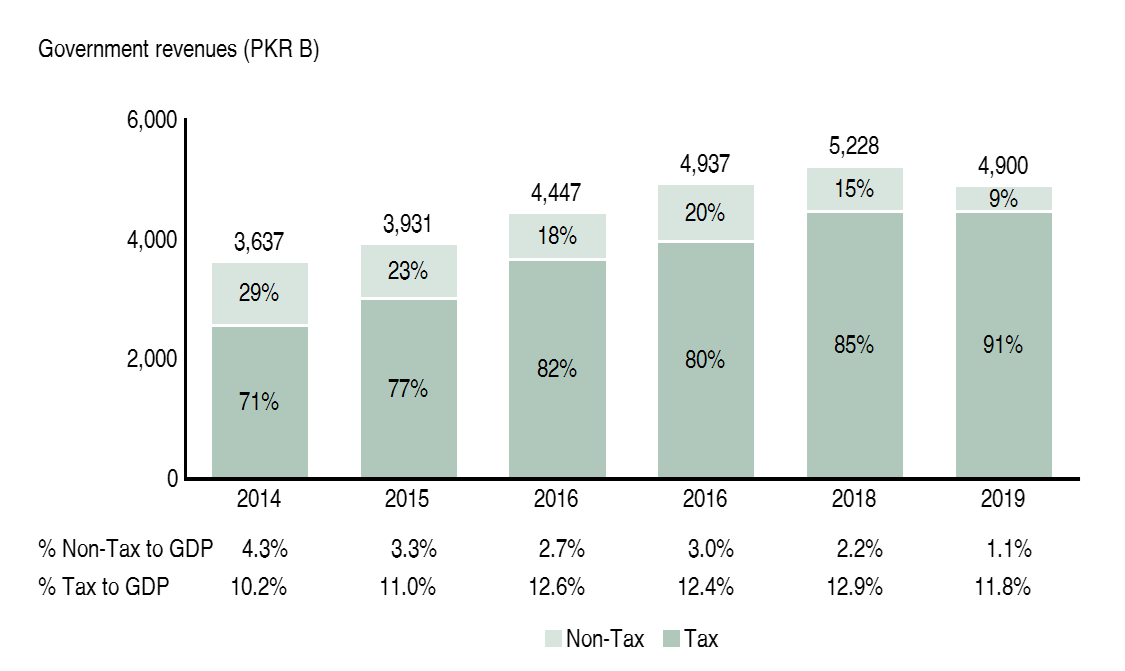

With the sub-par performance of public sector companies in recent years, non-tax to GDP ratio fell from 4.3% in 2014 to 1.1% in 2019. This has made collection of tax revenue even more important.

Source: Economic Survey of Pakistan 2019-20

With a push to document a larger part of the economy in recent years, tax to GDP ratio actually increased from 10.2% in 2014 to 12.9% in 2018 before falling to 11.8% in 2019. According to the World Bank, Pakistan’s tax revenue potential is up to 26% of GDP. Hence, the authorities responsible for collection of taxes in Pakistan only capture 50% of the potential value.

