What is the framework for calculating petrol prices in Pakistan, and why has the current government drastically lowered the petroleum levy?

By Ismyal Khan

The fluctuation in petrol prices is a source of much debate in Pakistan. Yet, there seems to be a lot of misinformation surrounding how the price is determined and what factors most influence its frequent adjustment. To help make sense of it, this article will explore the pricing data from the past few years to comment on the pricing framework, recent trends, and what consumers can expect in the coming months.

Factors affecting the price of petrol

Regardless of where you are in the world, the price of petrol you pay at the filling station is an accumulation of several components, each signifying a segment of the overall oil value chain. From crude oil exploration and production, to refining and final product distribution; the cost of fuel must account for each sector of the industry. In addition, unless you live in an oil-rich country, the government will most likely implement fuel taxes as a source of revenue to meet fiscal targets or as a tool to drive energy policy.

Although the price makeup includes the factors highlighted above, the pricing framework may vary significantly from country to country. The government may completely regulate the price through subsidies or price caps, or have an entirely deregulated price structure driven by the market. In Pakistan, the petrol price is regulated by the government, and the price is notified through the Oil and Gas Regulatory Authority (OGRA) on a monthly or fortnightly basis.

Pricing framework

Essentially, the final price of petrol a consumer pays in Pakistan comprises of six components. The table below lists each component, its average percentage of the total price in the past four years, and what it means.

| Sr. No. | Price Component | Avg % of Total Cost (Rs.) | Info |

| 1 | Ex-Refinery Price |

62.5% (Rs. 59.9) |

The ex-refinery price is the amount at which local refineries sell their product to the Oil Marketing Companies (OMCs). Refineries are not free to set this price and instead it is calculated by OGRA which follows the Import Parity Price formula. The price is determined by averaging the FOB price of Arab Gulf Gasoline 92 RON and then adding the import incidentals and surcharges*. It is essentially the landed cost of imported petrol and is almost wholly dependent on the global crude and fuel market. |

| 2 | IFEM |

3.6% (Rs. 3.4) |

In-land Freight Equalization Margin (IFEM) is calculated by OGRA and implemented to equalize prices throughout the country. Without this, there would be a marked difference between the price in Karachi and Islamabad. |

| 3 | Distributor Margin | 2.8% | This is the maximum margin OMCs (e.g. Total, Shell and PSO) earn per liter of petrol. In the case of petrol this is set by the Govt of Pakistan (GoP) and notified through OGRA. |

| (Rs. 2.7) | |||

| 4 | Dealer Commission |

3.7% (Rs. 3.5) |

Set by the GoP, this is the maximum amount the owner of a petrol station earns on every liter. |

| 5 | Petroleum Levy |

14.2% (Rs. 13.6) |

An amount collected as tax by GoP. The rate of levy is notified by the Ministry of Energy (Petroleum Division). |

| 6 | Sales Tax |

13.3% (Rs. 12.8) |

General Sales Tax (GST) applied as a fixed percentage on the sum of all the above components. The final cost after applying the sales tax is known as the Ex-Depot Sale Price. |

