With talks of a V-shaped economic recovery in Pakistan cluttering most newsfeeds, Macro Pakistani thought it was important to step back and think about the long lasting impact this pandemic might have. Our Year in Review last week mentioned how Pakistan is a hopeful nation. However, in this hope we should not lose sight of our current situation. Educational outcomes were already below those of Afghanistan’s. A study conducted in 2009 to assess the impact of the 2005 Kashmir earthquake found that the 14-week school closure led to children losing the equivalent of 1.5 school years of learning. This loss in learning is expected to cause these children to earn 15% less every year of their adult lives. If this impact of school closures is to be generalized for COVID-19, the future of human development in Pakistan does not shine bright for the next generation.

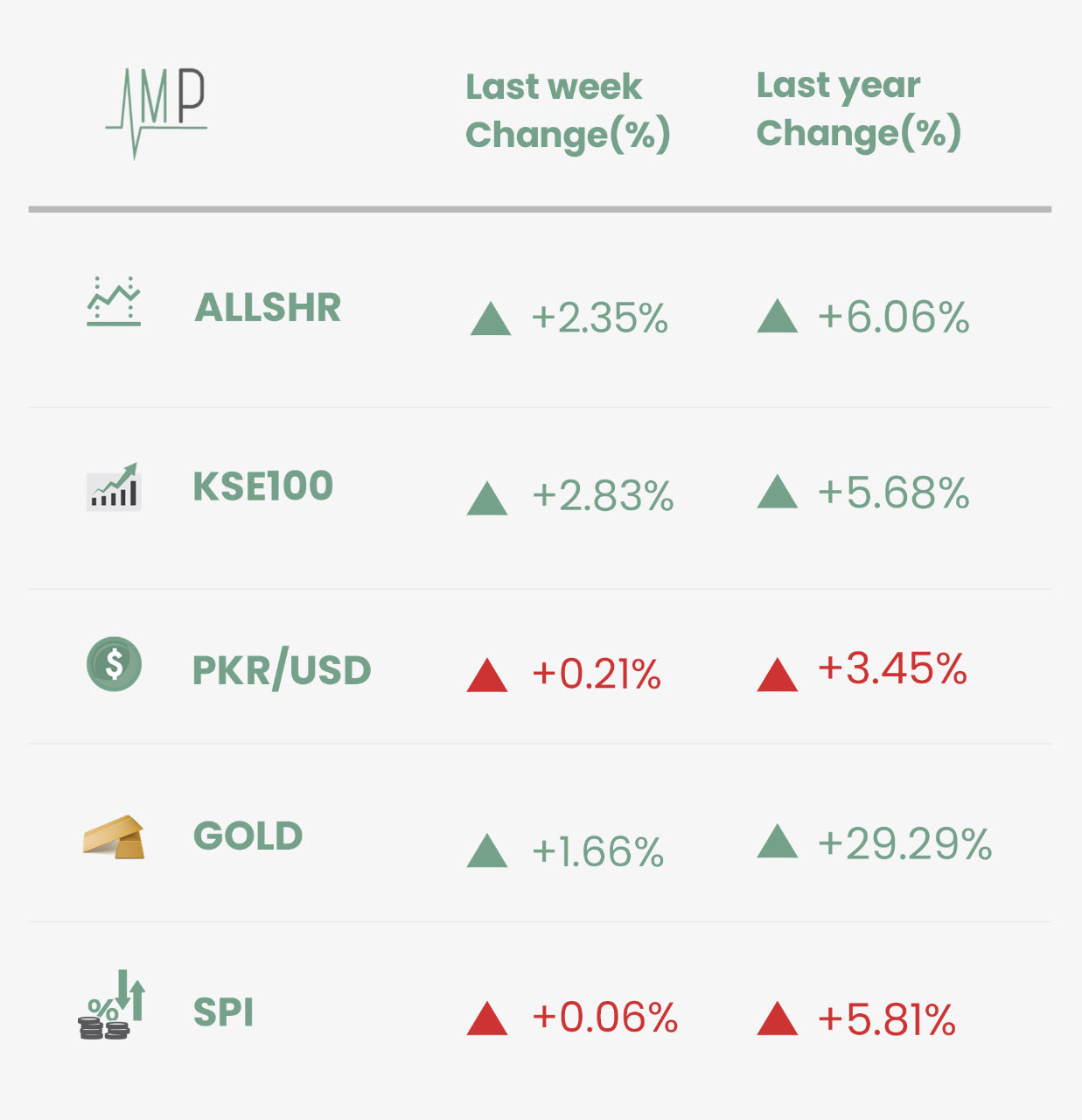

The KSE-100 crossed the 45,000 level to reach a 3-year high, with healthy buying from both local and international investors. A successful OPEC+ meeting led to higher oil prices and consequently fueled the rally behind energy stocks in Pakistan. In the past month alone, the index has returned over 9.5%. Gold prices are also up over 9% as compared to last month, having already returned 30% since last year. After falling briefly below the level of PKR 160/USD this week, the exchange rate again rose slightly. The annual change in Sensitive Price Index fell to 5.81% compared to 6.13% last week. This is the first time since the week of 3rd January 2019 that SPI inflation fell below the 6% mark.

For the poorest of the country (Q1), inflation was 6.7% compared to 7% last week, reflecting the trend of reduced food prices. On a weekly basis, prices rose slightly by 0.06%, despite lower annual inflation. Prices increased slightly despite fall in the prices of Chicken (-10.74%), Tomatoes (-7.21%) and Onions (-4.65%), due to the increase in prices of Sugar (+7.21%) and non-food items such as Petrol (+2.15%) and LPG (+10.02%). Macro Pakistani has also been warning of the increase in Chili Power prices, which are up almost 100% since last year. They contribute as much to a poor Pakistani’s consumption bundle as Petrol and Tomatoes and need to be closely looked at. Stay tuned to see more updates coming soon on our dedicated page for illustrative data on Pakistan’s economy.

