3 min read

The State Bank Governor’s remarks at a dinner in London yesterday caused quite a stir back home. Discussing the falling value of the rupee, Reza Baqir pointed out that every economic policy had “winners” and “losers”. He considered the winners of the depreciating rupee to be overseas Pakistanis, whose dollar would go a lot further back home, while the losers were those who went on foreign trips or bought expensive imported things.

Most of the criticism focused on his excessive praise for overseas Pakistanis when, in fact, less than 15% of Pakistani households receive remittances from overseas. However, less attention was paid to his accompanying remarks implying that the depreciating rupee really only mattered to elites who love buying expensive imports. Is that actually the case? I thought I’d take a look at SBP’s own data.

In FY 21, Pakistan imported USD 54 billion worth of goods. The biggest category was petroleum and mineral products (USD 11 billion), which have inelastic demand and just got a lot more expensive due to depreciation, disproportionately affecting the poor. Next, machinery (USD 8 billion) which is essential for capital formation, but will now be more expensive. Then you’ve got textiles (USD 5 billion), half of which is imported raw cotton, which in turn is crucial for our cotton yarn exports – so oops, our exports just got a lot more expensive and uncompetitive.

Okay, but I’ve been to Springs, I’ve seen our elites buying Marks & Spencer and Evian water, doesn’t all this add up? Well, the entirety of prepared foodstuffs we imported in FY 21 added up to a mere USD 0.6 billion. So, no, not really. Let the elites have their Evian, what we need instead is structural reform. Something for Reza Baqir to ruminate on perhaps, as he peruses the shelves of Marks & Spencer in London.

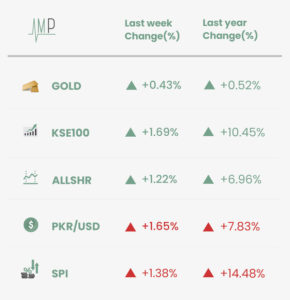

KSE-100 rose this week, amid reports of progress in talks between Pakistan and the IMF. PKR depreciated further this week, as concerns rose over rising inflation and the current account deficit. Local gold prices rose slightly this week, in line with increasing commodity prices internationally.

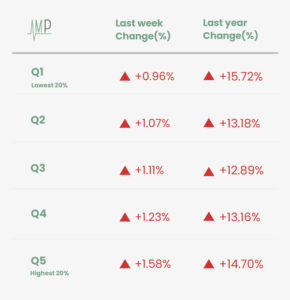

The annual change in Sensitive Price Index rose to 14.48% vs. 12.66% last week. The poorest of the country (Q1) continue to bear the brunt of increased prices, with a change of 15.72% vs. 14.70% for Q5. On a weekly basis, prices rose for all quintiles by 1.38%.

Increase in prices of Petrol (+8.19) and Tomatoes (+41.6%) contributed to weekly inflation. LPG (+7.11%) also contributed to rising prices this week. A fall in the price of Chicken (-2.45%) and Onions (-0.78%) helped moderate inflation this week.

.

What Else We’re Reading (Local)

- SadaPay and TAG, two of Pakistan’s leading fintech startups, are at war with each—and now NAB is involved too. (Profit)

- Pakistan remains on the FATF grey-list, with the next review planned for February 2022. (Business Recorder)

What Else We’re Reading (International)

- With the COP26 climate summit about to begin, countries such as Russia, Saudi Arabia and India are resisting attempts to set stronger targets on cutting emissions. (Bloomberg)

- The Turkish lira has been steadily losing value, as the central bank continues to cut interest rates despite rising inflation. (FT)