To wrap up the discussion on structural issues with investment in the economy, we will discuss housing in Pakistan. If you’ve read the series from the start, you would know, as a consumption driven economy, Pakistan is unable to save as much as other countries and then invest that money toward productivity enhancing initiatives. One of the main reasons why consumption levels are high is that Pakistanis have to spend an out sized amount on housing and utilities. We discussed utilities last time, so let’s dig into housing in Pakistan now.

Housing is important

Sticking with our explanation of the GDP, construction is part of Industrial sector while housing is part of the Services sector. When you have land and construct a new residential building on it, that is included in construction. If you sell that real estate for a higher value than what it cost you to construct it, that is included in housing services.

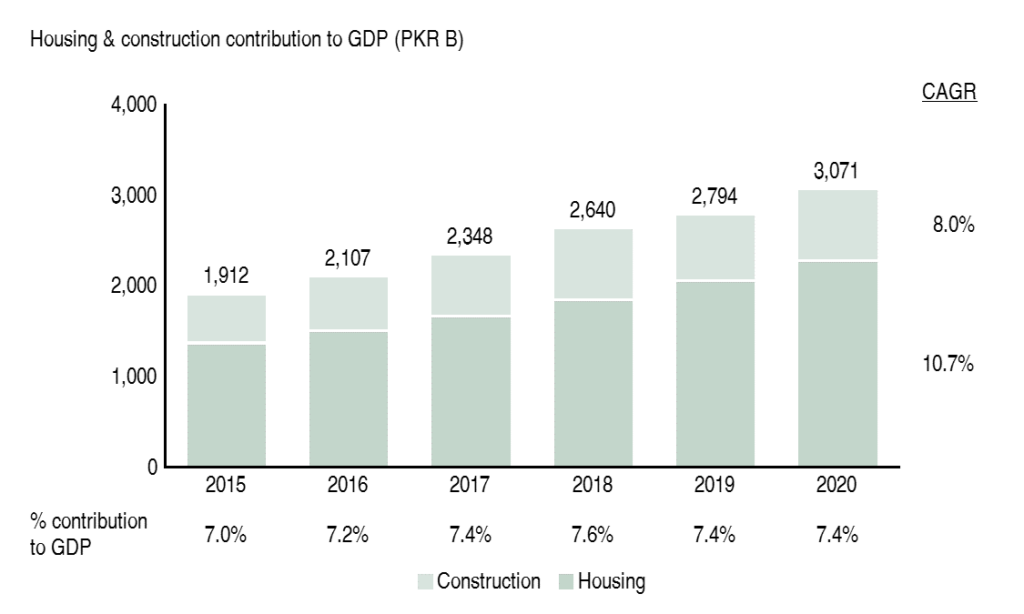

Contribution to GDP of Housing & Construction in Pakistan (2015-20)

Combined, both sectors contribute 7.4% to Pakistan’s nominal GDP but if you include allied industries (e.g. cement, steel, timber, paints), the contribution is much higher at 10-12%. Notice the growth of both sectors too. Housing sector has been growing at over 10% each year since 2015, while construction sector has only grown by 8% in nominal terms. However, if you consider real growth, both sectors have, on average, grown by 4% annually. Price increases have dominated growth for the housing sector instead. Anecdotal evidence suggests that these declared prices are actually understated so the overall importance of the construction and housing sectors is underreported.

