We’ve discussed how Pakistanis are consuming more and more of their income but not really what is happening with incomes. From the green charts that did not really show something positive, we know that our per capita incomes have also been increasing but slower than consumption. Let’s break down what incomes in Pakistan are like.

Wage against the machine

Pakistan’s Average Monthly Income by category (2019)

Notice over 40% of income across quintiles comes from wages for workers in Pakistan. If you include salaries from business and service sectors, this number rises to 58% with slight differentials across lower income and upper income quintiles. We discussed last time how a significant chunk of our private consumption is spent on housing, and notice how the benefactors of that expenditure are predominantly in the highest quintile, deriving 18% of their income from rented and owned properties.

The number of income earners per household also portray a non-trivial fact: rich people work less than poor people. If you are rich, your household probably has 1.5 earners but if you are poor, more hands will be on deck. Behind this insight are a lot of provincial and gender differences that we can discuss later. While the income contribution of agriculture and remittances is also important, let’s park those for now and focus on wages.

The high proportion of wages implies that we have a lot of unskilled workers in the economy. Skilled labor is more likely to be serving in the business and service sectors than relying on daily, weekly or monthly wages. There are many economic theories around what wage setting should be like but let’s skip the theory and go back to our role play.

We do not reap what we sow

Your shirt business is going strong and you are thinking of hiring another person. You currently produce 10 shirts which make you PKR 15,000. If you think there is demand for 20 shirts, how much would you be willing to pay the next person you hire?

Modern economic theory says wages should equal marginal productivity of labor. So the maximum you would be willing to pay the person you hire is PKR 15,000 since you expect their output to be worth a maximum of 10 shirts. If you pay more than PKR 15,000, you will actually lose money because the person’s marginal output is not worth more.

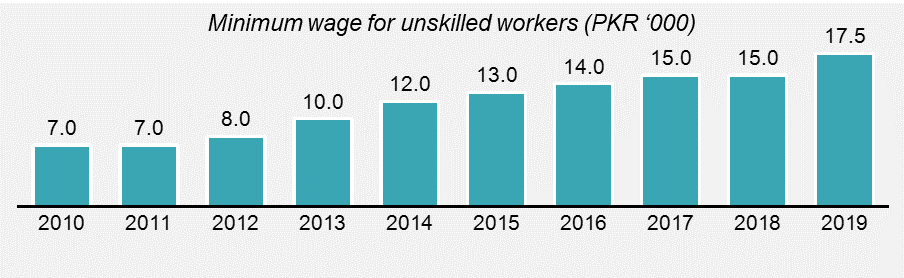

Pakistan’s Minimum Wage (2010-2019)

Before 2018, that amount would be fine but then minimum wages were increased in 2019 to PKR 17,500 (varies by province slightly but not important). If the output of the person you hired did not improve and you were still getting 10 shirts from them, you would now be worse off. Of course, the minimum wage only applies to you if you are part of the documented economy (which most of Pakistan is not). So if you have not invested in the past in innovation, your machinery is the same and your labor has not become more productive, it is safe to say the minimum wage spikes when new governments come in, will hurt.

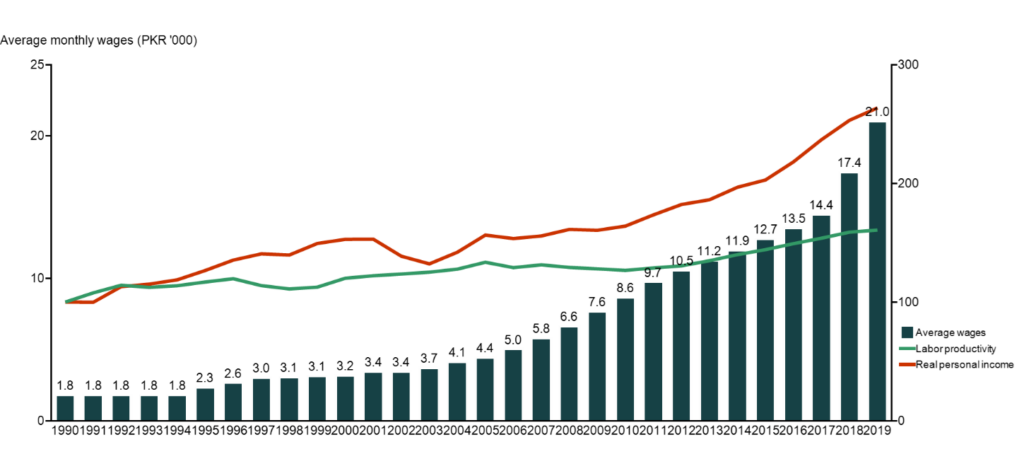

Pakistan’s Average Monthly Wages vs. Labor Productivity (1990-2019)