Taxes are a problem

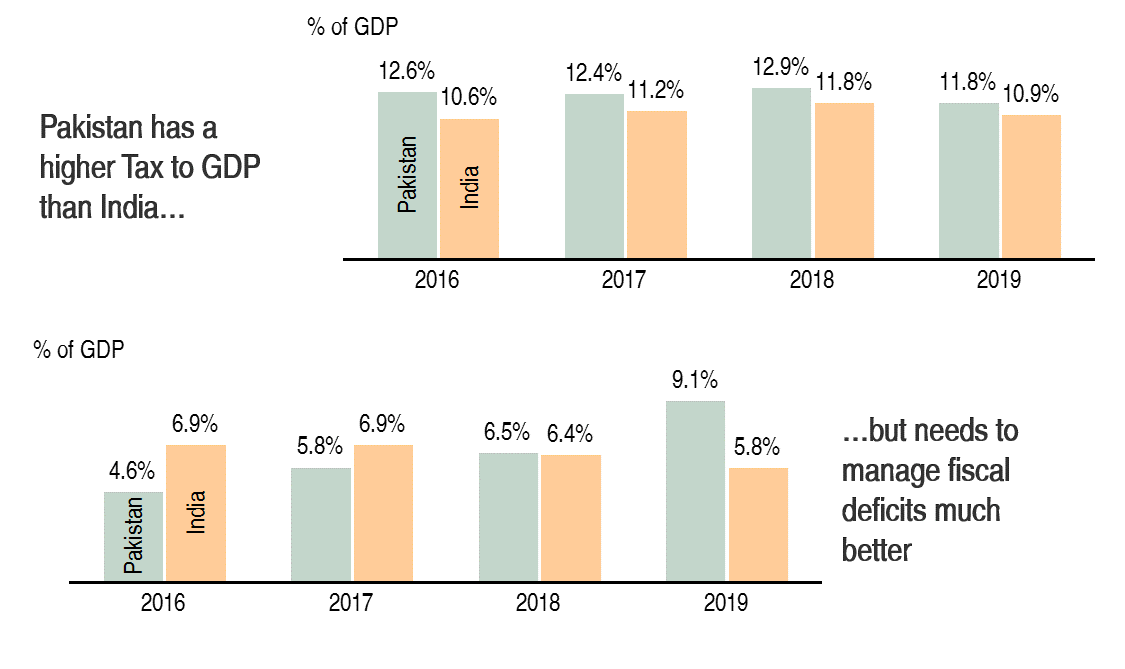

Usually Macro Pakistani points out international benchmarks to show how Pakistan is lagging behind other countries. However, in the case of tax to GDP, Pakistan has performed slightly better than India since 2016.

Source: Economic Survey of Pakistan 2019-20; Reserve Bank of India

India has many of the same problems that Pakistan has in terms of taxes. A large informal economy and weakness in compliance enforcement that enables large-scale tax evasion. Low and middle-income countries have an average tax to GDP of 13% and 18% respectively. As low middle-income countries, Pakistan and India should be somewhere in the middle of that range but are not. However, what India performs better at, is fiscal management. When their revenues are in decline, they are better able to manage budget deficits. Read the full article to understand how Pakistan continually misses budget targets due to ever changing economic projections.

Everyone pays taxes

The Federal Board of Revenue (FBR) has claimed in the past that only 1% of Pakistanis pay taxes. These are the kinds of myths Macro Pakistani is out to bust. It is true that just over 2 million people file taxes in Pakistan but the truth is everyone pays taxes.

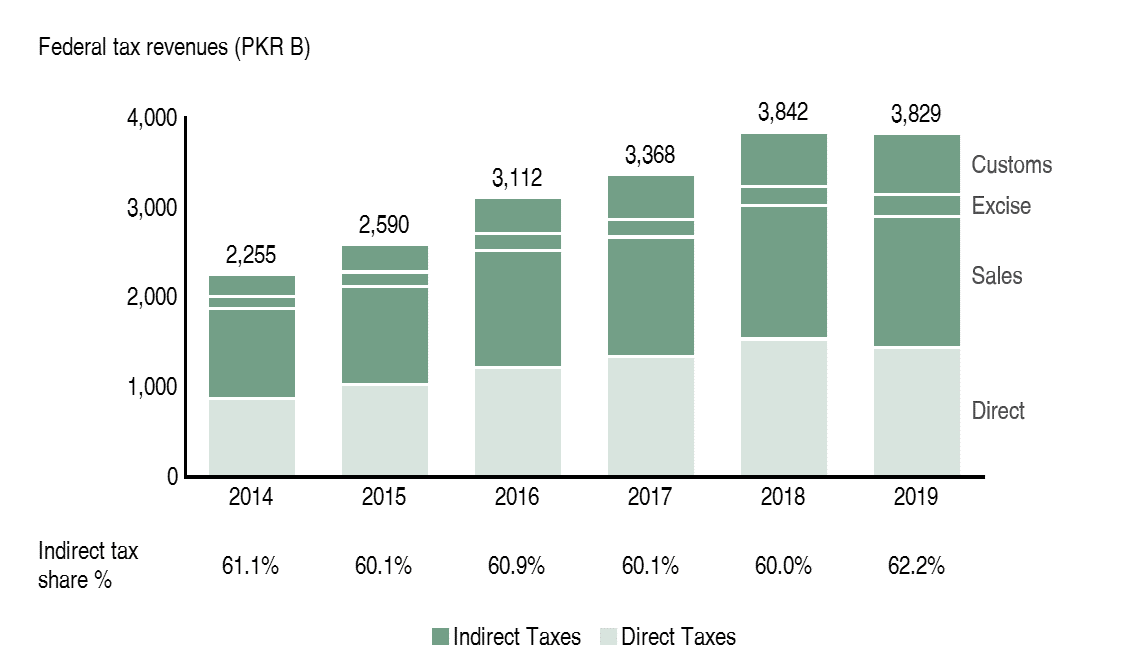

Source: State Bank of Pakistan; Federal Board of Revenue

Over 60% of tax revenue in Pakistan is from indirectly taxing the population. These kinds of taxes are regressive because they tax everyone the same. Domestic help in people’s homes pay the same tax on petrol for their motorcycles as the homeowner pays. Even within direct taxes, withholding taxes, which are also regressive, make up the majority. Anyone who has withdrawn money from the ATM must have paid the 0.6% withholding charge. Many might not know that they can claim some of that money back if they file taxes. So make sure you file your taxes!

