|

|

|

|

|

|

|

|

|

Good evening [subscriber:firstname | default:Subscriber]!

|

We have been talking about productivity and investments and how the different sectors in Pakistan are stagnating. Now we will discuss financing and that might be confusing to a few of you. Allow me to explain and set the scene for why low financing also leads to low investment and hence low productivity.

|

|

|

|

Why has the banking sector failed to improve financing in Pakistan?

|

Read the full article to get a more detailed primer on how banks work, but in summary:

|

Deposits: Banks take money from the public through current and savings accounts. They pay nothing on current accounts and a small rate on savings accounts.

|

Loans: They charge a higher rate when they lend that money out to the public for personal or commercial use. They could also not lend it out to the public and give it to the government to finance their deficits instead.

|

|

This is a simplified view and a few might say banks don’t actually lend money to the government, they invest in their securities which is true. Main point is that they take money from one place, put it in another, and take a cut in the middle.

|

|

Numbers are not nice

|

|

Taking loans improves returns on an investment but only 8% of firms in Pakistan use banks to finance investments as compared to Bangladesh’s 20% and India’s 30%. A key reason behind this is that instead of lending to the public, most banks choose to invest in the government because it is risk-free money.

|

|

|

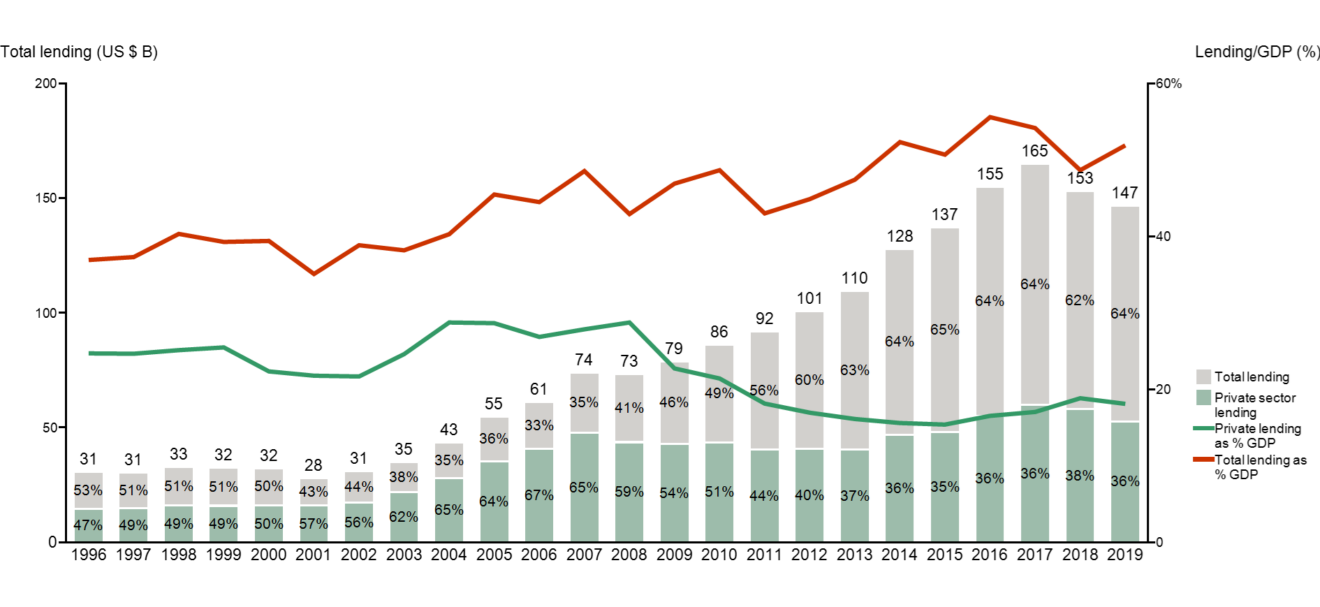

Source: Economist Intelligence Unit; World Development Indicators

|

|

While total lending has increased to over 50% of GDP (red line), less than 20% goes to the private sector (green line). Notice till right before the Global Financial Crisis in 2008, private financing in Pakistan was on the rise. From an earlier post, you might remember that this was also the time, investment in Pakistan was on the rise to about 20% of GDP. By 2019, private financing in Pakistan had fallen from 28.7% of GDP in 2008 to 18.1% and investment had fallen from 19.2% of GDP to 15.6%. All this while, government borrowing (grey bars) has been on a steady rise.