Minimum wages are only for unskilled labor so when they go up, you need to pay your skilled labor more too. On average in 2019, monthly wages were roughly PKR 21,000, which were more than 10 times what they were in 1990. Interestingly, if you calculate how much prices have changed by since then, it comes to around 10x. This means workers have been compensated more than inflation has increased in the last 30 years and that real wages have gone up. If you observe the red and green lines on the chart, you will see they have actually been compensated more than their productivity has increased. While real personal income, shown by the red line that reflects change in incomes net of inflation, has been on a steady rise, labor productivity, shown by the green line that reflects change in real output, has been flat.

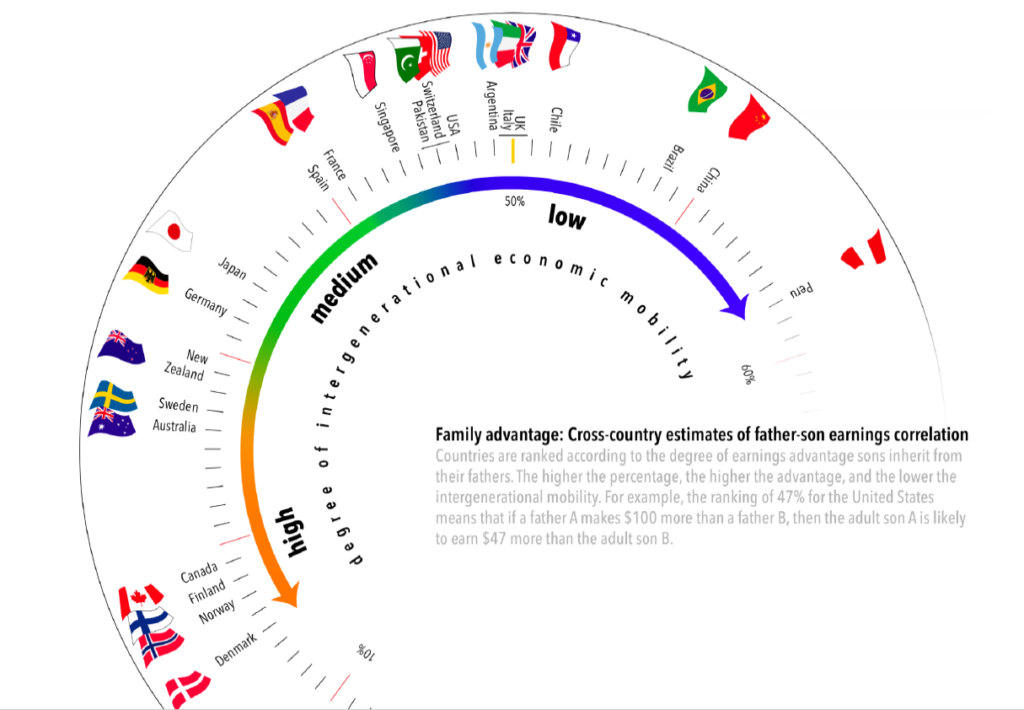

Rich Dad Rich Son

Just a side note: we have been talking about income and not wealth. One would usually associate higher consumption with higher wealth and not income. But wealth data in Pakistan is not readily available which is a bummer. The inherited family advantage is quite high which means inter-generational economic mobility is quite low. What this means is if my father made a healthy income, I am more likely to make a healthy income. I found a beautiful chart that shows this visually:

Global comparison of degree of earnings advantage

Basically the one time we are used as a global benchmark against the US is to show how poor our upward mobility is. The ranking for Pakistan of 46% means that if father A makes $100 more than father B, then the adult son A is likely to earn $46 more than the adult son B.

This has a lot to do with education and other socio-economic variables that we can discuss later. For now, let’s continue talking about income.

