Amidst the Covid-19 pandemic which saw interest rates plummet globally, economies slow down, and unemployment rise, the Pakistani Government announced the Naya Pakistan Certificate—a bond targeted primarily towards overseas Pakistanis in an attempt to attract foreign investment.

Bonds vs. Loans

To break down how bonds work, it is a security entitling you to a future payment. Similar to how a deposit account at a bank works, you buy bonds worth a sum from an issuing body. This entitles you to a payment of the money after the tenure is over, as well as an interest payment. This interest payment can be thought of as rent for borrowing the money. And much like a government can borrow money from commercial banks, it can also raise money through bonds.

Raising financing this way can be preferable to borrowing from banks. Firstly, because commercial banks can instead loan the same money to private actors for higher rates. So, to borrow a hefty enough amount, the government is likely to face a rate greater than the policy rate. Second, bank lending crowds out money for the private sector; money which could have gone to spur economic activity instead goes back to the government, leaving less for the private sector.

Bonds also allow retail investors to buy the sum since it can be broken down into smaller denominations. It serves as an investment, and it can also be used as a security. And unlike loans, the principal amount is returned at the end of the tenure instead of in installments over the tenure. Even if the bond market impacted the economy the same way raising debt from banks does, it still has the benefit of allowing individuals to safely invest their money. Investment avenues, especially at the individual level are narrow and bonds can alleviate (some) of that burden.

What sets Naya Pakistan Certificates apart

Naya Pakistan Certificates are different in that the funds are not sourced from the local market, meaning it is an injection of capital into the country. It is not uncommon for this to happen. Companies and governments do issue bonds in foreign markets. This comes at the risk of foreign exchange fluctuations since (usually) the money is to be paid back in the foreign currency. While the government takes pride in the inflow of funds, it is no surprise they have received so much popularity. The Eurobonds which were also floated earlier this year were offered for a minimum tenure of five years, and a return of 6% p.a. This also came at an oversubscription of twice the amount on offer. As global interest rates have plummeted, these offerings make for a very attractive and safe investment.

Furthermore, unlike a company’s bonds which can only hold its own assets liable, these are sovereign. Rarely, do governments default. Even if funds are low, there are avenues to borrow more to pay the money back, or more money can be printed. Both can have disastrous consequences for the economy, but almost none for the investors. Naya Pakistan Certificates, targeted towards Pakistani expatriates, are raised in PKR as well as three foreign currencies; US Dollar, Euro and GB Pound, with rates of return for foreign currency investments varying from 4.75% to 7.00% p.a.

Should the rates have been lower?

The popularity of Eurobonds and Naya Pakistan Certificates, and prevailing global interest rates do indicate that the same amount could’ve been raised at a lower rate. Approximately USD 1 billion have been invested in Naya Pakistan Certificates, conventional as well as Islamic ones combined.