Housing is very important

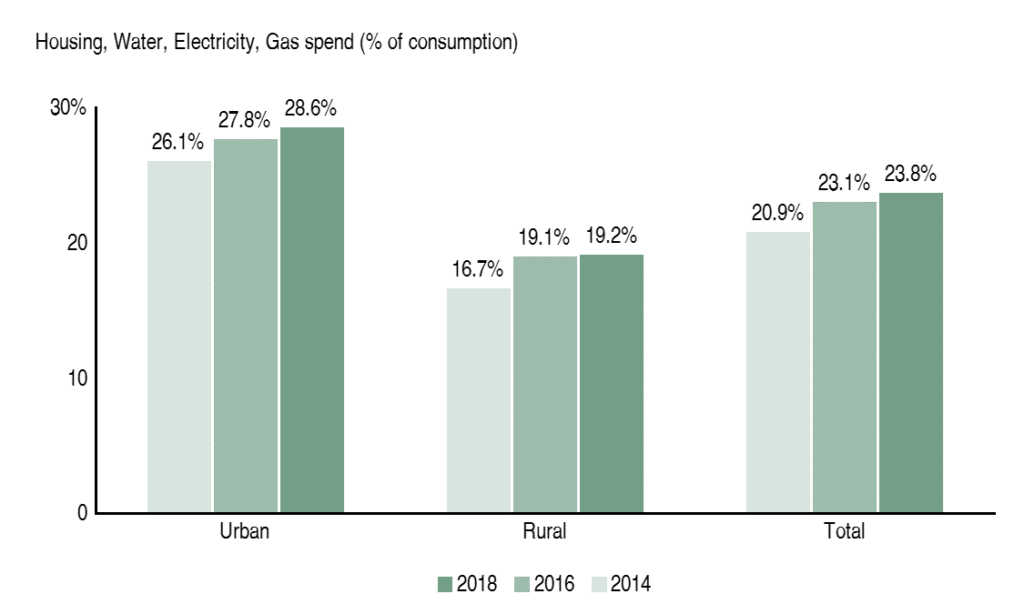

One way to check if macroeconomic numbers are under-reported, is to check the microeconomic inputs. Previously, we have discussed how housing and household fuels make up 30% of private consumption. From household surveys, we know that almost 25% of total consumption is housing and utilities. The number is higher in urban areas as compared to rural areas, primarily because of population growth and increased rural-urban migration. Urban households are spending increasing amounts on housing and utilities, up from 26% of consumption in 2014 to almost 29% in 2019.

Proportion of consumption spend on housing and utilities (2014-19)

According to the World Bank, over the next 20 years, expected urban population increase will be about 2.3 million per year. Taking average urban household size of six people, over 380,000 housing units are required in urban areas alone each year. If we take into account rural population as well, housing demand rises to almost 700,000 units each year. Formal supply for housing units in Pakistan ranges from 100,000 to 350,000 each year, which leaves at least 50% of demand unmet.

Housing indicators were last recorded by Pakistan, over 20 years ago, in the 1998 census. This explains why macroeconomic housing data seems understated. According to the census, Pakistan had 19.3 million housing units and a shortage of around 4 million units. Today, that shortage has grown to an estimated 10 million housing units, over half of which is in urban areas. Inadequate provision of housing, infrastructure and basic urban services, limit the ability of a region’s cities to realize the full benefits of ‘agglomeration’. To keep this bite sized, think of productivity growth in a city like Karachi. When people from rural Sindh move to Karachi, it spurs productivity growth and job creation, specifically in manufacturing and services.