| Total Average | Rs. 95.9 |

Pricing Trends

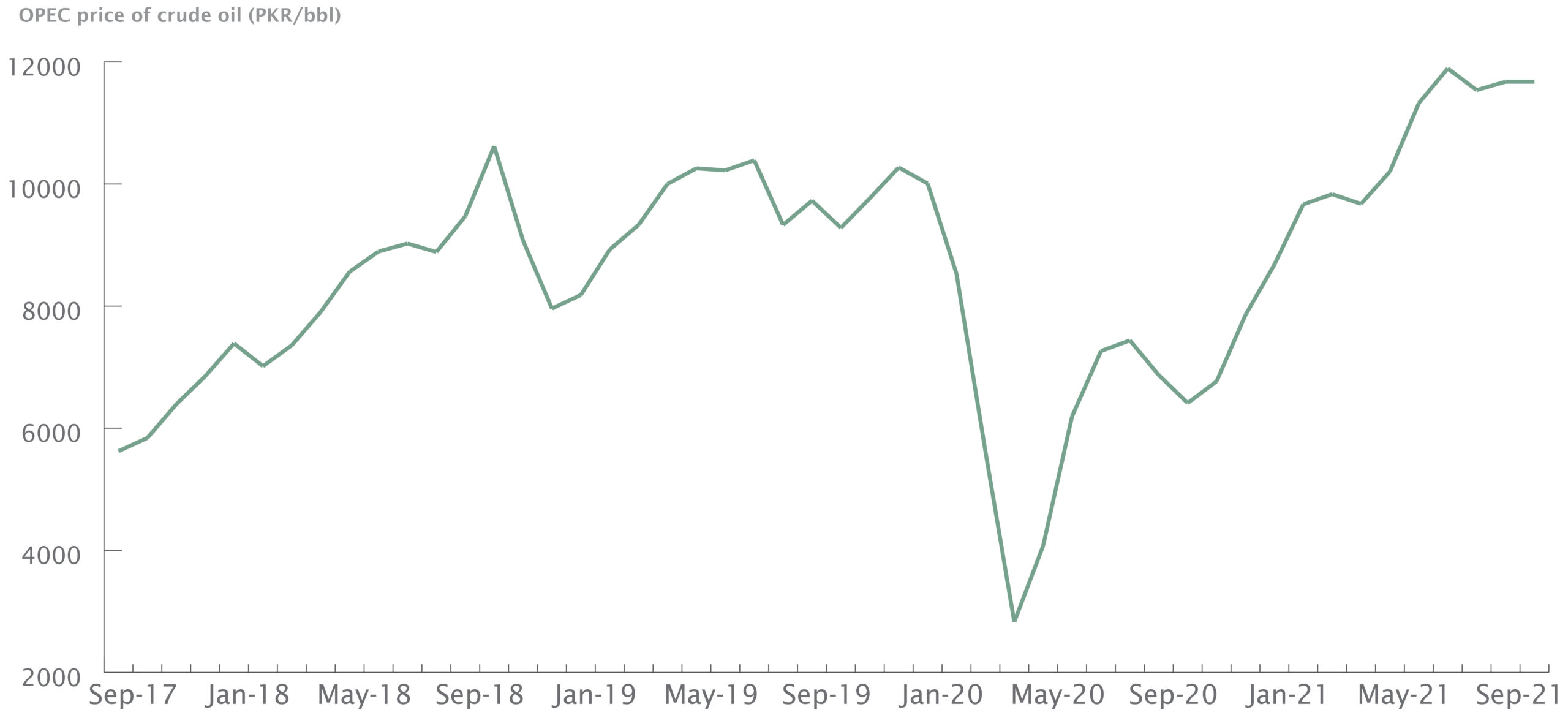

Unsurprisingly, the biggest factor influencing the final cost of petrol in Pakistan is the international oil market. Starting from early 2018, the devaluation of the rupee meant that the cost of a barrel of crude oil started rising significantly for Pakistan, even as the price remained fairly stable in USD terms. To give an example, a barrel of crude oil priced at USD 67 in January 2018 cost PKR 7,400 while in May 2021, the same USD price cost PKR 10,205.