|

|

How Asia doesn't work

|

|

For a lot of the developing countries in Asia that we have mentioned, economic growth was fueled by growth in private credit. Over the last 25 years, share of private credit for all regional comparisons increased while it worsened for Pakistan.

|

|

|

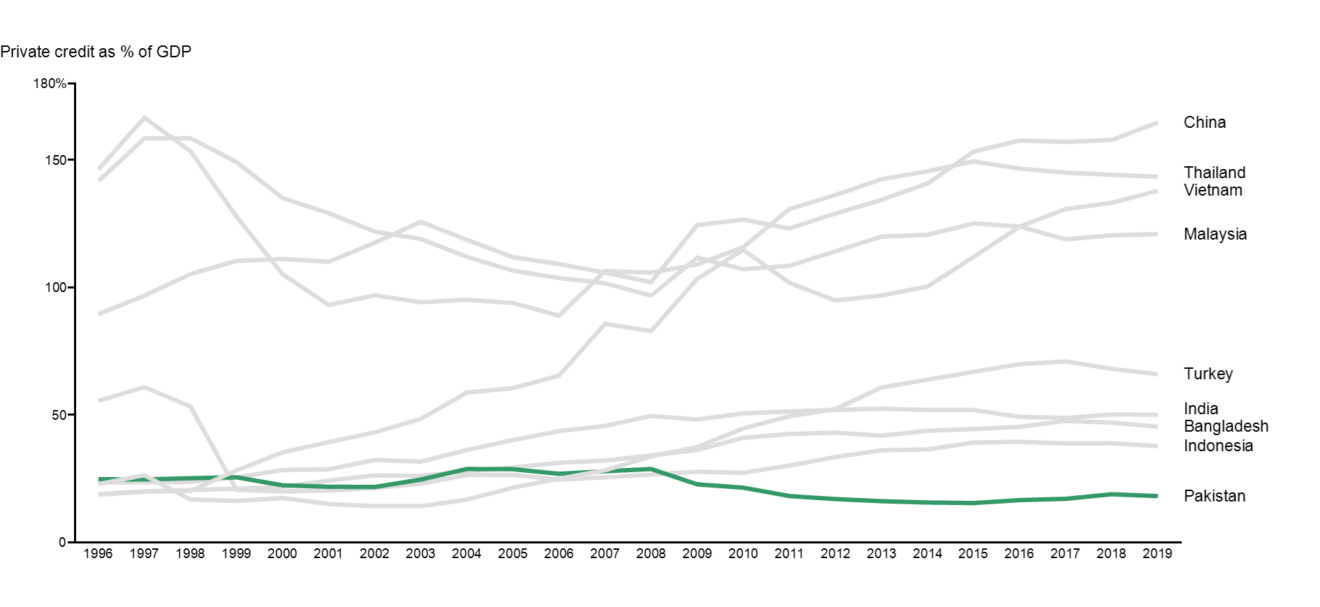

Source: World Development Indicators

|

|

Again, let's not compare Pakistan to China, where the private sector alone borrows 165% of GDP, but India should be a good comparison. In 1996, private financing made up just over 24-25% of GDP in both countries. While the number has doubled to 50% for India today, it has fallen to below 20% for Pakistan.