Living in close quarters

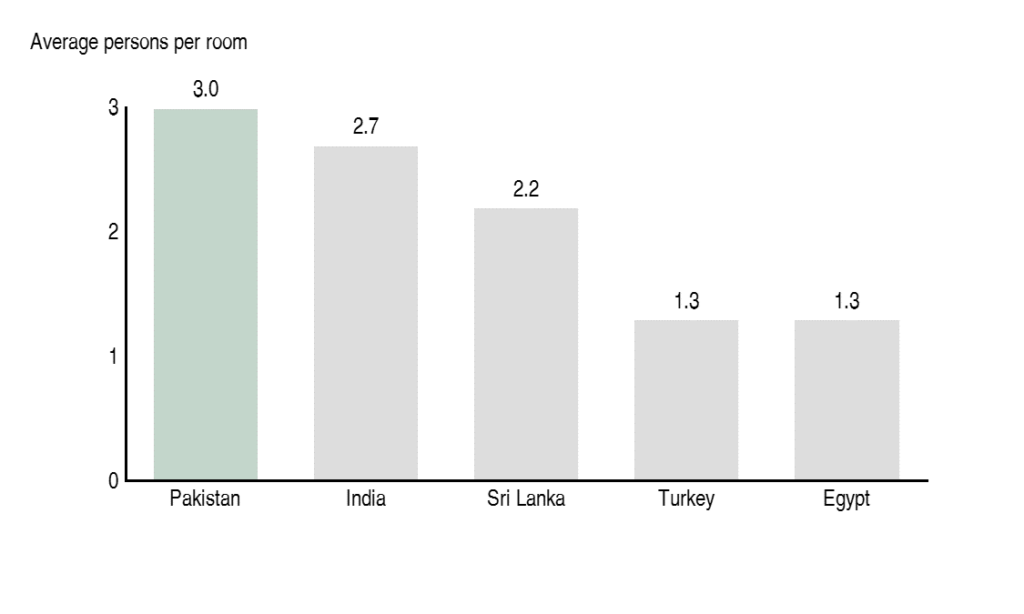

However, urbanization in Pakistan has been messy and has just led to congestion. The shortfall of housing in Pakistan has resulted in more people living per room in the country. On average, about three persons live in a room in Pakistan, as compared to India’s 2.7 and Sri Lanka’s 2.2.

Average persons per room in Pakistan vs. Global benchmarks

Back in 1998, the United Nations reported these numbers with a split of urban (2.8 persons) and rural (3.1 persons). After 22 years, these numbers would have changed for the worse, given the pace of population growth and the rising shortage of housing units in Pakistan. Many of these statistics also only track formal housing units. In 2009, another estimate showed that 46.6% of urban population was living in slums (“katchi abadis”). According to the International Institute for Environment and Development, 61% of the Karachi’s population lives in katchi abadis. The same report also talks about how the unmet demand for housing in Pakistan has been accommodated in past years.

About 25% of unmet demand was catered to by katchi abadis, which is an informal subdivision of government land. Over 60% was met through informal subdivision of agricultural land (ISAL) on a city’s periphery and 15% through densification of existing inner cities. These ISALs are part of the reason that a large portion of our agricultural land has been classified as culturable waste. Lack of investment in agriculture has led to rural-urban migration as farmers look for higher income generating jobs in urban cities. As they move, because of a lack of investment in housing, majority of migrants have to settle in informal squatter settlements that take over agricultural land. The issue leads to an outsized spend on housing in our consumption basket, which leads to low savings and lower investment. Hence, the cycle continues.

To get rich is glorious

As this cycle continues, it should be easy to see who endures the worst of these issues. Housing shortage disproportionately affects lower income segments with a higher burden of inflation. Lower income families have more people per household and require larger housing units.

