2 min read

Petrol prices hit PKR 145.82 per litre this week, the highest in Pakistan’s history. Electricity prices were also hiked by PKR 2.27 per unit today, after already being increased by PKR 1.95 per unit in February. Meanwhile, gas prices are set to skyrocket in the coming months, as the country faces a likely RLNG shortage due to increased demand over the winter.

Whatever the mitigating factors behind these increases, it is certainly not a good look for the government. And there are certainly mitigating factors, with rising prices of oil and gas in the international market, and electricity tariff increases being imposed as part of IMF conditions.

However, one must not ignore the government’s own role in this. The rising petrol prices are in part due to rupee depreciation as a result of the government’s inability to get the current account deficit under control. The reliance on IMF loans, once so despised by Imran Khan, are due to the government’s ineffectiveness in substantially growing our tax base. And the impending gas shortages are due to the government delaying RNLG imports for the second year in a row. Three years into its tenure, the government is running out of excuses.

Featured Article

Prevalence of stunting in Pakistan has barely decreased since 1965, while wasting has actually gotten worse since then. Why is that? By Asad Pabani

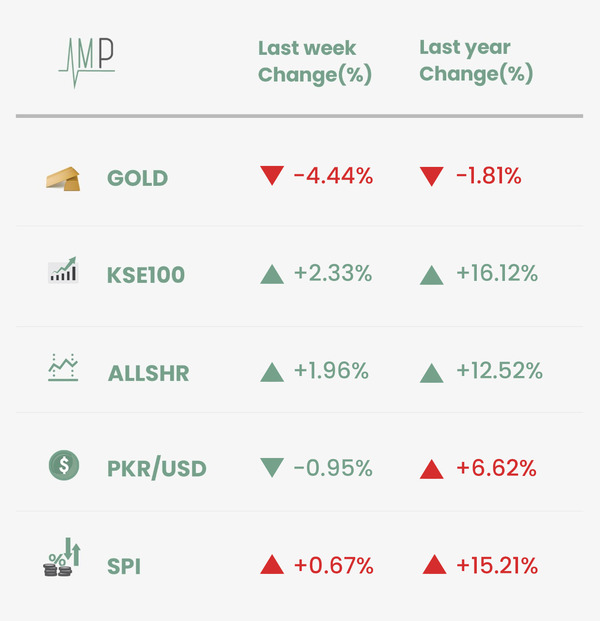

KSE-100 rose this week, due to a fall in international commodity prices. PKR appreciated again this week, due to clarity on the IMF’s Extended Funded Facility assistance for Pakistan. Local gold prices fell this week, in line with a decline in price in the international market.

The annual change in Sensitive Price Index rose to 15.21% vs. 14.31% last week. The poorest of the country (Q1) continue to bear the brunt of increased prices, with a change of 16.43% vs. 15.68% for Q5. On a weekly basis, prices rose for all quintiles by 0.67%.

Increase in prices of Tomatoes (+19.2%), Sugar (+5.32%) and Mutton (+0.33%) contributed to weekly inflation. A fall in the price of Chicken (-2.06%) and Onions (-3.12%) helped moderate inflation this week.

.

What Else We’re Reading (Local)

What Else We’re Reading (International)