If you were not already following our dedicated graphics page, we would highly recommend visiting it now. After months of scouring through data and building the tools required to automate collection and visualization, we have released our first cut of MP Monthly. We have selected Inflation, Trade, Remittances and Large Scale Manufacturing as the first data points to visualize. Please do let us know if you have any feedback. Going forward, as soon as the relevant government agencies release public data, it will be available on our website with some analytics and charts. We hope this will help you make better sense of the news. Macro Pakistani continues to work toward democratizing access to economic information in Pakistan. Your critique and support are both welcome.

After falling this week, the KSE-100 rose again, as the State Bank of Pakistan decided to maintain its policy rate at 7%. Lower interest rates boost business valuations and also signal lower expected inflation. In global markets, expectations of inflationary pressures from a US stimulus caused gold prices to rise after falling this week. The exchange also rose slightly maintaining its level around PKR 160/USD. The annual change in Sensitive Price Index rose to 6.54% compared to 5.77% last week.

While on an annual basis, inflation experienced by the poorest of the country rose to 7.93% compared to 7.28% last week; this week saw an increase of only 0.06% in prices for them. The rest of the country, particularly the highest income earners, felt a higher burden of inflation. Commodities making up a higher proportion of the consumption basket of the rich, such as Chicken (+4.9%) and Petrol (+3.0%), were up this week. Ghee, which is almost three times more important to the lowest income earners than the rest of the country, was also up by 2.9% since last week and over 20% since last year. This meant inflation has started to rise again after a drop in recent weeks. Falling prices of Tomatoes (-14.8%), Potatoes (-1.8%) and Sugar (-1.3%) reduced inflationary pressures.

RAAST: The answer to Pakistan’s cash problems?

By Faiz Ahmed

How Raast works has been well publicized already. What the State Bank’s new instant payment system is solving for, is not. Pakistan’s cash problems have limited formality in the economy, increased corruption and enabled rampant tax evasion. Higher printing and other administrative costs unique to cash have just highlighted the importance digital financial services further. Read the full article to find out why there is a need to connect end-users through payment channels in a seamless manner and improve financial inclusion in the country.

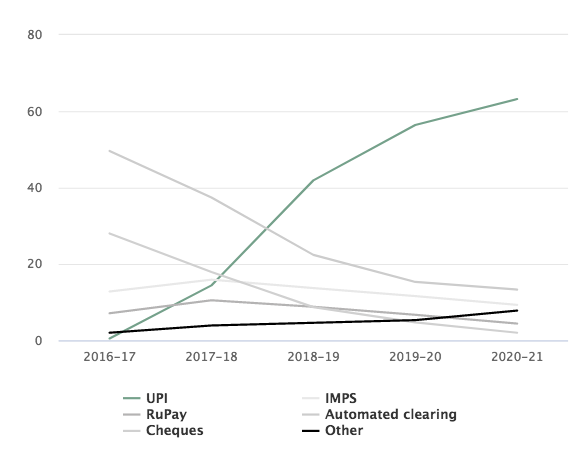

Raast has been fairly compared to India’s United Payment Interface, which was launched in 2016 and completed changed the digital financial services ecosystem in the country. Not only did UPI take the lion’s share of transactions, it also increased the size of pie. Retail financial transactions increased from 7.1 billion in 2016-17 to 26.5 billion in 2019-20. More recently, since October 2020, there have been over 2 billion transactions facilitated by the system per month and its share in total transactions has risen to over 60%.

Share of UPI transactions in India (% of total financial transactions)

There are over 2 billion transactions on United Payment Interface, making up 63% of total now

Note: Excludes ATM cash withdrawals

Source: NPCI

Notice the transactions that UPI has replaced. The two major ones have been Automated Clearing and Cheques and both involve paper money transactions. Pakistan has a cash problem similar to India’s 5 years ago. With Raast, the necessary public infrastructure has been put in place and it is time for all private financial institutions in the country to augment SBP’s efforts. It is only then that Pakistan will be able to address its cash problem and improve financial inclusion in a meaningful way.

What Else We’re Reading (Local)

- SBP has maintained the policy rate at 7% and provided forward guidance that the rate will remain intact in the near future (Business Recorder)

- Power tariff was raised by PKR 1.95 per unit, much less than the increase required to address the sector’s perennial issues (Dawn)

- A vibrant market with multiple buyers and sellers ought to create an environment which enables price discovery in a transparent manner in the energy sector (Profit)

- The government is set to approve a new policy on equity investments from abroad aimed at improving ease of doing business and raising capital (Business Recorder)

What Else We’re Reading (International)

- Higher corporate taxes, clean energy initiatives and more will likely have to wait for COVID-19 stimulus as Joe Biden takes office (Wall Street)

- China’s economy expanded at a faster rate than before the coronavirus as GDP rose 6.5% in the 4th quarter; other big economies struggle to recover (Financial Times)