Everyone doesn’t file taxes

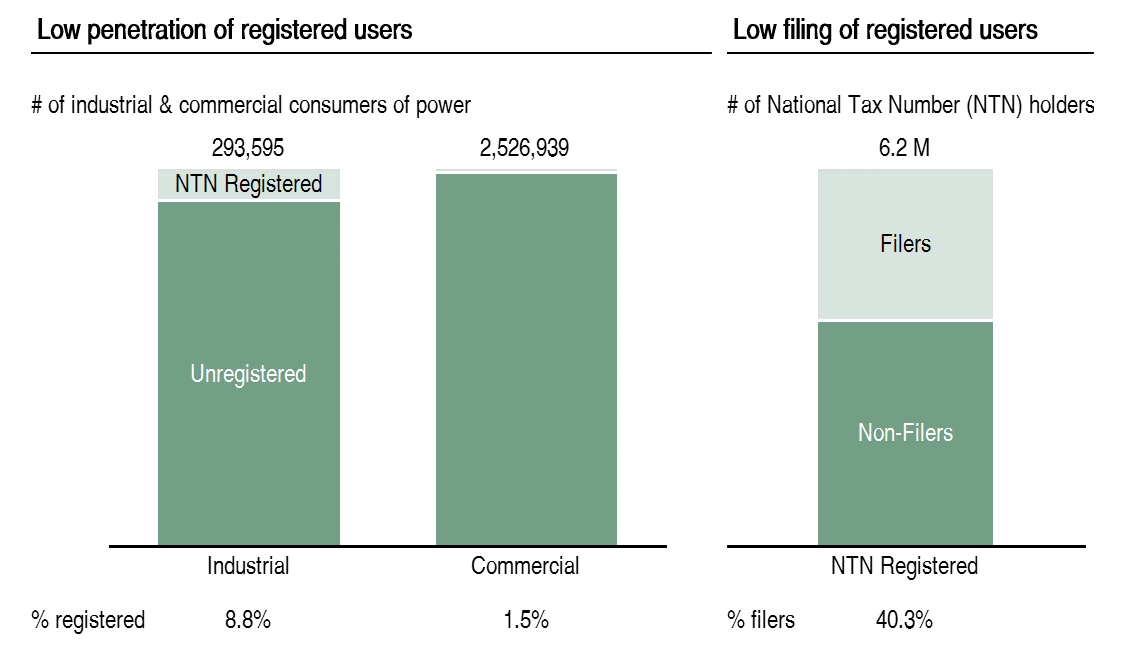

If the entire country pays their dues, we could collect twice as much as tax as we currently do and spend on public goods more effectively. However, businesses know that once they come into the tax net, their profitability will erode and hence they choose not to declare their incomes. The government knows these businesses exist, since in order to run a business, they at least need gas and electricity connections. However, only 8.8% of industrial and 1.5% of commercial users with gas connections are formally registered. Furthermore, only ~40% of these registered users actually file taxes.

Source: Federal Board of Revenue; Dawn (excl. unregistered K-Electric users)

This non-compliance is a major reason why Pakistan is not able to collect the full potential of taxes. The gap between actual taxes collected and full potential is significant across sectors. It varies from 46% for the manufacturing sector, to 67% for the services sector. For the agriculture sector, the gap is over 90% with an estimated tax gap of PKR 70 billion.

Existing tax filers are unhappy

While agriculture sector pays hardly any taxes, manufacturing and utilities contribute up to 3x more than their GDP share in direct taxes. Because not everyone files their taxes, the formal sectors that do, are overburdened

Source: Federal Board of Revenue; Business Recorder; MP Analysis

.While manufacturing sector makes up 12.5% of GDP, it pays 34.5% of all direct taxes in the country. If we account for indirect taxes too, the number rises to over 50%. The petroleum industry alone pays 17% of all taxes in Pakistan. Along with utilities and construction, manufacturing is the hardest hit in terms of taxes, contributing almost three times as much to tax collection as to the economy itself.

Read the full article below to find out why some tax filers are happy (hint: they get concessions) and how that makes the government unhappy. We will discuss where the government spends the limited revenue it does end up receiving next time.

Read the full article in the link below

What is the issue with low collection of taxes in Pakistan?

To setup future conversations on government budgets, let’s analyze historical revenue first, bust the myth of how no one pays taxes in Pakistan and why the tax base needs to grow.

If you have any feedback on this newsletter or the website itself, feel free to reply to this email. You can also share the entire article and even selected excerpts by simply highlighting the text on your own profiles!