Is Insurance in Pakistan ripe for change?

By Hunain Kapadia

The insurance industry in Pakistan has been a boring one, failing to excite its customers over the years. Issues of religion, mis-selling, opaqueness and products/processes that belong in the last century have plagued the market. This has left insurance penetration in Pakistan at 0.92% of GDP, significantly lower than the global average of 7.2% and behind peer countries like India (3.76%) and Vietnam (2.24%).

Hunain, Co-founder at Smartchoice.pk, helps us understand the reasons behind low insurance penetration in Pakistan along with specific recommendations on how to reduce friction and make the industry more likable and affordable. Full disclosure: this is not sponsored content. It just so happens that the most mature channel which the western world has already realized remains digital in the insurance industry, especially aggregators like Smartchoice.pk.

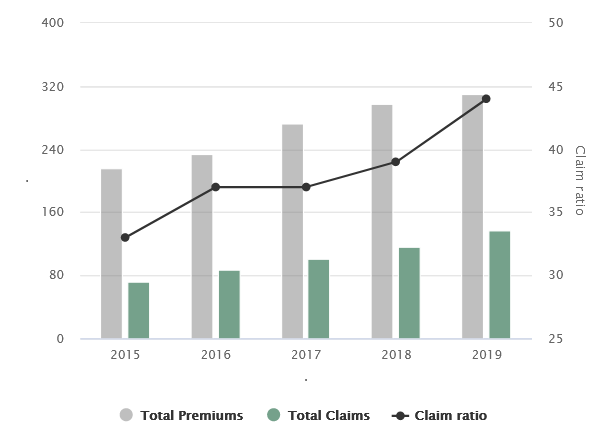

Claims vs. Premiums for insurance in Pakistan (PKR B)

It is a myth that insurance companies do not pay out claims in Pakistan

Source: The Insurance Association of Pakistan

What Else We’re Reading (Local)

- The government is set to unveil an ambitious Textile and Apparel Policy 2020-25 laden with cash subsidies and lower rates on utilities worth Rs960 billion (Dawn)

- Poor governance in the public sector has led to the power sector’s circular debt to rise to PKR 2.3 trillion, up by PKR 156 billion since July 2020 (Dawn)

- To push SME finance like it has been done in other developing countries, a credit guarantee scheme run by a development institution is required (Business Recorder)

- Government should make policy decisions to end power supply uncertainty in the summers by unbundling K-Electric and ensuring price competitiveness (Tribune)

What Else We’re Reading (International)

- The Fed’s quantitative easing boosts wealth inequality by increasing the net worth of those who own financial assets, chiefly of stocks and bonds (Financial Times)

- Job losses in 2020 were the worst since 1939, with Hispanics, Blacks and teenagers among the hardest hit as 9.3 million jobs were shed in the US economy (Wall Street)

- Saudi Arabia and three other Arab states agreed to fully restore ties with Qatar at the GCC leaders summit, ending a dispute that erupted in 2017 (Bloomberg)