2 min read

Earlier this week, the State Bank of Pakistan released its routine monthly remittances statistics. If you’ve ever wondered why all our governments excessively praise overseas Pakistanis, and seek to ingratiate themselves to the ruling families of Saudi Arabia and the UAE, then this document has the answers.

Quite simply, Pakistan is heavily reliant on remittances to shore up its economy. How reliant? Well, our trade deficit (the difference between export and import of goods) for the month of October was nearly USD 4 billion. So, if it weren’t for the USD 2.5 billion worth of remittances coming into the country in the same month, our overall current account deficit would be in much worse shape than it already is.

Of this USD 2.5 billion, the largest source of remittances is Pakistanis in Saudi Arabia (USD 0.66 billion) and the UAE (USD 0.46 billion). Collectively, Pakistanis in these two countries remit almost as much money as Pakistanis in the rest of the world combined.

That’s quite a risk considering that these countries don’t give foreigners citizenship, or really any kind of legal rights. If they feel like, they could kick out all the Pakistanis residing there tomorrow. In fact, they already attempted to do this in 2017 with Qatar, a country far more economically powerful than us.

While this scenario is hypothetical, Pakistan’s economy would be virtually on its knees if it were ever to become reality. We know this, and crucially, so do Saudi and the UAE. There are already plenty of impediments to progress in Pakistan, but the fact that we are completely economically dependent on two autocratic, arbitrary, human-rights violating regimes surely can’t be a positive sign.

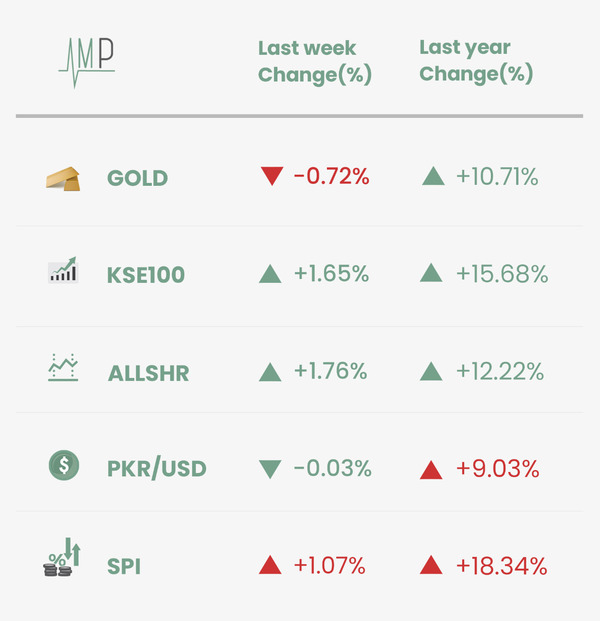

KSE-100 rose this week, due to the release of positive large-scale manufacturing (LSM) figures. PKR appreciated marginally this week, due to Finance Minister Tarin’s optimistic statements regarding impending dollar inflows from Saudi Arabia and the IMF. Local gold prices fell slightly this week, amid concerns over SBP increasing its benchmark interest rate.

The annual change in Sensitive Price Index rose to 18.34% vs. 17.37% last week. The poorest of the country (Q1) witnessed a change of 18.62% vs. 19.16% for Q5. On a weekly basis, prices rose for all quintiles by 1.07%.

Increase in prices of Chicken (+8.26%) and Cooking Oil (+4.72%) contributed to weekly inflation. A fall in the price of Tomatoes (-5.77%) and Sugar (-4.25%) helped moderate inflation this week.

.

What Else We’re Reading (Local)

What Else We’re Reading (International)