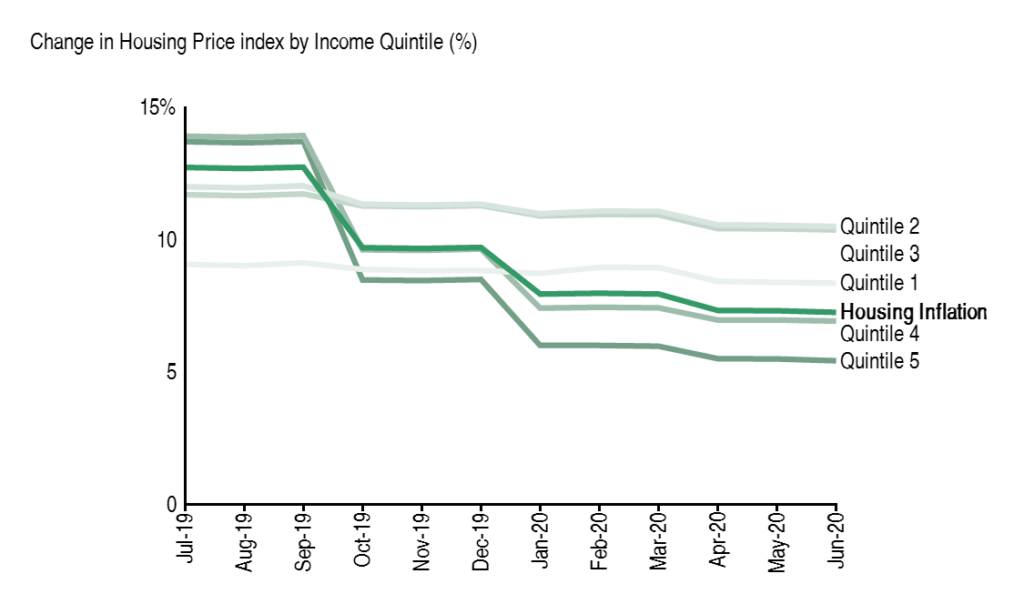

Housing inflation by income quintile (FY 2019-20)

We have spoken about how the burden of inflation since the financial crisis, has actually fallen on the rich. However, in the year 2019-20, this trend shifted, specifically for housing inflation (dark green line). If you notice, the bottom 3 quintiles, which represents the lowest 60% of income earners in Pakistan, experienced higher housing inflation than the rest of the country. According to Zameen.com, plot prices in Pakistan have risen by over PKR 2,000/sq. ft. since 2011 while house prices have increased by almost PKR 7,000/sq. ft. since 2011. In peri-urban katchi abadis in a city like Karachi, it used to cost approximately 8.3 times the daily wage to construct a semi-pucca house in 1991. By 2008, this number had risen to 60 times the daily wage of an unskilled worker. This problem has only exacerbated over the years while successive governments have attempted to address it.

Money makes money

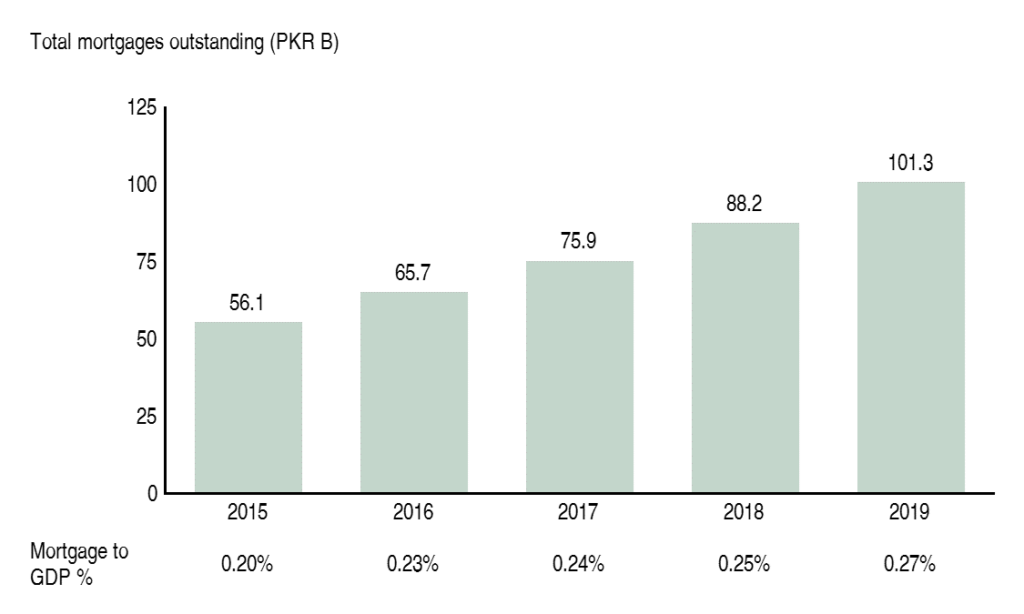

One way of solving the problem of unaffordable housing would be to give citizens the financial tools to afford it. We have discussed before how money makes money and how financing is important for investment. The same principle holds for housing investment too. However, Pakistan also lacks a developed mortgage market. Mortgage to GDP ratio of 0.27% is well below South Asian average of 3.4% and India’s 10%.