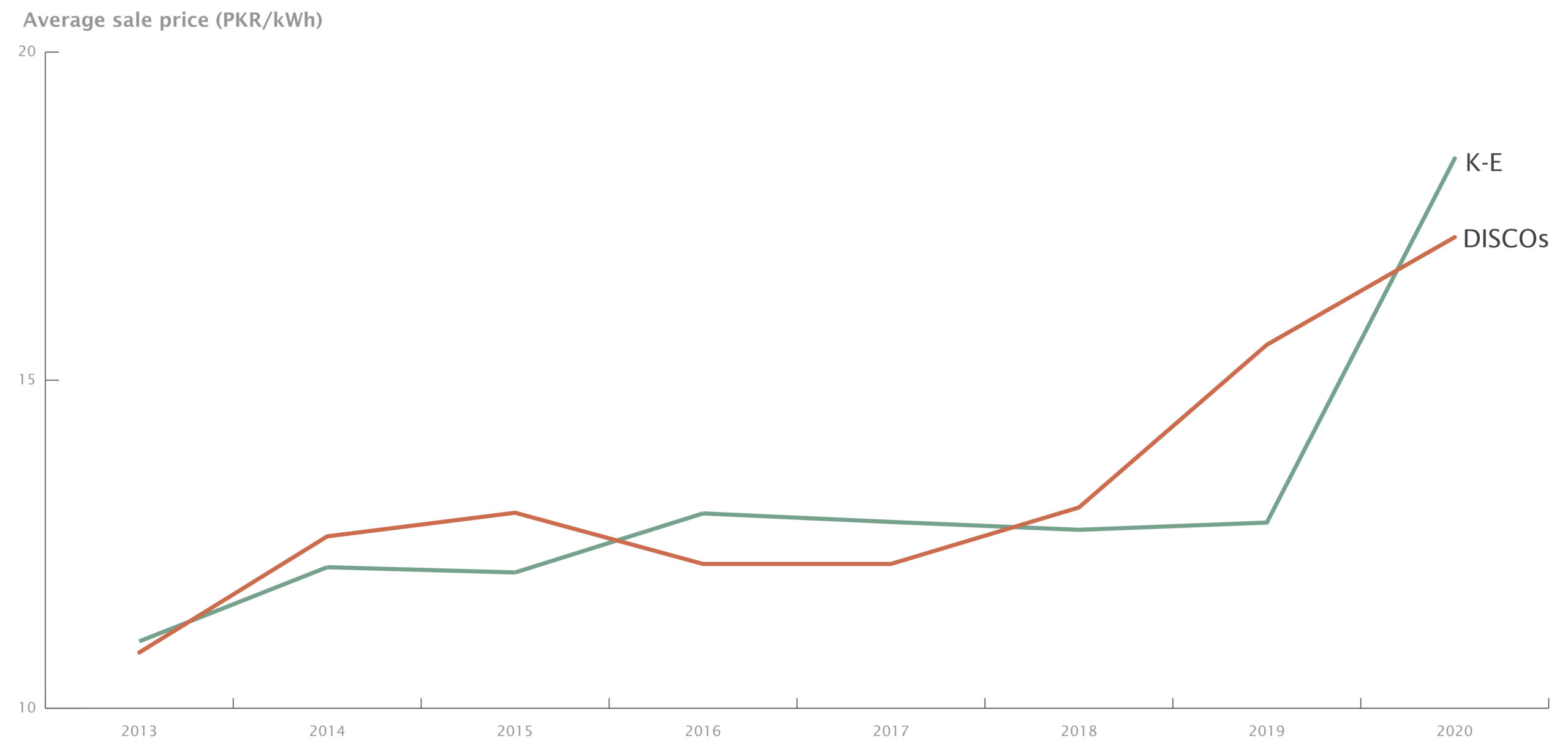

History tells us, however, that when the government offers high rates of return to encourage investment, it does not always go according to plan. The Nawaz Sharif government for example, approved numerous energy projects which came with lucrative Power Purchase Agreements (PPA) with NEPRA. Documents point towards indexed returns (to USD) of 12% and more on equity. Many established business groups set up subsidiaries or sister companies in the race to build wind and solar farms. Between government financing at preferential rates and the low risk of investment, their popularity was substantial. And while these incentives did increase our generation capacity beyond our requirement, it also substantially increased the cost of electricity in the country.

The average sale price of electricity in Pakistan has risen substantially over the past decade