Source: OPEC/Investing.com, MP Analysis

Source: OGRA, MP Analysis

Breaking down the price of petrol

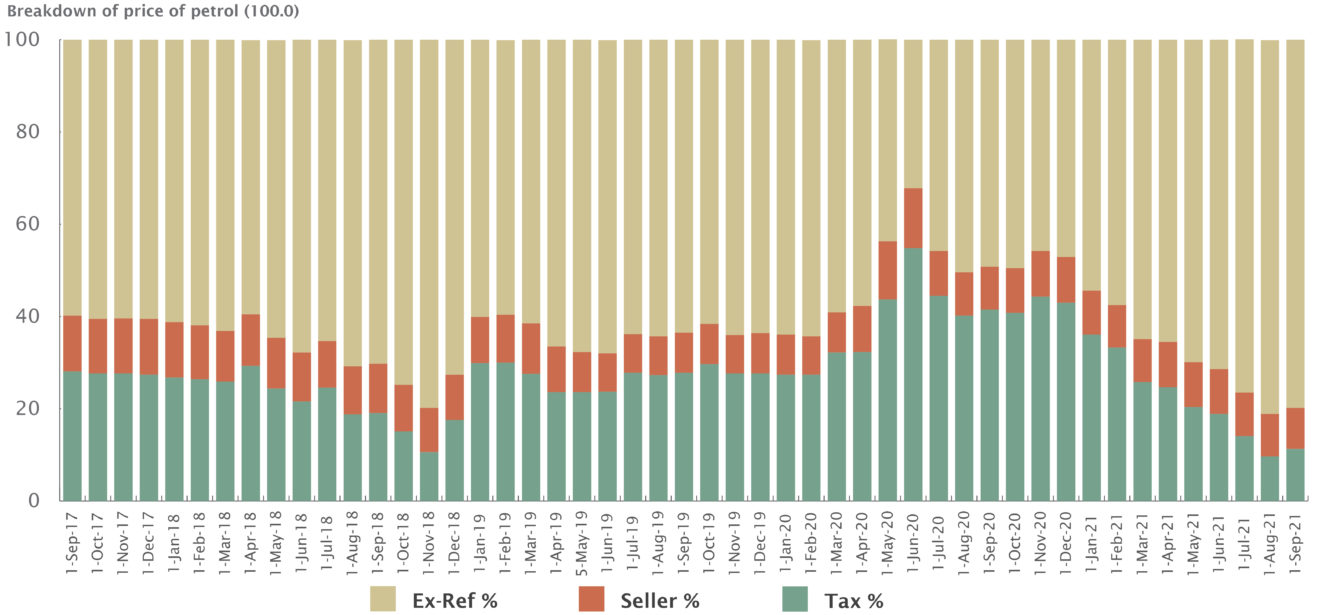

To explain how the government has been managing the price of petrol, the percentage breakdown of the price since January 2018 is presented below. To make things simpler, the six price components are divided into three sections; 1) ‘% Ex-Ref’ is only the ex-refinery price and is dependent on international crude/fuel prices 2) ‘% Seller’ is the combined percentage of IFEM, distributor margin and dealer commission and 3) ‘% Tax’ is the percentage sum of petroleum levy and sales tax.

Source: PSO, MP Analysis

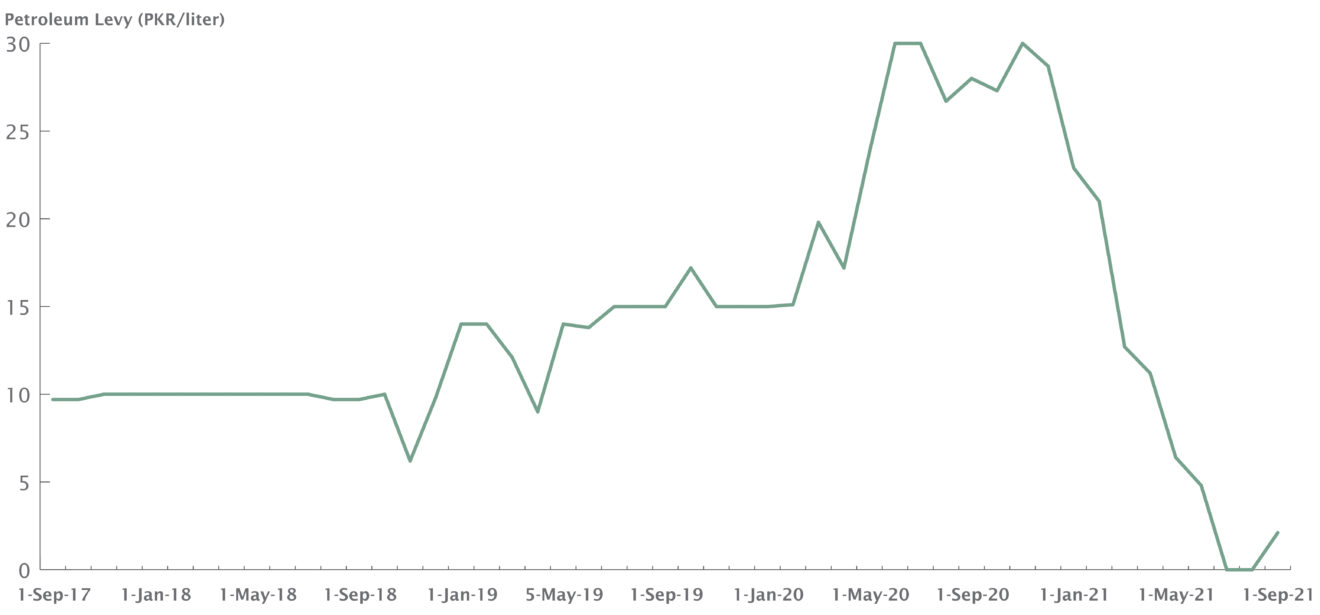

The government’s policy of decreasing its tax revenue instead of shifting the entire burden on to the consumer is now reaching a point where it is fast running out of options. For the first time, in July 2021, the petroleum levy was dropped to ZERO PKR, and it did not stop there. In August, with the international price of oil still rising, the government decided to decrease the GST % from 17% to 10%.

Source: PSO, MP Analysis

Loss of potential revenue

Before discussing the government’s possible course of action, it is worth noting the fiscal cost of its current pricing policy. If the petroleum levy and GST were both applied today, as they were being implemented for the past few years, then the price of petrol would be PKR 136.11 per liter (with 17% GST and PKR 11.42 Petroleum Levy), compared to the PKR 118.30 it is today (with 10.5% GST and PKR 2.11 Petroleum Levy).

This suggests that the government is losing potential revenue of PKR 17.81 on every liter being sold. So, bearing in mind that almost 30 million liters of petrol are sold each day then that equates to a daily loss in revenue of PKR 534 million—and this is only petrol we’re talking about. Thus, it begs the question; how much longer can the government afford to do this? And is there an upside to keeping prices low?

