This is the 50th issue of Macro Pakistani Bites and will be the last one I personally write. I started Macro Pakistani as a side thing but it evolved into a full-time role over the course of last year. Researching and writing about Pakistan’s economy has been an immense learning experience for me. Working with the team behind Macro Pakistani, from our contributors to the design team to the technical team, has been fantastic. After a year of writing weekly newsletters, I am pleased to announce that you will be hearing from someone new next week. We have added a new Editor-in-Chief to the team, who will continue to update you on a weekly basis, as I resume post-MBA responsibilities at Bain & Company. I will continue to write every now and then, and be available for questions as and when you have any. Please continue to write to me at faiz@macropakistani.com and stay in touch. Hoping Macro Pakistani becomes the go-to place for all Pakistanis looking to learn more about our economy!

Explore how burden of inadequate housing in Pakistan falls on low-income families, why mortgages are important and why investment here is misplaced.

Housing in Pakistan

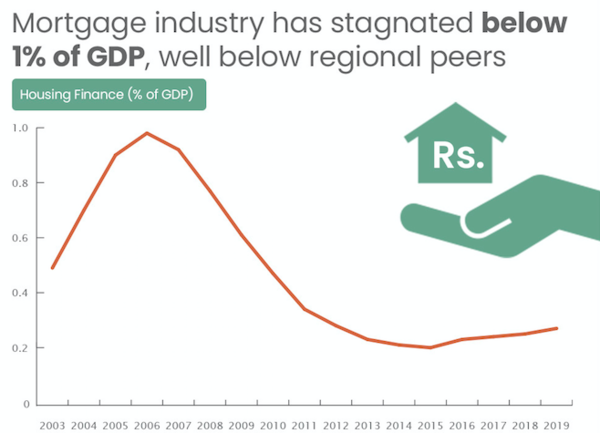

Source: State Bank of Pakistan; MP Analysis

Pakistan’s mortgage to GDP is well below 1% as compared to South Asian average of 3.4% and 10% in neighboring India. Watch the latest episode of BaKhabar to understand why housing finance is critical, how the government monopolized mortgages for 50 years and how Naya Pakistan Housing Scheme might not be enough.

KSE-100 continued its fall as Pakistan remained on the Financial Action Task Force’s (FATF) grey list. Pakistan has completed 26 of the 27 action items but still missed out on being removed from FATF monitoring. Additionally, the Morgan Stanley Capital International (MSCI) announced that Pakistan’s emerging market status will be reviewed since it no longer meets the standards for size and liquidity. While some market commentators rejoiced at this news, anticipating higher foreign inflows as a Frontier market, the reclassification is a downgrade. It highlights the weakness in Pakistani capital markets as no companies meet the requirements anymore, with Lucky Cement, MCB and HBL included just for continuity purposes. The exchange rate depreciated by more than 1% before recovering at the end of the week. Local gold prices fell this week, in line with the international sell-off last week. However, with US inflation coming in lower than anticipated, international gold prices are up again. This could lead to a recovery in local gold prices too.

The annual change in Sensitive Price Index is up to 15.29% vs. 14.52% last week. This means inflation is back up above 15% level after falling last week. On a weekly basis, prices rose significantly by 0.82%. While the weekly increase was the highest for the richest in the country, the poorest continue to experience the highest burden of inflation. Chicken prices (+11.43%) continued to rise along with Tomatoes (+14.56%) and Onions (+8.38%), leading to rising food inflation. Minor drops in the prices of Daal Masoor (-0.26%) and Sugar (-0.12%) failed to control inflation. The bureau has launched a city wise monitoring report, which could be helpful in improving governance in the coming week.

The annual change in Sensitive Price Index is up to 15.29% vs. 14.52% last week. This means inflation is back up above 15% level after falling last week. On a weekly basis, prices rose significantly by 0.82%. While the weekly increase was the highest for the richest in the country, the poorest continue to experience the highest burden of inflation. Chicken prices (+11.43%) continued to rise along with Tomatoes (+14.56%) and Onions (+8.38%), leading to rising food inflation. Minor drops in the prices of Daal Masoor (-0.26%) and Sugar (-0.12%) failed to control inflation. The bureau has launched a city wise monitoring report, which could be helpful in improving governance in the coming week.

- Potential RLNG or broader electricity shortage is looming for upcoming peak season as one of the two terminals requires scheduled maintenance (Business Recorder)

- Continuous current account deficits since December 2020 have consumed the benefit of the surplus generated in the first half of FY 2021 (Dawn)

- FATF decides to keep Pakistan on grey list as it is yet to fully implement the 27-point action plan with serious deficiencies remaining on financial terrorism (Profit)

What Else We’re Reading (International)

- Saudis agree oil deal worth at least USD 1.5 billion annually with Pakistan to counter Iran influence and build a front against their regional rival (Financial Times)

- Pakistan aims to double IT industry to USD 6 billion in 2 years by setting up dedicated tech zones across the country (Bloomberg)