Total mortgage outstanding in Pakistan (2015-20)

While the ratio has increased slightly over the last few years, it is important to note that the number of people with mortgages has declined. In 2016, when the mortgage market stood at PKR 65 billion, around 70,000 people had mortgages. In 2019, while the market had grown to over PKR 100 billion, only 58,620 people were able to avail these facilities.

To be a banker is glorious

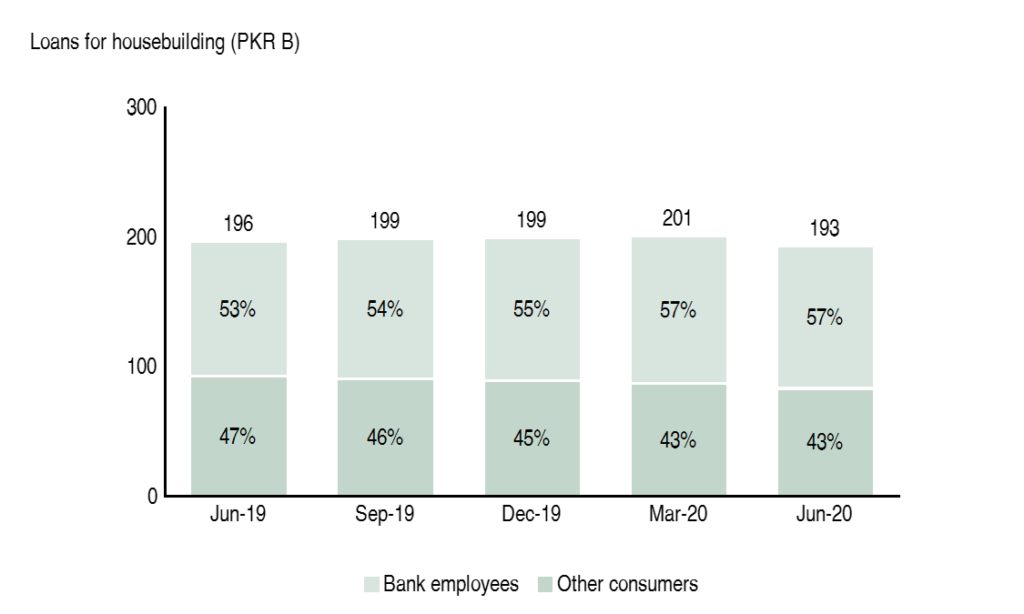

Furthermore, over 50% of loans given to finance house building (including mortgages) are to bank employees. With weak foreclosure laws, banks use option of ‘trapping’ future income of employees for security.

Total housebuilding loans in Pakistan (FY 2019-20)

It is important to understand what these weak foreclosure laws are since they lie at the root of the problem of why mortgages have failed to pick up in the country. You can read the full detail here, but it all started in 2001 when the then banker Finance Minister Shaukat Aziz, got the 2001 Recovery of Finances Ordinance passed. This made it easier for banks to take control of and sell properties in case the borrower defaulted. In 2013, the Supreme Court intervened and claimed that the existing law did not grant borrowers enough protection. By 2016, the law was reconstituted with a few amendments but there was a public outcry so the matter was put under litigation again.

In 2019, the Asian Development Bank refused to provide financial support for Naya Pakistan Housing Scheme until the litigation was resolved. In March 2020, the Lahore High Court ruled in favor of the State Bank of Pakistan, Ministry of Finance and the banks, with the Recovery of Finance Ordinance put back in place. This time, clauses to discourage predatory lending were inserted to protect borrowers. However, the matter is still expected to be challenged in the Supreme Court. While these legal issues persist, banks find it easier to provide housing loans to their employees. This is because they can make sure, if the borrower, the banker in this case, does default, they have control over their future salaries as security.