|

|

|

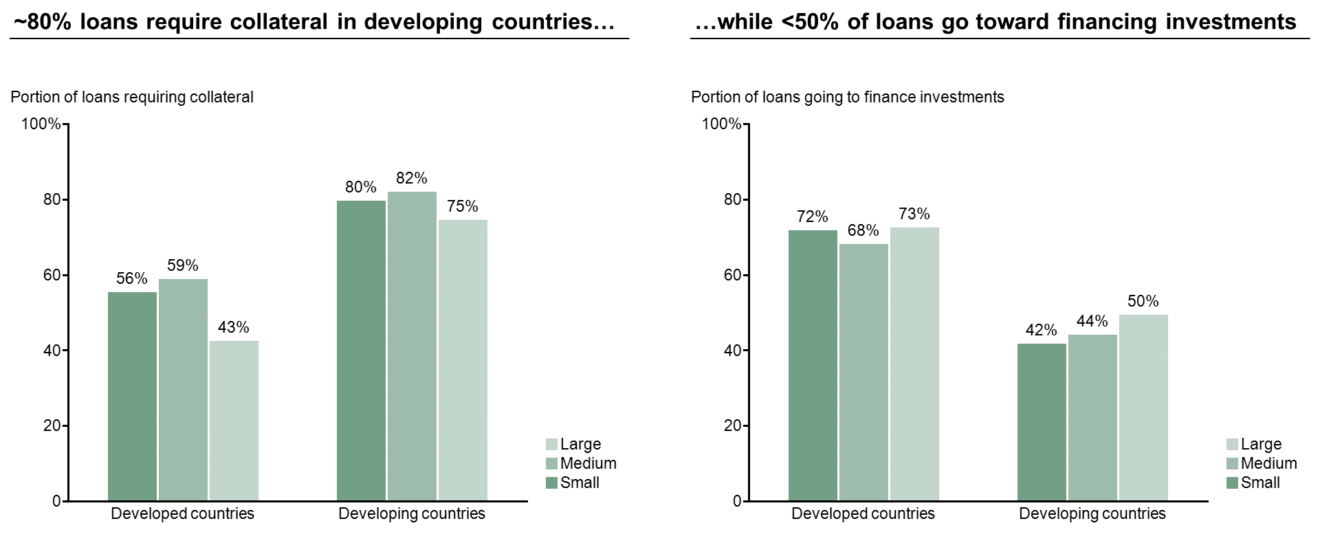

Most businesses will cite excessive collateral requirements, in addition to government crowding out, as the reason they are unable to get loans. But this problem is not unique to Pakistan with banks in most developing countries asking for collateral for ~80% of loans. Given collateral requirements, businesses are usually wary of investing in risky ideas too. You can see that in the chart below, with higher collateral requirements in developing countries translating into lower financing for investment.

|

|

|

Source: Around the World Survey (World Bank)

|

Size does matter

|

|

You will also see in the chart that there are minor differences between small, medium and large companies in those takeaways. However, in Pakistan, these differences are more pronounced.

