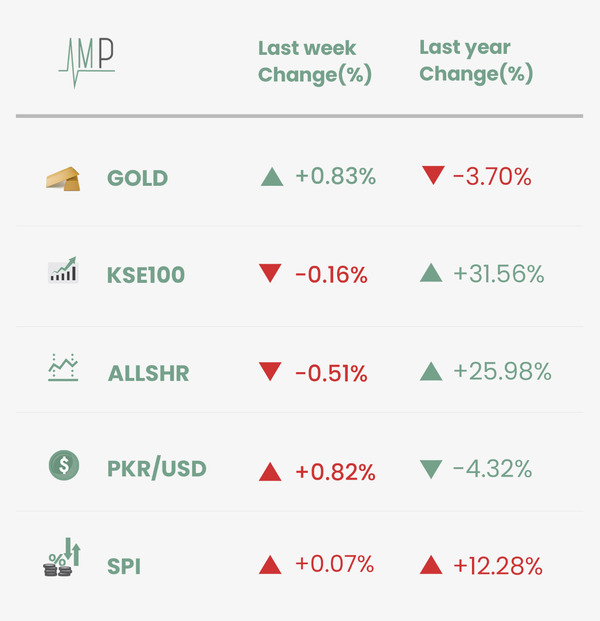

KSE-100 dipped slightly due to Covid-19 concerns. PKR lost value again this week as USD traded near three-month highs. Local gold prices increased marginally in line with international prices Despite a brief rally on Thursday, the KSE-100 fell slightly on a weekly basis as concerns about an incoming fourth wave of Covid-19 persisted. Escalating tensions in Afghanistan also contributed to the downturn. PKR lost value again this week as the USD hit a nearly three-month high in the global currency market. The currency crossed the PKR 159/USD level for the first time since end February. Local gold prices rose marginally, in line with an increase in international prices.

Annual change in Sensitive Price Index fell to 12.28% vs. 13.31% last week. Poorest of country (Q1) were disproportionately affected with change of 15.7%. On a weekly basis, prices rose slightly for all quintiles by 0.07%. The annual change in Sensitive Price Index fell to 12.28% vs. 13.31% last week. However, the poorest of the country (Q1) continue to bear the brunt of increased prices, with a change of 15.7% vs. 11.5% for Q5. On a weekly basis, prices rose for all quintiles by 0.07%. Prices of Tomatoes, Onions, Sugar and Ghee rose vs. last week. Drastic fall in Chicken prices helped moderate inflation Prices of Tomatoes (+11.5%) and Onions (+4.85%) continued to rise this week. Additionally, a modest increase in Sugar prices (+2.60%) and Ghee (+0.86%) also contributed to inflation. Chicken prices continued to fall (-12.97%) thus moderating inflation, with Bananas (-3.72%) also having a modest impact.

Annual change in Sensitive Price Index fell to 12.28% vs. 13.31% last week. Poorest of country (Q1) were disproportionately affected with change of 15.7%. On a weekly basis, prices rose slightly for all quintiles by 0.07%. The annual change in Sensitive Price Index fell to 12.28% vs. 13.31% last week. However, the poorest of the country (Q1) continue to bear the brunt of increased prices, with a change of 15.7% vs. 11.5% for Q5. On a weekly basis, prices rose for all quintiles by 0.07%. Prices of Tomatoes, Onions, Sugar and Ghee rose vs. last week. Drastic fall in Chicken prices helped moderate inflation Prices of Tomatoes (+11.5%) and Onions (+4.85%) continued to rise this week. Additionally, a modest increase in Sugar prices (+2.60%) and Ghee (+0.86%) also contributed to inflation. Chicken prices continued to fall (-12.97%) thus moderating inflation, with Bananas (-3.72%) also having a modest impact.

.

What Else We’re Reading (Local)

- After the success of WAPDA’s ‘green bonds’ in May, the Government of Pakistan is now looking to raise USD 1 billion through the world’s first ‘nature performance bond’, which aims to raise funds in return for meeting biodiversity and nature restoration targets (Dawn)

- Why are some of Pakistan’s biggest and ‘most desirable’ companies, such as Tapal, uninterested in publicly listing themselves on the PSX? (Profit)

What Else We’re Reading (International)

- Pakistan may not always see eye to eye with the Afghan government, but there are concerns that a Taliban takeover of its neighbour would be disastrous for Pakistan’s economy and society (WSJ)

- A rift between Saudi Arabia and the UAE over oil production quotas could see the UAE leave OPEC, potentially throwing the global oil market into disarray (FT)