Equations are nice

Just to recap what we have learned so far, because we have to spend a lot on our consumption and our incomes have not kept up, we do not save enough. When we do not save enough, we do not invest enough. When we do not invest enough particularly in improving total factor productivity, our output suffers. When our output suffers and there are mandatory wage increases, we either choose to employ less to not be worse off or continue paying less as part of the undocumented economy. This leads to our overall incomes not increasing by as much, and a further lack of investment down the value chain.

This relationship of savings and investment is a critical one so let’s get into another lesson of economics. We have already established the following equation:

Y = C + I + G + X – M

Y is how incomes are denoted and you are already aware of the other variables. Let’s bring in taxes now to complicate things:

Y – T = C + I + G – T + X – M

The equation does not change since we subtracted taxes (T) from the income side and the same from the government’s expenditure (G) side. We are supposed to pay taxes on our income to the government, so they can spend on public goods for us according to our social contract with the state. Then, we consume privately and are left with our private savings:

Y – T – C = I + G – T + X – M

Again, the equation does not change since we just brought private consumption (C) from the right hand side to the left and changed the sign to minus. Y – T – C is what we call private saving. Now let’s see what the government saves:

Private saving + T – G = I + X – M

Again, the equation does not change since we just brought taxes (T) and government expenditure (G) to the other side and changed signs. The government theoretically saves the difference between the taxes they collect and the expenditure they do. T – G is what we call public saving. Collectively, private and public savings are called national savings. Now let’s see what foreigners save:

Private saving + Public saving + M – X = I

Bringing imports (M) and exports (X) to the other side shows us the balance of trade. If we import more than we export, that means foreigners are saving in our country, whereas if we export more than we import, we are saving in foreign countries. M – X is what we call foreign saving and the left over I is investment. This is what the final equation looks like:

Domestic saving + Foreign saving = Investment

We want more FDI

The simple takeaway from the above lesson is that if your citizens do not save and (as we will discuss in more detail later) your government does not save, you will need foreigners to come in and save to have investment in the country. This foreign investment is called FDI or Foreign Direct Investment. All governments want it to complement their private and public savings for investment.

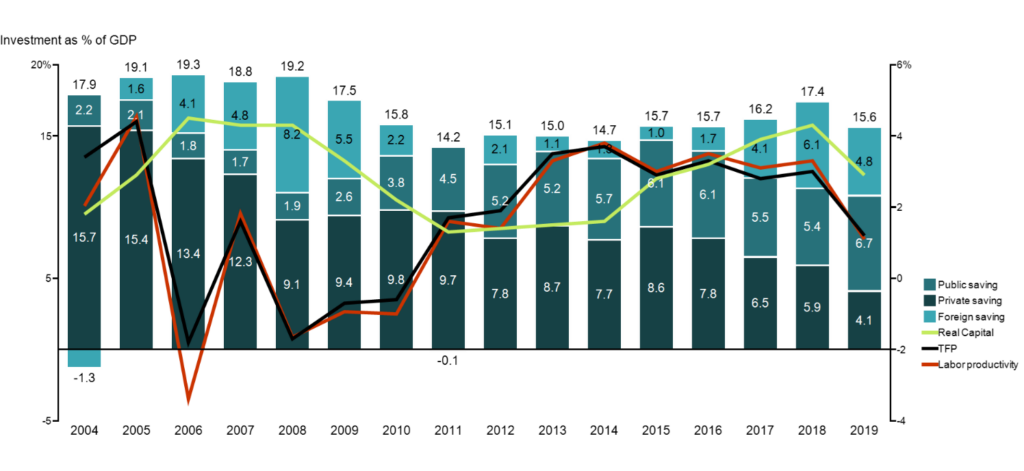

Pakistan’s Investment as % of GDP by saving type (2004-2019)

What you see in the beautiful chart above is the breakup of the equation for Pakistan and its impact on the three factors we discussed in earlier posts. In 2019, Pakistan spent 15.6% of its GDP on investment out of which only 4.1% came from private savings. In 2004, private savings used to contribute 15.7% of the total 17.9% investment, almost 3 times more. But because we have been consuming faster than our incomes have grown, this contribution has gone down. Also, recall that we spend half as much as Bangladesh on Investment.