The government’s calculus

In a developing country like Pakistan, which has such a high dependence on imported oil, an increase in international oil price creates inflationary pressures. So, apart from the obvious political considerations, the government has refrained from passing on the complete price increase to the consumers because it fears it will exacerbate inflation. This is a genuine concern—seeing as inflation has already been in double digits for much of the past six months. Even higher inflation would clearly put consumers and producers in considerable hardship. High inflation can also stifle economic activity and present a significant challenge to the government’s plans of ending its tenure with a strong growth phase.

However, as we saw earlier, there is a revenue cost to all this. And depending on how it is managed, that cost can have far greater economic consequences. Taxes on petroleum products, which include petrol, make up a large portion of the government’s annual revenue. Forgoing these means that it must search for other avenues to make up for that lost income. Failure to do so will lead to disgruntled creditors, a large budget deficit, and ultimately, problems in the balance of payments. All of these issues have plagued our economy for decades, and their implications are already very familiar to us.

The way forward

Moving forward, if the government remains determined to not increase petroleum prices, it is essentially left with one of three choices;

- Concede that it can no longer achieve its revenue target from petroleum products and, in return, present a clear and credible plan of raising income from other sources. So far, it has not been able to do so, and finding options to fill such a large void in such a short time is a tough task.

- Second, it realizes that the economy is still vulnerable to external shocks and decides to dial back on its plans of fiscal expansion, instead taking further measures to ensure stabilization and future sustainable growth. It is very unlikely the government will choose this path, bearing in mind the political toll and with general elections around the corner in 2023.

- The last option, and the one the government is most likely following at the moment, is to just wait. Wait and hope that the international price comes down, and in this way, it may recoup its losses by reinstating taxes while keeping local prices the same. If this does happen, then this decision could prove to be quite prudent. Nonetheless, with crude prices still hovering above USD 65/Barrel and the IMF’s sixth programme review in September, waiting is no longer possible.

Recommendations

By all accounts, the government cannot sustain the current pricing policy for much longer, especially if the crude price remains above USD 65/Barrel, as is expected. The government must plan accordingly, and along with taking measures to deal with the current situation, it has become necessary to find ways through which it does not end up in a similar position again. One such way could be to completely deregulate the pricing framework. This would allow the government to disassociate itself from petrol pricing and subsequently relieve some of the political baggage. Similarly, a longer-term solution would be to focus on securing other reliable and direct streams of income so it can cut its dependence on petroleum products altogether.

*Correction: A previous version of this article stated that the Ex-Refinery Price was calculated using the Platt’s Oilgram. That has now been updated, with a full explanation below.

“The calculation for Import Parity Price (IPP) of petrol has been tweaked over the years by OGRA. In the case of petrol, which product FOB prices should be averaged from the Platt’s Oilgram has depended on the quality of petrol fuel being sold in Pakistan and the pricing data made available by Platt’s. In the past, the calculation was carried out by averaging a ratio of Naphtha price, later this changed to varying proportions of Naphtha and Gasoline 95 RON plus import costs. However, now it is determined by averaging the FOB price of Arab Gulf Gasoline 92 RON and then adding the import incidentals and surcharges. Naphtha is an intermediate stream in a refinery which is converted / blended to make petrol of different RON specifications. As Pakistan switched to only importing petrol of minimum 92 RON in 2016 it has made sense to only adjust its pricing with Gasoline 92 RON.”

This was a much needed article. Thankyou very much.

Even the educated in Pakistan are unable to think along these lines and delve into stupid discussions and sharing of tweets made in the past by some politicians.

The issue is a kuch bigger one and it is about time people start thinking critically and how one issue is linked to the other.

Very educational and covers a vast variety of topics related to how and why oil prices change, the government revenue streams and the influence of politics in commodity prices.

Looking forward to more articles in the near future.

Wow. This article really helped me open my eyes regarding how much yeh government is actually doing for us.

Thank you.

Given that we are an oil importing country, pricing of petroleum cannot be reduced but may have to be increased in future, in line with prices in other oil importing countries. Furthermore alleviating the plight of the masses can only be achieved through increased and sustainable exports. Govt has always supported large groups at the cost of SMEs in the country. It is a global truth that employment is generated through SMEs as large organization tend to automate quickly thereby reducing requirement of human labour.

For eg, the govt launched TERF quickly with expected disbursement of PKR 500 Billion plus but taken ages to launch SME finance scheme which is convoluted scheme at a much higher interest rate than what was made available under TERF. SMEs are the lifeblood & engine of growth of any economy and until Govt becomes serious in supporting SMEs for increasing exports and also employment, long term economic recovery will remain a pipe dream.

Great read! Fascinating 🙂

Sir, its great you explained it in very shining and easy way to the people of Pakistan. I have never studied such a comprehensive and short brief writings on this topic since I have joined the fuel form and supply line of an avaition sector.

Hello need to clear one thing, in this he calculate the price of petrol 95 but actual price when he write the article is about 118, so why there is price difference? Can someone explain it.