Source: NTDC, MP Analysis

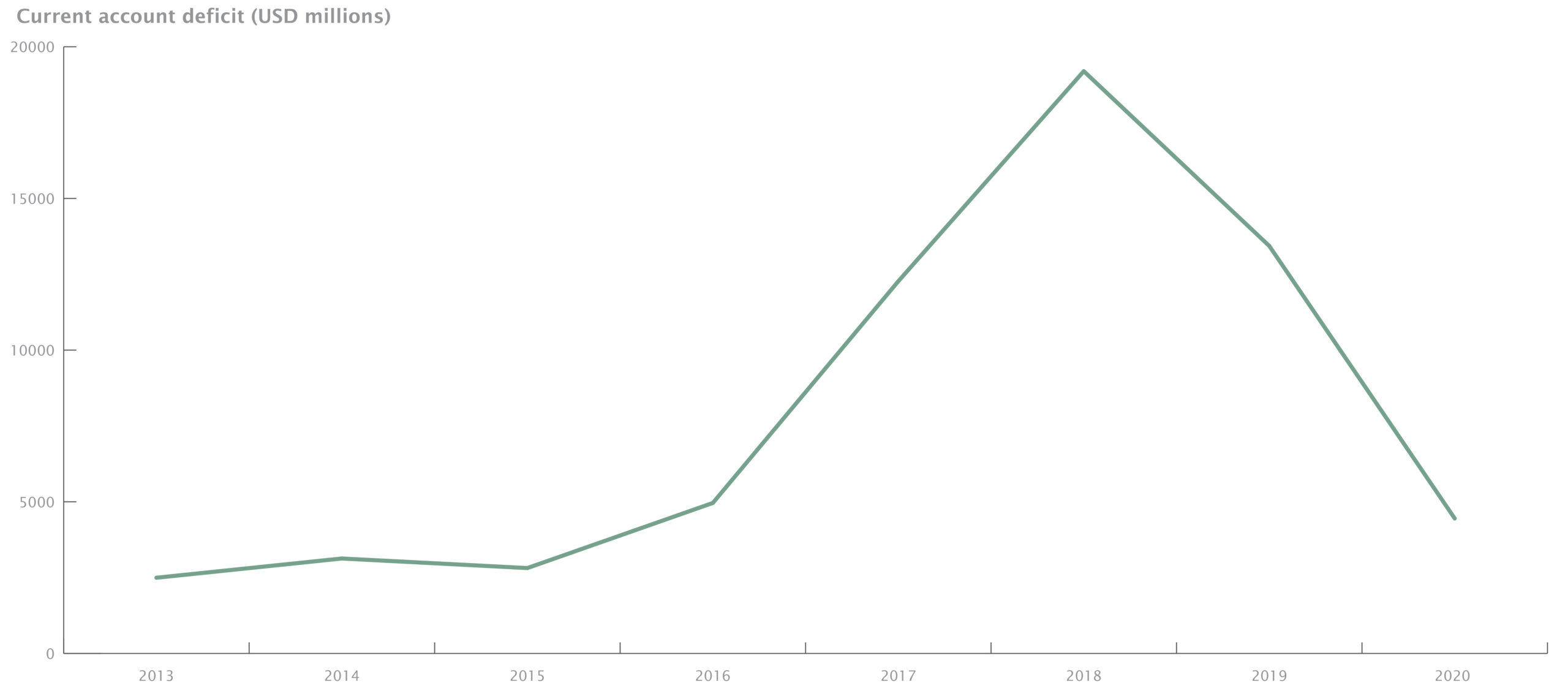

A widening current account deficit

One of the first problems with high rates of Naya Pakistan Certificates is that it makes things more expensive. Regardless of what the government spends it on, it could all have been achieved at a lower cost arguably. The second risk it presents is to the foreign exchange repayment schedule. The repayment will represent a significant amount of money leaving our foreign exchange reserves. The question is whether these investments will yield enough to make repayment viable. And perhaps more importantly, can our existing export base grow enough to build up our foreign reserves for eventual repayment? The last fiscal year closed at a deficit of USD 1.85 billion. Sources attribute this to rising cost of oil and vaccine imports. Our demand for both imported oil and vaccines is unlikely to fade anytime soon.

Pakistan’s current account deficit is already significant, and Naya Pakistan Certificates could exacerbate the problem through further outflows