|

|

|

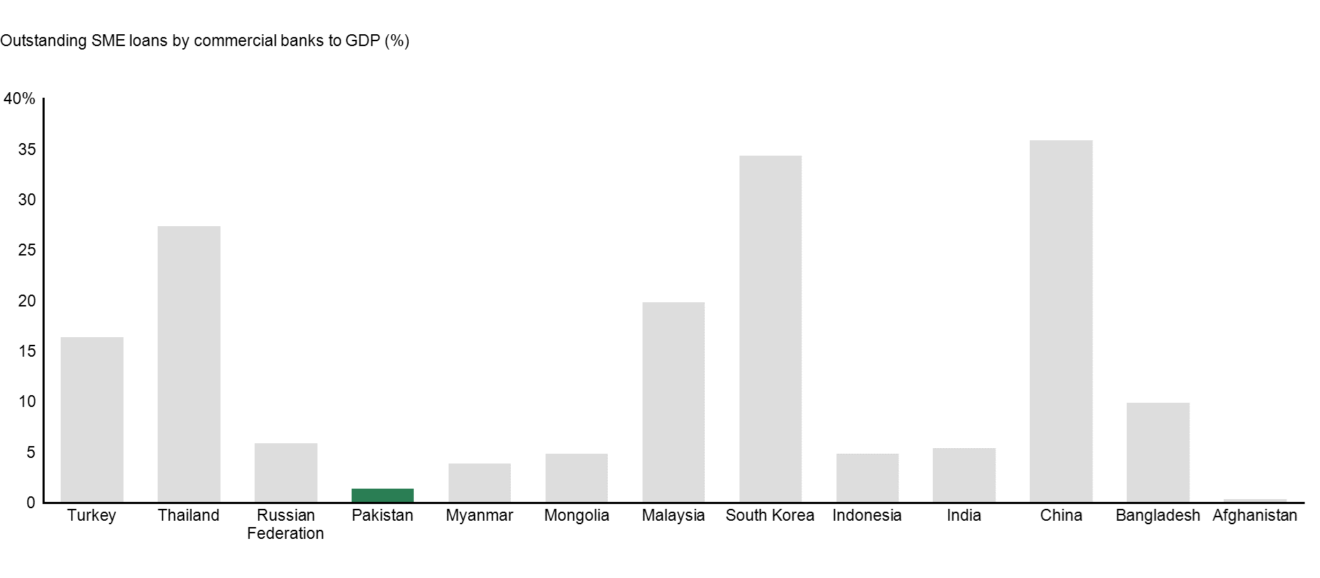

Source: UN Economic and Social Commission for Asia and the Pacific

|

|

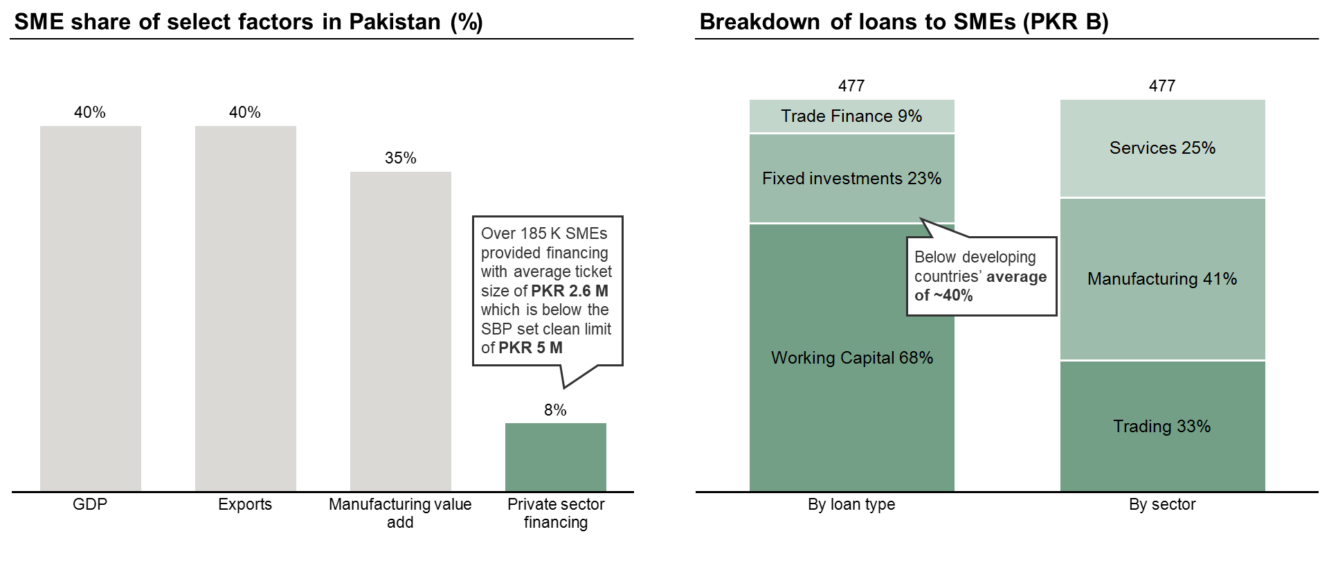

In Pakistan, access to finance for Small and Medium Enterprises (SMEs) is comparable to Afghanistan and 4-6 times less than India and Bangladesh. SME financing makes up 1.5% of GDP in Pakistan as compared to India’s 6% and Bangladesh’s 10%. What this means is that out of all private sector financing in Pakistan (18% of GDP), only 8% makes it to SMEs. SMEs are engines of growth for economies and without finance they cannot invest for the future.

|

|

|

Note: All figures as of Dec 2019; Source: Planning Commission of Pakistan, State Bank of Pakistan

|

|

Limited access to finance is despite the fact that SMEs make up close to 40% of Pakistan’s economy and are crucial for the manufacturing sector in particular. As is the case with other firms in Pakistan, SMEs are also unable to allocate enough funds to investment since most of their loans go towards working capital. While 42% of loans go toward investments for small firms in the developing world, only 23% of SME financing in Pakistan goes toward the same.

|

|

Public money makes money

|

|

As I have mentioned before, there are more efficient ways of public investing in industries rather than providing subsidies. One possible way of reducing the burden of collateral on SMEs is a proper Credit Guarantee Scheme. I say ‘proper’ because the last one the State Bank introduced failed to take off with inadequate marketing. They are currently working on improving that scheme and have launched a Secured Transactions Registry as well, which will allow businesses to use movable property as collateral. Movable property, unlike immovable property such as land, could include money owed to them by someone else. Think of informal receivables at a small mom and pop store – owners would now be able to use that owing to get a loan.

|

|

|

Read the full article below to learn how other structural issues such as lack of data could be addressed by a private credit bureau and how the entire financial ecosystem requires a revamp to encourage investment, productivity and eventually employment in Pakistan.

|

|

|

|

|

Read the full article in the link below

|

|

|