As private saving went down after 2004, we had to rely more on foreign savings for investment since public savings were also minimal at the time. Fortunately or unfortunately for us, depending on who you ask, this was also the time that US military and economic aid was pouring into Pakistan as part of the Coalition Support Fund created as part of the War on Terror. We will discuss this in detail later but basically up until 2010, our investment levels remained above 15% because FDI bailed us out.

However, notice the impact on the red line (labor productivity) and black line (total factor productivity). They fell sharply in the early years when foreign savings, primarily from the US, kept us afloat and started to fall again post 2014 when China started taking a stronger foothold. All this while the green line (capital growth) remained flat. We should note that during this time we had the 2005 earthquake as well as the 2008 financial crisis, which we have spoken about before. Both of these external factors destroyed our economy’s ability to grow but I was still confused.

We don’t want more FDI

How can there be an almost negative correlation between FDI and productivity in Pakistan?

Then I found an ugly chart by the State Bank of Pakistan that answered the question:

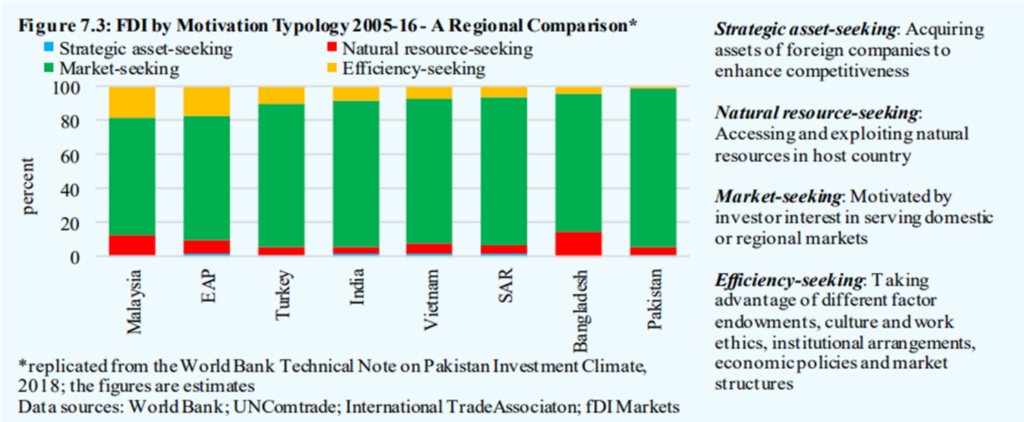

Without going into the details of what the different kinds of FDI mean, let’s step back. Because of Pakistan’s vicious cycle of low domestic savings leading to low investment, we started relying on Foreign Direct Investment a lot more. Now FDI in itself is amazing and we should encourage it. But we should encourage FDI that seeks efficiency, improves competitiveness and makes use of the country’s resources for the better.

However, Pakistan used to have many local content requirements, which meant if a foreign company makes an investment in Pakistan, it had to use a certain amount of local goods and services in the products they produced. But because our local content was not of high enough quality, the better forms of FDI never came. The auto industry is a classic example of this. What came instead was mostly investment that was market-seeking (green), which was just because we are a large country, with a large population and a large market to serve. Little to do with improving our total factor productivity or labor productivity.

If you just look at 2008 figures for FDI, this market-seeking phenomenon will start to make more sense. Pakistan attracted its highest ever amount of FDI at US$5.4 billion out of which 65% was focused on communications (with ownership of PTCL changing hands) and financial services (with foreign banks like Barclays conducting some mergers and acquisitions). These select sectors make up only 16% of our labor force as we will discuss later. This is why the green line for real capital growth, in the beautiful chart above the ugly one, remained flat, while the red and black lines dropped drastically.

Pre-COVID-19, all these structural issues were coming up to the surface. Our consumption was at extremely high levels, our private savings were at an all-time low, foreign savings were helping with the little investment we could muster, but they were not efficiency seeking. Hence, productivity was already low and growth of the economy depressed. The only complicated word I’ve used so far, should be echoing in your mind right now:

Hysteresis: When an economy is slowing down, the lack of investment destroys its ability to grow permanently.

Macro Pakistani

We will dig into investment and productivity by the major sectors of the Pakistani economy next to really understand pain points of the supply side of the GDP. That will help us better envisage what the full impact of COVID-19 is going to be on our economy and how long this impact will last.