Source: SBP, MP Analysis

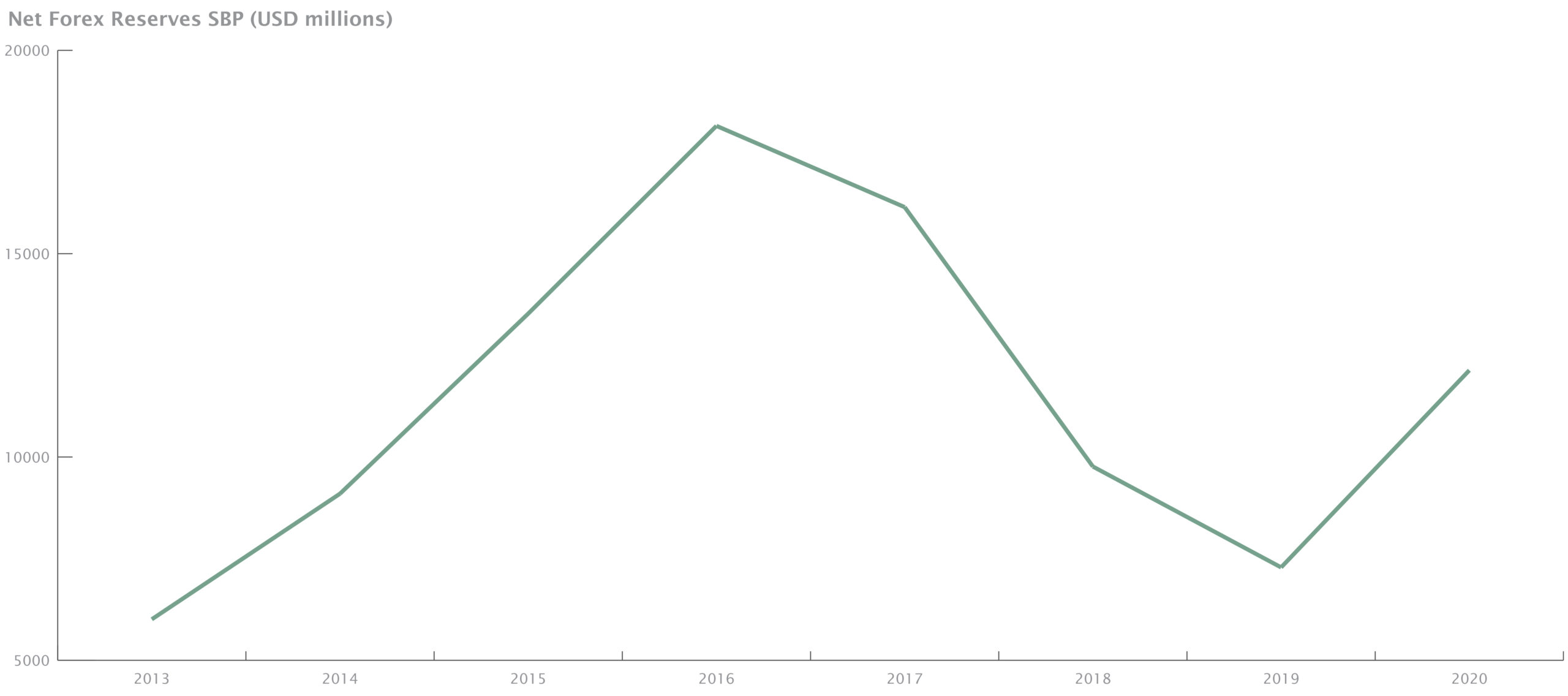

Risk to our foreign exchange reserves

Our import bill is further likely to increase in the near future due to Special Economic Zones (SEZs), which offer various tax incentives. These include lower or no tax rates on the import of machinery and other capital goods. Engineering as an industry is not as prevalent in Pakistan. This leaves little choice for industries, which almost exclusively import what they require. Capital expenditure is high, and while your books may show healthy performance and good decision making, it will still take years to make enough from export earnings to be commensurate with the forex used to buy capital goods. This industrial uptick itself is a significant risk to our current account in the near future, and one which analysts predict can see our current account run significant deficits. The higher end of these estimates $10 bn. Our reserves today, for comparison, are slightly north of $18 bn.

The foreign denomination of Naya Pakistan Certificates could pose a risk to the country’s foreign exchange reserves

Source: SBP, MP Analysis

These risks are highly significant, and the scenarios are not improbable. A depreciating rupee can lead to more inflation. This inflation can further dampen business activities, which both provide employment and keep the economy moving, as well as bring in foreign exchange. And while the risks to everyone within Pakistan are high, to those overseas and investing in NPCs, they remain almost none. The sovereign guarantee can entail an even higher rate of inflation to pay our bills. It can also lead to devaluation and depreciation of currency to make exports cheaper and attract buyers. Though it must be argued this phenomenon takes a long time to materialize, it does form an integral part of economic theory.

South Asian comparisons

In 2010, the State Bank of India raised EUR 750m through its issuance of Eurobonds to diversify its debt portfolio. These carried a coupon rate of 4.50%. This came after private sector operators from India had raised their own Eurobonds, in much larger sums. Bangladesh has also issued its own medium- and long-term notes. These come rated at BB- by S&P, and have a 10-year coupon rate of (4.75%), with a modification in Sept 2020 amidst the pandemic. Sri Lanka, too, issued bonds in late 2010. At a ten-year tenure and coupon rate of 6.25%, their economy has started to show signs of running into mild trouble. As repayment of their bonds looms closer, the government has tightened restrictions on the import of various products, including spices and agricultural chemicals. Furthermore, Fitch has downgraded their current rating to CCC. While India seems to have successfully raised and repaid the debt, Sri Lanka offers a cautionary tale.

The verdict

While it is hard to determine with accuracy the outcome of an alternative choice, Naya Pakistan Certificates could arguably have been raised at a lower interest rate. How much lower, is a more complex question to answer, as the risks posed by investing in Pakistan do justify a somewhat higher interest rate.

To offer a definitive verdict on Naya Pakistan Certificates, one prominent question still needs to be answered. What will the proceeds from these bonds fund? The answer to this is vague. Beyond the statements highlighting their use for development, there is no further information given. This lack is perhaps the greatest risk to everyone within the country. If, in the name of economic growth, the government reduces taxes or provides low interest loans to inefficient industries, growth will be limited and inequitable. If the money instead funds education equity with a focus on imparting technical and vocational skills, the returns to economy, and later in the forms of remittances, will be stable and long-term. Having a plan of utilization and its oversight is important. Until then, the country can only see the costs, and not the benefits, of this decision.

Great piece!

Very well written.

How is the average sale price of electricity calculated? Is it like averaging the end consumer tariff per unit across all consumer categories? Does it also include the government charges like sales tax? And why does the k-electric sale price differs from other discos?