Investment is bad

In addition to legal issues, housing and construction were also subjected to additional tax measures in 2018-19. Devaluation of the currency meant cost of building materials also increased. Hence, while there was strong growth in investment in housing, mostly by the private sector, investment in construction actually declined in the last few years.

Contribution to Investment of Housing & Construction in Pakistan (2015-20)

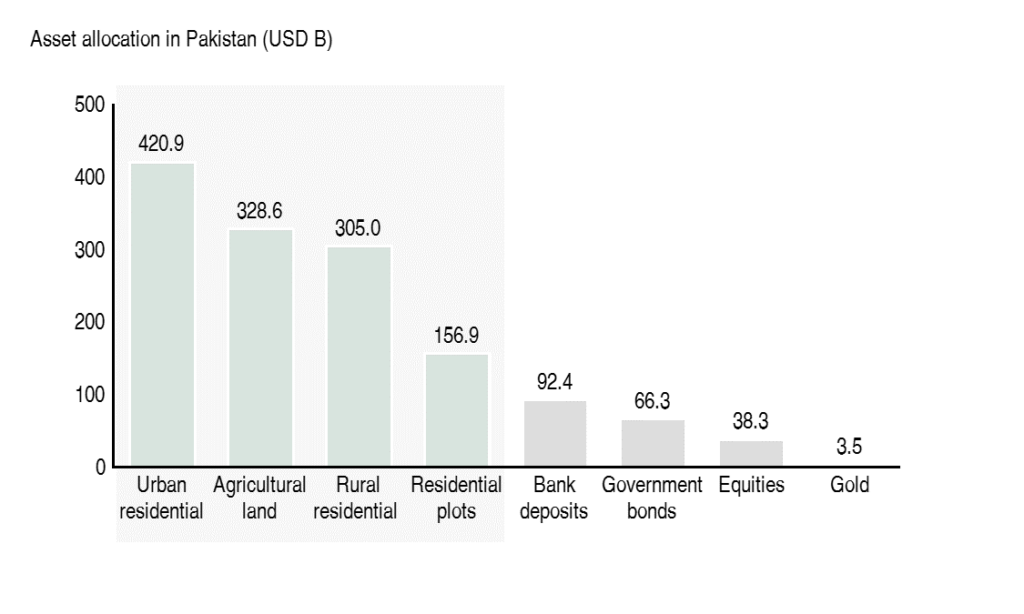

This should be a bit counter intuitive. If construction sector was in decline, why was the housing sector doing so well. The answer lies in Pakistan’s obsession with owning real estate. A recent analysis by Profit shows that the top four most popular investments for Pakistanis are related to housing and land. Total assets in these categories are worth over USD 1.2 trillion, which is more than 4 times the size of the economy.

Estimated asset allocation of Pakistanis 2020

Like elected officials before, the new government has also pledged to address the issues of housing in Pakistan. Naya Pakistan Housing Scheme is their answer, with a commitment to build 5 million new houses during their tenure. While we will address the details of the scheme and the construction package offered later, it is important to remember that other governments have also tried their hand at low cost housing and failed. The early signs seem positive, with PKR 30 billion committed in the new budget along with a State Bank decree that will force banks to increase housing loans. We will discuss public finances of Pakistan next to try to put these numbers into perspective.

What is the sentiment from the major banks around participating in a mortgage industry? do they have sufficient capital?

Is the government able to regulate this industry properly to control lending?

Capital should not be the issue. Deposits grew by 12% last year while loans given out only grew by 1%. Banks in Pakistan are pretty well capitalized but with the option to lend risk free to the government, they prefer not to lend as much to the private sector. SBP is the regulator and is one of the most progressive institutions in Pakistan. They have done a decent job at regulations but at the end of the day, it is up to the banks to implement those regulations. For e.g. now banks are mandated to have at least 5% in housing and construction loans as part of their total portfolio. SBP has currently kept the penalties vague on purpose because a lot more needs to be done in the ecosystem (land records, foreclosure laws) before it can start to fully blame and penalize banks for this matter.